Gold drifts lower in follow-up to yesterday’s dollar-driven advance

Pozsar sees US dollar’s exorbitant privilege under assault

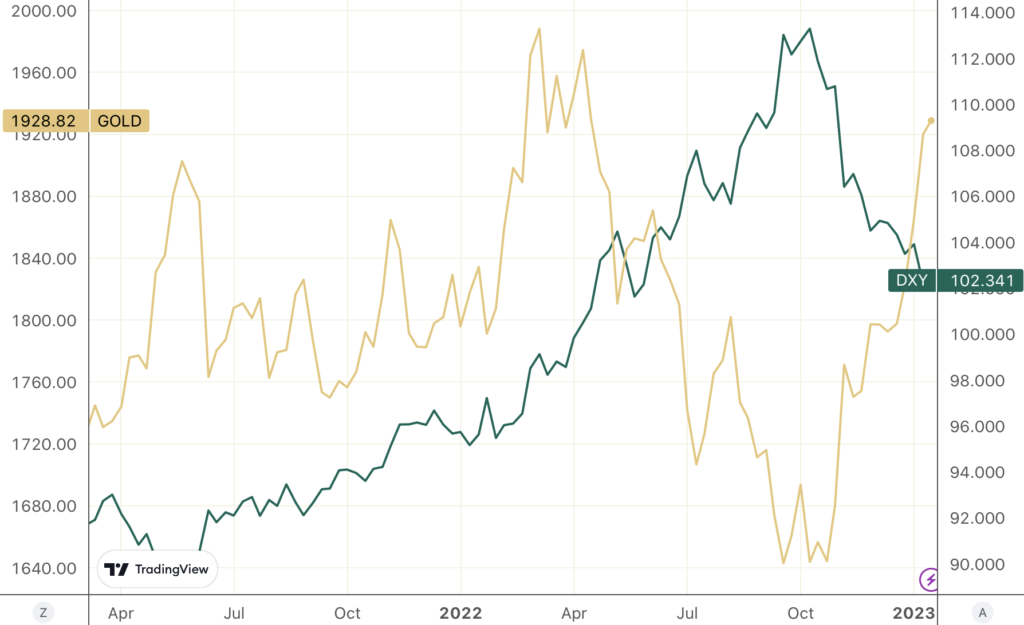

(USAGOLD –1/20/2023) – Gold is drifting marginally lower in the follow-up to yesterday’s strong, dollar-driven advance. It is down $4 at $1931. Silver is up 12¢ at $24.03. Gold’s upside since the turn of the year, during which it has gained almost 6%, has been accompanied by a groundswell of opinion that the greenback’s strong two-year advance is in the early stages of a reversal. Zoltan Pozsar, the head of short-term rate strategy at Credit Suisse, believes that China’s deepening ties with OPEC+ and BRICs+ will alter the “existing world order” and “eventually lead to ‘one world, two [monetary] systems.'”

Investors, he says in an opinion piece published this morning by Financial Times, have to discount new risks. “In finance,” he concludes,” everything is about marginal flows. These matter the most for the largest marginal borrower — the US Treasury. If less trade is invoiced in US dollars and there is a dwindling recycling of dollar surpluses into traditional reserve assets such as Treasuries, the ‘exorbitant privilege’ that the dollar holds as the international reserve currency could be under assault.” If Pozsar is correct, it will carry important implications for gold.

Gold and the US Dollar Index

(2021 to present)|

Chart courtesy of TradingView.com • • • Click to enlarge