Gold, silver off to respectable start for the New Year

Silver Institute reports record overall demand, 194 million ounce supply shortfall

(USAGOLD – 1/3/2023) – Gold is off to a respectable start for the new year as investors weighed the possibility of another troubling year in financial markets. It is up $12 at $1838. Silver is up 32¢ at $24.36. The metals gained despite a stronger dollar. Gold finished 2022 up 1.19%, but silver, after a see-saw struggle for much of the year, ended up posting the stronger gain – up 4.61%.

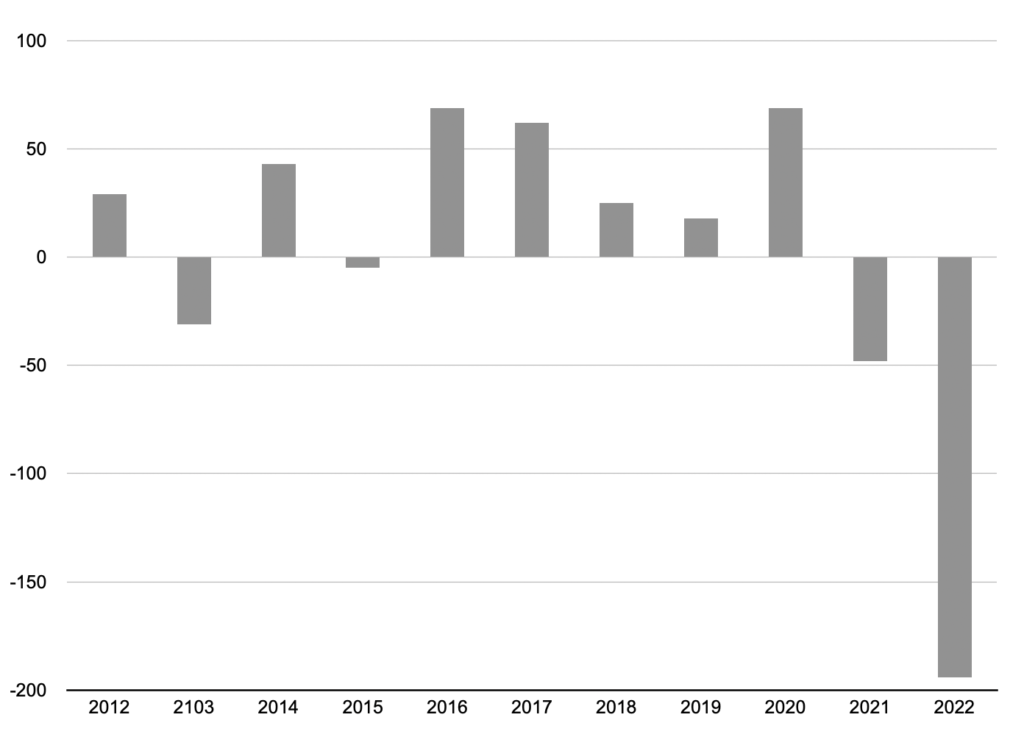

The Silver Institute reports record overall silver demand and static supply in its year-end summary released last week. The result was a 194 million ounce shortfall in 2022 – four times the 2021 deficit and a new record. “Physical silver investment (purchases of silver coins and bars) in 2022 was forecast to jump 18% to 329 Moz, a new record high,” reports SI. “Support was due to investor fears of high inflation, the Russia-Ukraine war, recessionary concerns, and buying on price dips. The rise was boosted further by a near-doubling of Indian demand, with investors often taking advantage of lower rupee prices.”

Silver surplus or deficit

(Millions of troy ounces)

Chart by USAGOLD [All rights reserved] • • • Data source: The Silver Institute