Gold marginally higher ahead of jobs report

Saxo Bank foresees strong gold demand from central banks and ETFs in ‘price friendly’ 2023

(USAGOLD – 1/6/2023) – Gold moved marginally higher as financial markets traded cautiously ahead of this morning’s jobs number. It is up $4 at $1849.50. Silver is up 19¢ at $23.52. The World Gold Council reports central banks added another 50 tonnes of gold to their collective holdings in November. Saxo Bank’s Ole Hansen sees 2023 as “price friendly” for investment metals as central banks continue buying and ETF demand turns to the plus side.

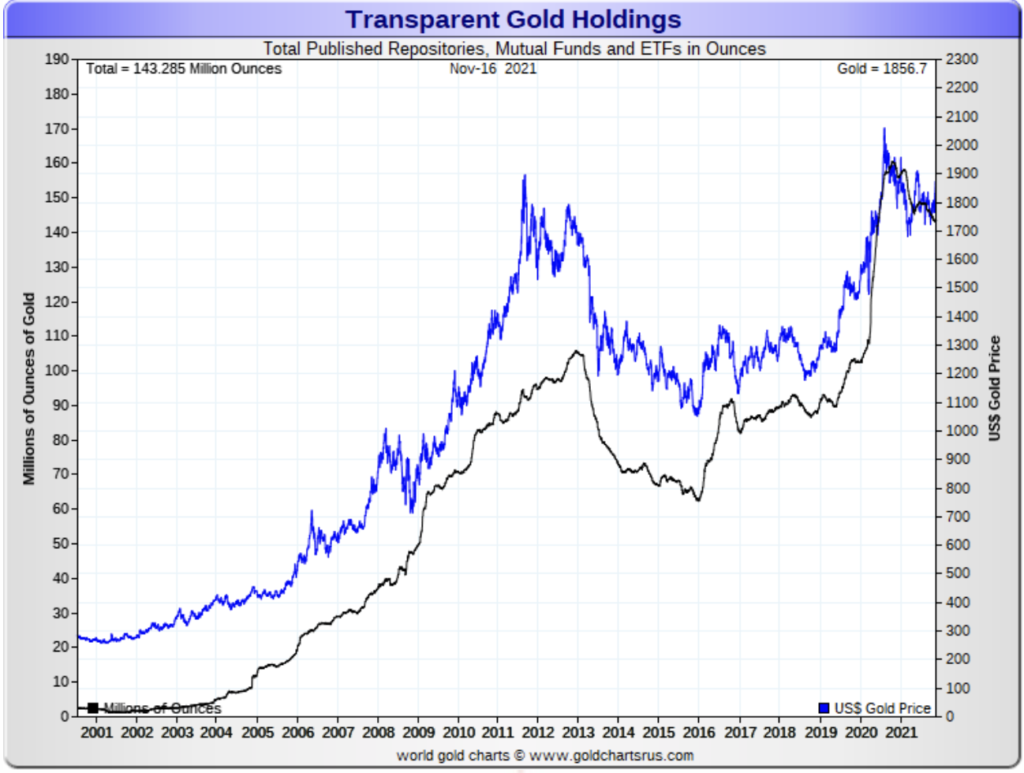

“This de-dollarization and general appetite for gold,” he says in a client update posted this morning, “should ensure another strong year of official sector gold buying. Adding to this we expect the friendlier investment environment for gold to reverse last year’s 120 tons reduction via ETF’s to a potential increase of at least 200 tons. Hedge funds meanwhile turned net buyers from early November when a triple bottom signaled a change away from the then prevailing strategy of selling gold on any signs of strength. As a result, the net position during this time flipped from a 38k contract net short to a 67k contract net long on December 27.”