Monthly Archives: February 2024

Today’s top gold news and opinion

2/29/2024

Resilient gold market defies lower rate cut predictions (Saxo)

Despite the rising ‘cost’ of holding a non interest paying gold position and the markets current obsession with AI related stocks and cryptos, the yellow metal has done well amid underlying demand for physical gold as well as the softer dollar.

PLATINUM PERSPECTIVES (World Platinum Investment Council)

With palladium oversold and platinum’s attractive fundamentals, both metals have upside.

NBP second biggest gold buyer in the world in 2023 (Warsaw Business Journal)

Gold’s popularity is evident among Polish households, with 13% holding savings in gold, rising to 48% among those aged 18-24.

Daily Gold Market Report

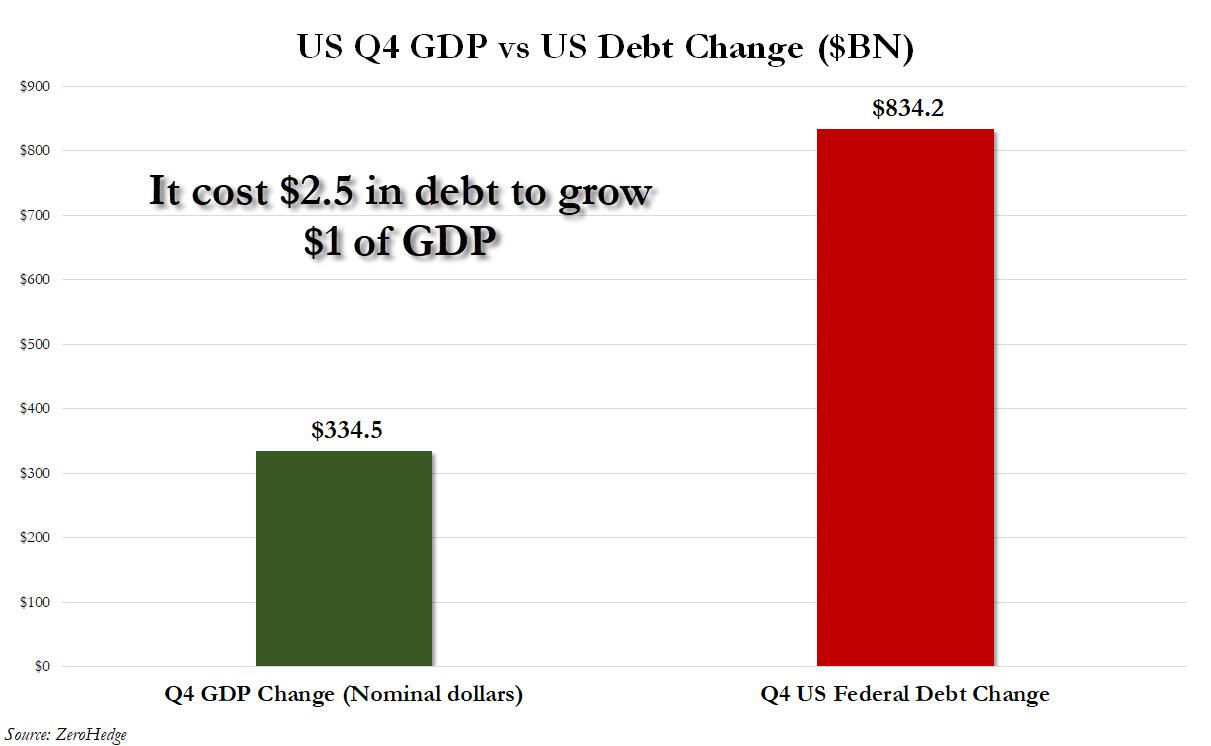

The Cost of Growth:

Q4 2023 Reveals Increased Spending and Higher National Debt

(USAGOLD – 2/29/2024) Gold and silver prices are higher in early trading Thursday, with gold hitting a three-week high, in the aftermath of an important PCE inflation report that came in lower than expected. Gold is trading at $2046.56, up $12.01. Silver is trading at $22.67, up 21 cents. The first revision of the Q4 2023 GDP figures released by the Biden administration’s Bureau of Economic Analysis, indicates a 3.2% growth rate, slightly down from the initial 3.3% estimate and below the consensus estimate of 3.3%. This growth was primarily driven by increases in consumer spending, exports, and state and local government spending, despite a rise in imports which negatively impacts GDP calculations. The revised figures show higher than expected growth in personal consumption, fixed investment, and government spending, although there was a notable decrease in the change in private inventories. Additionally, the figures highlight the substantial increase in national debt, indicating that the economy’s growth was significantly leveraged by borrowing, with $2.5 in debt incurred for every $1 in GDP growth, suggesting an unsustainable financial strategy.

Today’s top gold news and opinion

2/28/2024

Gold battles with 50-day SMA (Investing.com)

Momentum indicators turn neutral-to-positive

Gold back in favor as Gen Z buys (China Daily)

Gold jewelry processing and retail enterprises in China have also continuously innovated in the design of gold products, driving the increased demand for gold jewelry.

How Metal Demand will Skyrocket with Electric Vehicles & Electrification in 2024 (Noble 6)

Interview with Matt Watson, President of Precious Metals Commodity Management

Daily Gold Market Report

Investment Impact on Silver Prices:

A Decades-Long Analysis

(USAGOLD – 2/28/2024) In early trading on Wednesday, gold prices remain stagnant, influenced by negative external market factors that are unfavorable to investors betting on precious metals. These include a rising U.S. dollar index and declining crude oil prices. Gold is trading at $2033.00, up $2.52. Silver is trading at $22.39, down 7 cents. The Silver Institute recent 2024 Market Trend Report explores the impact of investment patterns and bullion stock levels on silver prices over several decades. Initially, surpluses led to large investor inventories in the U.S., followed by a period of disinvestment from 1990 to 2000 that contributed to a supply deficit and lower prices. The early 2000s saw a depletion of stocks, aiding a price recovery as investor interest surged, especially post-2009. Despite fluctuations, such as a price drop from 2012 to 2016 despite high investment levels, optimism and financial policies like quantitative easing maintained interest in silver. The role of different investor types is highlighted, showing how their strategies impact price movements. Data from 1990 to 2022 indicates a strong positive correlation between investment levels and silver prices, demonstrating the significant influence of investment on the market despite the complexity of factors involved.

Today’s top gold news and opinion

2/27/2024

Through the lens of gold (CME Group)

Is there a better way to view gold?

Golden Insights: Discover the Role of Gold in Modern Finance! (SWP)

The looming threat of an ‘everything crash’..

Is the Value of Gold Stable? (Econlib)

“An ounce of gold has always bought a good men’s suit”

Daily Gold Market Report

Unveiling Gold’s True Value:

Stability Across Markets and Time

(USAGOLD – 2/27/2024) Gold prices are up in early trading on Tuesday. Traders are short covering in the futures markets and some are perceived to be bargain hunting in the cash markets. Gold is trading at $2036.00, down $4.76. Silver is trading at $22.65, up 13 cents. Inspirante Trading Solutions explores a unique perspective on the value of gold, arguing that it should be viewed not just as a commodity measured in fiat currencies but as a primary unit of account and a true store of value. This viewpoint highlights gold’s ability to preserve wealth against the backdrop of fiat currency devaluation due to central bank policies and monetary expansion. By comparing the ratios of the Dow Jones Industrial Average, Nasdaq, and Russell 2000 indices to gold, it illustrates gold’s consistent purchasing power, despite fluctuations in the stock market. It also examines the ratio of average U.S. home prices to gold, showing that gold has maintained its purchasing power even as real estate prices have skyrocketed. Additionally, the stable relationship between the amount of gold needed to purchase a barrel of oil over decades, despite geopolitical and economic changes, underscores gold’s reliability as a measure of value across various sectors. This comprehensive analysis suggests that gold’s enduring worth is evident in its capacity to safeguard value in the face of inflation and market volatility.

Today’s top gold news and opinion

2/26/2024

Silver’s Golden Outlook (Vaneck)

The implied probability of the March rate cut dropped from 81.5% at the beginning of the year to 35% at the end of January.

US targets Russia with more than 500 new sanctions (BBC)

These include measures against Russia’s main card payment system, financial and military institutions

U.S. Mint Bullion Coin Revenue Falls 12.8% in FY 2023 (Coin News)

Across all gold, silver, and platinum bullion products, the United States Mint recorded sales of 22,009,000 ounces, marking a 24.5% increase compared to FY 2022.

Daily Gold Market Report

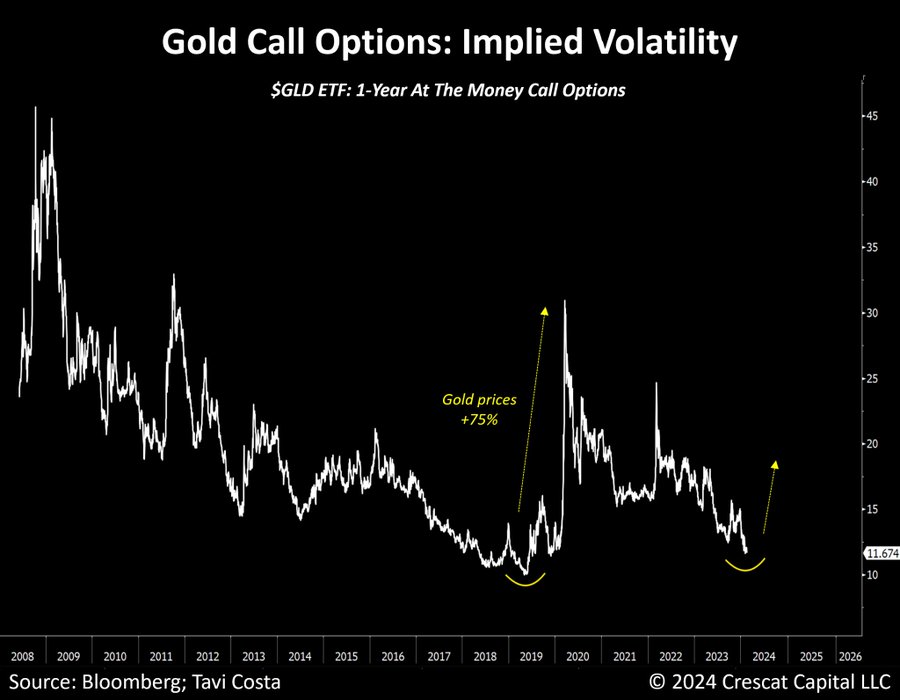

Gold’s Call Options Volatility Hits Historic Lows:

A Prelude to a Market Rally?

(USAGOLD – 2/26/2024) Gold prices are down slightly to start the week. Traders are looking for a fresh fundamental spark to drive price action. Gold is trading at $2026.89, down $8.51. Silver is trading at $22.55, down 40 cents. Tavi Costa of Crescat Capital recently highlighted on Twitter/X a significant drop in the implied volatility of call options on gold, marking one of its lowest points in history. This scenario is reminiscent of a past period that preceded a 75% rally in gold prices over subsequent years. Despite such potential gains seeming modest in the current speculative climate, the tweet suggests that a similar movement now could trigger long-awaited significant trends. Furthermore, Tavi points out a historical pattern where gold cycles align with those of other commodities, positively affecting the valuations of resource-rich emerging markets.

Daily Gold Market Report

The Evolution of Gold Investing:

From Anti-Bubble Asset to Bitcoin’s Partner in the BOLD Index

(USAGOLD – 2/23/2024) Gold prices continue to trade sideways to end the week. The gold market continues to struggling as expectations for the start of the Federal Reserve’s easing cycle continue to be pushed back. Gold is trading at $2025.73, up $1.43. Silver is trading at $22.75, down 1 cents. Charlie Morris of ByteTree recently wrote an article entitled “The Golden Anti-Bubble“, which explores the evolving relationship between gold, the Nasdaq, and other financial assets over the past decades, focusing on gold’s role as a diversifier and a ‘risk-off’ asset. Initially, during the dotcom bubble of the late 1990s, gold and the Nasdaq were uncorrelated, with gold entering a bull market following the Nasdaq’s peak in 2000. However, recent times have seen gold displaying correlations with both equities and bonds, particularly during the pandemic, challenging its traditional role as a diversification tool. He discusses gold’s performance in relation to various financial models, including TIPS (Treasury Inflation-Protected Securities), monetary versus consumer inflation, and the global money supply, suggesting that gold remains a valuable asset despite being currently undervalued according to some metrics. It also highlights the ByteTree’s Bitcoin and Gold Index (BOLD) (60% Bitcoin/ 40% Gold) strategy, which leverages rebalancing between bitcoin and gold to optimize returns, suggesting a modern approach to investing in gold. Despite gold’s strong fundamentals and central banks’ interest, investor engagement with gold ETFs has declined, presenting a paradox in gold investment behavior.

Today’s top gold news and opinion

2/22/2024

Goldman Sachs sees boost to commodity prices from rate cuts (Investing.com)

“driven by an easier Fed stance (rather than by lower GDP growth)”

Central Banks’ Gold Buying Spree Explained (Yahoo Finance)

Panel of industry professionals examines the rapid rate at which central banks have been buying physical gold.

Nvidia Declares AI a ‘Whole New Industry’—and Investors Agree (WSJ)

Chip maker’s blockbuster results and outlook signal that spending on AI hasn’t cooled after a red-hot year.

Daily Gold Market Report

Echoes of the 1970s:

Wall Street Braces for Inflation and Geopolitical Risks

(USAGOLD – 2/22/2024) Gold prices continue to trade sideways in early trading Thursday. Gold is trading at $2025.51, down $0.48. Silver is trading at $22.87, down 2 cents. A team of J.P. Morgan quantitative strategists, led by Marko Kolanovic, warns that the current market narrative, favoring a stable and balanced “Goldilocks” scenario, might shift towards a 1970s-style stagflation, with significant asset allocation implications. The 1970s were characterized by high inflation, geopolitical tensions, energy crises, flat equity markets, alongside superior bond performance, and an era that solidified gold’s reputation as a crucial asset for investors seeking to protect their wealth. The analysts highlight similarities with the present, including inflation waves and geopolitical conflicts in Eastern Europe, the Middle East, and the South China Sea, potentially leading to a second wave of inflation and market selloffs. They suggest that tensions, especially with China, could trigger a global economic impact, reviving the conflict inflation scenario of the 1970s. In such a situation, investors might pivot from equities to fixed-income assets seeking higher yields, as was the case from 1967 to 1980 when bonds outperformed stocks. By the end of the decade, gold prices had reached unprecedented levels, peaking at over $800 per ounce in January 1980. This represented an extraordinary rise from the $35 per ounce price fixed under the Bretton Woods system at the beginning of the decade.

Today’s top gold news and opinion

2/22/2024

Gold’s resilience despite recent ETF and futures selling (Saxo Bank)

Switzerland is the world’s biggest bullion refining and transit hub, and the 49% increase last month from a year ago was driven by robust sales to China and Hong Kong.

The safe haven appeal of gold amidst rising geopolitical risks in 2024 (IG Bank)

As data from GeoQuant shows, US political risk is also very tightly correlated with gold.

American Totalitarian “Crypto Dollar” May Come Before the Election (Brownstone Institute)

President Biden has Authorized the Exploration of a CBDC, and There Isn’t any Real Resistance in Congress.

Today’s top gold news and opinion

2/21/2024

Silver Set to Outperform in 2024 as Gold Loses Luster (Investing)

The gold-to-silver ratio, currently high, could drive demand for silver stocks if it indicates undervaluation.

Gold at $3,000 and oil at $100 by 2025? Citi analysts don’t rule it out (CNBC)

Central bank aggressive purchases, stagflation, and a global recession are catalysts that could drive the price of the yellow metal almost 50% higher.

The Federal Mega-Debt is Here to Stay (Mises)

Many Americans appear to have been lulled into accepting some variant of modern monetary theory

Daily Gold Market Report

Gold’s Unexpected Rebound:

How It Overcame Higher Yields and a Strong Dollar

(USAGOLD – 2/21/2024) Gold prices are unchanged in early trading Wednesday. Gold is trading at $2028.06, up $3.65. Silver is trading at $23.01, up 1 cent. Despite a backdrop of higher bond yields, a stronger US dollar, and no major escalation in geopolitical tensions in the Middle East—conditions typically unfavorable for gold—the precious metal demonstrated resilience in early 2024. Gold’s dip below $2000 per ounce was short-lived, as it quickly rebounded, indicating strong buying interest even at historically high levels. David Scutt of City Index suggests this rebound has potential for further gains, particularly as the US dollar rally shows signs of fatigue amid rising inflation expectations. The inverse relationship between gold and the US dollar index (DXY) has been notably strong, hinting at a weakening dollar providing a tailwind for gold prices. Additionally, market-based inflation expectations are rising, which could further support gold as a hedge against inflation. Despite the adverse macro environment and volatility following US economic reports, gold’s recovery to its previous trading range suggests a bullish outlook, with buying opportunities on pullbacks towards $2008 seen as offering favorable risk-reward scenarios.

Today’s top gold news and opinion

2/20/2024

UK recession prompts spike in gold demand among investors, new data from The Royal Mint shows (IFA)

Following news of the UK economy entering a recession in the latter stages of 2023, The Royal Mint saw a 22% uplift in daily sales of gold last Thursday.

PRECIOUS APPRAISAL (Heraeus)

Sticky inflation swipes some of gold’s recent gains..

FBI Director Says China Cyberattacks on U.S. Infrastructure Now at Unprecedented Scale (WSJ)

Pre-positioned malware could be triggered to disrupt critical systems in the U.S.

Daily Gold Market Report

MUFG Stands Firm on Gold:

A Bullish Outlook Amid Market Volatility and Geopolitical Tensions

(USAGOLD – 2/20/2024) Gold prices are posting gains after the holiday weekend in early trading Tuesday. Gold is trading at $2027.00, up $9.79. Silver is trading at $23.13, up 13 cents. MUFG, Japan’s largest bank and a significant voice in the commodities market, recently reiterated its 2024 Gold outlook, maintaining its price target of $2350/oz even after a market selloff, distinguishing itself from other financial institutions like UBS, which lowered its gold price forecast to $2200/oz. MUFG’s position is notable for several reasons: it’s based on research released post-selloff, it’s unaffected by US Dollar politics due to its non-US base and non-bullion dealer status, and it reflects confidence in gold’s resilience amid uncertain US monetary policy and inflation dynamics. Despite challenges from higher interest rates, MUFG underscores the importance of robust emerging market central bank purchases and gold’s role as a geopolitical hedge, factors central to its bullish stance. The bank acknowledges potential downside risks but remains constructive on gold, recommending a long position in anticipation of continued demand, especially from China and India, and gold’s safe-haven appeal amidst geopolitical tensions and economic uncertainties.

Daily Gold Market Report

UK and Japan Enter Technical Recessions:

The Case for Physical Gold Amidst Global Recessions

(USAGOLD – 2/16/2024) Gold prices experienced a slight decline from their overnight gains and faced modest selling pressure in early Friday trading. This shift occurred after a U.S. inflation report (PPI) came in higher than anticipated, and recent data on U.S. housing construction showed a larger-than-expected drop last month. Gold is trading at $2002.81, down $1.50. Silver is trading at $23.05, up 13 cents. As countries like the UK and Japan enter technical recessions, owning physical gold becomes increasingly important for several reasons. Gold has historically been regarded as a safe-haven asset, offering a hedge against inflation and currency devaluation that often accompany economic downturns. During recessions, investors seek stability, and gold’s intrinsic value provides a form of financial insurance against the volatility of stock markets and the weakening of fiat currencies. Additionally, gold’s scarcity and universal value mean it can serve as a store of wealth and a medium of exchange in times of economic uncertainty. As economies contract and central banks potentially implement measures like quantitative easing, which can lead to inflation, the appeal of gold, which cannot be artificially produced or inflated, becomes even more pronounced. Owning physical gold can be a prudent part of a diversified investment strategy during economic downturns.

Today’s top gold news and opinion

2/16/2024

Data breach affects 57,000 Bank of America accounts (American Banker)

TA data breach at Infosys McCamish, a financial software provider, compromised the name, address, date of birth, Social Security number, and other account information of 57,028 deferred compensation customers whose accounts were serviced by Bank of America.

Xi Jinping will make the West pay for China’s economic collapse (Telegraph)

It used to be said that when America sneezes, the rest of the world catches a cold. The same might now be true of Beijing…

Gold ETFs See $2.4 Billion in Outflows While Bitcoin ETFs Thrive (Crypto News)

Some speculate that the outflows from gold ETFs are not necessarily flowing directly into Bitcoin ETFs, but rather into US equities driven by the fear of missing out (FOMO).

Daily Gold Market Report

Silver’s Shining Forecast:

Poised for a Breakout in 2024 Amid Gold’s Stability

(USAGOLD – 2/15/2024) Gold prices remain steadfast around the crucial $2,000 per ounce mark following the release of retail sales data for January, which significantly underperformed market forecasts, along with a downward adjustment of December’s figures. Gold is trading at $2005.37, up $13.04. Silver is trading at $22.77, up 44 cents. A recent article by Damian Nowiszewski of Investing.com discusses the potential for silver to outperform gold in 2024, highlighting stable gold prices despite a hawkish Federal Reserve and forecasting a significant spike in silver demand. Analysts predict a bullish year for both metals, with silver expected to see increased demand, especially from the industrial sector. Technical analysis suggests both metals are in a consolidation phase, with potential for a breakout. The Silver Institute anticipates global silver demand to reach 1.2 billion ounces, driven by industrial and jewelry demand in India, with projections of silver prices reaching $30 per ounce by year-end. There are challenges for gold investment due to outflows from ETFs, competition from Bitcoin ETFs, and the effects of high inflation and economic slowdown on individual investors. Overall, silver’s potential is underscored by its anticipated demand surge and favorable technical indicators, suggesting it may be a more attractive option for investors in 2024.

“Meanwhile, silver also shows narrowed ranges, consolidating within the $22-23.50 per ounce range. If the retreat extends further south, investors should focus on a robust demand zone within the $21 per ounce range. An upward breakout from the current consolidation would signal there’s lot more to come, paving the way for a retest of $26 in the long term,” Nowiszewski suggests.

Today’s top gold news and opinion

2/15/2024

China’s gold market in January: wholesale gold demand jumped, official gold reserves rose further (World Gold Council)

The PBoC reported the 15th consecutive gold purchase in January, adding 10t to their gold reserves and lifting the total to 2,245t.

The Central Bank Gold Rush: What It Means for You (Wealthion)

Sheds light on the strategic moves by central banks, the inflation hedge that gold presents, and the ongoing debate between gold and bitcoin as investment assets

Druckenmiller dumps Alphabet, Amazon and Broadcom but Nvidia remains largest holding (Market Watch)

Duquesne Family Office scoops up shares of beaten-down gold miners Barrick Gold Corp. and Newmont Corp.