Daily Gold Market Report

Gold bolts higher as worry about the banking system persists

JP Morgan warns that the new Fed rescue package could carry a $2 trillion price tag

(USAGOLD – 3/17/2023) – Gold bolted higher in early trading as worry about the banking system persisted, and Wall Street braced for today’s $2.7 trillion in option expirations. It is up $24 at $1946. Silver is up 27¢ at $22.05. Bill Ackman, the well-known hedge fund manager, said that a $30 billion rescue package for First Republic thrown together by top Wall Street banks yesterday provided a “false sense of confidence” and “raised more questions than it answered.” He added that he is extremely concerned about a “financial contagion spinning out of the Fed’s control.” [Source: Bloomberg]

In something of a shocker, JP Morgan warned yesterday that the Fed may end up pumping as much as $2 trillion into the US banking system through its new Bank Term Funding Program. Degussa, the Swiss refiner, sounded the alarm about the new rescue package in a client advisory released this morning:

“How would the markets react to a sudden and enormous increase in central bank money pumped into the banking system and the Fed’s balance sheet expanding like never before? How will people react when the Fed cuts interest rates to prop up the banking system despite elevated inflation? And suppose confidence in the greenback, the world’s reserve currency, dwindles. What will happen to all the currencies essentially built on the US dollar?”

“It is high time to realize that the fiat US dollar monetary system faces tremendous challenges and that the risks of higher inflation and/or creditor defaults are increasing. Granted, this is an uncomfortable truth. However, holding at least some physical gold and silver is one possible solution to protect one’s portfolio from the vagaries of a fiat money system spiraling out of control.”

Daily Gold Market Report

Gold edges higher as an uneasy lull settles over markets

Will Rhind: Crisis in confidence driving investors to ‘the most famous safe have in the world’

(USAGOLD – 3/16/2023) – Gold edged higher as an uneasy lull settled over markets. It is up $6 at $1927. Silver is up 24¢ at $22.09. John Authers makes an important point about the bank crisis in his Bloomberg column this morning – one that’s been overlooked in much of the analysis so far. The issre in the banking system thus far, he explains, has been one of liquidity, but that is only part of the problem banks face: “The logic of the Fed’s tightening campaign is that it will eventually create solvency issues for banks — as in, their customers won’t be able to repay loans.”

Granite Shares’ Will Rhind says the gold market is signaling the beginning of a broader crisis. “What we’re seeing,” he says in a Yahoo!Finance interview yesterday, “is just a classic crisis of confidence. And when you see a crisis of confidence, but particularly in our financial system and our banking sector, people rush for safe havens. And arguably, there’s no more famous safe haven in the world than gold. It’s one of the highest quality assets out there with no counterparty or credit risk. So in other words, gold can’t go bankrupt, unlike a bank, and that’s very appealing at this particular point in time.”

Cartoon courtesy of MichaelPRamerez.com

Daily Gold Market Report

Gold resumes uptrend amidst more turmoil at Credit Suisse

Dalio says gold coins are a great way to teach children about investments

(USAGOLD – 3/15/2023) – Gold resumed its uptrend this morning amidst more turmoil at Credit Suisse and persistent concern about the global banking system. It is up $16.50 at $1923. Silver is up 43¢ at $22.19. With the safety of bank deposits in question, savers are turning to gold coins and bullion as a savings alternative. Ray Dalio, the widely followed founder of Bridgewater Associates, the world’s largest hedge fund, sees gifting gold coins as a great way to teach children about finance and investing, according to a Yahoo!Finance article posted this morning.

“Another great feature of gold is that it’s essentially timeless,” reads the article. “Gold has been highly valued by people from all walks of life for thousands of years, and that doesn’t seem to be changing any time soon. As an investment, gold has also historically been a safe haven during times of economic uncertainty. This factor makes it one of the most popular long-term investments.” Dalio gives a gold coin to his grandchildren every birthday and holiday.

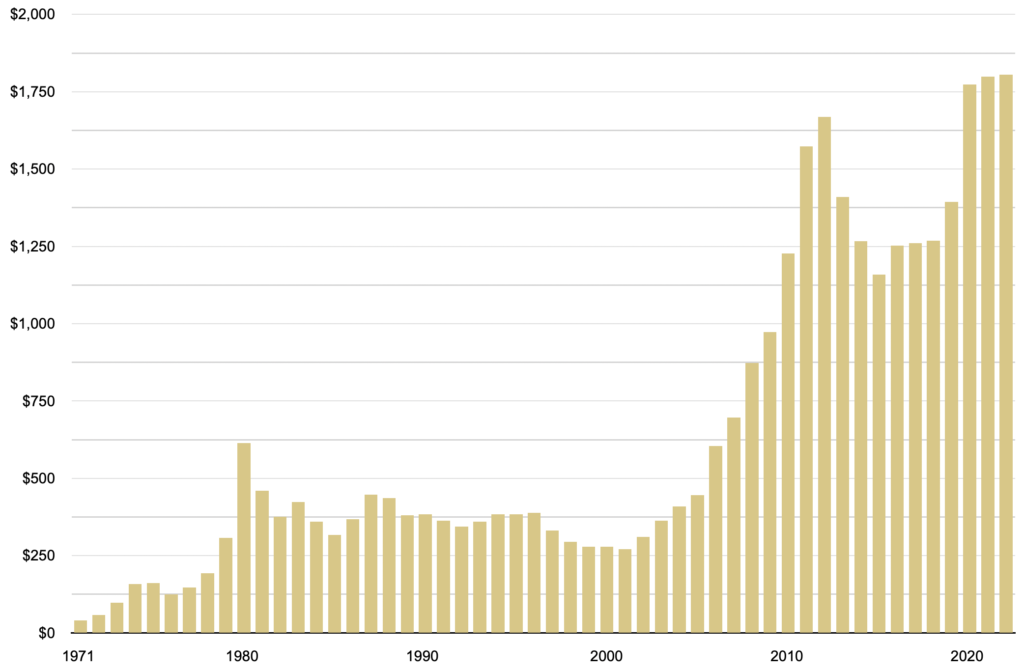

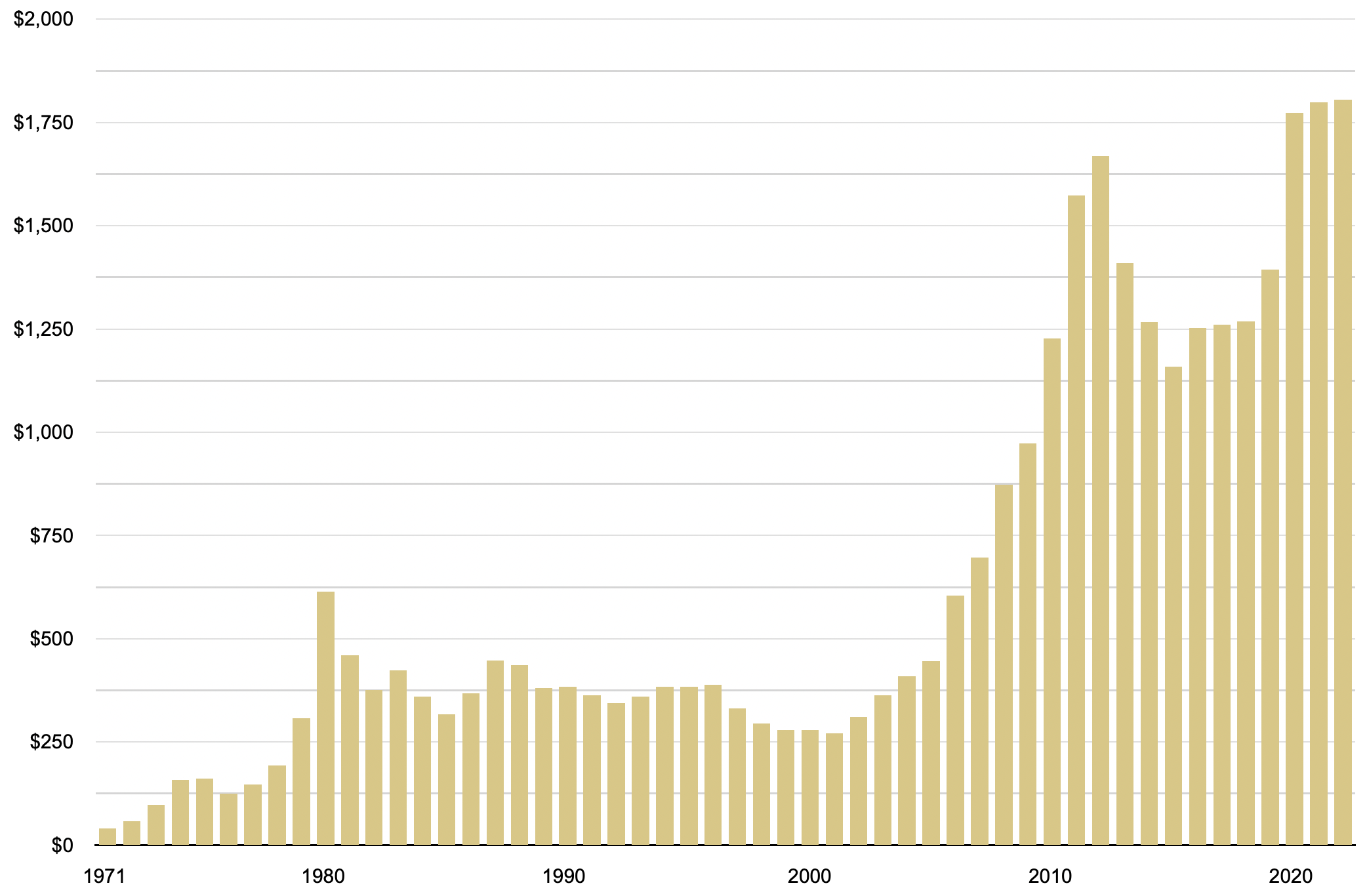

Gold average annual price

(1971-2022)

Chart by USAGOLD • • • Data source: Macrotrends.net

Daily Gold Market Report

Gold takes breather after solid two-trading session run-up

Roubini says ‘gold has upside in this environment’

(USAGOLD – 3/14/2023) – Gold is taking a breather this morning after the solid run-up that saw it gain 4% over the course of two trading sessions. It is down $8 at $1908. Silver is down 4¢ at $21.82. Gold has yet to react to this morning’s mixed CPI release showing a 6% inflation gain (versus a 6.2% consensus expectation), with core inflation exceeding expectations at 5.5%.

In an interview yesterday at Stansberry Research, Stern School of Business’ Nouriel Roubini said we are only in the first few innings of a major debt crisis. “The real economy and financial economy,” he warned, “are contradicting each other, and the government created a mess of too much debt and now it becomes another leverage cycle all over again. The Fed has been doing backdoor QE, and the financial system is reckless… Everything was in a bubble two years ago. Even in a mild recession, the S&P is going to fall between 30% and 50%, and gold has upside in this environment.”

Gold price

(%, 3/10/2023 through 3/13/2023)

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold posts solid gains on bank crisis, rescue plan

Deutschebank’s Saravelos calls Fed plan a ‘new form of quantitative easing’

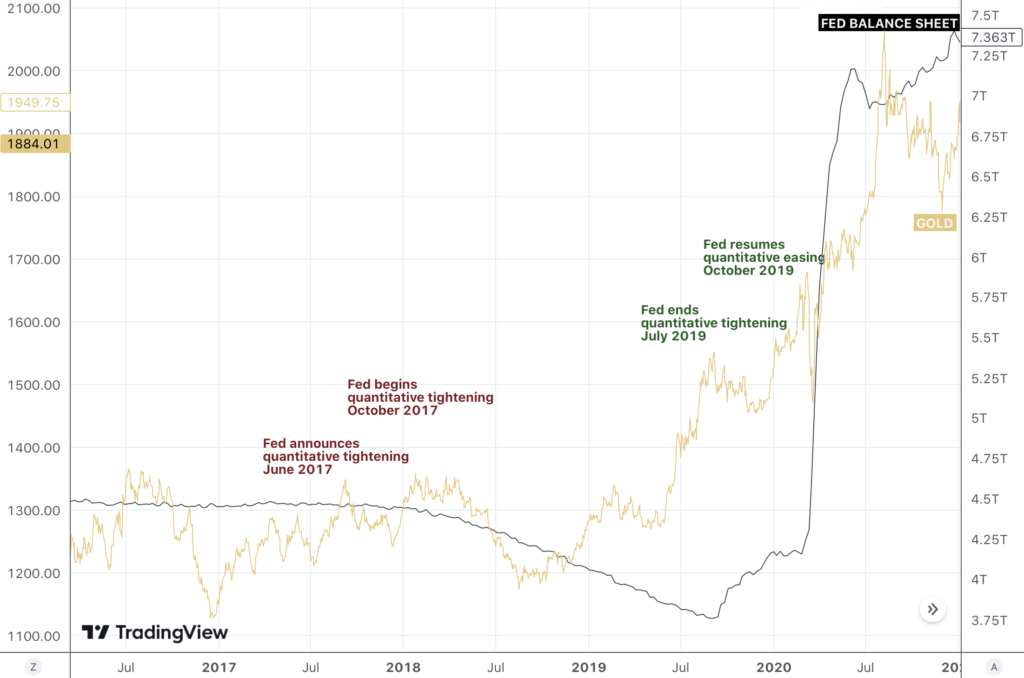

(USAGOLD –3/13/2023) – Gold posted solid gains for the second straight trading session as the Fed provided massive liquidity to ailing banks in an effort to forestall a system-wide bank crisis. It is up $30 at $1900. Silver is up 83¢ at $21.45. Deutschebank’s George Saravelos called the rescue a “new form of quantitative easing” in a Financial Times article this morning. In addition to the sudden injection of liquidity, gold is also reacting to the prospect of a rate pivot coming back into play. At the very least, it would be difficult to envision the FOMC raising rates under these conditions. It will take some time for the markets to fully sort out the implications of what the central bank and federal government put into play over the weekend,* but gold market analysts might look to the 2019 reinstatement of quantitative easing for guidance. (See chart below.)

“If the Fed is now backstopping anyone facing asset/rates pain,” says Rabobank’s Michael Every in a Bloomberg article this morning, “then they are de facto allowing a massive easing of financial conditions as well as soaring moral hazard. The market implications are that the US curve may bull steepen on the view that the Fed will soon actively pivot to line up its 1-year BTFP loans with where Fed funds rates then end up; or it may bear steepen if people think the Fed will allow inflation to get stickier with its actions.”

“So, if I have this right, the Fed will make loans on some of the collateral at a par valuation that is worth 40 percent less. Yikes.” – Jeffrey Gundlach, DoublieLine Capital

“More banks will likely fail despite the intervention, but we now have a clear roadmap for how the govt will manage them.” – Bill Ackman, Pershing Square

*Statement issued by the Federal Reserve Board of Governors yesterday.

Gold price and Fed balance sheet

(2016-2021)

Chart courtesy of TradingView.com • • • Annotations by USAGOLD • • • Click to enlarge

Daily Gold Market Report

Gold turns sharply higher on unemployment report, sudden bank collapse

‘Gold doesn’t need a crisis to move higher, but it definitely loves a crisis.’

(USAGOLD – 3/10/2023) – Gold turned sharply to the upside after the Labor Department reported higher-than-expected unemployment. It is up $20 at $1852. Silver is up 50¢ at $20.64. The metals are also getting a boost from the sudden collapse of one California bank (SVB) and the potential collapse of another (SVB Financial Group). The banks’ problems were brought on, says Bloomberg, by holdings of “low-interest bonds that can’t be sold in a hurry without losses. So if too many customers tap their deposits at once, it risks a vicious cycle.” (In other words, a classic bank run.) “The faster you raise interest rates,” says Capitalight Research’s Chantelle Schieven in a recent Kitco News interview, “the faster something is going to give, that something is going to break. Gold doesn’t need a crisis to move higher, but it definitely loves a crisis.”

Daily Gold Market Report

Gold edges higher as investors digest sustained tightening, financial headwinds

The rate deterrent no one is talking about

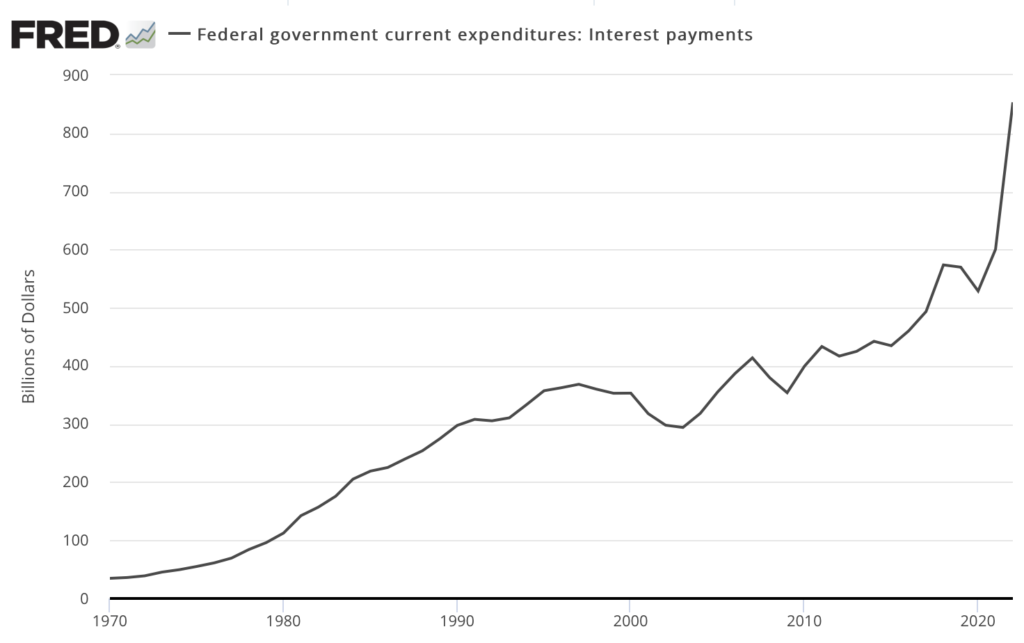

(USAGOLD – 3/9/2023) – Gold edged higher as investors continued to digest the prospect of sustained monetary tightening and accompanying financial headwinds. It is up $4.50 at $1821. Silver is up 8¢ at $20.18. Gold Newsletter’s Brien Lundin believes there is a major deterrent to sustained Fed tightening, and it is one that does not get a lot of attention.

“[We will] be paying over $1.75 trillion in interest costs on the federal debt if rates get into the range now being forecast (5.5%),” he points out in a recent advisory. “I don’t think it will happen, because it can’t. And I’m amazed that no one else is talking about this right now. Regardless, they’ll find out soon enough. With the latest official estimates of federal interest expenses at a breathtaking $852 billion, we’re going to cross the $1 trillion threshold very soon. I think that’s going to make headlines. When it does, it will illustrate the trap the Fed is in, and I think metals prices will begin to rise even before this happens.” [Source: Gold Newsletter]

Interest paid on the national debt

(Annual)

Sources: St. Louis Federal Reserve, U.S. Bureau of Economic Analysis

Daily Gold Market Report

Gold drifts sideways after yesterday’s Fed-inspired cross-markets rout

‘Gold is often highly sought after in periods of economic and financial uncertainty’

(USAGOLD – 3-8-2023) – Gold drifted sideways this morning as it attempted to regain its footing after yesterday’s Fed-inspired, cross-markets rout. It is level at $1816. Silver is up 2¢ at $20.16. Markets have been in a quandary as to how the Fed would respond to the recent run of robust economic data. Fed chairman Powell put an end to the speculation yesterday, promising an aggressive policy to fight inflation. In an analysis released this morning, Wisdom Tree, the Dublin-based investment firm, warns of headwinds for gold but reminds us that those same headwinds create the need for a safe haven.

Gold average annual price

(1971-2022)

Daily Gold Market Report

Gold trades marginally to the downside ahead of Powell testimony

‘High stakes’ testimony begins later today

(USAGOLD – 3/7/2023) – Gold traded marginally to the downside this morning as markets took to the sidelines ahead of Fed Chairman Powell’s two-day Congressional testimony beginning today. It is down $6 at $1843. Silver is down 15¢ at $20.97. This morning’s Financial Times characterized Powell’s testimony as “high-stakes” and his first public appearance since data releases “showed the central bank is still struggling to cool the US economy despite its year-long campaign of monetary tightening.” We should know more before the day is out, but for now, gold (and financial markets in general) looks to be on hold – albeit a wobbly hold.

Daily Gold Market Report

Gold trades cautiously to the downside in follow-up to last week’s strong showing

Commerzbank thinks gold might have bottomed

(USAGOLD –3/6/2023) – Gold traded cautiously to the downside this morning in the follow-up to last week’s strong showing. It is down $6 at $1853. Silver is down 16¢ at $21.18. Germany’s Commerzbank sees last week’s rally as an indicator gold may have bottomed. “By the end of the month,” says the bank, “the expected rate peak had been pushed back into the autumn – what is more, it is now set to total almost 5.5%, which is around 70 bps higher than envisaged at the start of the month. Moreover, there is no longer any expectation of rate cuts this year. The price increase seen [last] week despite even higher interest rate expectations could indicate that the correction of the gold price is more or less complete and that the price may have bottomed out at the beginning of the week.” (Source: FXStreet)

Gold price

(Five days)

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold pushes to higher ground looking to close out solid first week of March

China adds another 15 tonnes to its reserve holdings in January

(USAGOLD –3-3-2023) – Gold pushed to higher ground this morning as it looks to close out a solid first week of March. It is up $12 at $1850. Silver is up 18¢ at $21.16. It will surprise some to know that gold is up $40 (+1.9%) since Monday; silver is up 41¢ (+2.2%). Central banks picked up where they left off last year, adding more gold to their coffers in January. According to the World Gold Council, China added another 15 tonnes, while Turkey bought 23 tonnes. Societe General, the French bank, sees 2023 “as the beginning of the end to US dollar strength” and advises its clientele to continue “rebalancing” out of the dollar and into gold. “Gold,” it says, “will be a powerful protection against a falling USD.” (Source: FX Street)

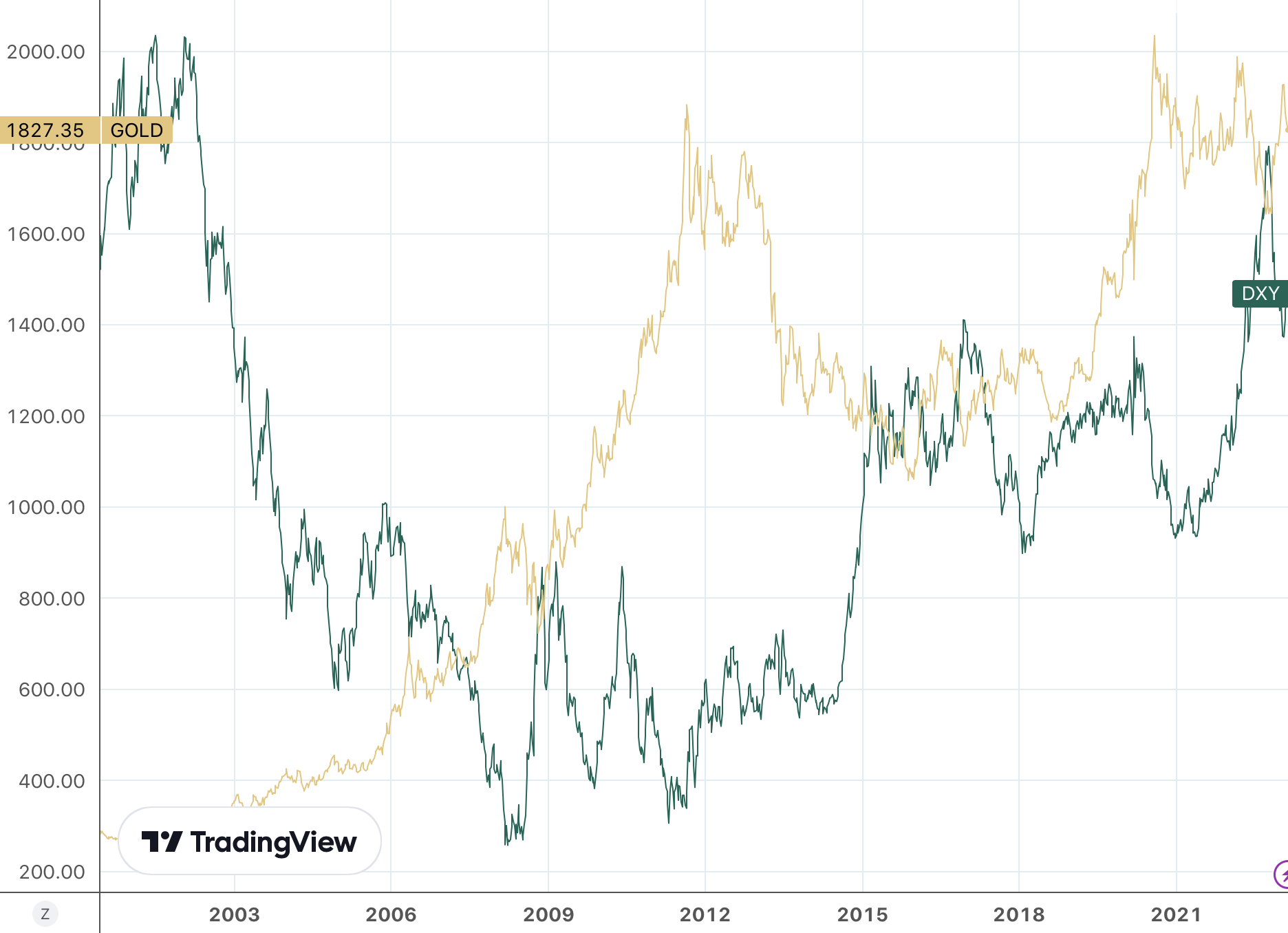

US Dollar Index and Gold

(2000-present)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold drifts sideways in quiet trading

Europe: A clear sign inflation is not about to go quietly into the good night

(USAGOLD – 3/2/2023) – Gold drifted sideways in quiet trading this morning as the “higher for longer” rate scenario hung like a dark cloud over financial markets. It is down $2 at $1837. Silver is down 25¢ at $20.86. Many will take this morning’s Eurozone’s stickier-than-expected consumer price report as a further sign that inflation is not about to go quietly into the good night. The jobless claims number added to gold’s weakness, coming in lower than expected and adding to market worries about persistent inflation.

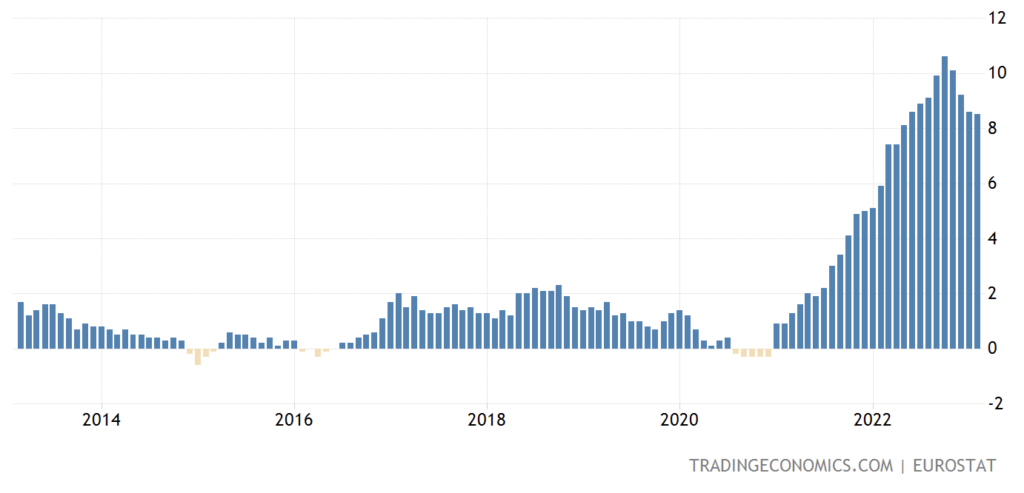

Eurozone inflation rate

(%, annualized)

Chart courtesy of TradingEconomics.com

Daily Market Report

Gold trades to the upside after finding support near the $1800 mark

London-based Norman reports ‘good bargain hunting on the lows’

(USAGOLD – 3//1/2023) – Gold continued higher this morning in a follow-up to yesterday’s sharp upside reversal near the $1800 mark. It is up $11 in the early going at $1840. Silver is up 18¢ at $21.15. London-based gold market analyst Ross Norman told Reuters earlier today that “the [gold] market is cautiously optimistic” after China reported manufacturing growing at its fastest pace in a decade. A stronger Chinese economy is likely to boost local gold demand. “Gold,” Norman added, “was clearly oversold and we’re seeing good bargain hunting on the lows, having found technical support at the $1,808 level … the market looks poised to firm but cautiously so, with U.S. inflation-linked data being a constant driver.”

Gold price

(Five day)

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold descends toward the $1800 level

Standard Chartered sees gold as ‘closing in on oversold territory’

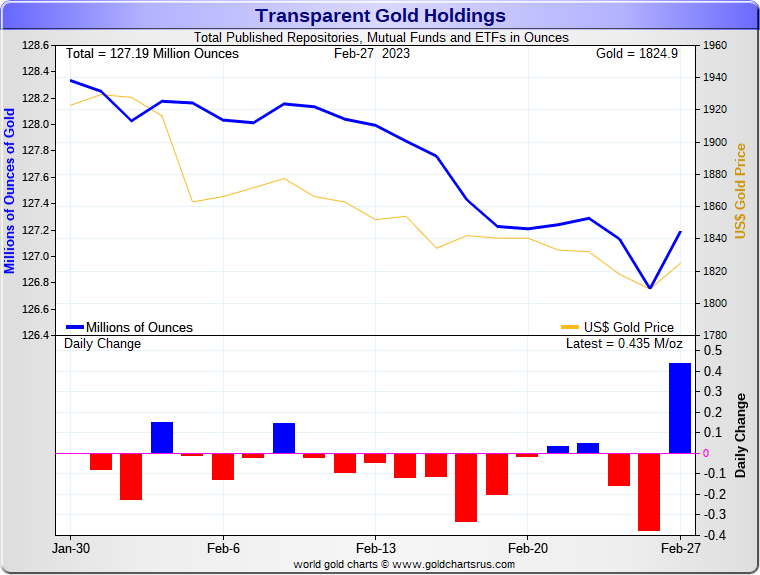

(USAGOLD – 2/28/2023) – Gold descended toward the $1800 level in today’s early going as it looks to close out what’s been an unforgiving month. It is down $8 at $1811.50. Silver is down 8¢ at $20.62. Gold’s month-lomg selloff began in early February when it ran into technical resistance at $1960 and gathered momentum as investors added worry about a more hawkish Fed to the mix. Standard Chartered’s Suki Cooper sees gold as “closing in on oversold territory” and puts the next support level at $1788. ETF outflows, she says in a client note cited by Kitco News, have been one of the culprits in gold’s retreat with a reduction of 20 metric tonnes thus far in February, “and 11 tonnes materializing in the last four sessions.”

Chart courtesy of GoldChartsRUs

Gold drifts marginally higher as it looks to close out a dismal February

Yellow metal gives back $140 of the $340 price gain since last November

(USAGOLD – 2/27-2023) – Gold drifted marginally higher in directionless trade this morning as it looks to close out what’s been a dismal month. It is up $2 at $1815. Silver is down 5¢ at $20.80. Saxo Bank’s Ole Hansen sees renewed dollar strength and a weaker bond market as the two primary factors providing headwinds for gold. The yellow metal, he reminds us by way of perspective, gained $340 in the rally that began last November, and has now given back $140.

“For now,” he says in an advisory posted Friday, “gold is likely to take much of its directional inspiration from the dollar and, until we see another rollover, gold will continue to look for support. Demand for gold remains uneven, but in the short term we anticipate that central bank demand will more than offset a continued lack of appetite from investors in the ETF market where total holdings continue to be reduced, down by almost 50 tons since early November when gold began its strong run-up in prices.”

Gold and silver prices

(One month)

Chart courtesy of TradingView.com • • • Click to enlarge

__________________________________

“Markets got ahead of themselves in terms of pricing in Fed cuts, Investors were betting that the Fed was going to get inflation down successfully and quickly. I think this process is going to take longer than people thought.” – Idanna Appio, First Eagle Investment Management, via Financial Times

Gold pushes lower in cautious trading ahead of PCE inflation numbers

Fidelity investment manager makes interesting adjustment in personal portfolio

(USAGOLD – 2/24/2023) – Gold drifted lower this morning in cautious trading ahead of PCE inflation numbers to be released later today. It is down $5 at $1820. Silver is down 26¢ at $21.12. The PCE index is expected to come in slightly higher than last month. Fidelity’s Becks Nunn says she has decided to add alternative investments, including gold, to her personal portfolio after the dismal showing of stocks and bonds over the past year.

“You need to consider what else you have in your portfolio,” she writes in an advisory published yesterday, “and whether you already have enough diversification. When I looked at my accounts holding report, I noticed my alternative investments sat at around 5%. I’ve now changed this so that I’m now roughly invested in 50% equities, 35% bonds and 15% weighted to property and gold. This feels about right to me as my investment horizon is still reasonably long. Of course, what’s right for you is something only you can decide.”

Gold tracks sideways as ‘higher for longer’ gains traction

Holmes advises investors to take advantage of the gold-dollar inverse correlation

(USAGOLD – 2/23/2023) – Gold is tracking sideways this morning as the ‘higher for longer’ scenario gained traction, the dollar weakened slightly, and the markets weathered the release of January’s FOMC minutes no worse for the wear. It is up $2 at $1830. Silver is up 5¢ at $21.65. US Global Investors Frank Holmes advises investors to exploit the inverse correlation between gold and the dollar. The time to accumulate gold, he says, is during periods of dollar strength.

“Gold,” he continues in an advisory posted yesterday, “is nearing its strongest buy signal in four months as the US dollar eases off a rally that’s carried the greenback to its highest point since early January. According to the 14-day relative strength index (RSI), gold was at its most oversold level since October 2022 at the end of last week, indicating it may be time to consider buying in anticipation of mean reversion.… Gold is currently about 6% off its 2023 high of just under $1,960 an ounce, under pressure from the dollar, which has made gains against a basket of world currencies on economic data that all but guarantees additional rate hikes. Unemployment sits at 3.4%, the lowest reading in more than half a century, giving the Federal Reserve the go-ahead to continue its fight against inflation.”

US Dollar Index and Gold

(2000-present)

Chart courtesy of TradingView.com • • • Click to enlarge

Gold pushes to higher ground on light short covering, bottom fishing

Standard Chartered sees fading headwinds for gold

(USAGOLD – 2/22/2023) – Gold pushed to higher ground in early trading on what looks to be a combination of light short covering and some investor bottom fishing. It is up $8 at $1845.50. Silver is up 11¢ at $22.02. Standard Chartered, the German investment bank, says gold’s headwinds have begun to fade.

“We would gradually add exposure to gold (especially those who are underinvested),” it says in an advisory reported at FXStreet, “given that XAU/USD is starting to look oversold. Moreover, central bank demand remains strong and we expect that to continue supporting gold prices. The rebound in real yields and the USD is likely to level off, in our view, fading headwinds against gold. The bright metal can also serve as an attractive hedge against short-term volatility due to geopolitical tensions.”

Couldn’t resist passing along Ramirez’ latest:

Cartoon courtesy of MichaelPRamirez.com

Gold tracks lower on Fed rate trajectory

Gold would have to be priced at $32,000/oz to cover Fed’s balance sheet

(USAGOLD – 2/21/2023) – Gold tracked to the downside in early trading as worries about the Fed rate trajectory continued to weigh on market sentiment. It is down $8 at $1836. Silver is down 8¢ at $21.81. Goldman Sachs’ chief economist Jan Hatzius predicts the Fed will raise rates another 0.75% by mid-year with no cuts until 2024. Analysts will be looking for clues on where the Fed might be headed in the minutes from February’s FOMC meeting to be released tomorrow.

In an article posted at Eurasia Review, macroeconomic analyst Alexander Gloy offers food for thought: “At the current price of $1,875 per ounce, US gold reserves are worth approximately $490 billion. In order to back all outstanding currency with gold reserves, the price of gold would have to reach $8,800 per ounce, roughly five times higher than it is today. If gold were to cover all money created by the Federal Reserve (which is equal to its current liability of $8.4 trillion) the price of gold would have to be upwards of $32,000 per ounce (nearly eighteen times the current price of gold).”

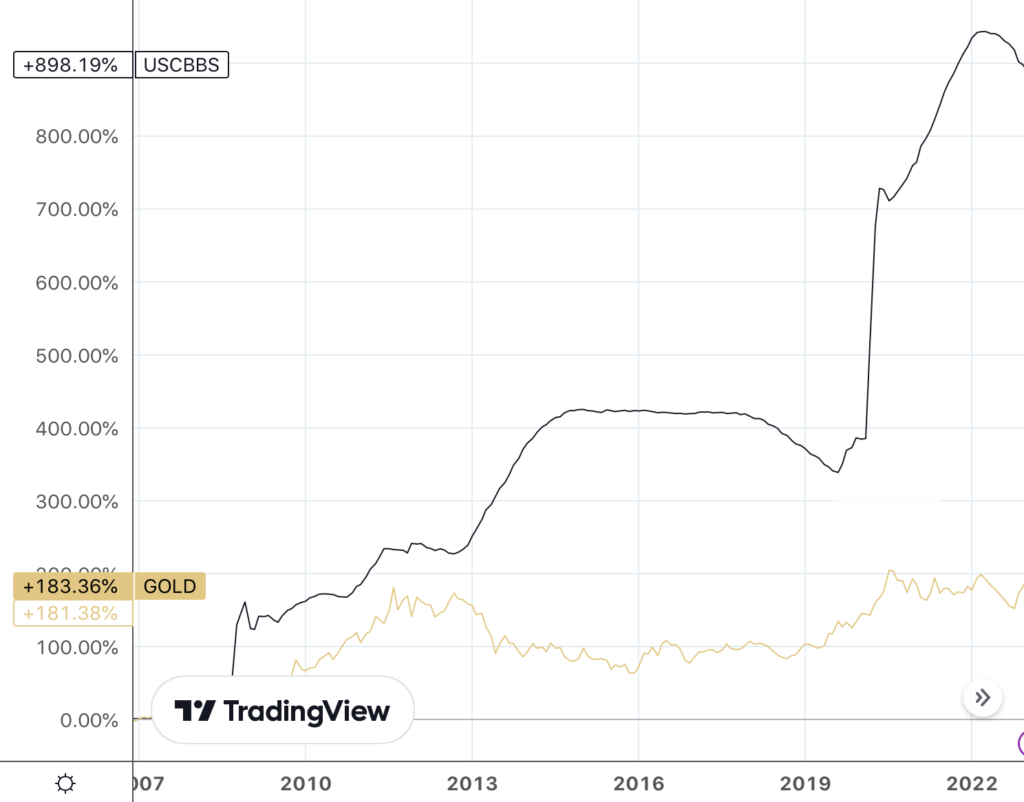

Gold and the Fed Balance Sheet

(%, 2007-present)

Chart courtesy of TradingView.com

Gold up marginally as dollar firms; investors worry about Fed rate trajectory

Gilbert sticks with his $2428 forecast, but says support must first hold at $1845-50

(USAGOLD – 2/20/2023) – Gold is up marginally this morning as the dollar firmed and investors continued to worry about the Fed’s rate trafectory. It is up $1 at $1846. Silver is down 2¢ at $21.79. Market analyst Avi Gilbert welcomes gold’s recent pullback as the “set-up” for his forecasted $2428 target. He says support, though, must first hold in the $1845-50 region.

“As long as that support holds,” he says in an advisory posted at Seeking Alpha. “I am expecting a rally over the coming weeks. Should that rally take shape as an 5-wave structure, which adheres to our Fibonacci Pinball structure, then we will have to prepare for a break out in gold over the coming month, which will next point us north of $2,100SPX and quite rapidly. However, if the next rally is corrective in nature or if we see a sustained break of $1845/50 support, then it opens the door to the potential that this pullback/consolidation will take us several more weeks, and can potentially take us down to test the $1735/1,780 region.”

Gold continues selloff on hot wholesale inflation, hawkish Fed rhetoric

‘Investors’ eternal optimism is shaken.’

(USAGOLD –2/17/2023) – Gold continued its selloff in overseas trading as traders reacted to a hotter-than-expected wholesale price report and two prominent Fed officials suggesting that a 0.5% future rate hike would be justified. It is down $8 at $1830. Silver is down 26¢ at $21.40. Both metals have been in steady downtrends since early February after hitting technical resistance at $1960 and $24.50.

In a Bloomberg report this morning, Oanda Europe’s Craig Elam neatly summarized current investor psychology: “It’s taken a lot but it would appear investors’ eternal optimism is being shaken, with the latest PPI figures finally driving the message home that bringing the economy in for a soft landing will be extraordinarily challenging and there’ll likely be plenty of turbulence along the way,” In the meanwhile, inflation is on the march as are Russian forces in Ukraine; the stock market is in a funk, and US Treasuries are suffering a sharp selloff equal to gold’s.

Gold and US Treasuries

(%, February 2023)

Chart courtesy of TradingView.com

Gold trades marginally to the upside still caught up in technical sell-off

Could central banks’ attitude toward gold more broadly pave the way for investors?

(USAGOLD – 2/16/2023) – Gold is trading marginally to the upside this morning in a market that looks to be still caught up in the technical selling-off that began in early February at the $1960 level. It is up $4 at $1841.50. Silver is down 5¢ at $21.67. Van Eck, the international investment firm, says that “most investors seem uninterested in gold until things get ugly” but believes central banks’ attitude toward the metal might change that way of thinking.

“Could the attitude of central banks towards gold be paving the way for investors more broadly?” it asks in an analysis posted at Seeking Alpha recently. “A track record of 13 years of consecutive net buying demonstrates that as a group these institutions are not trying to ‘time’ the gold market. Their commitment to gold appears to be long-term and based on gold’s key attributes as a safe haven and portfolio diversifier. We, too, believe that gold, rather than being viewed as an asset of last resort, should be considered a core component and enjoy a permanent allocation in any portfolio.”

Editor’s note: Some are surprised to learn that since the United States went off the gold standard in 1971, gold has outperformed stocks by a wide margin. Gold is up 4696% over the 52 years. Stocks are up 3829.5% (as of this morning).

Gold and the Dow Jones Industrial Average

(1971 to present)

Chart courtesy of TradingView.com • • • Click to enlarge

No DMR today (2-15-2023). Below is yesterday’s report.

________________________________________________

Gold moves higher in tentative trading ahead of CPI release

Paulson says gold will appreciate this year and on a three, five, and ten year basis

(USAGOLD – 2/14/2023) – Gold moved higher in tentative trading ahead of today’s CPI release. It is up $7 at $1863. Silver is down 21¢ at $21.88. Trading Economics puts the consensus CPI number at 6.2% annualized, which would be a notable decline from December’s 6.5% reading. John Paulson, the New York-based hedge fund impresario, believes “inflation will be more persistent than the markets currently perceive, and that the Fed will raise rates another 50 to 100 basis points, “then hold it there until we get a severe economic shock.”

“We’re at the beginning of trends that are going to increase the demand for gold,” he says in a recent interview with Alain Elkann, “and inflation and geopolitical tensions will determine the rate at which gold increases. This year gold will appreciate versus the dollar, and also over a three, five and ten year basis.” He points out that central banks around the world are “looking for an alternative reserve currency” and that gold is on the rise again: “[I] t’s been the reserve currency of the world for thousands of years, a legitimate alternative to holding the dollar or other paper currencies.”

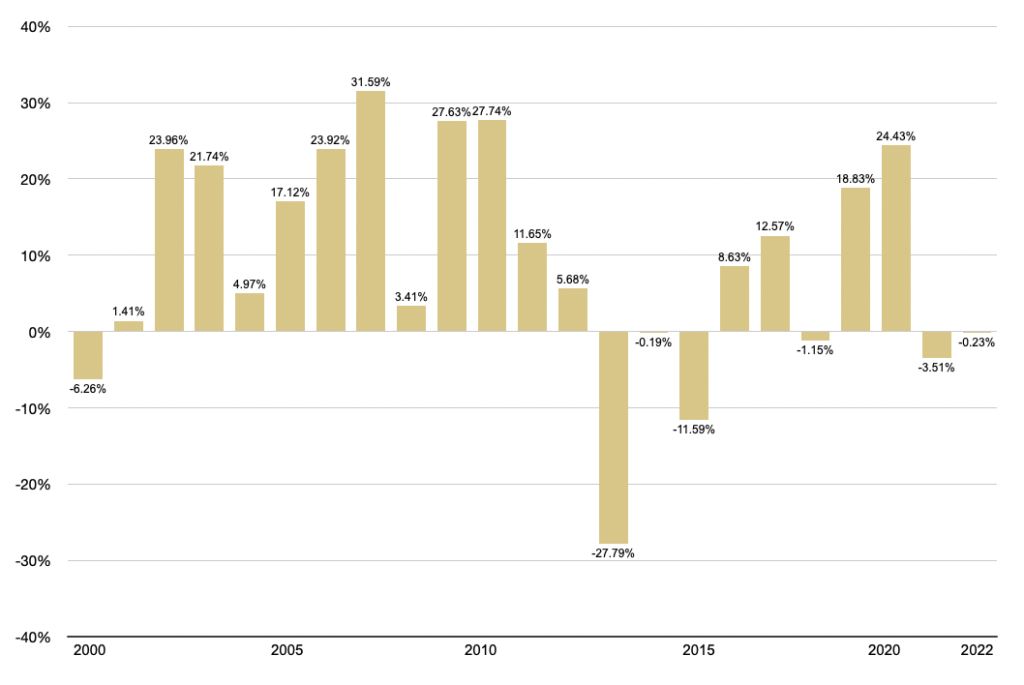

Gold annual returns

(2000-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: Macrotrends.net • • • Click to enlarge

Gold drifts lower ahead of tomorrow’s all-important inflation data

Ukraine war has turned Russia into a nation of gold bugs

(USAGOLD – 2/13/2023) – Gold drifted lower in quiet trading ahead of tomorrow’s all-important inflation data in what looks to be a continuation of the technical selling that began early this month. It is down $8 at $1860. Silver is down 9¢ at $22.00. IG, the UK– based investment firm, believes gold is in a period of consolidation within a broader uptrend.…The narrative continues to be broadly gold supportive,” it says in an advisory released this morning.”

Financial Times reports that the war In Ukraine has turned Russia into a nation of gold bugs. “The demand for gold coins and bars grew faster in Russia than any other country, rising nearly five times the level of the previous year,” it says in an article posted over the weekend. Polymetal’s Vitaly Nesis told FT that “private citizens are looking for a way to save money, and euros and dollars are in short supply, so the popularity of gold has surged. As long as we experience geopolitical instability, the demand for gold may be significant.”

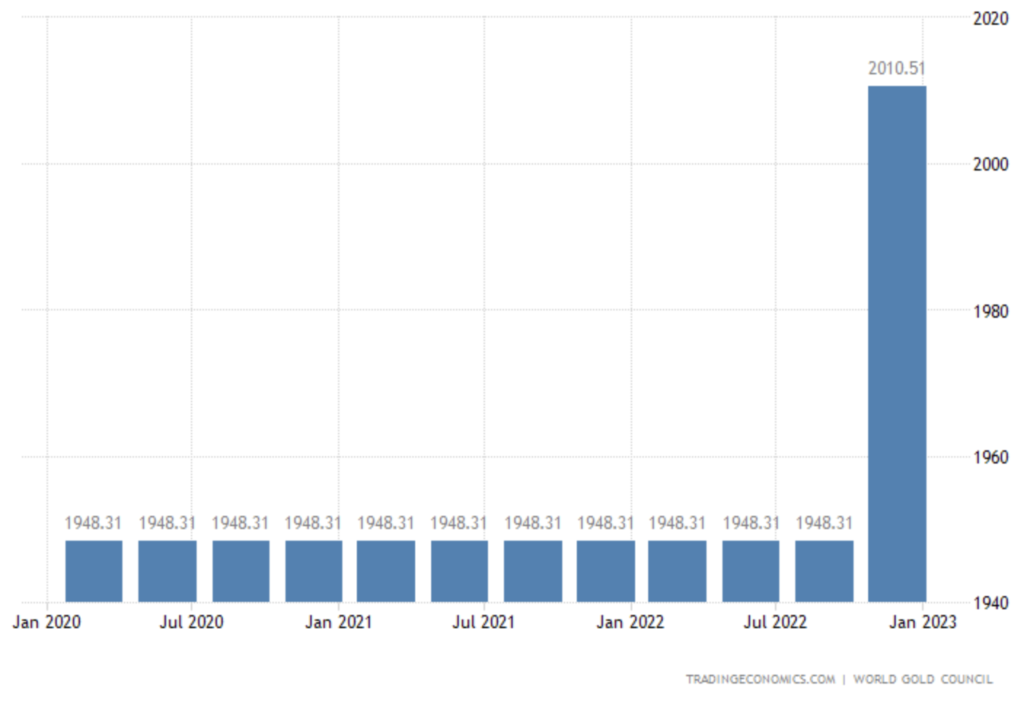

(Editor’s note: FT reports that investor interest in gold jumped following the government’s lifting of the VAT tax on the metal. “The switch to gold,” it notes, “has been strongly encouraged by the Russian government.” Russia itself has more than doubled its gold stockpile over the past decade, as shown below.)

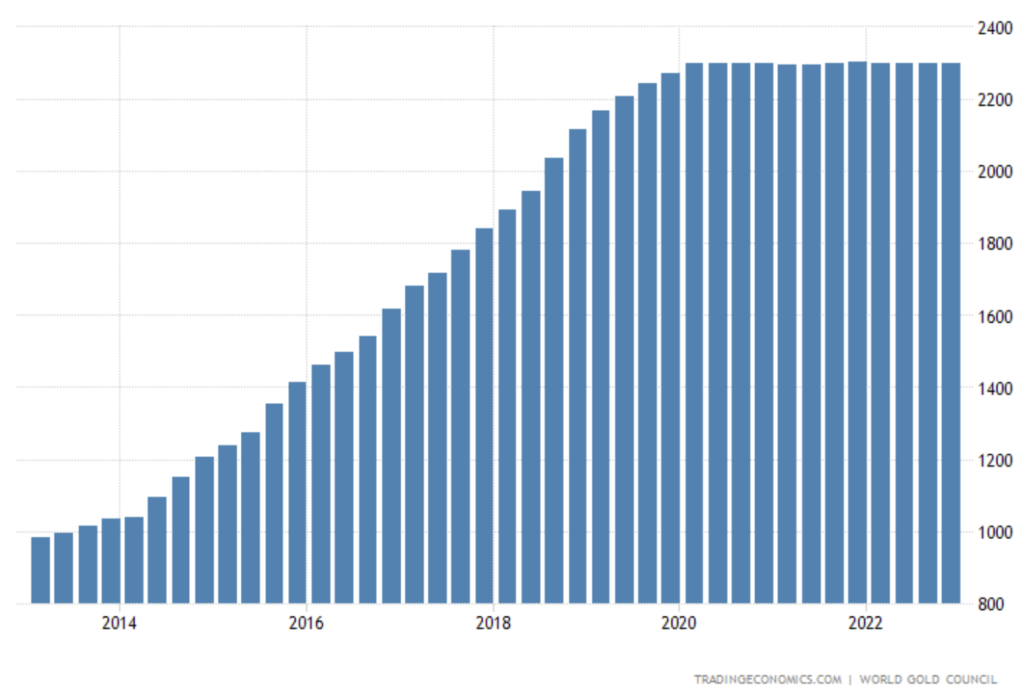

Russia gold reserves

(Metric tonnes)

Chart courtesy of TradingEconomics.com

Gold up marginally as attention turns to Tuesday’s inflation report

Holmes undaunted by recent gold selloff, sees strong year ahead

(USAGOLD – 2/10/2023) – Gold is up marginally this morning as financial markets turned their attention to Tuesday’s consumer inflation report. It is up $3 at $1866. Silver is up 13¢ at $22.18. Trading Economics forecasts a 6.3% annualized inflation rate for January as compared to December’s 6.5% reading. Global Investor’s Franks Holmes is undaunted by gold’s reversal from the $1960 mark over the past ten days.

“I don’t believe that this takes away from the fact that gold posted its best start to the year since 2015,” he says in an update posted this morning at Bullion Vault. The yellow metal rose 5.72% in January, compared to 8.39% in the same month eight years ago.…Gold was one of the very few bright spots in a dismal 2022, ending the year essentially flat, and I expect its performance to remain strong in the year ahead.”

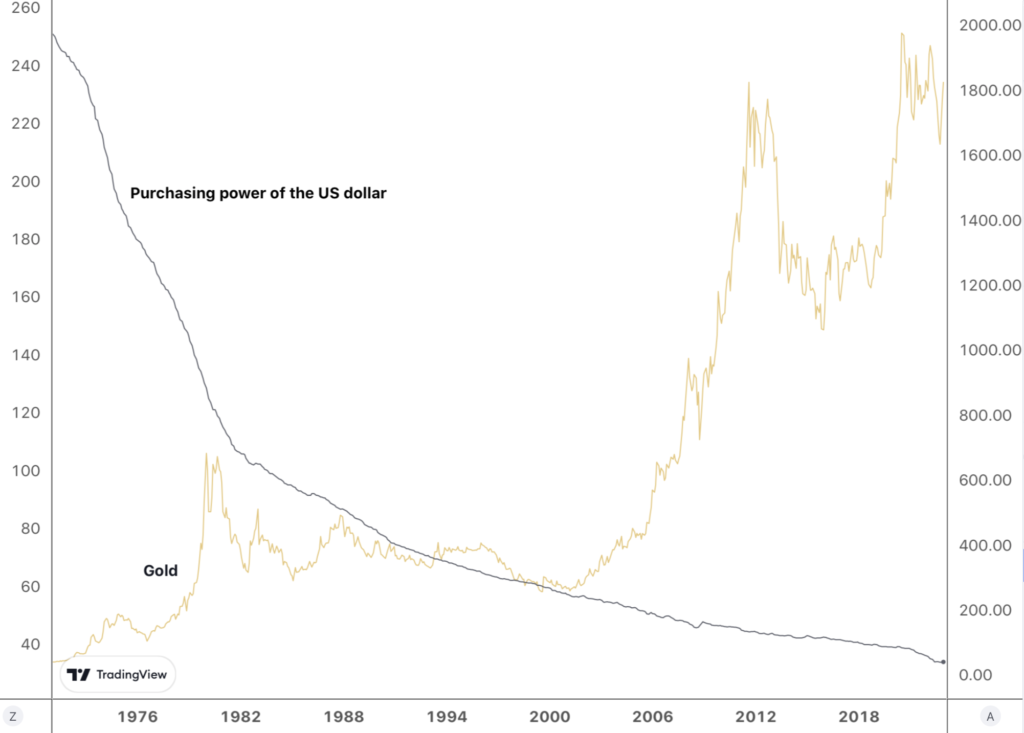

Gold and the purchasing power of the US dollar

(1971-2022)

Chart courtesy of TradingView.com • • • Click to enlarge

Gold tracks marginally higher in overseas markets under quiet conditions

Gold bullion desks confirm strong interest from China’s official sector for undisclosed reasons

(USAGOLD – 2/9/2023) – Gold tracked marginally higher in overseas markets under generally quiet conditions. It is up $6 at $1884. Silver is up 7¢ at $22.47. Of late, gold has shown signs of life in Asian and European trading, only to run into resistance during the US trading session. China added another almost 15 metric tonnes of gold to its reserves in January, bringing its total holdings to 2025.51 metric tonnes. January is the third straight month it has added to its gold holdings. The acquisitions have coincided with an uptrend in the gold price that began in November of last year.

“Gold bullion trading desks have confirmed this strong interest is a continuation of flow demand from China since early November 2022,” says Sprott analyst Paul Wong in a report posted yesterday, “and the estimated tonnages bought would align with the most significant numbers since 2017. Price action and trading desk anecdotes denote large buying from China’s’ official sector’ (possibly any combination of People’s Bank of China, central bank-related entities or state banks) for undisclosed reasons.”

China gold reserves

(Metric tonnes)

Chart courtesy of TradingEconomics.com

Gold turns quietly to the upside on less-than-aggressive Powell policy stance

Better Markets says the US is now dealing with ‘historically high persistent inflation’

(USAGOLD – 2/8/2023) – Gold turned quietly to the upside in early trading following the Fed chair’s less-than-aggressive positioning before the Washington Economic Club yesterday. It is up $2 at $1877. Silver is up 21¢ at $22.43. Many suspected Powell would come out guns blazing following last Friday’s big jobs numbers. Instead, we got a promise of more of the same – more restrained rate increases only over a more extended period. The markets, according to press reports, are reading the speech as dovish.

Stating that the US is now dealing with “historically high persistent inflation,” Better Markets’ Dennis Kelleher and Phillip Basel see the Fed and financial markets as living with a banquet of consequences the result of Fed policies past and present – “an unprecedented array of multiple, simultaneous, and consequential economic, financial, and geopolitical shocks that are causing significant volatility and stress in financial markets while straining consumers and businesses in the real economy. In this environment, the margin for error is vanishingly small.” [For the full report, please see “Federal Reserve Policies and Systemic Instability: Decoupling Asset Pricing from Underlying Risks,” Kelleher and Basel, January 17, 2023.]

Gold inches higher ahead of Powell speech later today

Norman sees Goldilocks’ year for gold – ‘not too hot, not too cold’

(USAGOLD – 2/7/2023) – Gold inched higher ahead of a speech later today by Fed Chairman Powell before the Washington Economic Club. It is up $5 at $1873. Silver is down 11¢ at $22.23. The markets will be watching to see if Powell takes the opportunity to address Friday’s explosive jobs number. Ross Norman, who has won the London Bullion Market Association’s annual price forecasting contest a number of times, sees 2023 as a Goldilocks’ year for gold– “not too hot, not too cold.”

“The four key positive factors we see in gold’s favour,” he says in a Linked-In post,” are scope for increased speculative longs as the market trends higher, a shift in the tide in ETF demand from redemptions to creations as institutions re-enter the market looking for diversification, ongoing official purchases in a polarised world and ongoing strength in physical demand from the economically literate.” He sees gold ranging between $1834 and $2070 in 2023 as “headwinds turn into tailwinds.”

Gold struggles to stay positive after last week’s steep sell-off

Markets unsure how to read Friday’s explosive jobs number

(USAGOLD – 2/6/2023) – Gold struggled to stay positive this morning in the wake of last week’s steep selloff. It is up $7 at $1875. Silver is up 7¢ at $22.50. Judging from the reaction, the markets are not sure how to read Friday’s explosive jobs number. An anomaly? A return of the phantom workforce that disappeared during the pandemic? A repudiation of the recession scenario? Outright inflation? Of course, the most important reading will be the Fed’s, and it is likely to remain cautious.

Gold Newsletter‘s Brien Lundin offered the following summation of Friday’s events in the gold market: “Gold is being hit this morning because the positive surprise on the jobs number is a strong indication that the Fed has more than a single rate hike left in it. Unfortunately for the bulls, it’s being hit harder than equities because it’s been outperforming stocks over the last few months. Profits are being taken by those who have enjoyed that ride.”

Editor’s note: As we pointed out in late January, with hedge funds back in the gold market, we should expect more volatility and technical trading at key chart numbers.This break actually began on Thursday with selling at the $1960 mark. Friday’s jobs number accelerated the downtrend.)

Gold Price

(1/30/2023 through 2/3/2023)

Chart courtesy of TradingView.com • • • Click to enlarge

Gold trades to the downside ahead of tomorrow’s rate decision

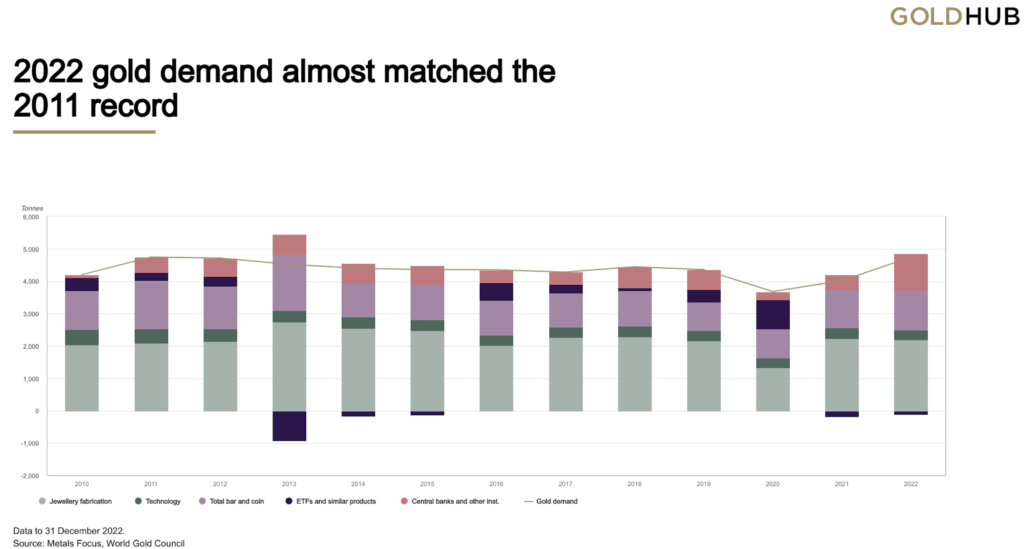

WGC reports strongest gold demand in over a decade led by central banks

(USAGOLD – 1/31/2023) – Gold is trading to the downside this morning ahead of tomorrow’s Fed decision and press conference. It is down $9 at $1917. Silver is down 27¢ at $23.42. Wall Street expects the Fed to strike a more dovish tone, but there is a minority worried about a hawkish surprise. The World Gold Council reports the strongest demand for gold in over a decade. “Colossal central bank purchases,” it says in its full-year demand trends report for 2022, “aided by vigorous retail investor buying and slower ETF outflows, lifted annual demand to an 11-year high.” Investment demand for gold coins and bars grew by 10% to 1,107 tonnes. Central bank buying was at a 55-year high of 1,136 tonnes.

Chart courtesy of the World Gold Council • • • Click to enlarge

Interested in gold but struggling

to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

8:40 am Fri. April 19, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115