Monthly Archives: January 2024

Today’s top gold news and opinion

1/31/2024

World’s biggest jeweller Pandora stops using mined silver and gold (NASDAQ)

Using recycled, instead of newly mined, metals cuts Pandora’s indirect CO2 emissions by around 58,000 tonnes annually

GLOBAL SILVER DEMAND FORECASTED TO RISE TO 1.2 BILLION OUNCES IN 2024 (Silver Institute)

Global silver demand is expected to rise 1 percent, pushed higher by the continued strength of industrial end-uses and a recovery in jewelry and silverware demand.

Which commodities will see the greatest price increases in 2024? (Mining Technology)

A GlobalData poll found that gold, lithium, and copper are among the commodities set to see the greatest price increases in 2024.

Daily Gold Market Report

Black Swan’s Taleb Sounds the Alarm:

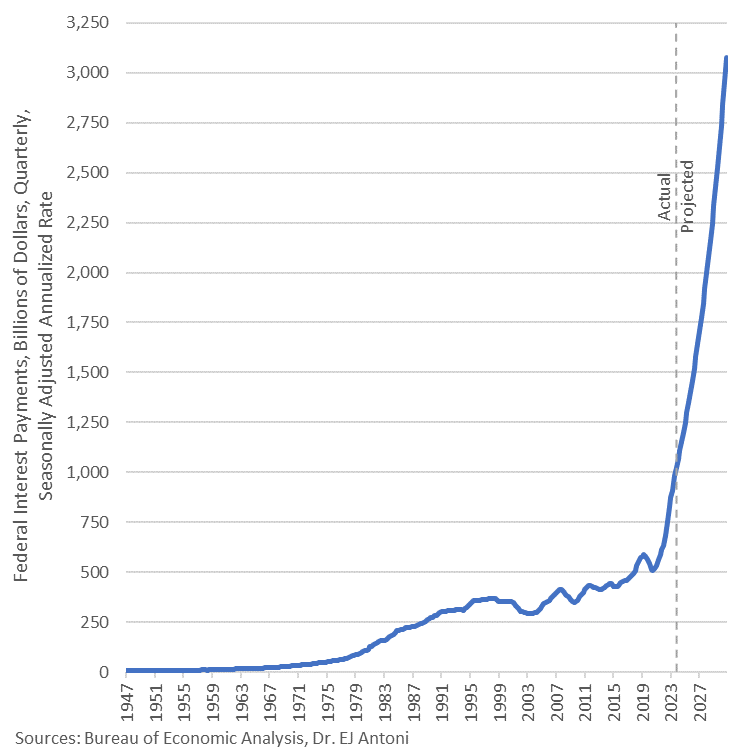

U.S. ‘Death Spiral’ Due to Mounting Debt Crisis

(USAGOLD – 1/31/2024) Gold prices are up in early trading Wednesday, ahead of the conclusion of the U.S. central bank monetary policy meeting. Gold is trading at $2048.10, up $11.09. Silver is trading at $23.22, up 5 cents. Nassim Nicholas Taleb, author of “Black Swan,” warned that the U.S. is facing a critical situation with its escalating national debt, which he describes as a “white swan” event – highly probable and potentially disastrous. Speaking at a Universa Investments event reported by Bloomberg, Taleb criticized the U.S. political system, particularly Congress, for continually extending the debt limit without addressing the underlying issue. He suggested that the increasing interconnectivity of the global economy makes the situation more precarious. This concern is echoed by other financial experts like former Treasury Secretary Robert Rubin and BlackRock Inc.’s Vice Chairman Philipp Hildebrand. Universa Investments, where Taleb advises, is known for its strategy of profiting from market downturns. Taleb expressed a gloomy view of the Western political system, indicating that a significant external intervention or an unlikely miracle might be necessary to reverse the debt spiral.

Today’s top gold news and opinion

1/30/2024

PRECIOUS-Safe-haven gold gains as Middle East worries mount (NASDAQ)

There is enough instability still in the Middle East to keep investors interested in gold as part of a safe-haven play

Record sales for global jewellery leader (Jeweller Magazine)

“While remaining vigilant in the current context, we enter 2024 with confidence, backed by our highly desirable brands and our agile teams.”

– BERNARD ARNAULT, LVMH

Nebraska Bill Would Eliminate Capital Gains Taxes on the Sale of Gold and Silver, Reject CBDC (Tenth Amendment Center)

Passage into law would relieve some of the tax burdens on investors and eliminate one barrier to using gold and silver in everyday transactions

Daily Gold Market Report

Jamie Dimon’s Stark Warning:

U.S. Debt Nears ‘Cliff’ with Global Fallout Imminent

(USAGOLD – 1/30/2024) Gold prices are higher in early trading Tuesday, as the world anxiously awaits the U.S. military’s response. Gold is trading at $2045.90, up $12.67. Silver is trading at $23.26, up 6 cents. JPMorgan Chase CEO Jamie Dimon warns of a potential global market crisis due to the escalating U.S. government debt. He expressed these concerns at a Bipartisan Policy Center event, alongside former Speaker Paul Ryan. Dimon compares the current economic situation to the 1980s, highlighting the significantly higher debt-to-GDP ratio now, which is around 100% compared to 35% back then. He predicts that by 2035, this ratio could reach 130%. Dimon also emphasized the global impact of the U.S. debt, noting that countries like Japan, China, and the U.K. hold substantial portions of it. He stressed the importance of a stronger America and military for global security, and advocated for closer collaboration between the public and private sectors.

Daily Gold Market Report

Gold Prices Decoupled from Real Interest Rates:

The New Economic Driver

(USAGOLD – 1/29/2024) Gold prices are higher in early trading Monday , driven by a surge in safe-haven investments following a terrorist attack in Jordan that resulted in the death of three U.S. soldiers. Gold is trading at $2035.39, up $16.87. Silver is trading at $22.99, up 19 cents. Frank Holmes, of U.S. Global Investors, recently wrote an article discussing how the traditional correlation between gold prices and real interest rates, a key economic indicator, has weakened according to BMO Capital Markets. Despite a strong U.S. economy, indicated by a higher-than-expected GDP growth and positive consumer and business sentiments, gold remains a recommended investment. This shift is attributed to several factors. Analysts believe gold will benefit from rate cuts and increased investment demand. Notably, emerging economies, especially China, are diversifying away from the U.S. dollar and increasing their gold holdings, making this the new primary driver of gold prices. Central banks, particularly the People’s Bank of China, have been buying significant amounts of gold, impacting the market. The article also mentions that Chinese households, facing a declining stock market, are turning towards gold, further supporting its demand. Despite potential risks from a possible equity market rally in China, BMO and analyst Colin Hamilton foresee continued central bank buying and household investment in gold as a multi-year trend, positioning gold as not just a safe haven but also a strategic asset in a diversifying global economy.

Today’s top gold news and opinion

1/29/2024

China’s cratering markets drive mainstay retail investors away (Reuters)

“The logic is simple: stay away from all yuan assets”

How Digital Gold is democratising investments in precious metals (Financial Express)

Even Gen Z and millennials prefer to invest in Digital Gold since one can acquire smaller quantities from credible platforms such as MMTC-PAMP

BRICS & BITCOIN: THE DUO SET TO DETHRONE THE DOLLAR IN 2024 – MORGAN STANLEY (Cryptopolitan)

BRICS and Bitcoin are projected to harm the US dollar in 2024 as the globe moves away from the dollar

Daily Gold Market Report

Overstepping Boundaries:

Court Finds FBI Violated Constitution in 2021 Vault Raid

(USAGOLD – 1/26/2024) Gold prices remain unchanged in early Friday trading, following a significant monthly U.S. inflation report that confirmed a decrease in inflation levels. Gold is trading at $2020.49, down 35 cents. Silver is trading at $22.81, down 10 cents. In 2021, the FBI’s seizure of contents from safe deposit boxes during a raid on a Beverly Hills vault was deemed unconstitutional by a federal appeals court reports The Epoch Times. The operation targeted U.S. Private Vaults, a business offering anonymous box rentals, on suspicions of criminal use. The warrant allowed opening boxes for inventory and owner identification, but the FBI’s actions exceeded this scope. Initial district court rulings favored the government, citing an inventory exception to the Fourth Amendment. However, the appeals court found this inapplicable, highlighting the FBI’s use of custom instructions and lack of probable cause for all boxes. The case was remanded for further action, including the destruction of records collected on the box renters involved in the class-action lawsuit. This ruling is significant in reinforcing constitutional limits on government searches.

Today’s top gold news and opinion

1/26/2024

Gold & Yields: A Correlated Divergence (Hedgeye)

Gold has become a highly liquid financial asset..

Platinum for palladium substitution is embedded into automotive demand and unlikely to reverse swiftly (World Platinum Investment Council)

Platinum for palladium autocatalyst substitution is expected to reach 700 koz in 2024

The Green Spark: A Catalyst Transforming Water Into Energy Wealth (SciTechDaily)

A stable, reactive, and cost-effective ruthenium catalyst for sustainable hydrogen production through proton exchange membrane water electrolysis.

Today’s top gold news and opinion

1/25/2024

Americans Have Burned Through Their Savings (Newsweek)

More than a fifth of Americans are without any savings..

BRICS Making Good Progress On Their Golden Path (Forbes)

A more promising development has been the introduction of “gold checking accounts” in Russia%

Silver prices may be down, but they are not out; Bank of America sees potential in 2024 (Kitco)

SA bottoming out of the global economy in the coming months would support the silver market

Daily Gold Market Report

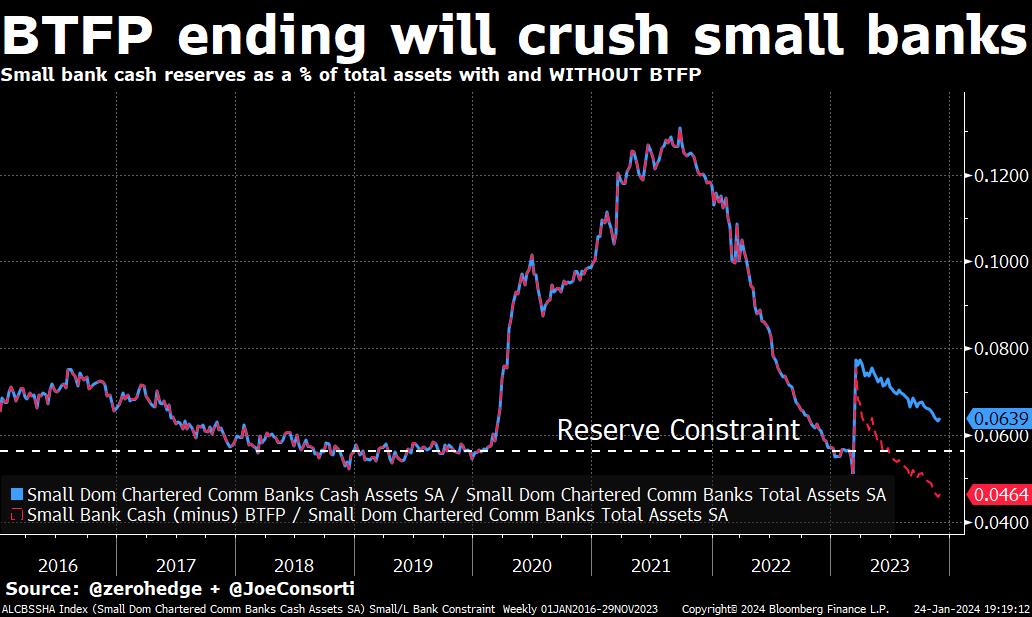

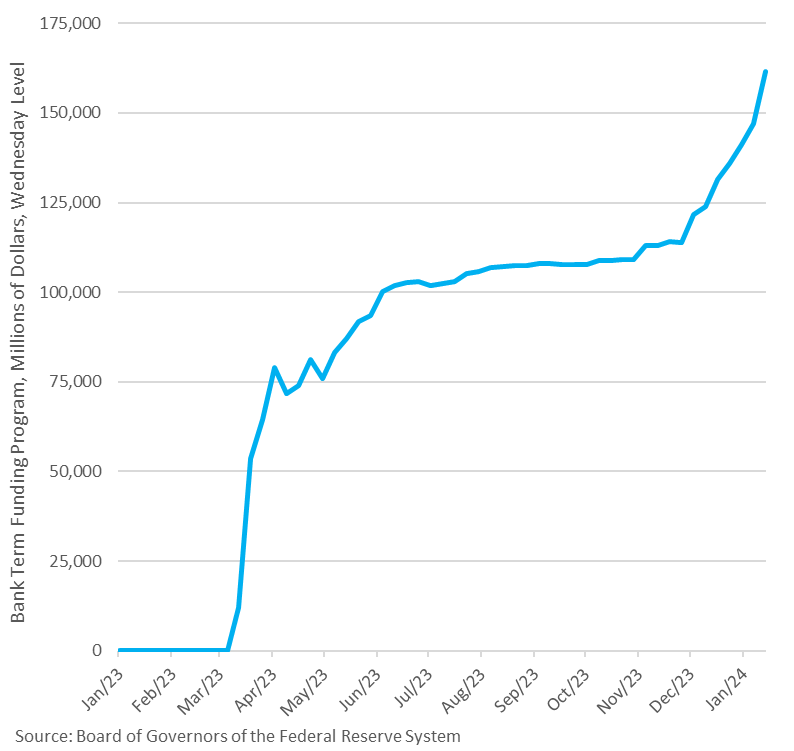

Federal Reserve to End Bank Term Funding Program Amid Exploitation Concerns:

Shifts Focus to Discount Window

(USAGOLD – 1/25/2024) Gold prices are trading higher following the release of recent data indicating that the U.S. economy’s growth surpassed expectations, alongside inflation rates that were lower than anticipated. Gold is trading at $2022.21, up $8.32. Silver is trading at $22.88, up 22 cents. The Federal Reserve Board announced the termination of the Bank Term Funding Program (BTFP) on March 11, following reports of banks exploiting the program for profit. This decision comes amid concerns over the program’s optics and its role in providing banks with essentially free money ($47 billion) over the last two months. The Fed now plans to address future liquidity needs through the discount window as we reported on Tuesday, the same mechanism involved in the 2008 financial crisis. This is shaping up to an interesting end to Q1 of 2024 for the banking system.

Daily Gold Market Report

Golden Warning:

Skyrocketing Gold/Silver Ratio Suggests Stormy Economic Seas Ahead

(USAGOLD – 1/24/2024) Gold prices were up earlier this morning but have since reversed. Investors are exercising caution as they await crucial US economic data, including the Q4 GDP announcement on Thursday and the Core PCE Price Index release on Friday, which will provide more clarity on market direction. Gold is trading at $2025.57, down $3.71. Silver is trading at $22.67, up 23 cents. The gold/silver ratio is a financial metric that compares the relative value of gold to silver, indicating how many ounces of silver it takes to purchase one ounce of gold. Historically, this ratio has fluctuated, reflecting various economic and market conditions. The average gold/silver ratio since the year 2000 is approximately 65:1. When the gold/silver ratio exceeds 90:1, it often signals turbulent times ahead. In recent years, the ratio was above 90:1 during the COVID crash of 2020 and the March Bank Failures of 2023. This high ratio typically indicates that investors are favoring gold over silver, which is often seen as a less stable investment. Gold is traditionally viewed as a safe-haven asset during times of economic uncertainty, political tensions, or financial instability. Therefore, a significantly high gold/silver ratio can be interpreted as a lack of investor confidence in the economy, suggesting that investors are bracing for potentially challenging economic conditions.

Today’s top gold news and opinion

1/24/2024

UBS sees a 10% spike for gold this year as rate cut speculation swirls (CNBC)

“power of the Fed’s policy pivot should not be underestimated”

Unemployment rises in nearly a third of US states in December (Reuters)

Thirteen states and D.C. have unemployment rates at or above 4%

LBMA Precious Metals Market Volumes, December 2023 and the Year as a Whole, And Their Significance (NASDAQ)

Spot gold volumes were a multiple of 47 times global mine production

Today’s top gold news and opinion

1/23/2024

Gold: Will 2024 be a Breakout Year on Rate Cut Hopes? (CME Group)

After decades as net sellers, central banks became net buyers of gold after the financial crisis

Gold slides on trimmed US rate cut bets, rallying equities (Reuters)

Market sees 41.6% chance of a March rate cut

PRECIOUS METALS FORECASTS 2024 : Ross Norman Metals Daily, London (LinkedIn)

GOLD = Average $2166 High $2300 Low $2000

Daily Gold Market Report

Mandatory Fed Borrowing for Banks:

A Strategy for Stability or a Step Towards Financial Control?

(USAGOLD – 1/23/2024) Gold and silver prices have marginally increased in early trading on Tuesday, due to modest rebounding after recent downward trends. Gold is trading at $2023.38, up $1.68. Silver is trading at $22.34, up 25 cents. Bloomberg reports that U.S. regulators, including the Office of the Comptroller of the Currency, the Federal Reserve, and the FDIC, are preparing a plan to require banks to use the Federal Reserve’s discount window at least once a year. This move aims to remove the stigma associated with borrowing from this facility and ensure banks are operationally ready to access funds during times of financial stress. The proposal is in response to the failure of several midsize banks last year and is part of a broader effort to strengthen the banking system’s resilience to crises. The plan may also include making the discount window more attractive by potentially lowering borrowing costs and adjusting balance sheet treatments for certain assets.

Daily Gold Market Report

The Return of Inflation:

Analyzing Worldwide Economic Trends and Central Bank Challenges

(USAGOLD – 1/22/2024) Gold prices are slightly down this morning as the positive U.S. economic data has restrained the enthusiasm of precious metals bulls, leading to reduced market expectations for early U.S. interest rate cuts by the Federal Reserve. Gold is trading at $2020.93, down $8.56. Silver is trading at $22.00, down 66 cents. Peter St Onge recently wrote an article that discusses the resurgence of inflation worldwide, contrasting the optimism of economists like Paul Krugman with recent data indicating a rise in inflation rates. The Bureau of Labor Statistics reported a significant increase in the Consumer Price Index (CPI), including both the overall CPI and the “core” CPI that excludes food and energy. “Finally, so-called “SuperCore” inflation — not a joke. Which the Fed pulled out of its hat to strip out housing costs. That one’s doing even worse, hitting almost 5% annualized. That feeling when your fake statistics don’t work out,’ St Onge emphasizes. Despite the Federal Reserve’s efforts to control inflation through tight monetary policy, inflation persists due to continued government spending and financial dynamics on Wall Street. St Onge concludes with, “Central banks across the West — really across the world — have painted themselves into the mother of corners, potentially facing durable global stagflation for the first time in 50 years, this time paired with a financial crisis that would make it a combination not seen since the 1930’s.”

Today’s top gold news and opinion

1/22/2024

Moody’s points to further pain after surge in corporate defaults (FT)

“High funding costs, together with tighter financing conditions . . . prompted a rise in corporate defaults during 2023”

Bitcoin Will Never Be ‘Money’ Precisely Because It’s Nothing Like Gold (Forbes)

T”In reality, money is quiet. Or should be. Good money is never talked about, nor are returns written about with glee.”

US Prepares Rule Forcing Banks to Tap Fed Discount Window (Bloomberg)

Michael Hsu says idea is to create a ‘fire drill’ for trouble

Today’s top gold news and opinion

1/19/2024

Data dependent precious metals continue their bumpy ride (Saxo)

Silver continues to trade near a ten-month low relative to gold

China’s Gold Market in 2023: Demand improved and premiums rose (World Gold Council)

The Shanghai Gold Benchmark Price PM (SHAUPM) in RMB, surged by 17% in 2023

Gold drifts higher as Middle East tension attracts safe-haven inflows (Reuters)

Atlanta Fed president open to cut U.S. interest rates sooner…

Daily Gold Market Report

Inflation Proof Investments:

How Gold Outperforms Ski Pass Costs

(USAGOLD – 1/19/2024) Gold prices are posting modest gains even as there was no major, markets-moving news overnight, which has allowed some better risk appetite in the marketplace to end the trading week.. Gold is trading at $2029.63, up $6.29. Silver is trading at $22.63, down 11 cents. Incrementum AG just released the “The Gold/Ski Pass Ratio 2024” report which discusses the impact of inflation on ski ticket prices in Austria and the value of gold as an investment. “With an increase of 10.2%, ski ticket prices have risen even more sharply this winter season than in the 2022/23 winter season. Since the 1990/91 winter season, ski ticket prices have risen by an average of 3.5% annually,” Incrementum reports. The comparison between ski ticket prices and gold prices reveals that gold investors have been relatively insulated from these increases. The purchasing power of gold in terms of ski passes has remained high, indicating that gold is a stable investment that can protect against inflation and maintain or even increase purchasing power over time.

Daily Gold Market Report

Bank of America’s Earnings Take a Massive Hit:

Profits Plummet by Over Half Amidst Market Turbulence and Hefty Charges

(USAGOLD – 1/18/2024) Gold prices are trading slightly higher after the number of American workers applying for first-time unemployment benefits last week came in well below expectations. Gold is trading at $2012.07, up $5.82. Silver is trading at $22.51, down 4 cents. Bank of America reported a significant drop in its fourth-quarter earnings late last week, with profits falling 56% to $3.14 billion, impacted by one-time charges. The decline was primarily due to a $1.6 billion charge related to the transition from the London Interbank Offered Rate and a $2.1 billion Federal Deposit Insurance Corp. fee following the failures of Silicon Valley Bank and Signature Bank. Revenue decreased by 10% to $21.99 billion, against a forecast of $23.7 billion. Despite a challenging quarter, the bank saw increases in trading revenue and investment banking fees, with trading revenue up 3% to $3.62 billion and investment banking fees rising 8% to $1.18 billion. The bank also released $88 million from its reserves for potential loan losses. The bank giant also shed over 4,000 (2%) employees in turbulent year. However, it faced challenges with an extensive portfolio of low-rate securities and increasing loan charge-offs, though a late-year bond rally helped reduce unrealized losses.

Today’s top gold news and opinion

1/18/2024

Gold retreats to over one-month low after data dims rate-cut hopes (Reuters)

Palladium lowest since 2018

Gold Resurgence: Central Banks, Market Turmoil, and the Unfolding Financial Paradigm (Commodity Discovery Fund)

The spotlight now rests on the United States, prompting speculation about potential explicit or implicit gold revaluation in the future.

US banking giants shed over 17,000 employees in turbulent year (Reuters)

Trouble on the street…