Gold trades sideways ahead of this week’s Fed decision and press conference

Schroders says gold does well during recessions returning 28% on average

(USAGOLD – 1/30/2023) – Gold is trading sideways this morning as the markets remain cautious ahead of Wednesday’s Fed rate decision and press conference. It is down $2.50 at $1928. Silver is up 9¢ at $23.76. If a recession is in the cards, then what might we expect from gold? Schroders, the London-based investment firm, has some answers. Gold, it says in a report released last week, “tends to do well in absolute and relative terms during US recessions.” It has returned 28% on average and outperformed stocks by 37%.

“One observation we would make is that when the policy responses to US have been particularly loose/accommodative, the gold price performance has been most explosive,” says the firm. “This was the case in 1973 (when Arthur Burns was Federal Reserve governor) and was also the case in 2008 and 2020. We think policy responses to future US recessions will also be highly accommodative and involve a return to combined fiscal/monetary support.”

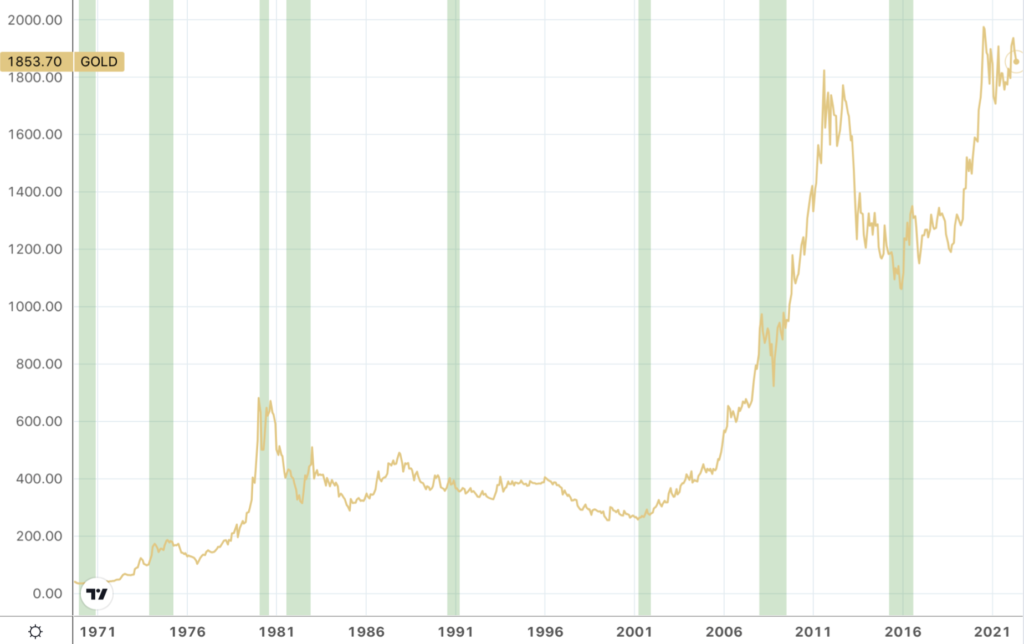

Gold and recessions

(Shaded bars = recessions)

Chart courtesy of TradingView.com • • • Click to enlarge