Monthly Archives: March 2024

Daily Gold Market Report

Exploring the Gold Standard:

Potential for Price Equilibrium in Modern Economy

(USAGOLD – 3/28/2024) Gold prices are again posting double digit gains early this morning, closing in on all time highs.The Bureau of Economic Analysis (BEA) reported this morning that the final calculation of the U.S. economy’s growth for the fourth quarter revealed an expansion rate of 3.4%, higher than expected. Gold is trading at $2206.44, up $11.65. Silver is trading at $24.59, down 6 cents. A study by the Federal Reserve Bank of Philadelphia suggests that a hypothetical return to the gold standard could lead to long-term price stability, with inflation and deflation being temporary. The working paper by Jesús Fernández-Villaverde and Daniel Sanches, published in February, examines the gold standard’s potential effects in a small open economy, concluding that the price level would eventually stabilize at a long-run equilibrium. While the gold standard historically collapsed due to its inflexibility, the authors note that during the transition, monetary changes would have long-term real effects, especially in response to economic integration or trade shocks. Despite these short-term fluctuations, they argue that a gold-backed economy would ultimately be stable and self-correcting.

DMR will be back on Monday April 1st. Have a great Easter Holiday!

Daily Gold Market Report

Record Operating Loss for the Fed:

Interest Rate Hikes Lead to $114.3 Billion Shortfall

(USAGOLD – 3/27/2024) Gold prices are posting double digit gains early this morning. Gold is trading at $2190.38, up $11.58. Silver is trading at $24.55, up 9 cents. In 2023, the Federal Reserve experienced its largest operating loss ever, amounting to $114.3 billion, due to significantly elevated interest expenses, which forced it to halt remittances to the Treasury. The central bank’s interest expenses surged to $281.1 billion, nearly tripling from the previous year, while its interest income from its asset portfolio decreased slightly to $163.8 billion from around $170 billion in 2022. This financial situation arose as the Fed raised interest rates starting in March 2022 to combat inflation, leading to increased interest payments to banks for excess reserves, which reached a record $176.8 billion. To manage the shortfall, the Fed issued a “deferred asset” to the Treasury, which grew to a record $133.3 billion and has no impact on its monetary policy conduct.

USAGOLD Comment: The combination of potential lower interest rates, central bank demand, gold’s status as a safe-haven asset, its role as an inflation hedge, and market sentiment all contribute to a favorable environment for gold prices.

Today’s top gold news and opinion

3/27/2024

Rate cuts are a good environment for gold investment, says World Gold Council’s Joe Cavatoni (CNBC)

World Gold Council Market Strategist, joins ‘Closing Bell: Overtime’ to discuss gold as the commodity nears all time highs.

GOLD INVESTING HANDBOOK FOR ASSET MANAGERS (World Bank)

The available empirical evidence suggests that some reserve managers respond to relative costs and returns by increasing the share of gold in their reserves when the expected return on financial assets such as US Treasury securities is low, while viewing gold as a hedge against economic and geopolitical risks

Cocoa breaks $10,000 a tonne as shortages squeeze ‘out of control’ market (FT)

Cocoa futures traded as high as $10,080 in New York, more than double their price only two months ago, as traders warned a global shortage of cocoa beans would herald higher price tags for chocolate bars.

Daily Gold Market Report

From Experiment to Reality:

SWIFT’s Ambitious Plan for a CBDC-Connected Financial System

(USAGOLD – 3/26/2024) Gold prices are stronger in early trading on Tuesday. Gold is trading at $2188.03, up $16.20. Silver is trading at $24.0, up 2 cents. SWIFT, the global bank messaging network, is planning to launch a new platform within the next 12 to 24 months to integrate central bank digital currencies (CBDCs) with the existing financial system. This development is significant for the emerging CBDC ecosystem, as SWIFT plays a crucial role in global banking. With approximately 90% of the world’s central banks exploring digital currencies to keep pace with cryptocurrencies, SWIFT’s innovation head, Nick Kerigan, revealed that their recent trial, which included a diverse group of central banks and financial institutions, aimed to ensure interoperability of different CBDCs and reduce payment system fragmentation. The trial also explored the use of CBDCs in complex transactions and the potential for automation to enhance speed and reduce costs. The successful trial outcomes have set a timeline for SWIFT to move from experimental to practical application. SWIFT’s network, which connects over 11,500 banks and is used in over 200 countries, positions it advantageously for the CBDC rollout, despite the possibility of delays in major CBDC launches. The platform is expected to offer a scalable solution for digital asset payments, aligning with predictions that $16 trillion in assets could be tokenized by 2030.

Today’s top gold news and opinion

3/26/2024

Is it a golden era for gold? (JP Morgan)

The metal has historically delivered attractive long-term returns, appreciating ~8% on an annual basis over the past 20 years.

Palladium demand supported for longer after new US emissions law changes (Heraeus)

The US has announced less severe emissions targets that will effectively allow for more catalysed car sales.

Citadel CEO Ken Griffin shares his views on the markets and the industry in 2024 (CNBC)

“There’s no country that’s going to bail America out. We’re going to right our own ship. There’s no IMF for the United States of America.”

Today’s top gold news and opinion

3/25/2024

Gold prices to hit $2,200 and a ‘dramatic’ outperformance awaits silver in 2024, says UBS (CNBC)

As interest rates dip, gold becomes more appealing compared to alternative investments like bonds.

Exploring the catalysts for a PGM resurgence, with World Platinum Investment Council’s Edward Sterck (Investor Steam)

With the global pivot towards green technology, Platinum Group Metals such as platinum, palladium and rhodium will continue to play a central role in that transition.

Nicholas Frappell: Gold Price Targets for 2024 and Key Drivers to Watch (NASDAQ)

He described US$2,580 as a “much lower probability outcome,” saying it’s more like one in eight.

Daily Gold Market Report

The Dynamics of Investment:

Gold and Bitcoin ETFs in the Post-Pandemic Era

(USAGOLD – 3/25/2024) In early trading on Monday in the U.S., gold prices strengthened, buoyed by positive external market factors, including a weaker U.S. dollar index and slightly increased crude oil prices. Gold is trading at $2177.82, up $12.38. Silver is trading at $24.79, up 11 cents. The Financial Times recently disscussed the relationship between the outflows from gold exchange-traded funds (ETFs) and the inflows into bitcoin ETFs, addressing the speculation that the rise of bitcoin ETFs might be causing a decline in gold ETF investments. JPMorgan’s research indicates that this is not the case; the outflows from gold ETFs began in April 2022 and have continued steadily, unrelated to the emergence of bitcoin ETFs. Despite the outflows, central banks and private investors continue to invest in physical gold, driven by a desire for privacy and tangibility, especially post-pandemic. While bitcoin ETFs have seen significant inflows, there has been a simultaneous sell-off of bitcoin held directly on exchanges, suggesting a shift rather than new investment. The overall demand for both gold and bitcoin appears to be influenced by momentum traders, and the World Gold Council and Morningstar analysts concur that investment in gold remains robust when considering all forms of investment, not just ETFs.

Today’s top gold news and opinion

3/22/2024

Gold takes a breather after record, Fed-fuelled rally (NASDAQ)

Traders are now pricing in a 70% chance that the Fed will begin cutting rates in June, up from 65% before the rate decision.

Gold still has upside, despite new record high – BofA Securities (Investing)

BofA Securities still sees owning gold as one of its top trades for 2024.

U.S. Sues Apple, Alleges Tech Giant Exploits Illegal Monopoly (WSJ)

Justice Department says company makes it difficult for competitors to integrate with iPhone

Daily Gold Market Report

From Smartwatches to AI:

The Surprising Connection Between Platinum and the Next Tech Boom

(USAGOLD – 3/22/2024) Gold prices are lower on Friday, after fading the all time high. Today, the U.S. Congress is making efforts to prevent another federal government shutdown, but the marketplace seems largely indifferent. Gold is trading at $2174.72, down $6.16. Silver is trading at $24.75, up 1 cent. A recent article from the World Platinum Investment Council discusses the increasing demand for platinum thin film coatings due to their critical role in semiconductor and sensor applications. With the generative AI market expected to grow to approximately $1.3 trillion over the next decade, the need for semiconductors, which are integral for AI functionalities like processing and data sensing, is also surging. Platinum, known for its conductivity and stability, is identified as an ideal material for sputtering targets used in creating these thin films. This technology is pivotal for advancements in microelectromechanical systems (MEMS), nanotechnologies, and in enhancing the efficiency of battery electric vehicles by improving battery life through precise temperature measurements. Additionally, platinum thin films are being used in the rapidly growing market for wearables, like smartwatches and health trackers, for continuous monitoring of vital signs. Bosch’s investment of three billion euros in its semiconductor and sensor business by 2026 underscores the importance and growth of this sector.

Daily Gold Market Report

Fed Holds Rates Steady:

Gold Rockets To New All Time High

(USAGOLD – 3/21/2024) Gold prices are sharply higher in early trading Thursday, with gold setting a record high of $2,222.91/oz overnight. Silver prices hit a 3.5-month high overnight at $25.77/oz. A dovish tone by the U.S. Federal Reserve has boosted the precious metals markets late this week. Gold is trading at $2200.25, up $13.86. Silver is trading at $25.23, down 35 cents. During the Federal Open Market Committee (FOMC) meeting, the Federal Reserve maintained interest rates at 5.25% to 5.50% and communicated a cautious stance on inflation, suggesting it was “Not terrible” and possibly seasonal. Despite the dot plot indicating three rate cuts for 2024, adjustments for 2025 and beyond hinted at a more hawkish outlook, suggesting a readiness to reduce the number of rate cuts if necessary. However, Fed Chair Powell’s press conference painted a less hawkish picture, downplaying the recent inflation spike as seasonal and indicating a slowdown in the pace of quantitative tightening (QT). This dovish tone during the press conference led to a bullish reaction in the markets, with assets rallying as Powell suggested the Fed would slow the offloading of Treasuries and other bonds, aligning with earlier plans. Powell also says the Federal Reserve is not working on a CBDC, and has no plans to propose one. “It’s wrong to say we’re working on a CBDC.” See Powell’s full answer on CBDCs below:

Today’s top gold news and opinion

3/21/2024

Gold Jumps Above $2,200 an Ounce for First Time on Dovish Powell (Bloomberg)

Bullion has rallied around 11% since the middle of February.

Turks pile into the dollar, gold and stocks as 67% inflation savages ‘worthless lira’ (CNN)

“Since people haven’t seen inflation fall, they don’t trust the Turkish lira anymore”

Peter Krauth: Silver’s Time Will Come, Why Price Hasn’t Moved (Yet) (NASDAQ)

“I believe that you have numerous industrial consumers buying long futures contracts and/or buying silver ETFs, and then asking for delivery. When the futures contracts mature, they can stand for delivery.”

Daily Gold Market Report

Economic Forecasts and Inflation Monitoring:

Key Points from the March 2024 Federal Reserve Meeting

(USAGOLD – 3/20/2024) Gold prices are slightly lower this morning. The market has been relatively calm at the beginning of the week, with traders seemingly holding back in anticipation of the Federal Open Market Committee (FOMC) monetary policy meeting’s conclusion in the afternoon. Gold is trading at $2152.20, down $5.39. Silver is trading at $24.95, up 4 cents. The Federal Reserve is expected to maintain its benchmark interest rate at a range of 5.25% to 5.5% at its March 2024 meeting, while providing fresh clues on the path of future interest-rate cuts. Economists predict that the FOMC will pencil in three rate cuts for 2024, as policymakers discuss slowing the balance-sheet unwind. The Fed is focused on addressing stubborn inflation and monitoring a slowly rising jobless rate, with the “dot plot” of individual member’s interest rate expectations indicating three cuts in 2024, four in 2025, three more in 2026, and two more at some point to take the long-range federal funds rate down to around 2.5%. The FOMC will release its quarterly update on the economy, specifically for gross domestic product, inflation, and the unemployment rate, with a focus on inflation and its effect on expectations for rates. As oil prices continue to rise and with gold prices near all time highs the Fed has their hands full.

Today’s top gold news and opinion

3/20/2024

COT: Hedge funds buying expands from precious metals to copper and grains (Saxo)

A week that included the February US CPI, which topped forecasts, thereby reinforcing the Federal Reserve’s cautious approach to cutting interest rates.

World Gold Council: Global Demand for Gold Will Drive Prices Up in 2024 (Swiss Resource Capital AG)

Interview with Market Strategist Joseph Cavatoni from the World Gold Council at PDAC 2024 in Toronto.

Idaho Senate Passes Bill to Authorize State Gold and Silver Reserves (Tenth Admendment Center)

Holding gold and silver in reserve would also create a pathway for Idaho to maintain financial independence should the U.S. dollar collapse, a very real possibility as the world moves away from the greenback as its reserve currency.

Daily Gold Market Report

State of Utah Rejects CBDCs:

Protects Sound Money

(USAGOLD – 3/19/2024) Gold prices are lower this morning. Gold is trading at $2154.50, down $5.86. Silver is trading at $24.88, down 16 cents. On March 14, 2024, Utah Governor Spencer Cox signed House Bill 164 into law, which excludes central bank digital currencies (CBDCs) from the state’s definition of legal tender and money. This legislation, introduced by Rep. Tyler Clancy and sponsored in the Senate by Sen. Michael Kennedy, amends the Utah Specie Legal Tender Act and the state’s Uniform Commercial Code to clarify that CBDCs are not considered specie legal tender nor legal tender in Utah. The bill was overwhelmingly passed by the state legislature, with the Senate voting 27-1 and the House approving it 68-0. The law is set to take effect on May 1, 2024.

“Government-issued digital currencies are sold on the promise of providing a safe, convenient, and more secure alternative to physical cash. We’re also told it will help stop dangerous criminals who like the intractability of cash. But there is a darker side – the promise of control. At the root of the move toward government digital currency is “the war on cash.” The elimination of cash creates the potential for the government to track and even control consumer spending,” Michael Boldin of the Tenth Amendment Center concludes.

Today’s top gold news and opinion

3/19/2024

Does the gold:silver ratio point silver higher? (Heraeus)

Since 2006, the gold:silver ratio has averaged 60.09 during previous gold all-time-high peaks

To the Governor: Wisconsin Passes Bill to Repeal Sales Tax on Gold and Silver (Tenth Admendment Center)

Repealing sales taxes on precious metal bullion takes a step toward treating gold and silver as money instead of commodities.

Gold Shines As Homebuying Affordability Hits A Record Low (Forbes)

Historically, wars have been catalysts for gold price appreciation, and the current geopolitical landscape appears to be no exception.

Today’s top gold news and opinion

3/18/2024

“Silver the New Oil the Next Uranium” (Metal Investment Fourm)

Peter Krauth presents at Metals Investor Forum

MYTH OF GOLD: The Magic Metal Born from Stardust (WELT)

Gold is a metal like no other.

Gold Beans All the Rage With China’s Gen Z as Deflation Bites (Yahoo)

Weighing as little as one gram, the beans — and other forms of gold jewelry — are increasingly viewed as the safest investment bet for young Chinese in an era of economic uncertainty.

Daily Gold Market Report

The Rising Importance of Hard Assets:

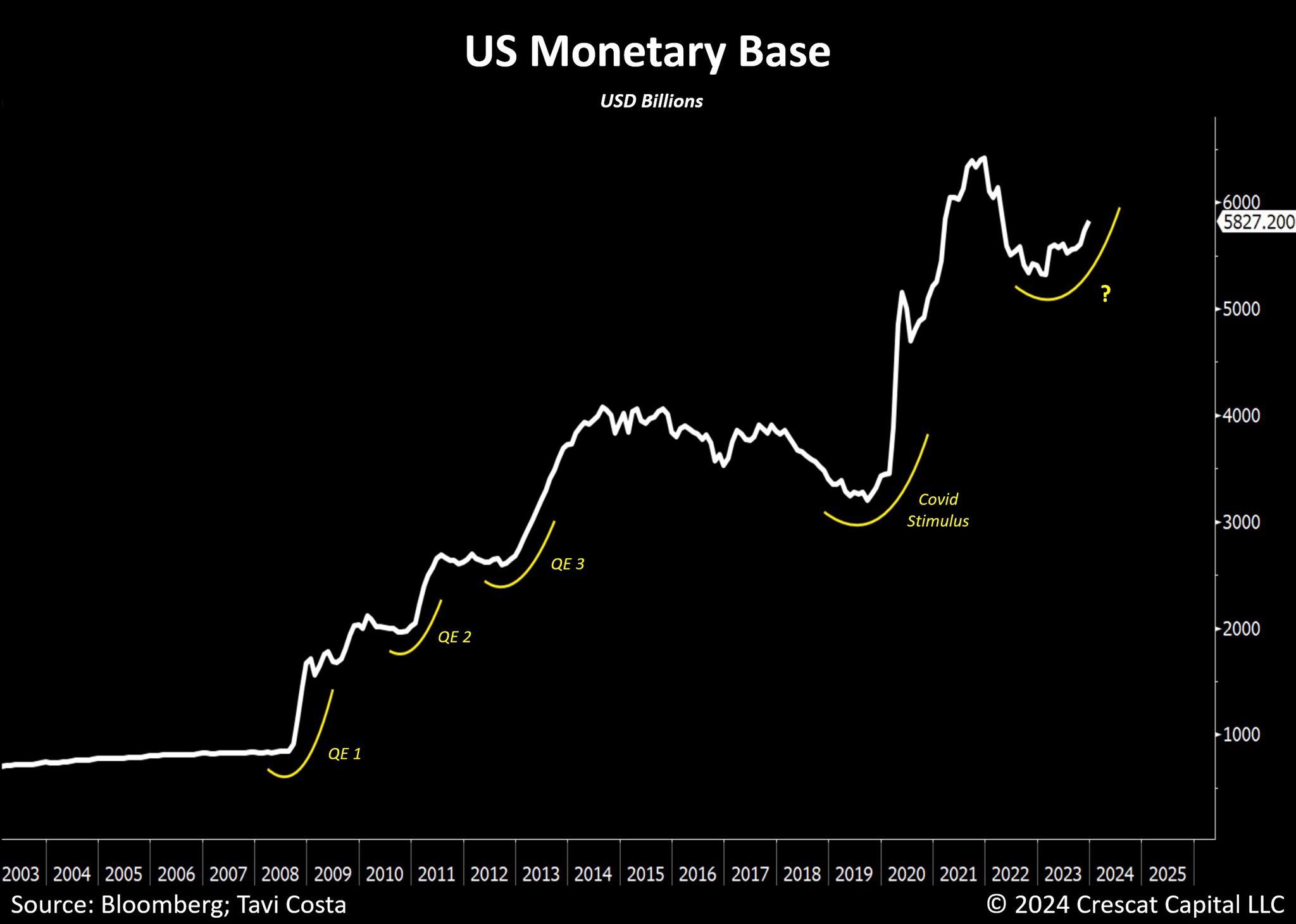

Protecting Wealth with Physical Gold Amidst Monetary Expansion

(USAGOLD – 3/18/2024) Gold prices are slightly higher this morning. This week’s significant U.S. economic event is the Federal Reserve’s Open Market Committee (FOMC) meeting, which starts on Tuesday morning and concludes on Wednesday afternoon. It will be followed by a statement and a press conference led by Fed Chairman Jerome Powell. Gold is trading at $2157.57, up $1.67. Silver is trading at $25.28, up 10 cents. Despite the implementation of what is described as one of the most restrictive monetary policies in history, the monetary base is still increasing. The situation suggests that in the event of a recession, traditional monetary policy tools may not be as effective in managing economic downturns. Tavi Costa, of Crestcat Capital suggests that with the potential for traditional fiat currencies to lose value or become less reliable in such uncertain economic times, the ownership of hard assets like physical gold becomes crucial. This perspective underscores the importance of diversifying one’s investment portfolio with tangible assets that can withstand economic fluctuations, offering a measure of financial security.

Daily Gold Market Report

Decentralized Blockchains vs. Permissioned Networks:

The Cybersecurity Debate in Asset Tokenization

(USAGOLD – 3/15/2024) Gold prices are lower this morning after manufacturing activity in the New York region collapsed this month. Gold is trading at $2160.16, down $2.03. Silver is trading at $25.15, up 33 cents. Regulators are moving towards allowing banks to tokenize financial assets on permissioned networks rather than decentralized, permissionless blockchains, raising concerns about cybersecurity vulnerabilities. The tokenization process involves creating digital representations of real-world assets on a blockchain, and while this trend is gaining momentum, the preference for permissioned networks could lead to significant risks. Permissioned networks, controlled by a few entities, are more susceptible to hacking compared to the robust security of decentralized blockchains, which are maintained by thousands of validators and have a strong track record of resisting cyber attacks. The push for tokenization on permissioned networks by regulators and financial institutions could potentially set the stage for unprecedented cybersecurity breaches in the financial system.

USAGOLD Comment: Owning physical offline assets (gold and silver) is essential for maintaining financial security and protecting one’s wealth from potential cyber threats and vulnerabilities in digital systems.

Today’s top gold news and opinion

3/15/2024

Here’s What You Need To Know About Gold’s Long-Term Bull Market (Forbes)

In theory, gold should follow the money supply fairly closely and it does.

Where does gold go now? (IG)

Both The Economist and Barron’s have featured covers with bullish market predictions, which could actually be a contrarian signal.

The Biggest Bank Heist in History Is Coming (Coinbase)

Regulators are permitting banks to tokenize financial assets such as bank deposits, U.S. Treasuries and corporate debt.

Today’s top gold news and opinion

3/14/2024

Gold Expected to Shine Amid Uncertainty (BMO)

Market participants typically dislike uncertainty…

Gold: Unique in every way (Wisdomtree)

Gold has exhibited equity-like returns of +8.5% per annum over the last 20 years with very minimal downside capture.

Bitcoin ETF Volumes Overtake Gold (Bytetree)

Bitcoin and gold assets combined amount to $237bn, and Bitcoin has a 31% growing share…