No DMR today

We will update later if anything of interest develops. The following is Friday’s report.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gold closes out a hapless week dominated by a speculative US dollar frenzy

Bridgewater’s Prince says investors need to prepare for a decade of stagflation

(USAGOLD – 7/15/2022) – Gold continued its trek to the downside in early trading as it closed out a hapless week dominated by a speculative frenzy and run-up in the US dollar index. It is down $4 on the day at $1708.50 and 2% on the week. Silver is up 2¢ on the day and down 4.1% on the week. In an opinion piece published in Financial Times this morning, Bob Prince, Bridgewater Associates’ co-chief investment officer, says that investors need to prepare for a decade of stagflation by shifting away from “vulnerable equity and equity-like exposure.”

“Historically, equities have been the worst-performing asset in stagflationary periods,” writes Prince, “because they are vulnerable to both falling growth and rising inflation. Other predominantly growth-sensitive assets like credit and real estate also perform poorly. Nominal bonds are closer to flat in such environments.… Within these monetary policy regimes, the relative returns of assets still align with their biases, with index-linked bonds, gold, and commodities giving investors better relative returns regardless of how policymakers respond.” Bridgewater Associates is the world’s largest hedge fund.

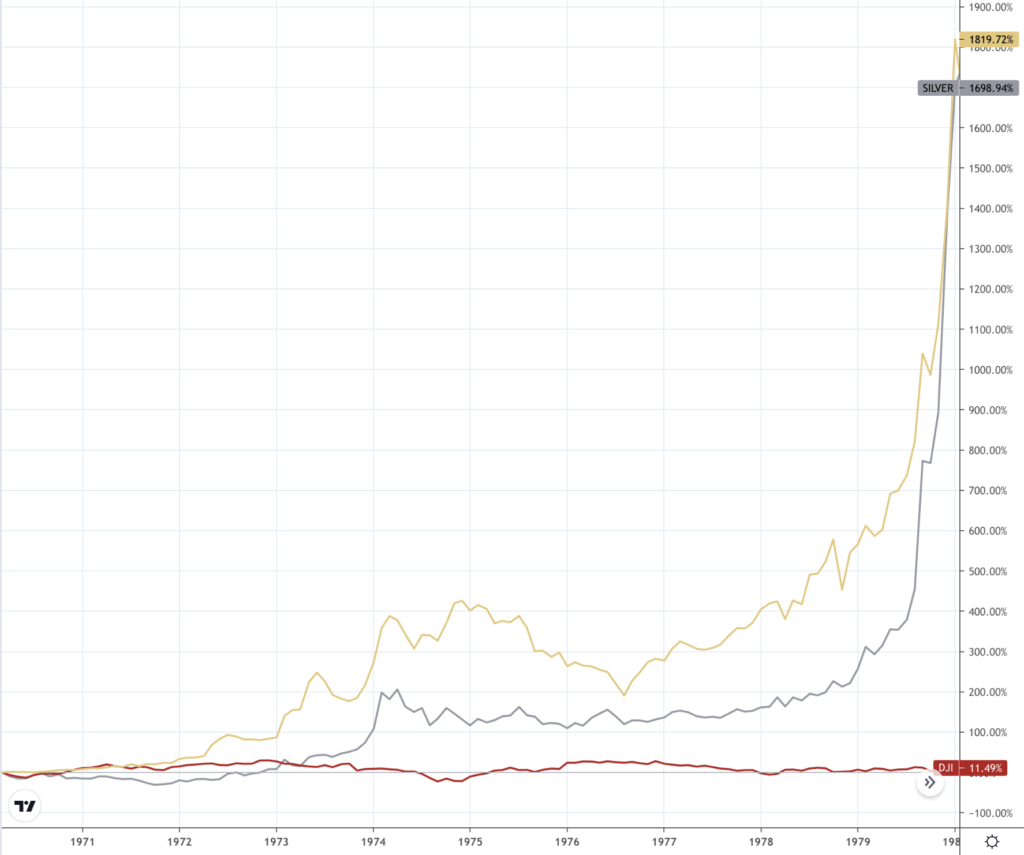

Editor’s note: To illustrate Prince’s point, we return to a chart posted previously with this report. It shows the performances of gold, silver, and stocks during the 1970s, the last time investors faced a stagflationary shock. Gold rose 1820%, silver 1699%, and the DJIA 11.5%

Gold, silver, and stocks performance

(%, 1970-1979)

Chart courtesy of TradingView.com • • • Click to enlarge