Gold gains as investors worry about possible government debt default

EWT analyst Gilbert says gold is poised for major rally, sees $2428 as next target

(USAGOLD – 1/24/2023) – Gold gained ground in early trading as investors began to worry about the knock-on effects of a possible federal government debt default. It is up $8.50 at $1941. Silver is up 28¢ at $23.79. State Street CEO Ron O’Hanley told Bloomberg that a showdown in Congress over the debt limit could cause a “fair amount of damage [in the bond market] well before you saw a default.” O’Hanley says the risks of a deadlock are greater this time around because “people believe that this is the only way they can get their message across.” State Street is one of the world’s largest asset management and custodial firms.

Avi Gilbert, the Elliot Wave Theorist who gained a significant following with his call for a sharp drop in gold after it hit record highs in 2011, now says that the metal is poised for a major rally. “Back in 2011,” he explains in an analysis posted recently at Seeking Alpha,” I utilized a 100+ year structure in gold to identify the topping target for gold. And, I used the same structure to identify a bottoming target for the correction I expected, even before that correction began. So, now I am going to provide you my next target on the upside – and that is $2,428.”

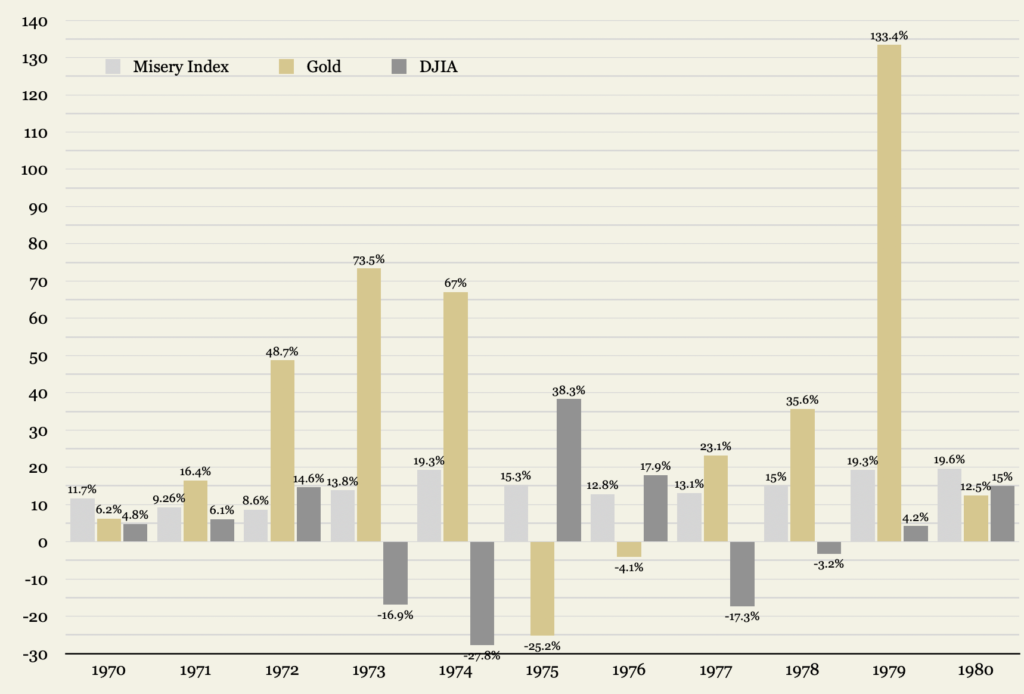

Gold, Dow Jones and Misery Index

(1970-1980 period of stagflation)