Gold level as sharp dollar advance continues

‘The last time this happened markets got very wobbly.’

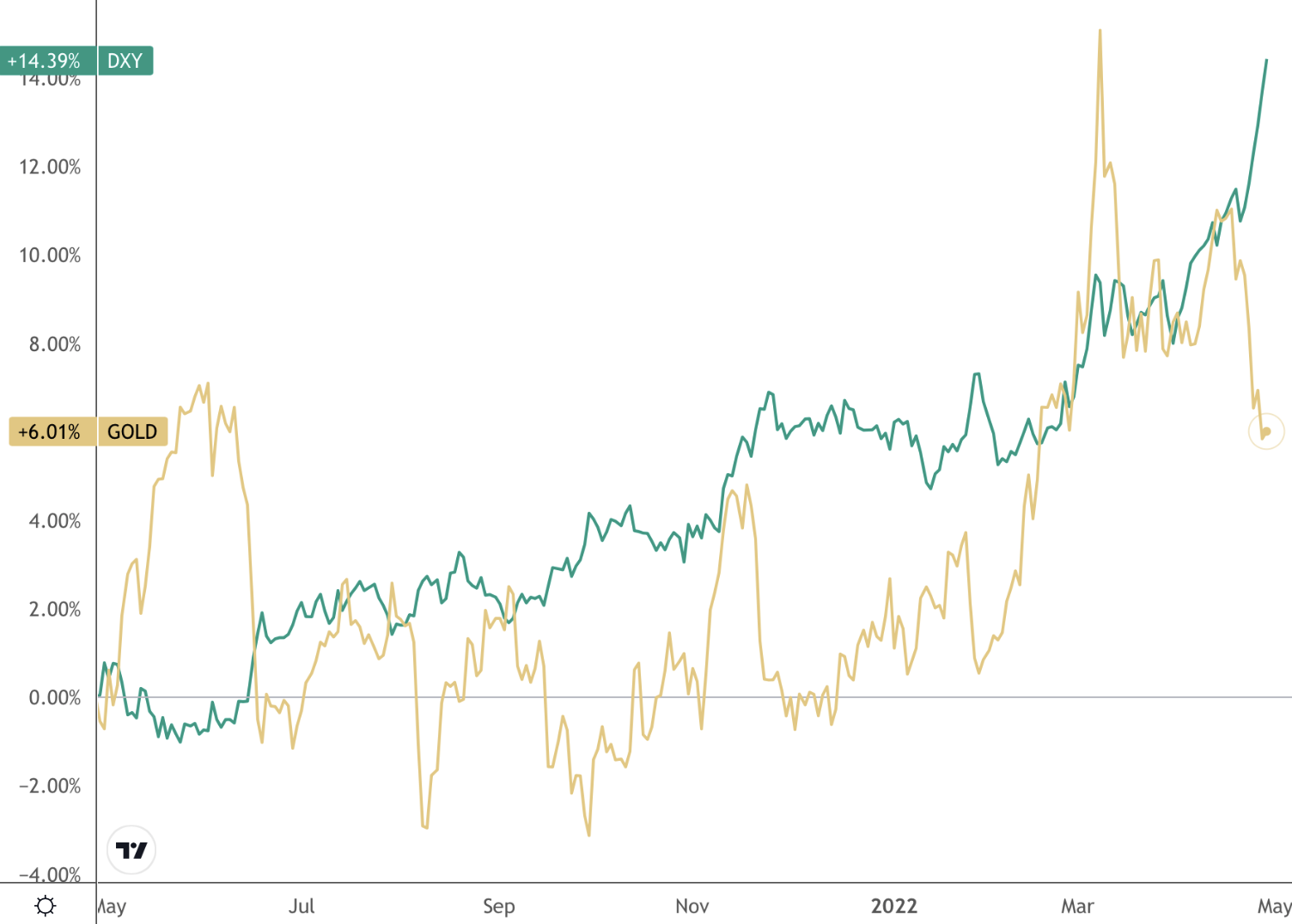

(USAGOLD – 4/28/2022) – Gold is level this morning as the dollar advanced sharply against both the Japanese yen and Chinese yuan, and the markets awaited this morning’s GDP number expected to come in at an anemic 1.1% for the first quarter. It is trading at $1888 in the early going. Silver is down 30¢ at $23.08. Gold and the dollar generally advanced in tandem over the past year as investors positioned themselves defensively in response to weakening global bond markets. That all changed over the past month when the Japanese, Chinese, and European central banks advertised looser monetary policies while the Federal Reserve signaled the polar opposite. In response, the dollar index took a sharp turn to the upside (up 14% over the past year), while gold weakened from near all-time highs (though, as a matter of perspective, it is still up about 6% over the past year).

“China,” writes Money Week’s John Stepek in an analysis posted Tuesday, “is now on the wrong side of the central bank rate-raising cycle. (Ed. note: The same might be said for Japan and Europe.) China’s slowdown means it’s not going to raise interest rates – but the US is, and, all else being equal (it never is, but rates matter more than most things) higher rates will attract more money than lower rates. Anyway, last time this happened markets got very wobbly, which is one reason why central banks decided against raising rates. As you may well have noticed, markets are pretty wobbly right now as well. So a few questions arise from all this.” Stepek advises sticking with inflation bets. “I’d hold some gold (it’s handy to have in a panic),” he concludes, “and I’d make sure you allocate more to cash than usual simply to have it around in case you need it or want it to take advantage of any opportunities.”

Gold and the U.S. Dollar Index

(%, 12-months)

Chart courtesy of TradingView.com