Gold trades sideways ahead of this week’s Fed decision and press conference

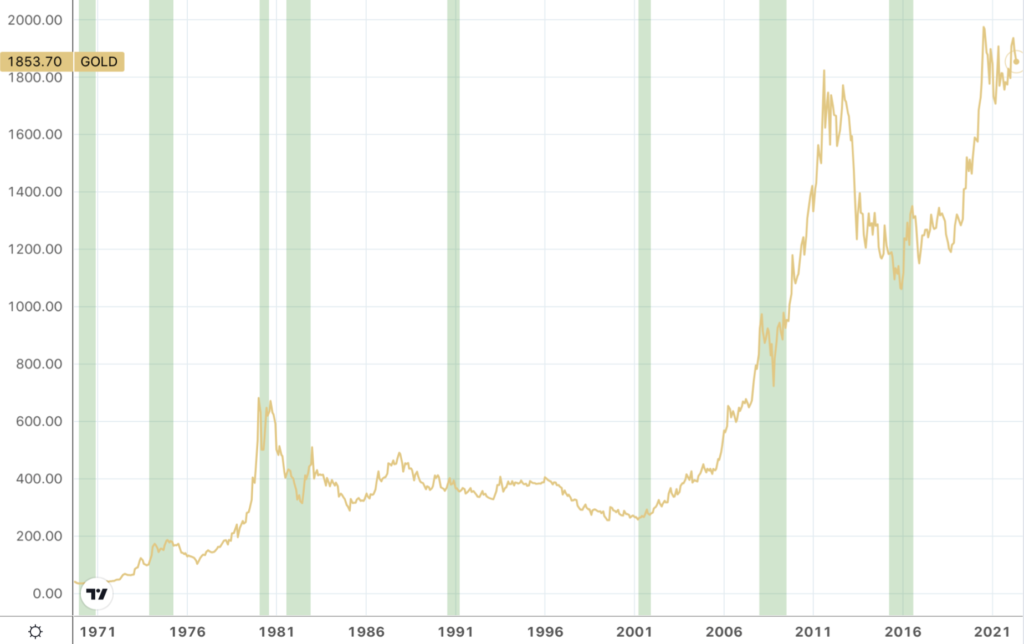

Schroders says gold does well during recessions returning 28% on average

(USAGOLD – 1/30/2023) – Gold is trading sideways this morning as the markets remain cautious ahead of Wednesday’s Fed rate decision and press conference. It is down $2.50 at $1928. Silver is up 9¢ at $23.76. If a recession is in the cards, then what might we expect from gold? Schroders, the London-based investment firm, has some answers. Gold, it says in a report released last week, “tends to do well in absolute and relative terms during US recessions.” It has returned 28% on average and outperformed stocks by 37%.

“One observation we would make is that when the policy responses to US have been particularly loose/accommodative, the gold price performance has been most explosive,” says the firm. “This was the case in 1973 (when Arthur Burns was Federal Reserve governor) and was also the case in 2008 and 2020. We think policy responses to future US recessions will also be highly accommodative and involve a return to combined fiscal/monetary support.”

Gold and recessions

(Shaded bars = recessions)

Chart courtesy of TradingView.com • • • Click to enlarge

Gold trades sideways ahead of next week’s Fed decision

Bill Blain: Buy gold now to finance future bottom-fishing in other markets

(USAGOLD – 1/27/2023) –Gold is trading sideways as we go into the weekend and next week’s Fed decision. It is up $2 at $1933.50. Silver is down 19¢ at $23.79. Morning Porridge’s Bill Blain believes having some gold stuck away to finance future bottom fishing in other markets is a good thing. “That’s when the liquidity of gold is a marvelous thing,” he says. “In times of market uncertainty it’s a beneficial asset to hold.” (In the chart below, please note the price levels during times of economic uncertainty.)

“My colleague Ashley Boolell, Shard’s head of commodities, reckons gold is going to a new record level this year,” he says in a lengthy analysis on gold posted at Zero Hedge yesterday, “fuelled by a number of factors – not least being the ongoing market uncertainty. Each time we get another unexpected market number, or a corporate shock, it chips way confidence. In uncertain markets gold is seen as the safe-haven investment – especially when there is the threat of the technical US default on the back of the debt-ceiling being blocked by the Alt-Right of the Republican Party.”

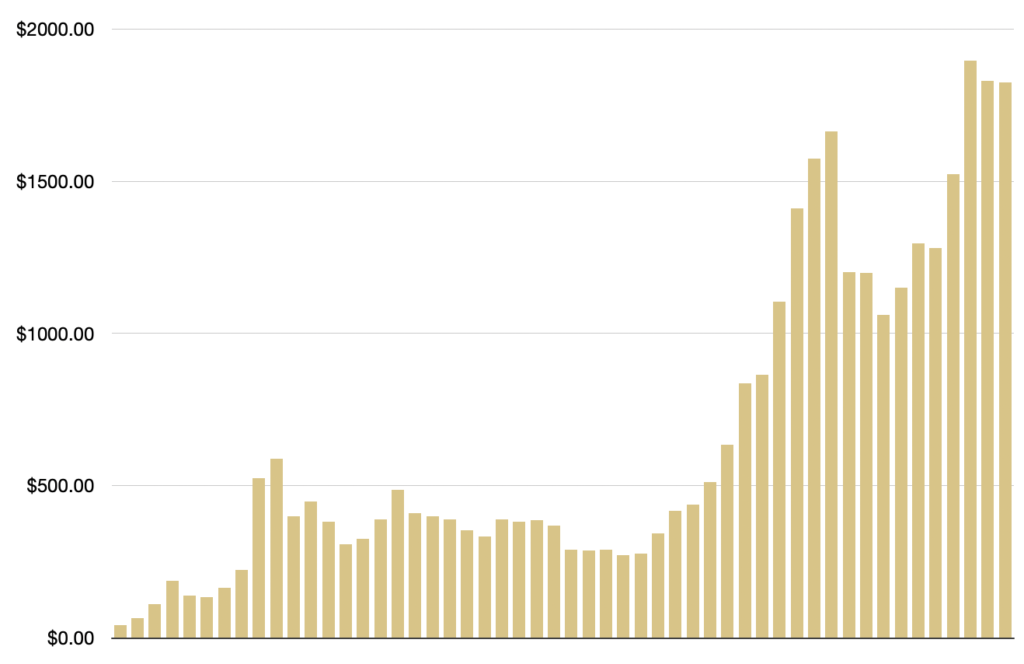

Gold annual average prices

(1971 – 2022)

Gold retreats after bumping against $1950 level in overnight trading

Dalio says dollar-dominated world order and globalized economy are ‘fading away’

(USAGOLD – 1/26/2023) – Gold retreated after bumping against the $1950 level in overnight trading. It is down $11 this morning at $1938. Silver is down 21¢ at $23.80. A key factor in gold’s pricing of late has been the return of hedge fund interest. “Hedge funds meanwhile have been near constant buyers since early November,” writes Saxo Bank’s Ole Hansen in a report issued earlier this week, “and during this time the net long has jumped from a 3.9 million ounce net short to a 9.3 million ounce net long, a nine-month high.” With greater hedge fund involvement in play, we should not be surprised at increased volatility and technical trading at key chart numbers.

Ray Dalio, who founded the world’s largest hedge fund, says the world order is shaping up in ways similar to the pre-World War II era, with “each country’s populism and nationalism growing in preparation for greater conflicts.” In the process, he says in an article on the Modern Diplomacy website, “the era of a ‘dollar-dominated world order and a globalized economy was ‘fading away.’ We are now going to have the major powers and their allies form economic, currency, and military blocs.” Mature economies, he says, “have run up very large debts and have developed a dependence on their central banks to print money to buy the government debts,” he said. The increase in debt monetization “will mean that holders of debt assets will get bad inflation-adjusted returns.” Dalio is a long-time advocate of gold ownership.

Gold and silver prices

(October 2022 to present)

Chart courtesy of TradingView.com

Gold turns to the downside in featureless trading

Gold posts record high in Japan, Switzerland exports 524 tonnes to China in 2022

(USAGOLD – 1/25/2023) – Gold turned to the downside this morning in featureless trading ahead of next week’s Fed meeting. It is down $12 at $1928. Silver is down 21¢ at $23.53. Jerry Grantham returned to the fray this morning to predict a bleak future for the stock market – a further 17% decline in 2023.

A few gold notes to start your day…… Australia’s Perth Mint, which enjoys a strong market for its wares in East Asia, reports record bullion product sales in 2022. Switzerland, where the world’s primary precious metals refineries are located, exported 524 tonnes of gold to China last year, the highest level since 2018. Gold prices posted a record high in Japan yesterday amidst inflation and recession concerns. Goldman Sachs says China’s reopening is a gamechanger for gold and oil…and the US dollar. Last, the US national debt is now six times larger than it was at the start of the century and is expected to grow at a rate of $1.3 trillion per year for the next decade. And that is a conservative estimate…

Gold gains as investors worry about possible government debt default

EWT analyst Gilbert says gold is poised for major rally, sees $2428 as next target

(USAGOLD – 1/24/2023) – Gold gained ground in early trading as investors began to worry about the knock-on effects of a possible federal government debt default. It is up $8.50 at $1941. Silver is up 28¢ at $23.79. State Street CEO Ron O’Hanley told Bloomberg that a showdown in Congress over the debt limit could cause a “fair amount of damage [in the bond market] well before you saw a default.” O’Hanley says the risks of a deadlock are greater this time around because “people believe that this is the only way they can get their message across.” State Street is one of the world’s largest asset management and custodial firms.

Avi Gilbert, the Elliot Wave Theorist who gained a significant following with his call for a sharp drop in gold after it hit record highs in 2011, now says that the metal is poised for a major rally. “Back in 2011,” he explains in an analysis posted recently at Seeking Alpha,” I utilized a 100+ year structure in gold to identify the topping target for gold. And, I used the same structure to identify a bottoming target for the correction I expected, even before that correction began. So, now I am going to provide you my next target on the upside – and that is $2,428.”

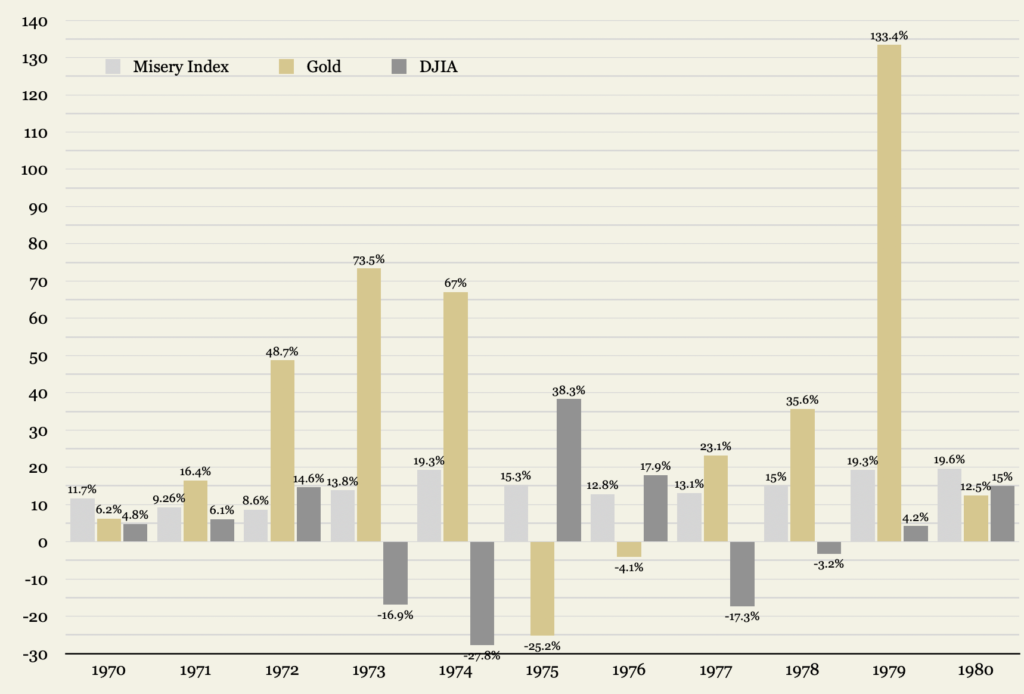

Gold, Dow Jones and Misery Index

(1970-1980 period of stagflation)

Gold starts week on a quiet note

Gold Newsletter’s Lundin says gold is in a ‘largely unrecognized’ bull market

(USAGOLD 1/23/2023) – Gold is starting the week on a quiet note as markets in general remain in a quandary over Fed policy and the possibility of a recession. It is up $2 at $1930. Silver is down 23¢ at $23.81. It is helpful to keep in mind that since gold’s triple bottom in early November, it is up almost 18%. It is up 5.5% since the start of the year. Gold Newsletter’s Brien Lundin sees gold’s steady performance of late as the start of a ‘largely unrecognized’ bull market.

“[T]he metal is consistently finding reasons to rise, as opposed to excuses to fall,” he says in a recent alert, “If you’ve been reading my stuff for very long, you know that I hold this as one of the most important hallmarks of a bull market. When the market is interpreting even potentially bearish news as bullish, that’s a bull market. Thus, even when the Dow is losing 600 points as it did yesterday, gold barely budged. All of this is good and bodes well for the future.”

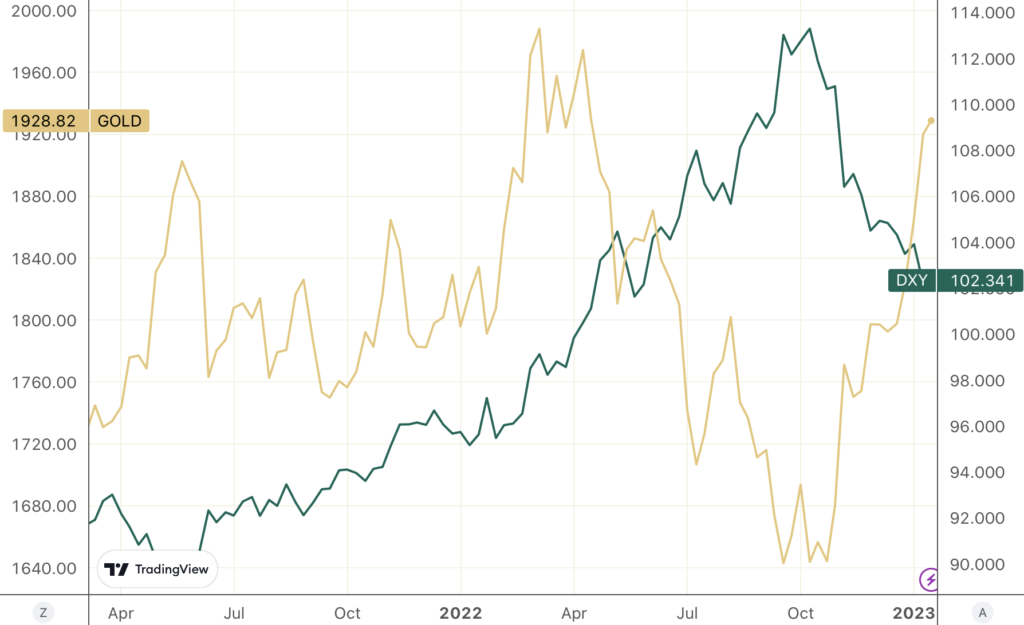

Gold drifts lower in follow-up to yesterday’s dollar-driven advance

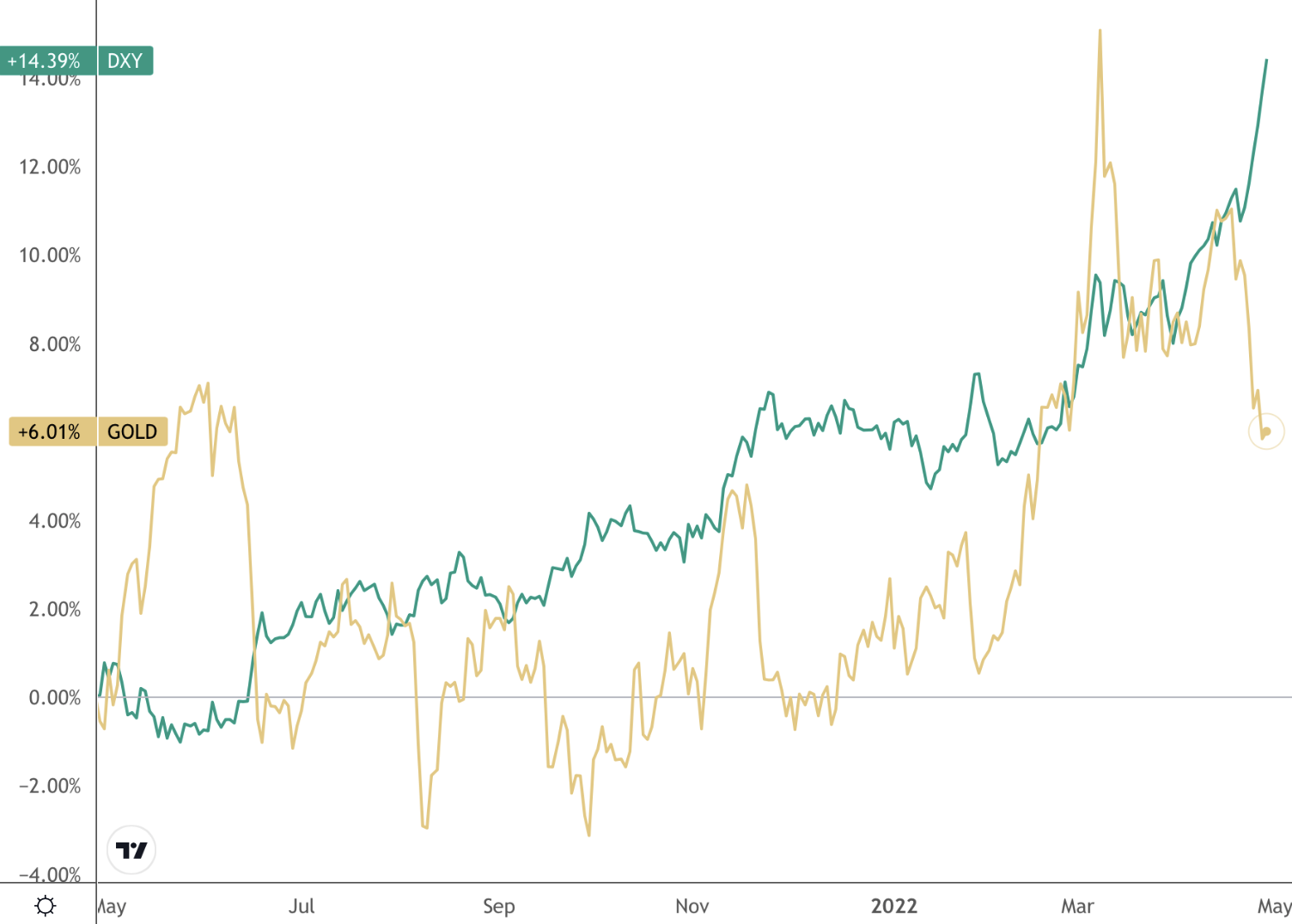

Pozsar sees US dollar’s exorbitant privilege under assault

(USAGOLD –1/20/2023) – Gold is drifting marginally lower in the follow-up to yesterday’s strong, dollar-driven advance. It is down $4 at $1931. Silver is up 12¢ at $24.03. Gold’s upside since the turn of the year, during which it has gained almost 6%, has been accompanied by a groundswell of opinion that the greenback’s strong two-year advance is in the early stages of a reversal. Zoltan Pozsar, the head of short-term rate strategy at Credit Suisse, believes that China’s deepening ties with OPEC+ and BRICs+ will alter the “existing world order” and “eventually lead to ‘one world, two [monetary] systems.'”

Investors, he says in an opinion piece published this morning by Financial Times, have to discount new risks. “In finance,” he concludes,” everything is about marginal flows. These matter the most for the largest marginal borrower — the US Treasury. If less trade is invoiced in US dollars and there is a dwindling recycling of dollar surpluses into traditional reserve assets such as Treasuries, the ‘exorbitant privilege’ that the dollar holds as the international reserve currency could be under assault.” If Pozsar is correct, it will carry important implications for gold.

Gold and the US Dollar Index

(2021 to present)|

Chart courtesy of TradingView.com • • • Click to enlarge

Gold pushes higher in cautious trading ahead of Fed speeches

Investor cash holdings near record high; Somerset Webb warns ‘it is only a temporary king’

(USAGOLD – 1/19/2023) – Gold pushed higher in cautious trading ahead of speeches from several Fed officials today, including the St. Louis Fed’s influential James Bullard. It is up $11 at $1917.50. Silver is up 3¢ at $23.57. The dollar hit a seven-month low in overseas trading adding impetus to gold’s upside and leading some to believe that the dominant trend for 2022 might be reversing. CNBC reported yesterday that investors are now holding near-record levels of cash. Merryn Somerset Webb, a senior columnist at Bloomberg Opinion, thinks that might be another dead end for investors. “If you are holding cash,” she says, “it is only a temporary king.” She says that inflation, which erodes the value of cash, will be with us for the long haul and that investors should look to gold, as an alternative.

“As Alex Chartres of Ruffer recently said on my podcast,” she writes in a recent opinion piece, “there aren’t many other things you can turn to as a long-term safe haven in today’s markets. A year ago, some thought Bitcoin might be a rival – a digital gold even. The market has now ‘kneecapped’ that idea. These days, if you want gold, you will need to buy, well, gold. That being the case, the question is not have you too much, but have you enough — the very same question the head of the PBoC is clearly asking himself right now.

Inflation-adjusted price of gold

Chart courtesy of MacroTrends.net

No DMR today – 1/18/2023; Yesterday’s report follows.

________________________________________________________________

Gold tracks lower as recession, possible government shutdown dent sentiment

Roubini sees gold at $3000 by 2028 as Fed ‘wimps out’ on inflation

(USAGOLD – 1/17/2023) – Gold tracked to the downside this morning as recession and a possible federal government shutdown dented investor sentiment. It is down $6 at $1912.50. Silver is down 24¢ at $24.14. Nouriel Roubini, who has become increasingly vocal about investors including gold in their portfolio mix, believes that the Fed will “wimp out” on the inflation fight as it faces the possibility of an economic crash and a new financial crisis.

He says gold is the best protection for investors and predicts it will rise to $3000 by 2028, providing investors with an average annual return of 10% over the next five years. “If I am right, that we will have a hard landing, the inflation is going to be persistent, the central banks are in a dilemma, and therefore, both equities and bonds will do poorly … Gold should do better,” he said in a recent Kitco News interview.

A little Ramirez-style humor to start your week –

Gold edges higher to close out productive week

Hathaway says gold built solid technical base in 2022, setting stage for strong advance in 2023

(USAGOLD – 1/13/2023) – Gold edged higher in early trading as it looks to finish out what’s been a productive week. It is up $3.50 at $1903. Silver is down 7¢ at $23.77. On the week, gold is up 1.84%, and silver is down .83%. It’s beginning to look like gold might be running into some resistance at the $1900 level. Long-time market analyst John Hathaway says that gold spent 2022 building “a solid base” in technical terms that has set the stage in 2023 for “a strong advance to new record highs against the supposedly invincible U.S. dollar.”

“2023 will reveal that the gross mispricing of financial assets that led to the worst performance of financial markets since 2008 has been only partially resolved,” says Hathaway in an analysis posted earlier this month. “We believe the bear market [in stocks and bonds] is far from over, even though investment sentiment is more negative than at the market lows of 2002 and 2008 (AAII Investor Sentiment Survey). With the economy likely to slump into a protracted recession, the Federal Reserve (‘Fed’) will be forced to abort its anti-inflation campaign. A Fed reversal could give temporary respite to financial assets. More importantly, it could underscore the dependency of public policy on money printing and provide a significant boost to the precious metals sector.”

Gold and silver price gains

(Five years)

Chart courtesy of TradingView.com

Gold pushes toward $1900 mark in advance of CPI data

‘Once you get into the 1900s, it becomes a gravitational pull toward $2000.’

(USAGOLD – 1/12/2023) – Gold pushed toward the $1900 level in advance of today’s inflation data. It is up $10 at $1888. Silver is up 37¢ at $23.85. The consensus view is that the CPI will come in at 6.5% – a significant drop from the 7.1% reading in November that might inspire a more dovish Fed. Financial Times attributes gold’s 15% rise since early November to expectations that the Federal Reserve “will slow the pace of its increases in borrowing costs as inflation eases off its highs.” It quotes Blue Line’s Phillip Streible as saying gold could break through $1900 if today’s inflation reading comes in weaker than expected. “Once you get in the 1900s,” he says, “it becomes a gravitational pull towards $2,000.”

Gold drifts sideways ahead of tomorrow’s inflation data

Credit Suisse foresees the possibility of $2300 gold and ‘likely beyond’

(USAGOLD – 1/11/2023) – Gold drifted sideways in early trading as investors awaited tomorrow’s Labor Department inflation data. It is up $1.50 at $1881. Silver is up 20¢ at $23.89. Trading Economics forecasts a 6.7% inflation reading for December – a sharp drop from November’s 7.1% and a number the markets would likely interpret as a dovish influence on the Fed. Technical analysts at Credit Suisse foresee the possibility of gold trading at $2300 in 2023.

“We look for further tactical gains to test the 61.8% retracement of the 2022 fall and June 2022 high at $1,876/96, which ideally caps for now,” says the bank In a report posted this morning at FXStreet. “Should strength directly extend though we see resistance next at the 78.6% retracement and April 2022 high at $1,973/1,998. Whilst on a big picture basis this strength is seen as a rally within a broader long-term sideways range, should the rally ever extend above the record highs from 2020 and 2022 at $2,070/2,075, this would be seen to mark a significant and long-term break higher, opening up we think $2,300 and likely beyond.”

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics

Gold drifts sideways ahead of inflation data, Powell speech

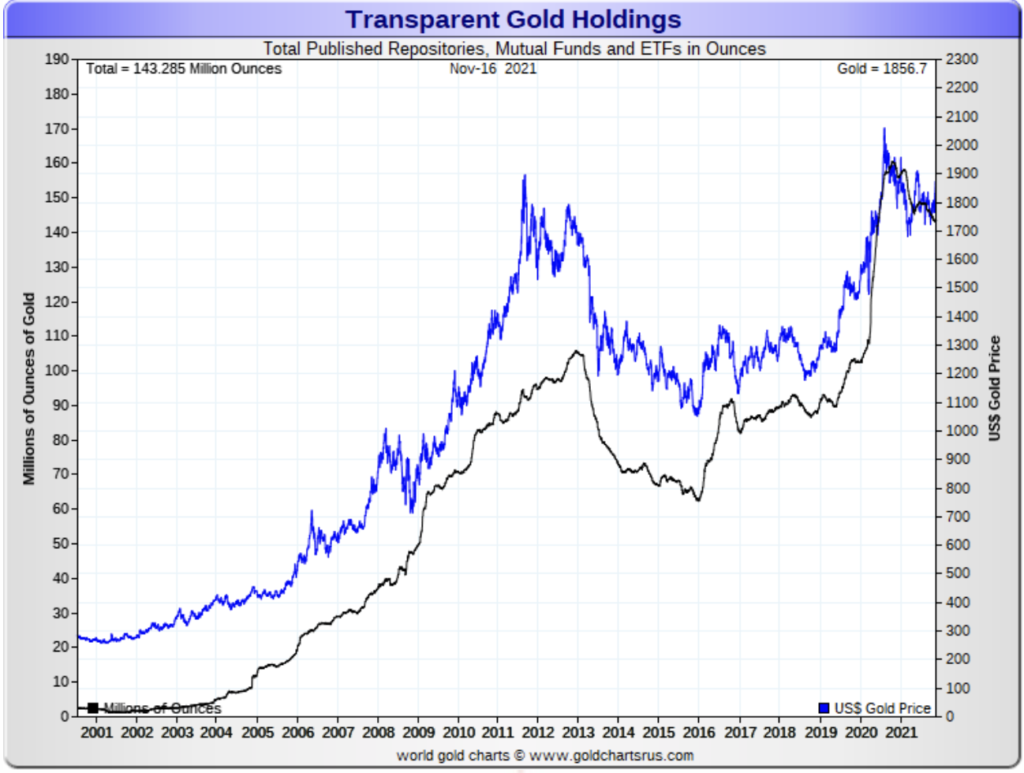

Saxo Bank says gold has been the “star performer” during the first week of commodities trading

(USAGOLD – 1/10/2023) – Gold drifted sideways ahead of tomorrow’s all-important inflation report and Jerome Powell’s speech later today. It is level at $1874.50. Silver is down 19¢ at $23.56. Saxo Bank’s Ole Hansen offers a solid assessment of the developing demand for gold among futures traders in an analysis posted this morning. To sustain the momentum, though, he thinks gold will need further support from central bank and ETF investors. “Both of which are playing out,” he adds, “after China’s PBoC added 62 tons during November and December while ETFs last week saw its first back to back week of buying since last April.”

“Demand for gold,” he says, “which started to recover after the yellow metal made a triple bottom around $1620 back in November (See chart), extended into the new year with funds raising their net long by 8% to 7.8k lots, a seven-month high. Supported by momentum and the outlook for a friendlier 2023 for investment metals gold has been the star performer during the first week of trading. While many wise traders over the years have refrained from getting involved during the first few weeks of a new year, the continued rally has increasingly forced technical focused traders to get involved.”

Gold Price

(One Year)

Chart courtesy of TradingView.com

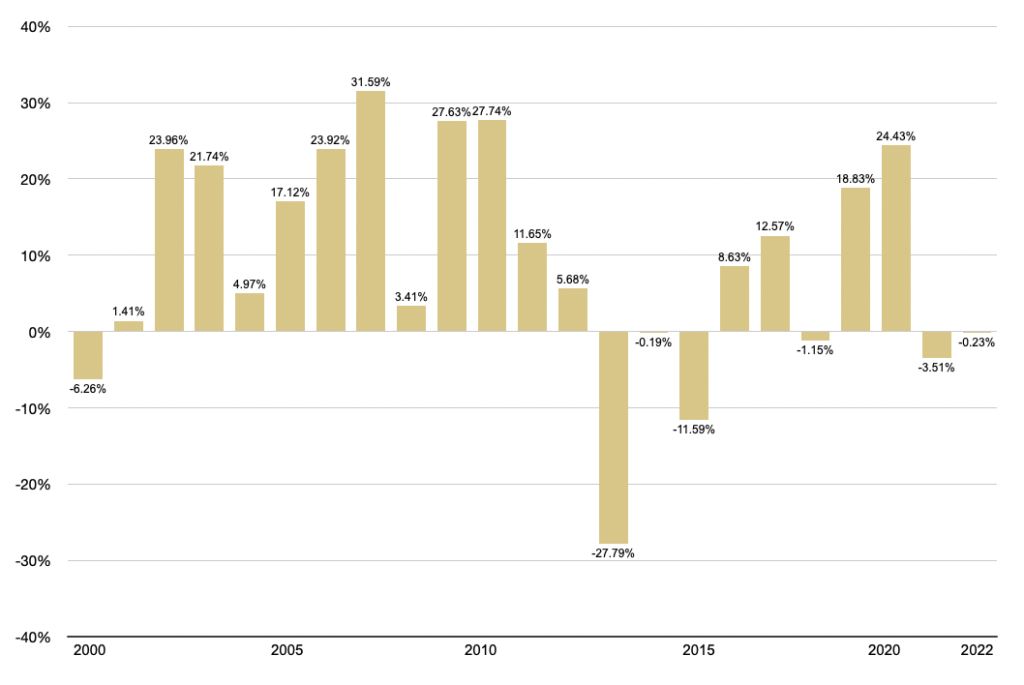

Gold extends new year rally

China announced adding another 30 tonnes to its reserves in December

(USAGOLD –1/9/2023) – Gold extended its new year rally this morning as investors prepped for Thursday’s inflation data release, and commodities, led by oil, turned to the upside on the prospect of economic recovery in China. It is up $9 at $1877.50. Silver is up 10¢ at $24.02. Adding to the momentum, China announced the acquisition of another 30 tonnes of the yellow metal in December – the second month in a row it added to its coffers. Credit Bubble Bulletin‘s Doug Noland sees bubbles everywhere, each in its own unique stage of inflation or deflation. The one non-bubble in his scenario is gold at a time of “acute currency market uncertainty and instability.”

“[Will 2023] be the year of precious metals?” he asks. “Precious metals were generally out of the blocks quickly to begin the new year. Metals performed relatively well last year in the face of dollar strength and rising rates. A year of currency market uncertainty, persistent inflation, and ongoing expansion of non-productive Credit would seem to support the precious metals. After a 2022 inflection point, I would expect 2023 to provide more New Cycle momentum. There will be ebbs and flows, but the cycle of hard asset outperformance versus financial assets is in its infancy.”

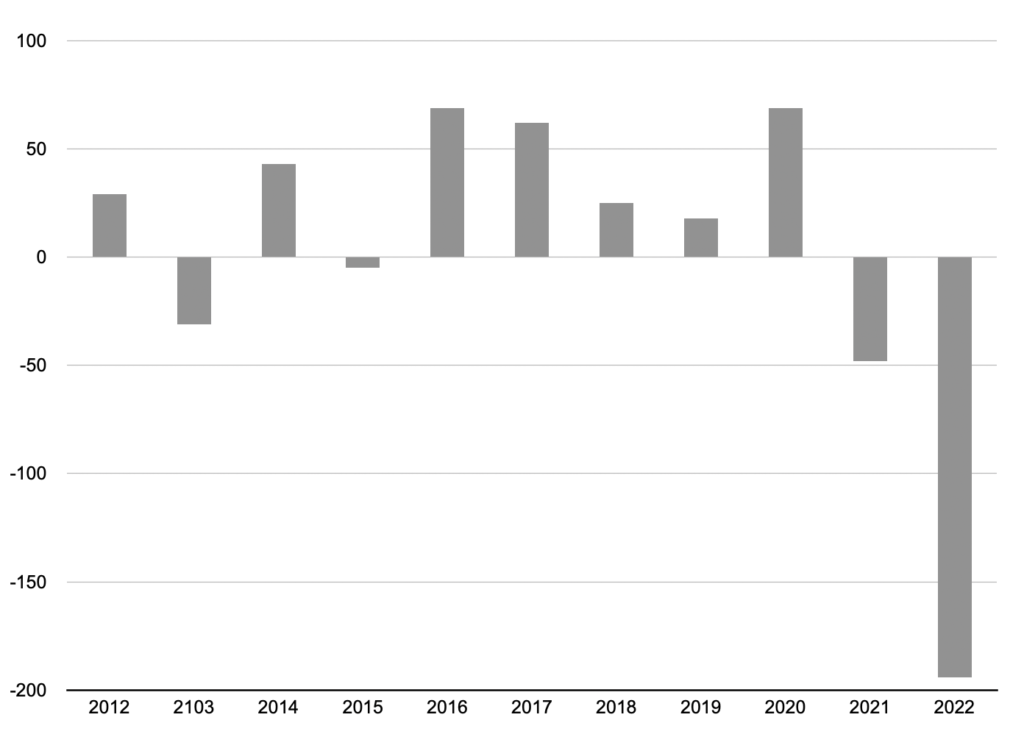

Gold annual returns

(%, 2000-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: MacroTrends.net • • • Click to enlarge

Gold marginally higher ahead of jobs report

Saxo Bank foresees strong gold demand from central banks and ETFs in ‘price friendly’ 2023

(USAGOLD – 1/6/2023) – Gold moved marginally higher as financial markets traded cautiously ahead of this morning’s jobs number. It is up $4 at $1849.50. Silver is up 19¢ at $23.52. The World Gold Council reports central banks added another 50 tonnes of gold to their collective holdings in November. Saxo Bank’s Ole Hansen sees 2023 as “price friendly” for investment metals as central banks continue buying and ETF demand turns to the plus side.

“This de-dollarization and general appetite for gold,” he says in a client update posted this morning, “should ensure another strong year of official sector gold buying. Adding to this we expect the friendlier investment environment for gold to reverse last year’s 120 tons reduction via ETF’s to a potential increase of at least 200 tons. Hedge funds meanwhile turned net buyers from early November when a triple bottom signaled a change away from the then prevailing strategy of selling gold on any signs of strength. As a result, the net position during this time flipped from a 38k contract net short to a 67k contract net long on December 27.”

Gold gives back some of its early-year gains

The lack of dovish indicators in Fed minutes plays on market sentiment

(USAGOLD – 1/5/20230) – Gold drifted to the downside this morning, giving back some of the gains since the start of the year. It is down $7 at $1849.50. Silver is down 32¢ at $23.52. Pressing on market sentiment was the lack of any dovish indicators on rates in December’s FOMC meeting minutes released yesterday. In fact, the FOMC reported that “no participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023.” Yet, traders, for their part, cling to the notion that a weakening economy will force the Fed to step back.

“Gold is having a great start to the New Year,” writes senior market analyst Ed Moya at the Oanda website. “Wall Street continues to pile into gold as global bond yields continue to slide and recessionary risks remain elevated. Many traders are growing confident that the end of the Fed’s tightening cycle is nearing and that rate cuts could happen at the end of the year. Gold is eyeing the $1900 level, but for that to happen we’ll need to see the bond market rally remain in place a while longer.”

Gold extends new year rally into second day

Napier says rate increases will not keep up with inflation; gold will benefit

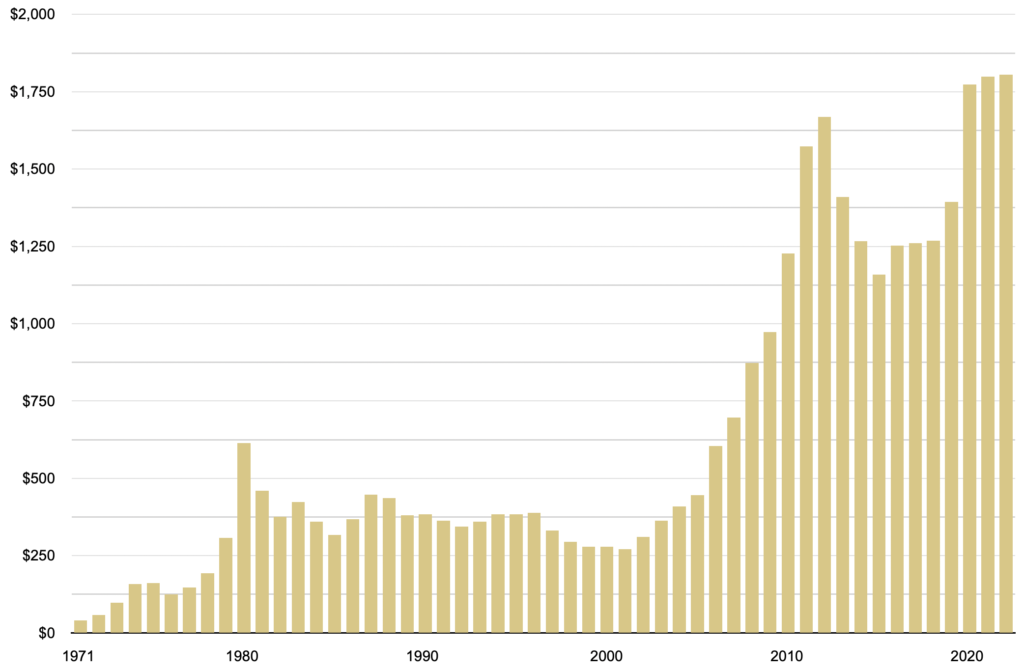

(USAGOLD – 1/4/2023) – Gold took its new year rally into its second day on rising hopes that inflation is on the fade and the Fed will begin dialing down interest rate increases. It is up $16 at $1858. Silver is up 20¢ at $24.27. Russell Napier, the highly regarded markets analyst, is at odds with the building sentiment on inflation and rates. He says inflation will not be matched by rate increases – a process he calls “financial repression” that will remain in place for at least a decade. Gold, he believes, will be among the beneficiaries.

“Gold has long seemed a better bet in an environment when inflation would be rising faster than interest rates,” he writes in an analysis published Monday in the Toronto Star. “Going forward, the more investors focus on governments’ need to ensure that interest rates remain below the rate of inflation, the more the price of gold is likely to rise. This will be particularly true when central bankers begin to reduce interest rates. Should a financial repression require capital controls to coral investors into local currency government bonds, the rise in the gold price will accelerate.”

Gold average annual price

(1971-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: MacroTrends.net

Gold, silver off to respectable start for the New Year

Silver Institute reports record overall demand, 194 million ounce supply shortfall

(USAGOLD – 1/3/2023) – Gold is off to a respectable start for the new year as investors weighed the possibility of another troubling year in financial markets. It is up $12 at $1838. Silver is up 32¢ at $24.36. The metals gained despite a stronger dollar. Gold finished 2022 up 1.19%, but silver, after a see-saw struggle for much of the year, ended up posting the stronger gain – up 4.61%.

The Silver Institute reports record overall silver demand and static supply in its year-end summary released last week. The result was a 194 million ounce shortfall in 2022 – four times the 2021 deficit and a new record. “Physical silver investment (purchases of silver coins and bars) in 2022 was forecast to jump 18% to 329 Moz, a new record high,” reports SI. “Support was due to investor fears of high inflation, the Russia-Ukraine war, recessionary concerns, and buying on price dips. The rise was boosted further by a near-doubling of Indian demand, with investors often taking advantage of lower rupee prices.”

Silver surplus or deficit

(Millions of troy ounces)

Chart by USAGOLD [All rights reserved] • • • Data source: The Silver Institute

No DMR today

We will update later if anything of interest develops. The following is Friday’s report.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gold closes out a hapless week dominated by a speculative US dollar frenzy

Bridgewater’s Prince says investors need to prepare for a decade of stagflation

(USAGOLD – 7/15/2022) – Gold continued its trek to the downside in early trading as it closed out a hapless week dominated by a speculative frenzy and run-up in the US dollar index. It is down $4 on the day at $1708.50 and 2% on the week. Silver is up 2¢ on the day and down 4.1% on the week. In an opinion piece published in Financial Times this morning, Bob Prince, Bridgewater Associates’ co-chief investment officer, says that investors need to prepare for a decade of stagflation by shifting away from “vulnerable equity and equity-like exposure.”

“Historically, equities have been the worst-performing asset in stagflationary periods,” writes Prince, “because they are vulnerable to both falling growth and rising inflation. Other predominantly growth-sensitive assets like credit and real estate also perform poorly. Nominal bonds are closer to flat in such environments.… Within these monetary policy regimes, the relative returns of assets still align with their biases, with index-linked bonds, gold, and commodities giving investors better relative returns regardless of how policymakers respond.” Bridgewater Associates is the world’s largest hedge fund.

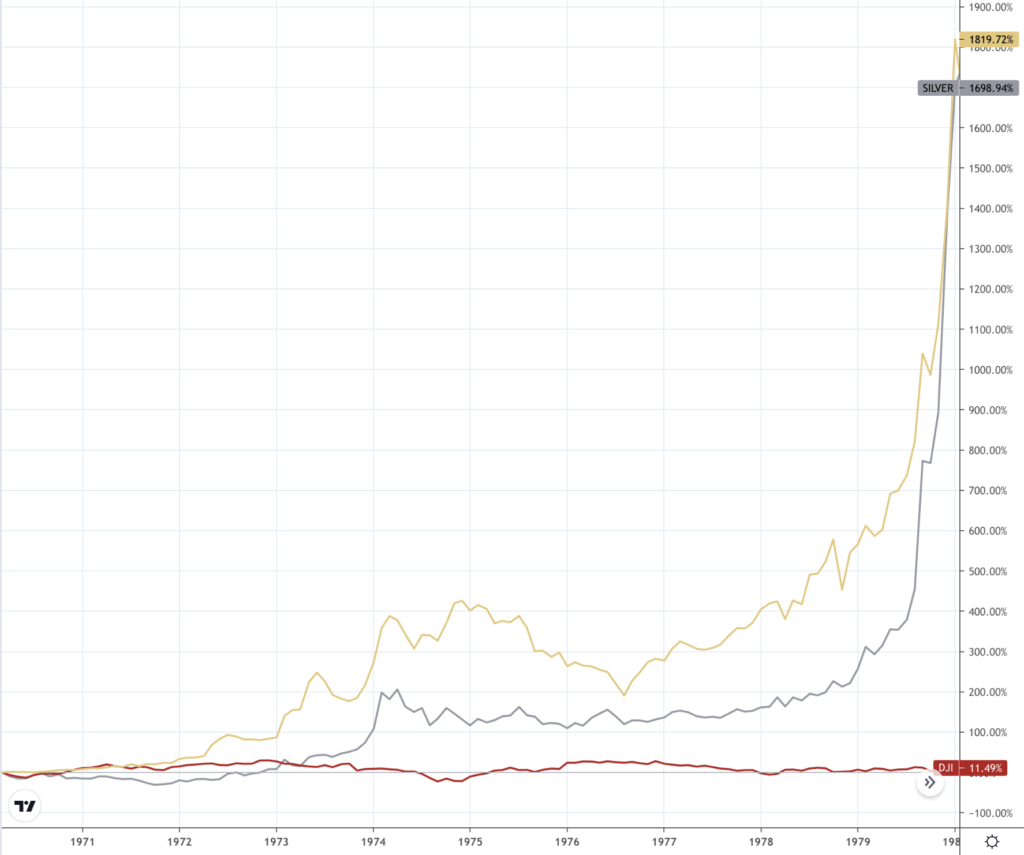

Editor’s note: To illustrate Prince’s point, we return to a chart posted previously with this report. It shows the performances of gold, silver, and stocks during the 1970s, the last time investors faced a stagflationary shock. Gold rose 1820%, silver 1699%, and the DJIA 11.5%

Gold, silver, and stocks performance

(%, 1970-1979)

Chart courtesy of TradingView.com • • • Click to enlarge

Gold rallies on weaker dollar, yesterday’s negative GDP number

Crescat sees ‘probable step-function devaluation of fiat currency systems’ against gold

(USAGOLD – 4/29/2022) – Gold rallied this morning on firmer Asian currencies and a somewhat delayed response to yesterday’s negative GDP print. It is up $21 at $1918. Silver is up 22¢ at $23.45. Gold looks like it will finish April down about 1%. Always more volatile, silver is setting up to finish the month down 6%. The World Gold Council released its Gold Demand Trends report for the first quarter yesterday, and it shows overall demand up 34% over last year’s first quarter, with soaring investment demand (up 203%) leading the way. That uptick, in turn, was led by increased ETF demand as funds and institutions returned to the market. In a recent detailed analysis posted at Seeking Alpha, Crescat Capital suggests that we are entering a new era for the global monetary system but that it might not be what is popularly envisioned.

“Contrary to much gold conspiracy thought, it does not mean that we are facing the demise of the Western banking system nor the rise of authoritarian economies and their fiat currencies. It doesn’t necessarily mean the rise of non-government backed intangible currencies either. Governments will maintain legal authority and power over currency systems. Individuals and businesses will use those currencies. The strongest fiat currencies are likely to continue to be those in advanced economies where the principles of liberty, justice, democracy, entrepreneurship, and free markets reign. The macro setup today portends a deleveraging of the global economy through inflation, including a probable step-function devaluation of all fiat currency systems relative to gold, a persistent phenomenon throughout world history.”

(Editor’s note: The accompanying chart supports Crescat’s argument. Over the past five years, gold is up 50.5% against the dollar; 44% against the Chinese yuan; 55.5% against the British pound; 55.8% against the euro; 75.7% against the Japanese yen; and 79% against the Indian rupee, with a notable acceleration in those trends since the beginning of 2022.)

Gold in major national currencies

(%, five-year)

Chart courtesy of TradingView.com • • • Click to enlarge

Gold level as sharp dollar advance continues

‘The last time this happened markets got very wobbly.’

(USAGOLD – 4/28/2022) – Gold is level this morning as the dollar advanced sharply against both the Japanese yen and Chinese yuan, and the markets awaited this morning’s GDP number expected to come in at an anemic 1.1% for the first quarter. It is trading at $1888 in the early going. Silver is down 30¢ at $23.08. Gold and the dollar generally advanced in tandem over the past year as investors positioned themselves defensively in response to weakening global bond markets. That all changed over the past month when the Japanese, Chinese, and European central banks advertised looser monetary policies while the Federal Reserve signaled the polar opposite. In response, the dollar index took a sharp turn to the upside (up 14% over the past year), while gold weakened from near all-time highs (though, as a matter of perspective, it is still up about 6% over the past year).

“China,” writes Money Week’s John Stepek in an analysis posted Tuesday, “is now on the wrong side of the central bank rate-raising cycle. (Ed. note: The same might be said for Japan and Europe.) China’s slowdown means it’s not going to raise interest rates – but the US is, and, all else being equal (it never is, but rates matter more than most things) higher rates will attract more money than lower rates. Anyway, last time this happened markets got very wobbly, which is one reason why central banks decided against raising rates. As you may well have noticed, markets are pretty wobbly right now as well. So a few questions arise from all this.” Stepek advises sticking with inflation bets. “I’d hold some gold (it’s handy to have in a panic),” he concludes, “and I’d make sure you allocate more to cash than usual simply to have it around in case you need it or want it to take advantage of any opportunities.”

Gold and the U.S. Dollar Index

(%, 12-months)

Chart courtesy of TradingView.com

Gold continues to seesaw around $1900 as the dollar hits a two-year high

Deutsche Bank sees higher inflation as the “defining macro story of the decade”

(USAGOLD – 4/27/2022) – Gold continued to seesaw around the $1900 with a firmer dollar – now at two-year highs – the dominant feature in this morning’s trading. It is down $4 at $1904. Silver is up 15¢ at $23.71. As next week’s Fed meeting draws near, concern mounts over the prospect of global stagflation. In an analysis reviewed this morning at Zero Hedge, Deutsche Bank doubles down on its recent prediction that “higher inflation” will be the “defining macro story of the decade” and that sentiment is now “skewed heavily to the downside risk of a significant recession.” The prospect of an inflationary recession, though, simply tops a lengthy list of investor concerns that includes further escalation in the Ukraine war, the China lockdowns, a more hawkish Fed, supply disruptions – etc. According to a Reuters report yesterday, Swiss gold exports to the United States “rocketed” higher in March to their highest level since the early days of the pandemic in 2020 as investors “stocked up on bullion.”

Gold garners marginal support at $1900

Sprott’s Brady expects Fed to pull another 180 on quantitative tightening

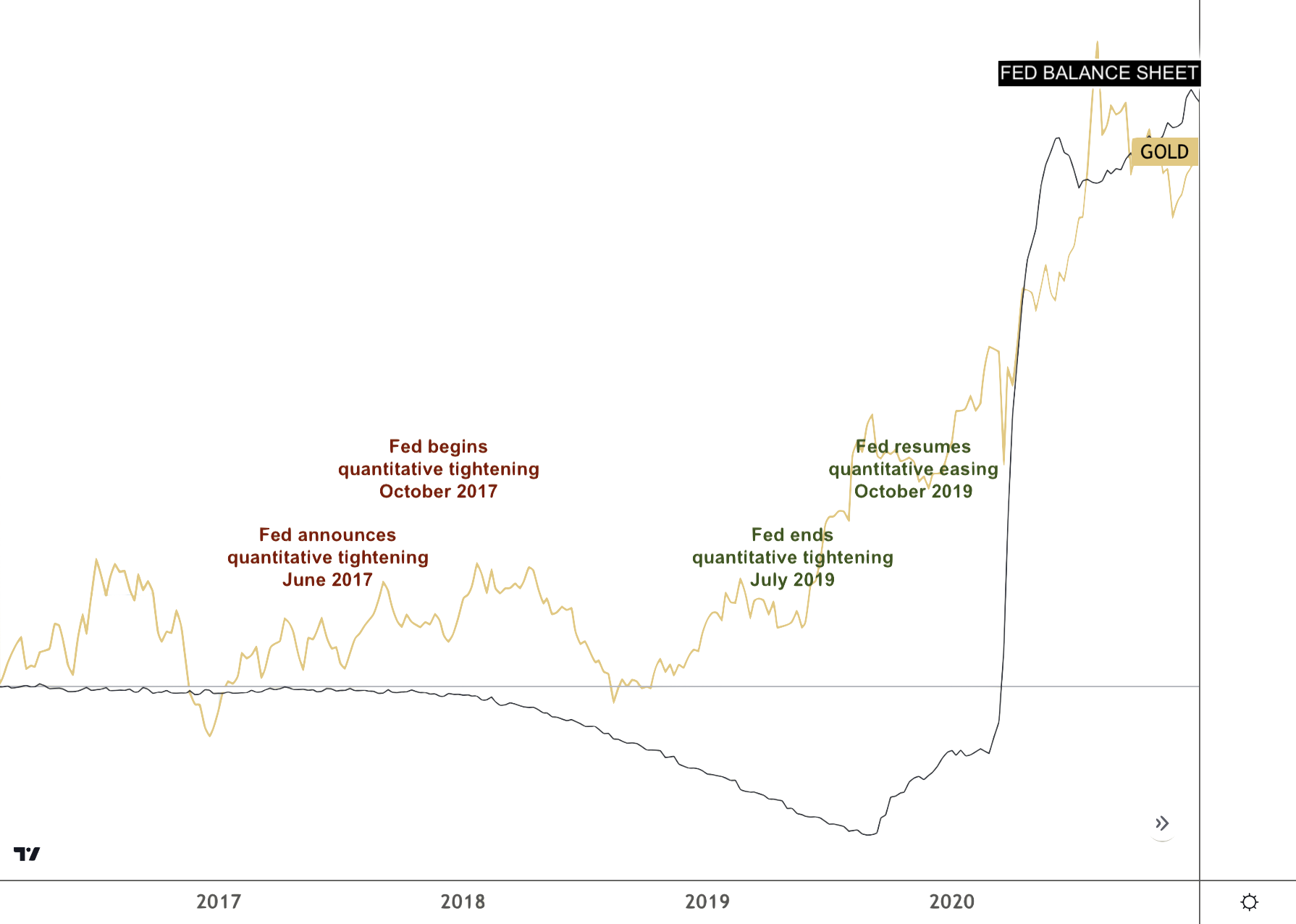

(USAGOLD – 4/26-2022) – Gold garnered marginal support at the $1900 level this morning as markets continued to worry about the lockdowns in China, a more aggressive Fed, and a possible stagflationary recession. It is up $6 at $1906.50. Silver is up 13¢ at $23.75. Sprott Money’s David Brady sees gold’s current difficulties as a temporary blip in a Fed-inspired longer-term uptrend.

“Note that various markets are tagging levels last seen in March 2020, December 2018, and 2007-08,” he says in a Seeking Alpha article posted before yesterday’s descent to the $1900 level. “What happened next in each of those circumstances? The Fed turned on the printing presses. I fully expect them to do so again. It’s just a question of when. My best guess is around the September to October timeframe, typically the worst time for stocks. The alternative is the collapse of everything. When the Fed pulls its next 180, watch real yields plummet and gold, silver, and the miners go parabolic, IMHO. In the meantime, we could suffer more downside. 1900 is the key support level in gold that needs to hold in order to avoid a deeper dive. Whether it holds 1900 and we go straight up or we get a bigger drop and then head higher, the ultimate destination is the same, just as it was post-March 2020, December 2018, and 2007-08.”

Gold and the Fed Balance Sheet

(2016-2021)

Chart courtesy of TradingView.com • • • Click to enlarge

Gold weighed down by a stronger dollar, Fed hawkishness, China lockdowns

Blain says the markets are ‘significantly underestimating’ Ukraine consequences

(USAGOLD – 4/25/2022) – Gold continued its decline this morning, weighed down by a stronger dollar, perceived Fed hawkishness, and growing concern over the lockdowns in China. It is down $23 at $1911. Silver is down 53¢ at $23.69. Despite the market weakness (or perhaps because of it), Saxo Bank’s Ole Hansen reports strong demand for the metal coming from “asset managers seeking protection against rising inflation, lower growth, geopolitical uncertainties as well as elevated volatility in stocks and not least bonds.” The net effect over the past week has been a gradual slide in gold and a much steeper one in silver as investors attempt to sort out the conflicting signals. Shard Capital’s Bill Blain is convinced that the markets are “significantly underestimating how the rollover from Ukraine consequences will hit the global economy.”

“The waves of tectonic economic instability unleashed by the Ukraine conflict,” he writes in a recent advisory, “have shocked and caught the global commentariat of politicians, central bankers, economists and investment analysts off guard. Inflation from agribusinesses, energy and supply chains is spinning unchecked – and, like a nuclear reaction, they are triggering a host of follow up consequences. It feels a little bit Chernobyl – the reactor is going critical! Our cosy assumptions about how the interconnected globalised economy was supposed to work are being rocked to the core.”

Gold tracks south as diverging central bank policies push the dollar higher

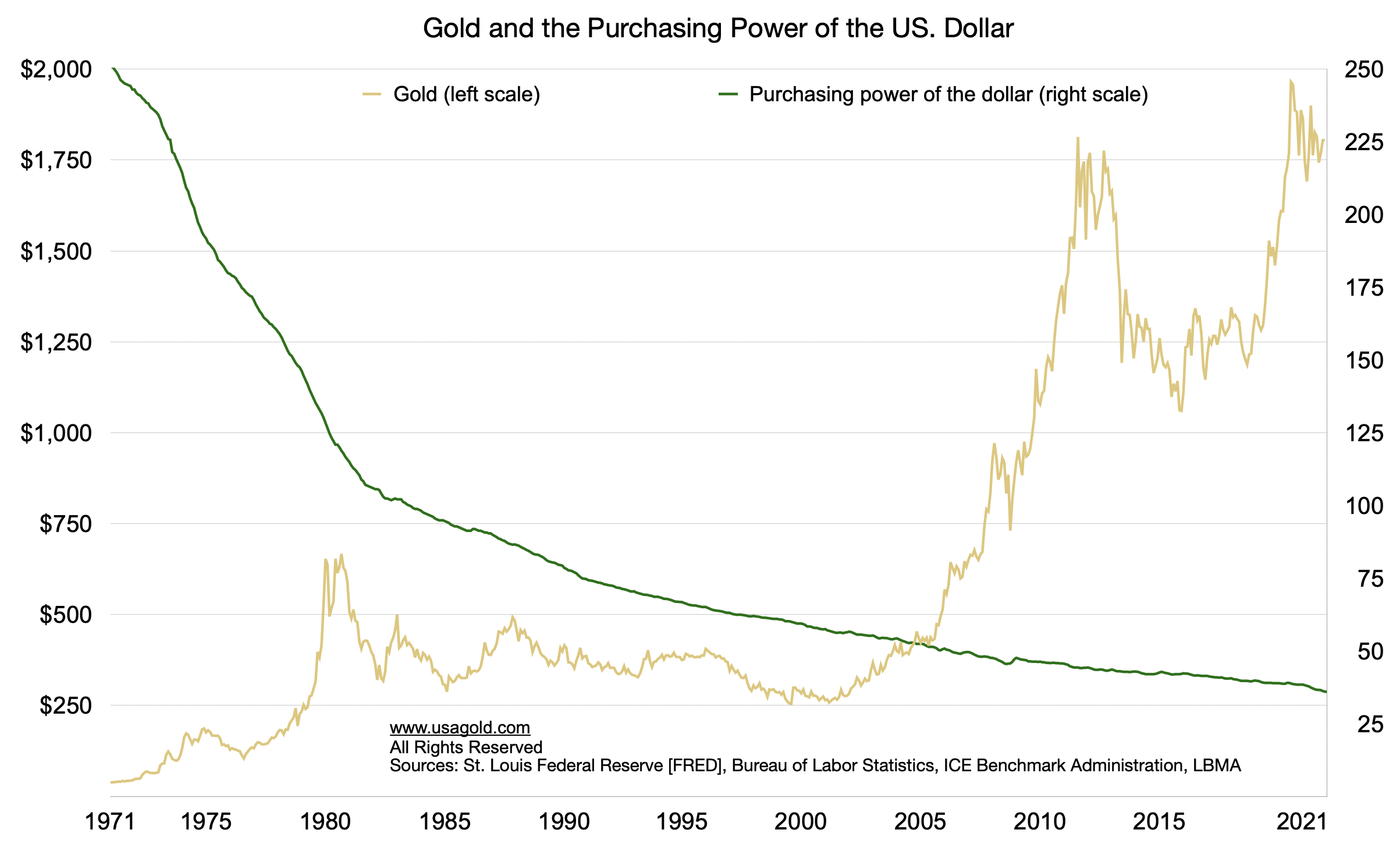

James Turk: ‘Gold preserves purchasing power over long periods of time.’

(USAGOLD – 4/22/2022) – Gold is tracking south this morning as a combination of hawkish Fed policy and dovish tilts in Japan and China pushes the dollar higher. It is down $15 at $1939. Silver is down 34¢ at $24.40. Though the dollar is in an uptrend against other currencies, its purchasing power in terms of goods and services is in sharp decline – and that, in the end, is what most concerns U.S.-based investors. Veteran market analyst James Turk made some insightful comments on that score in a recent interview posted at Epoch Times. Gold, he says, “does not suffer from entropy; it cannot be destroyed.”

“All the gold mined throughout history,” he continues, “still exists in its aboveground stock, which if formed in a cube could slide under the arches of the Eiffel Tower. Gold is mined and then accumulated because its greatest use is money. … Importantly, gold preserves purchasing power over long periods of time. Doing so enables sound economic calculation – namely, measuring prices – and that is essential to economic activity. For example, though the price of crude oil is rising in terms of euros, dollars, pounds, and the other national currencies, there is no inflation when prices are calculated in weights of gold. … A gram of gold buys essentially the same amount of crude oil as it did in 1950. This result occurs because the aboveground stock of gold grows by approximately the same rate as world population, causing the supply and demand for gold to remain in balance with the supply and demand of the goods and services humanity needs. Nature provides everything humanity needs to advance, including money.”

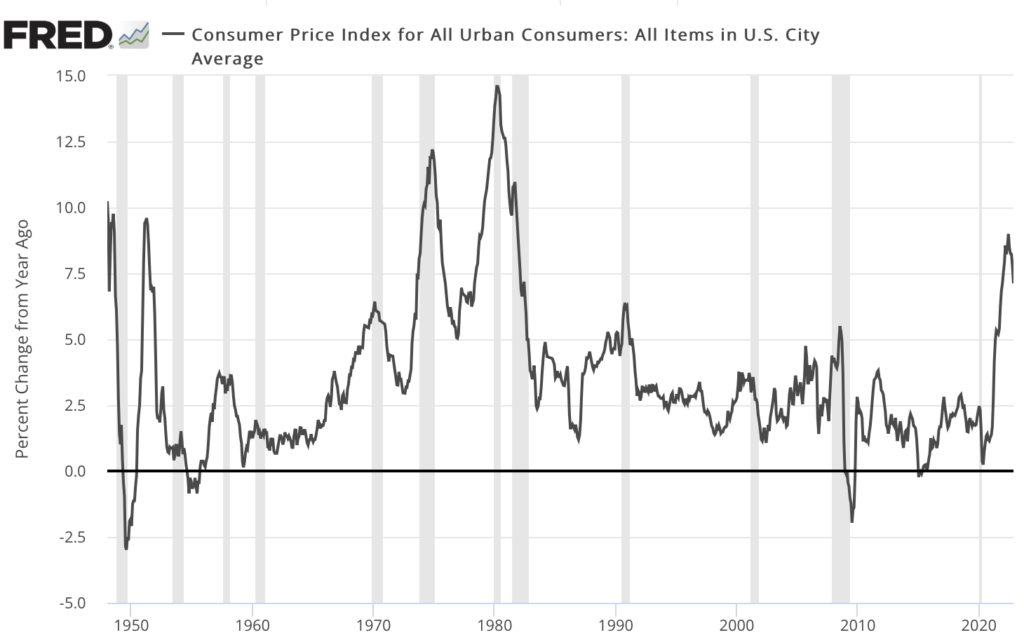

We offer two charts this morning to support Turk’s argument. The first shows the performance of gold against the long-term decline of the dollar. The second shows the sharp acceleration in that decline over the past eighteen months.

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics

Gold slides under generally subdued market conditions

Saxo Bank says gold now getting ‘directional input’ from oil

(USAGOLD – 4/21/2022) – Gold slid further this morning under generally subdued conditions in most markets. It is down $10 at $1950. Silver is down 40¢ at $24.88. The downtrend of the past few days aside, Saxo Bank’s Ole Hansen sees gold’s performance thus far this year (+8%) as “impressive” against the backdrop of rising yields and a firmer U.S. dollar. He believes its strength has to do with investors seeking safe haven from multiple uncertainties present long before the Ukraine war began – trends now exacerbated by the conflict.

“…The actual impact of sharply higher prices of everything,” he says in a report released yesterday, “is now increasingly being felt across the world. In response to this investors are increasingly waking up to the fact that the good years which delivered strong equity returns and stable yields are over. … Instead of real yields, we have increasingly seen gold take some of its directional input from crude oil, a development that makes perfect sense. The ebb and flow of the oil price impacts inflation through refined products such as diesel and gasoline while its strength or weakness also tell us something about the level of geopolitical risks in the system.”

Chart courtesy of TradingEconomics.com

Gold attempts to stabilize after yesterday’s sell-off

Greenlight’s Einhorn skeptical of the recent blitz in hawkish Fed rhetoric

(USAGOLD – 4/20/2022) – Gold is attempting to stabilize after yesterday’s sell-off driven by short-selling/profit-taking near the $2000 level, a firming dollar, and hawkish comments from Fed governor James Bullard. It is level at $1953. Silver is up 3¢ at $25.29. Greenlight Capital’s David Einhorn is among the group of Wall Street veterans skeptical of the recent blitz in hawkish Fed rhetoric. “[I]s the Fed doing whatever it takes or is it just talking tough, while in reality implementing a weak initial response that could exacerbate the problem?” he asks in his just-released quarterly review of markets. “We think it is clearly the latter. … [T]his feels like trying to figure out whether it’s best to clear a foot of snow from your driveway with a soup ladle vs. an ice cream scooper. This certainly isn’t doing whatever it takes.”

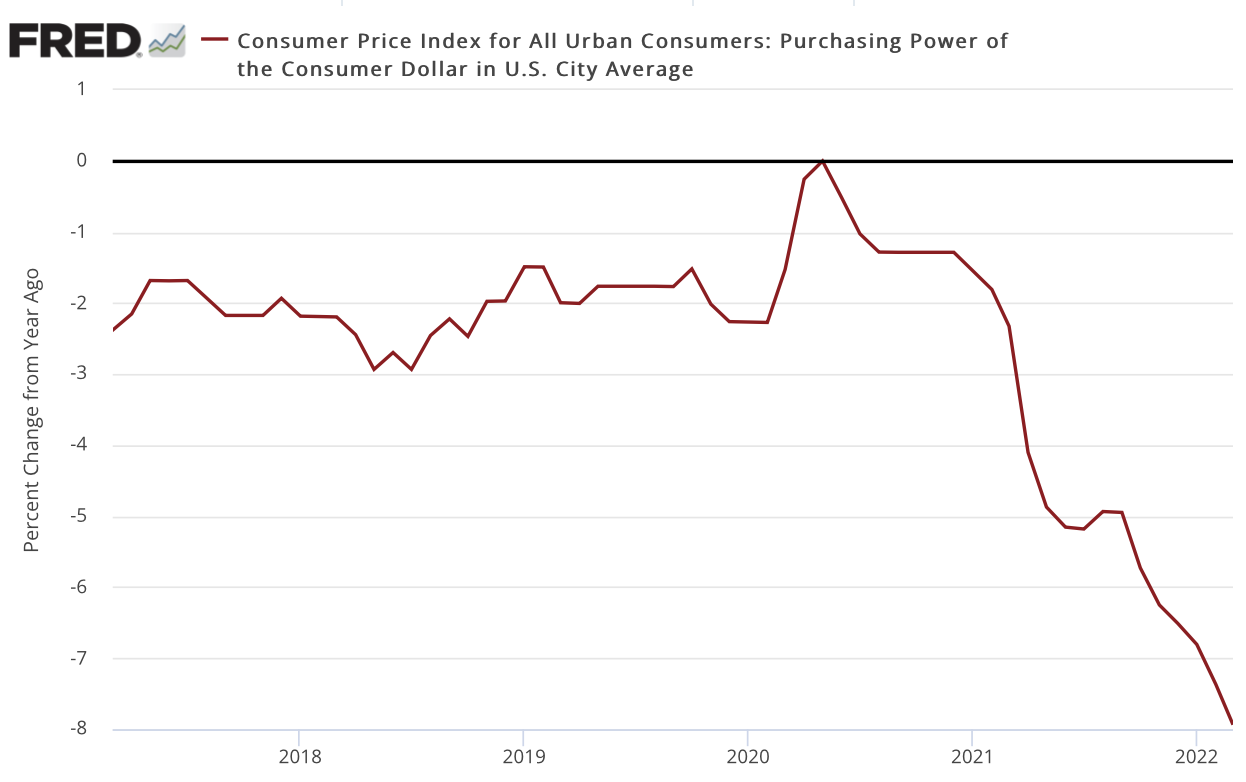

Gold trades listlessly amidst a steady blitz of hawkish Fed rhetoric

Jupiter’s Naylor-Leyland outlines what might trigger gold’s next breakout

(USAGOLD – 4/19/2022) – Gold is trading listlessly this morning as markets, in general, reflect caution amidst a steady blitz of hawkish rhetoric from Fed members. It is down $1 at $1980. Silver is up 3¢ at $25.97. Both metals are mounting challenges of psychologically important price levels – $2000 for gold and $26 for silver. Jupiter Asset Management’s Ned Naylor-Leyland thinks that there will be a break out in the gold price and that “the trigger may be when inflation surprises to the upside, or the market accepts that seven interest rate hikes in the US is a bit too aggressive.” He also believes that when the breakout occurs silver will outperform gold and “very dramatically so.”

“People are interested in gold because they are worried about future purchasing power,” he writes in an article posted at Gulf News. “The market is still considering whether the US Federal Reserve (Fed) will be able to raise interest rates as much as seven times this year and whether or not inflation will materially weaken. In my view, this is why gold hasn’t broken out properly yet — the market is focused on relatively hawkish observations.” Many of our readers will be surprised by the chart posted below. The dollar has lost 8% in purchasing power over the past year.

Purchasing power of the U.S. dollar

(Percent change year over year)

Sources: St. Louis Federal Reserve [FRED]. U.S. Bureau of Labor Statistics

Gold surges on war, inflation and bond market concerns

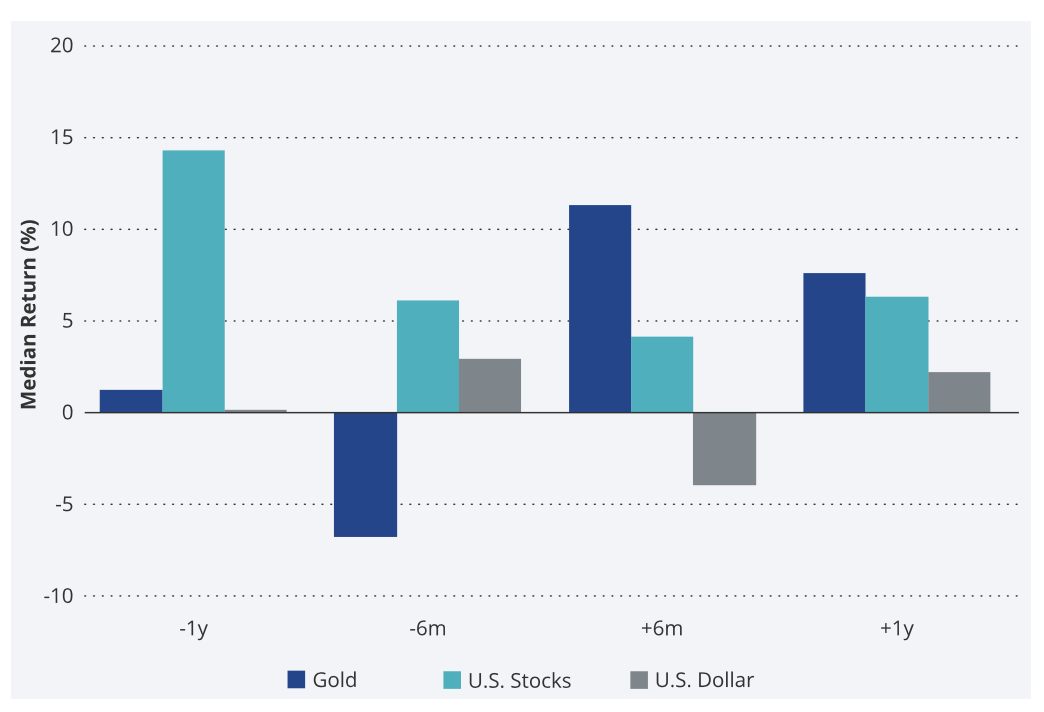

Van Eck says the metal has emerged as ‘an uncontested store of value’ for central banks

(USAGOLD – 4/15/2022) – Gold surged in early trading on a familiar trio of concerns – the escalating conflict in Ukraine, broadening inflation, and declining global bond markets. It is up $18 at $1994. Silver is up 31¢ at $26.05. Gold closed out last week up 1.34%. Silver finished the week up 3.5%. Van Eck Funds, the global investment firm, believes that gold has emerged as an “uncontested store of value” in the eyes of the world’s central banks.

Further, it says in a report posted Wednesday at Seeking Alpha, “the gold price will likely continue to be driven by the effects and risks brought about by the ongoing war, its potential for expansion beyond Ukraine, and residual, negative impacts on the world economy. In addition, gold markets will be watching the Fed in its fight against inflation.” It concludes that “both persistent inflation and/or a recession would be positive for gold.” Last, it points out that during the last four tightening cycles (1994, 1999, 2004 and 2015) gold outperformed stocks and the U.S. dollar “in the six months and the twelve months after the first hike of the cycle, even though it underperformed in the months ahead of it.”

Gold, US stocks, and US Treasuries over the past four Fed tightening cycles

(%, median return)

Chart note: Median returns based on the past four tightening cycles starting in February 1994, June 1999, June 2004, and December 2015. US dollar performance based on the Fed trade-weighted dollar index prior to 1997 and the DXY index thereafter, due to data availability.

Gold is taking a breather this morning after past two days run-up

Lundin: ‘The macro-environment has turned solidly in favor of gold and silver.’

(USAGOLD –4/14/2022) – Gold is taking a breather this morning from the run-up of the past two days driven primarily by elevated inflation numbers and a threatened escalation in the Ukraine conflict. It is level at $1980.50. Silver is down 7¢ at $25.75. Both metals are mounting challenges of psychologically important price levels – $2000 for gold and $26 for silver.

“The macro-environment has turned solidly in the favor of gold and silver,” writes Gold Newsletter’s Brien Lundin in a client advisory yesterday. “Unlike the experience of the past few years, the metals are responding as they should. Imagine for a moment that you’re back in the gold of last year. Somebody tells you that in 12 months, the dollar Index would be over 100, the 10-year Treasury yield would be pushing 2.7%, the Fed is saying they’re going to hike a half-point at every meeting in the foreseeable future and the CPI just posted the highest inflation rate in 40 years. They then tell you to predict the price of gold in this scenario.”

“In the mindset of a year ago,” he continues, “most investors would have predicted that gold would be trading at the previous lows around $1,150 or so. That’s because all of the above metrics were, at that point in time, considered bearish for gold. The reason? The markets were obsessed with Fed policy rather than the actual economic drivers. Anything that hinted of a more-hawkish Fed sent the traders and algos selling the yellow metal. We’ve come a long way, baby. The transition in sentiment has been bumpy, as I predicted, but more and more we’re seeing investors regarding high inflation as bullish for gold. Just as important, they are rightly viewing the Fed’s rate-hike campaign as a positive.”

Source: tradingeconomics.com

Looking for more than an e-commerce platform?

DISCOVER THE USAGOLD DIFFERENCE

"Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

9:07 pm Thu. May 2, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115