Featuring top analysts. Updated regularly.

Gold price target set at $2075 record level

Van Eck/Joe Foster and Imaru Casanova/6-14-2023

“The main drivers of past gold bull markets are extraordinary tail risks and a falling dollar. We are living in an age of tail risks as the world goes through sickness, war, social disorder and financial stress that most people thought were relegated to the past. The level of tail risks today are at least as significant as past bull markets.”

USAGOLD note: Foster and Casanova say that gold has been in a bull market since December 2015 – rising 87% over the period.

Gold’s bull market trend since 2015

(After Van Eck’s chart published at the link below)

Chart courtesy of TradingView.com and Van Eck • • • Click to enlarge

Gold can overcome near-term headwinds

UBS Insights/Chief Investment Office/6-8-2023

USAGOLD note: UBS forecasts gold will be $2100 by year-end, and $2250 by mid-2024.

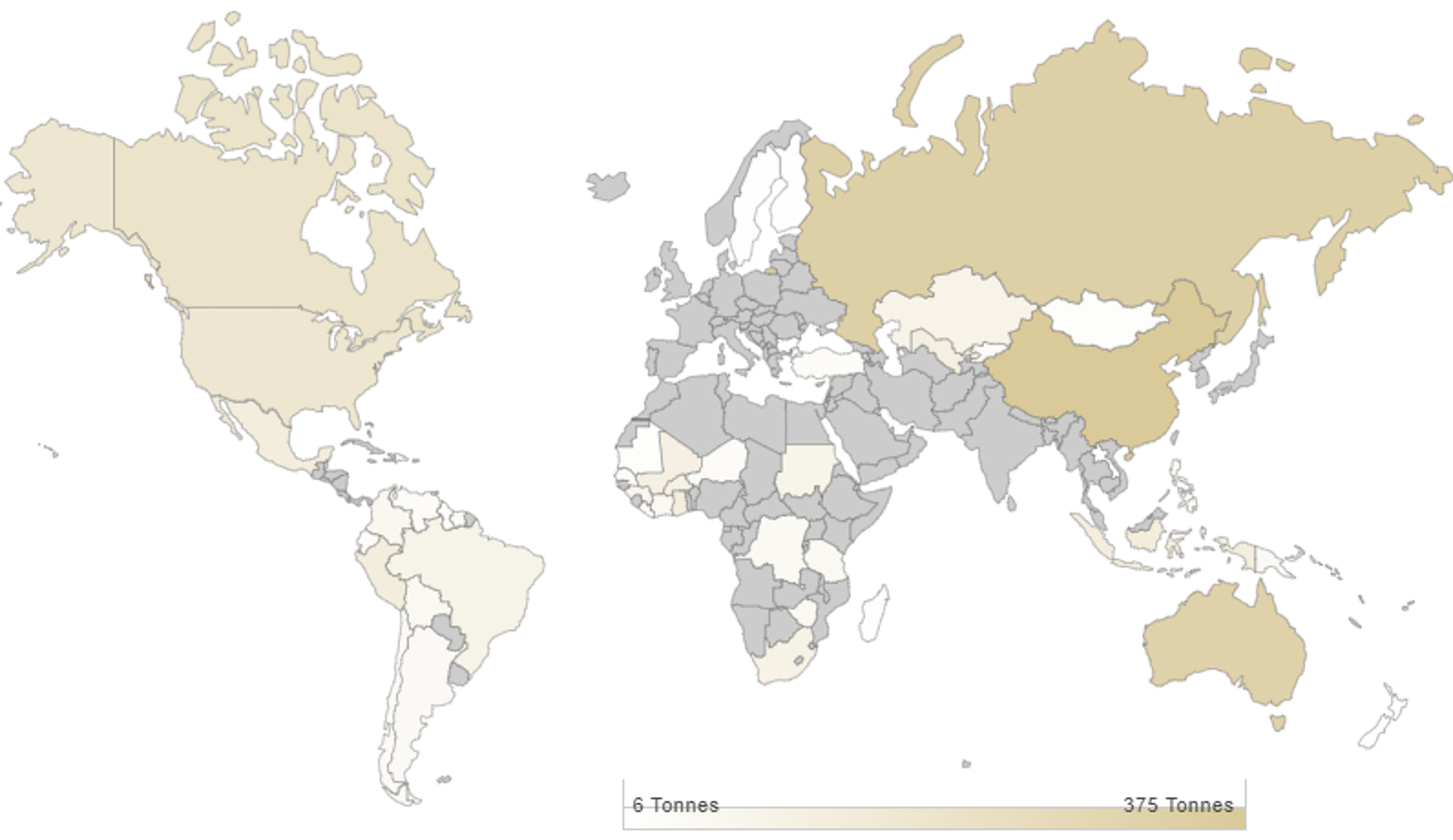

Gold production up an anemic 1% in 2022

World Gold Council/Krishan Gopaul/6-23-2023

“According to Metals Focus’ latest estimate, global gold production in 2022 was 3,628t. This is 1% higher y/y.…The latest country-level data shows no change amongst the five largest gold producing nations compared to 2021. China remains the world’s largest gold producer, followed by Russia, Australia, the United States and Ghana.”

USAGOLD note: An anemic showing on the supply side of the gold fundamentals’ equation at a time of record global demand.

Gold mine production by country (2022)

Map courtesy of World Gold Council, Data source: Metals Focus • • • Click to enlarge

China’s gold-buying boom is slowing sharply as economic woes hit retail demand

MarketsInsider/Filip De Mott/6-20-2023

USAGOLD note: Expanded only 24%? Given the Chinese people’s historic attachment to gold, most analysts will see the slowing demand at present as a lull in the dominant trend.

Gold stays gold, forever

HedgeNordic/Eugene Guzun/6-13-2023

USAGOLD note: Guzun adds that gold has returned 7.7% annually since 1971, the year the United States went off the gold standard.

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“We have a distinctive philosophy around gold. We believe gold has unique risk/reward characteristics that enable it to help preserve real value over the long term. We use gold as a potential hedge and do not speculate on its price over the next six to 12 months. We believe it is not possible to forecast the price of gold or, for that matter, the price of other investment assets. This, in fact, is why we have a potential hedge …”

Thomas Kertsos

First Eagle Investment Management

Gold Hub interview

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The surprising uses of gold throughout history

USAGOLD note: Gold is money, but through its long history it has been used in a wide variety of applications from the sacred to the practical.

Reserve Bank of India ups gold reserve 40% over past five years

EconomicTimes/Gayatri Nayak/6-8-2023

“The Reserve Bank of India’s gold reserves have risen by over 40% since it resumed the purchase of the yellow metal over five years ago. This shows gold has emerged as a strong hedge against inflation and also helped reduce dependence on the dollar to an extent. India’s central bank, unlike others, never sells its gold.”

USAGOLD note: At 795 tonnes, India has the ninth-largest gold reserve in the world. The World Gold Council reports that Indian households may hold as much as 24,000 to 25,000 tonnes of the metal.

India Gold Reserves

Source: TradingEconomics.com

China: A gold bullion investor’s best friend?

Barchart/Levi Donohue/6-2-2023

USAGOLD note: Donohue uncovers a little-known Chinese initiative through its banking system that could bring millions of new investors into the market. We consider China’s latest gold-friendly policy a very important development. “Western bullion investors,” says Donohue, “should brace for a demand shock in the market which will see premiums on gold bullion bars and coins rise and decouple from the paper gold price. China is betting the prospects of its own citizens on gold and as of yet very few people in the west have noticed.”

China’s gold binge extends to seventh month as holdings climb

Bloomberg/Sybilla Gross/6-7-2023

“China increased its gold reserves for a seventh straight month, signaling ongoing strong demand for the precious metal from the world’s central banks. China raised its gold holdings by about 16 tons in May, according to data from the People’s Bank of China…”

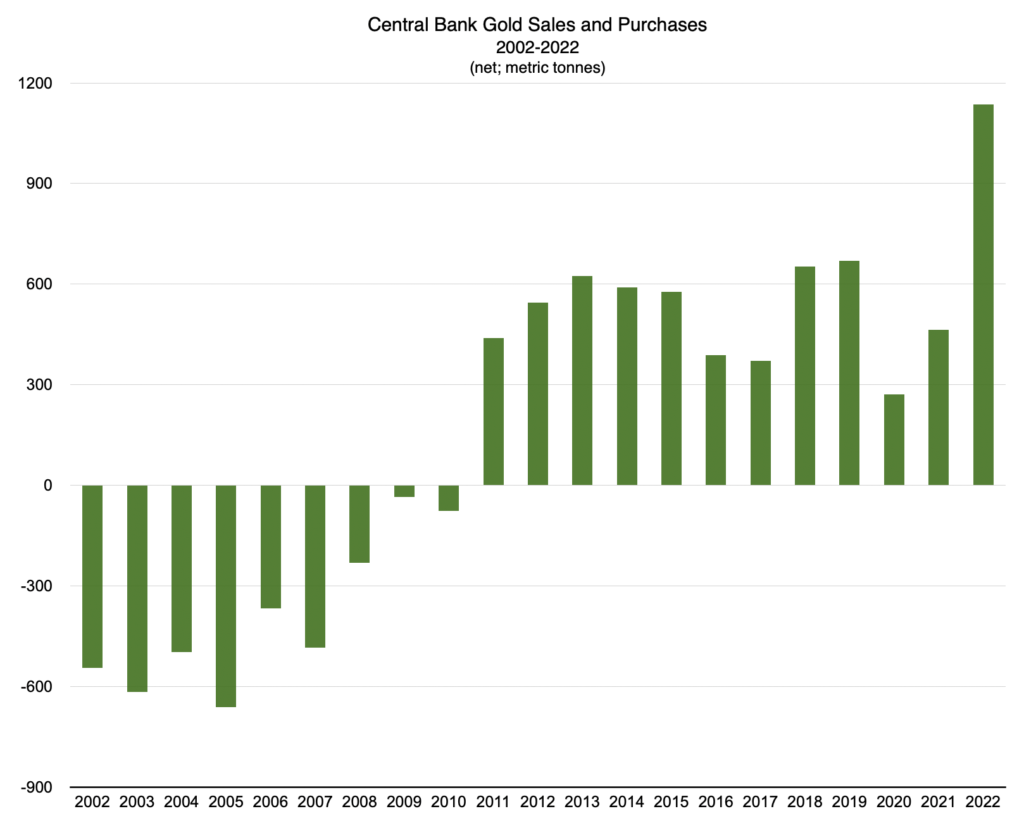

USAGOLD note: China has led the global central bank gold buying spree. Central bank gold buying was at a record pace in 2023 and it has remained strong in 2023. The chart below is quarterly and does not include China’s most recent purchases which have taken its total holdings to 2092 metric tonnes.

China Gold Reserves

Source: TradingEconomics.com

Gold to shine again

Singapore Bullion Market Association/Chen Guangzi/June 2023

USAGOLD note: A practical overview new investors will find informative. Guangzhi is head of research at KGI Securities Singapore. His analysis includes an enlightening table of gold’s performance during recessions.

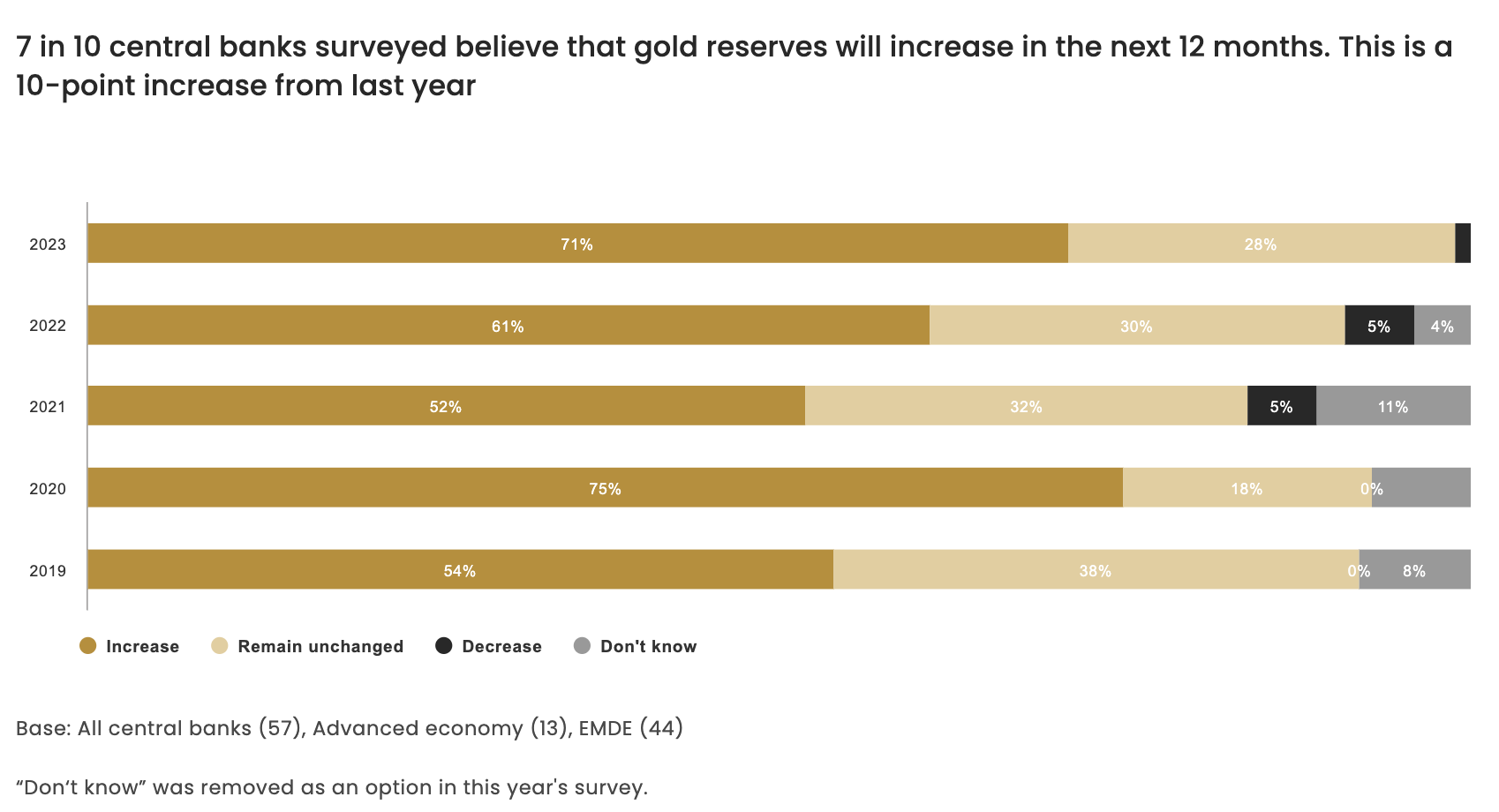

2023 central bank gold reserves survey

World Gold Council/Gold Hub/5-30-2023

“Following a historical high level of central bank gold buying, gold continues to be viewed favourably by central banks. Our 2023 survey revealed that 24% of central banks intend to increase their holding reserves in the next 12 months. Furthermore, central banks’ views towards the future role of the US dollar were more pessimistic than in previous surveys. By contrast, their views towards gold’s future role grew more optimistic, with 62% saying that gold will have a greater share of total reserves compared to 46% last year.”

USAGOLD note: Many believe that central bank purchases are the chief reason for gold’s rise over the past year to central banks purchases. That being the case, World Gold Council’s finding in the survey bode well for the future.

Fred Hickey: ‘Long term, conditions are perfect for gold to go to record high’

theMarketNZZ/Interview of Fred Hickey by Christoph Gisiger/5-26-2023

USAGOLD note: Hickey says “gold does best when stocks are going down.” He adds that stocks are being held up by “this FOMO move” in tech stocks but it will eventually end.

The new gold boom: how long can it last?

Financial Times/Harry Dempsey and Lelie Hook/5-25-2023

USAGOLD note: Financial Times takes a deep dive into what is driving gold demand at present and comes away with conclusions that might come as a surprise to many of our readers……

In Gold We Trust 2023

Incrementum/Ronald-Peter Stoferle and Mark J. Valek/May, 2023

“The full year 2022 was clearly positive for gold in all currencies, with the one exception of the US dollar. Gold in US dollars suffered from the marked appreciation of the dollar. On average, the price gain in other currencies was 7.2%. In the (former) safe-haven currency, the Japanese yen, the gold price rose by 13.7%. In euro terms, it was up 6%, for the 5th annual gain in a row, which ruthlessly reveals the glaring weakness of the European single currency. In the current year, 2023, gold is clearly in the plus in all listed currencies, on average by 8.7%.”

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Gold has your back when central bankers don’t.“

Jay Martin

Cambridge House International

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

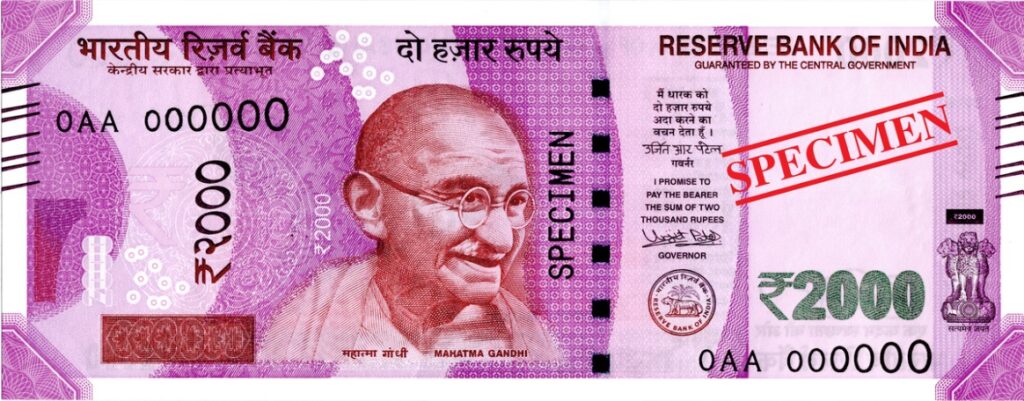

2000 rupee note withdrawal spurs purchase of gold and silver

HIndustanTimes/Staff/5-22-2023

USAGOLD note: In a separate article, Bloomberg mentioned that the 2000 rupee note withdrawal was “reminiscent of a shock demonetization exercise in 2016.”

__________________________________

Image attribution: Reserve Bank of India, GODL-India <https://data.gov.in/sites/default/files/Gazette_Notification_OGDL.pdf>, via Wikimedia Commons

Cut stocks, buy gold, hold your cash, JPMorgan’s Kolanovic says

Boomberg/Alexandra Semenova/5-23-2023

USAGOLD note: At one time, Kolanovic was considered Wall Street’s most vocal bull.

Three reasons to buy gold now

UBS/Chief Investment Office/5-18-2023

USAGOLD note: UBS sees gold at $2100 by year end and $2200 by March 2024.

Gold: Older than the solar system itself

Deutsche Goldmesse/Dominic Frisby/5-6-2023

“Gold was present in the dust which formed the solar system billions and billions of years ago and gradually that dust accreted to form the planets.”

USAGOLD note: In this video, Frisby makes an engaging presentation on the yellow metal saying “We have a primal instinct for gold.”

The gold cases resurface

The New York Sun/Editorial Staff/5-22-2023

USAGOLD note: We note with interest that President Ulysses S. Grant (photo insert) declared at the time that the US should pay its debts in gold as a matter of national honor. If that were to occur today, it would wipe out the US gold reserve of 8133 metric tonnes. The Sun delves into what the Fourteenth Amendment is really all about.

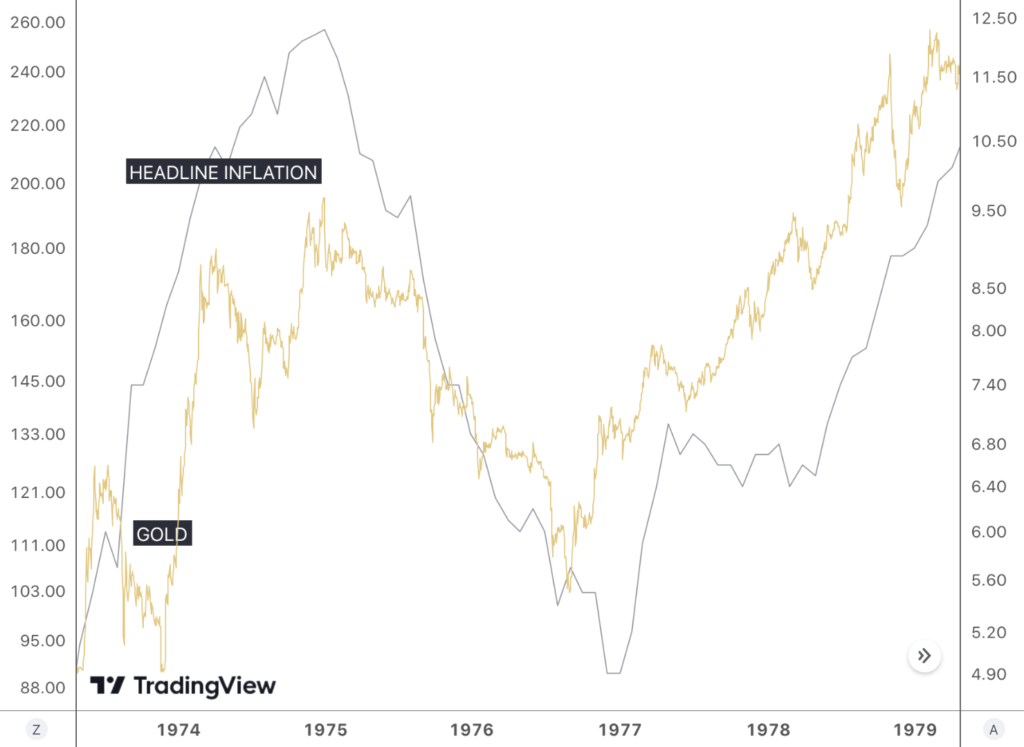

Now’s the time to get ahead of inflation’s resurgence

Zero Hedge/Simon White/5-18-2023

“[T]he current lull in inflation offers the perfect opportunity to take advantage of cheap inflation hedges before price growth starts to accelerate again.” He goes on to say that “the stage is thus set for a renewal in inflation’s upward trend. This will shake confidence that inflation is a ‘one-shot’ problem and instead is likely to be with us for some time. This is likely to prompt a root-and-branch rethink about how to invest in an environment of persistent and entrenched inflation. Inflation hedges that look cheap today thus won’t be cheap for very long.”

USAGOLD note: Simon White is a Bloomberg macro strategist. He likens the current inflation situation to the 1970s in which we had periods of decelerating inflation that were calms before the inflationary storms to come. Inflation, as we have said many times, is a process rather than an event.

Gold and headline inflation

(1970-1979, log scale)

Chart courtesy of TradingView.com • • • Click to enlarge

Why investors are going gaga for gold

Financial Times/Gillian Tett/5-19-2023

USAGOLD note: Though Tett focuses on gold’s safety in the context of the debt ceiling wrangle (which she sees as still unsettled), she also sees major changes underway in the way both private and professional investors view the metal in the context of longer term economic and financial trends.

Boom and bust: How commodity super cycles influence gold and silver prices

LBMA-The Alchemist/Tom Brady and Chantelle Schieven/May 2023

“It is interesting to note that silver and gold prices appear to have increasingly trended in similar patterns to those of the industrial metals, particularly since President Nixon eliminated the backing of the US dollar with gold in 1971. Closing the gold window thus removed a very large non-industrial buyer of gold. Under the gold standard system, government could be counted upon to purchase mine production en masse at set prices, regardless of industrial growth or decline in any particular moment. Silver, with its broadening industrial demand, has been ~75% correlated with the Industrial Metals Index.”

USAGOLD note: Brady and Schieven believe we are headed for the boom phase of a new commodity supercycle that could last 10 to 20 years. Gold and silver, they show, have tracked supercycle booms in the past [Please see chart], and, as a result, they are “very bullish” on both metals over the long run.

Gold, silver, and producer price index industrial metals

(1925 to present, log scale)

Chart courtesy of TradingView.com • • • Click to enlarge

The Deutsche Bundesbank and gold: A bond that never breaks?

The Alchemist/Wolfgang Wrzesniok-Rossbach/5-11-2023

“Over the next few years, the gold reserves literally exploded. By 1959, when the European Payments Union was replaced by the European Monetary Agreement, Germany had already received 1,584 tons of gold from its European partner countries. As a result of further inflows from the Bretton Woods system, among others, the Bundesbank’s total holdings reached 2,344 tons by the end of 1959, and the inflows continued steadily.”

USAGOLD note: Germany owns the second-largest stockpile of gold in the world at 3,355 tonnes. “T]he knowledge of the existence of this treasure,” says Wrzesniok-Rossbach, “clearly allows many Germans to sleep better in light of the many financial and economic policy imponderables in the

present day.

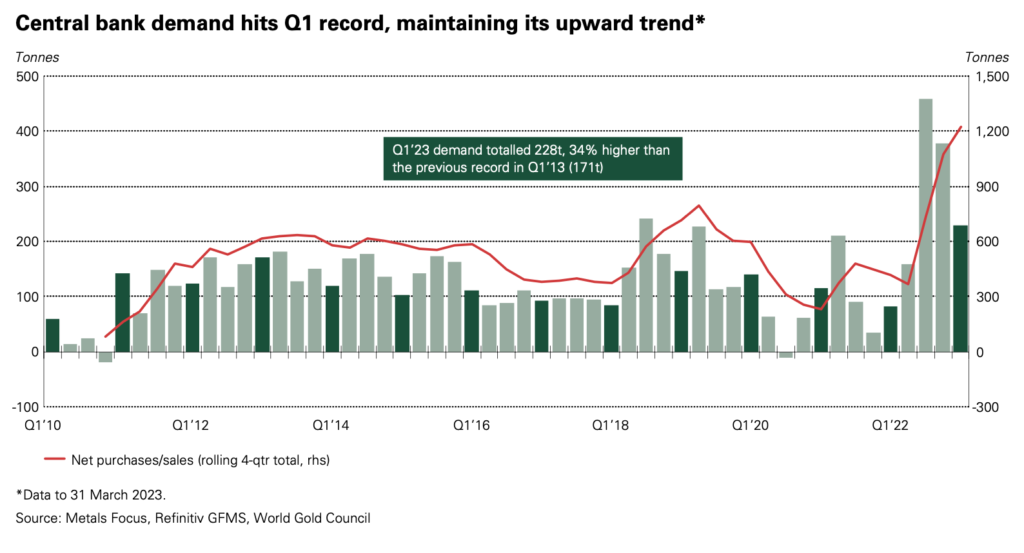

World Gold Council Demand Trends – Q1, 2023

World Gold Council/Staff/5-5-2023

“Q1 saw diverging trends in gold investment demand: a small decline in gold ETF holdings versus hearty bar and coin buying.”

USAGOLD note: There are no real surprises in the World Gold Council’s first quarter Demand Trends report just a continuation of the positive trends that have been in place since last year. That includes strong central bank and private investor demand. One standout statistic – first quarter central bank demand was 34% higher than the previous Q1 record in 2013.

Chart courtesy of World Gold Council • • • Click to enlarge

How does gold perform with inflation, stagflation, and recession?

CME Group/Jim Iuorio/4-28-2023

USAGOLD note: As it turns out, gold can perform well under all three of the scenarios, though the reaction to past inflations has been mixed…… Iurio offers a detailed review of the metal’s performance and the rationale for owning under each scenario.

Central bank gold demand hits first-quarter record, investments surge on U.S. banking turmoil

USAGOLD note: This article summarizes the World Gold Council’s Demand trends for the first quarter of 2023. Of interest, gold ETFs experienced “significant” inflows. Bar and coins demand was up 5% with the US posting its best quarter since 2010.

Gold market primer: Market size and structure

Gold Hub/World Gold Council/4-27-2023

“Gold is an attractive means of helping investors diversify their portfolios. Its relative scarcity supports its long-term investment appeal. But its market size is large enough to make it relevant for a wide variety of investors, from individuals to institutions and central banks. This Primer gives an overview of the available above-ground stock of gold, the relative size of the financial gold market, and the composition of demand and supply that supports gold’s investment credentials.”

USAGOLD note: The World Gold Council offers an informative look at gold market dynamics for beginners and a refresher course for long-time investors.

Wild cards and the case for gold

YahooFinance/Mary Anne and Pamela Aden/4-25-2023

USAGOLD note: The Aden sisters (Aden Forecast) have been a mainstay in financial circles for decades. Known for their straightforward market analysis, they now believe that a “big financial shift” is in the cards and that central banks and private investors are stockpiling gold to prepare for it.

Real demand pushes gold towards a new standard

Lombard Odier/Stephane Monier/4-24-2023

“What do the Singaporean, Turkish, and Chinese central banks have in common with jittery investors? Answer, they’ve been buying gold as a haven and diversifier from fears of a recession, a crisis of confidence in banking, and a weakening US dollar. We see this as an indication that economic factors are taking over from financial speculation as the main driver of demand for gold.”

USAGOLD note: Mornier makes an important observation about changing gold market psychology we thought worth passing along. If real, or physical, demand is going to play a greater role in the pricing of gold – if indeed we are at the cusp of a new standard in the marketplace – then we will be that much closer to the dog regaining control of the tail.

Wild fires and torrential rain in California unleash ‘a flood of gold’ – nuggets worth $2000 each

Daily Mail/Hope Sloop/4-23-2023

USAGOLD note: The barbarous relic strikes back……Gold Fever in California.

What strong gold says about the weak dollar

Financial Times/Ruchir Sharma/4-23-2023

“The prime example right now is gold, up 20 percent in six months. Surging demand is not led by the usual suspects — investors large and small, seeking a hedge against inflation and low real interest rates. Instead, the heavy buyers are central banks, which are sharply reducing their dollar holdings and seeking a safe alternative.”

USAGOLD note: Sharma explains why central banks are moving out of the dollar and into gold. “[T]he oldest and most traditional of assets, gold,” he says, “is now a vehicle of central bank revolt against the dollar.” He sees the strong central bank demand as “something new” in the gold market. The World Gold Council, we will add, reports the strongest start to a year in 2023 since “at least 2010.”

Chart by USAGOLD [All rights reserved], Data source: World Gold Council

Silver market in new era of structural deficits

The Silver Institute/World Silver Survey 2023/4-19-2023

USAGOLD note: The structural deficits are the result of solid global demand and declining mine production. Of special note, TSI reports that the current supply shortfall amounts to “more than half more than half of this year’s forecasted annual mine production, and more than half of the inventories presently held in London vaults offering custodian services.” In general, TSI paints a bullish scenario for the metal going forward.

Ruffer Investment Review offers unique perspective, practical advice

Ruffer Investment Review/Jonathan Ruffer/April 2023

USAGOLD note: Ruffer believes that investors need to keep their powder dry in order to take advantage of the next bottom in financial markets. As a result, he recommends a strong cash position even though inflation erodes its value. Though he does not mention gold in this essay (except in a historical context), his firm has recommended holding it in the past. [Please see: Gold Matters, September 2020.]

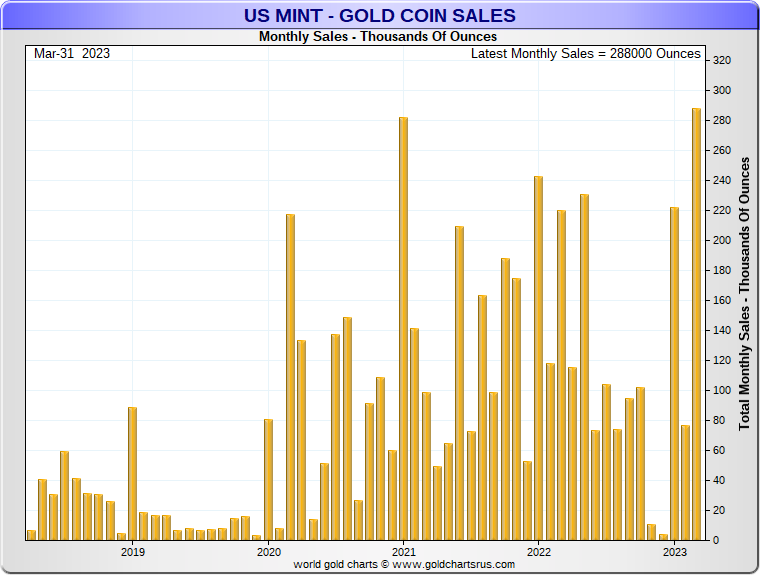

US Mint gold bullion coins see explosive sales in March

“Sales of American Eagle and Buffalo gold bullion coins from the U.S. Mint experienced an incredible rally in March, rocketing from the prior month, and far beyond last year’s sales figures from the same month.”

USAGOLD note: Demand for gold and silver bullion coins is running strong, driven by safe-haven investors looking for an alternative to bank savings. The US Mint reports a 277% gain in sales of the American Eagle gold bullion coin over last month and a 38% gain over the same month last year, according to CoinNews. Demand for the American Eagle silver bullion coin in March was at par with last month, but ultra-high premiums have channeled strong global demand to lower premium alternatives like the Canadian Maple Leaf and the Austrian Philharmonics. Combined sales of American Gold Eagle and Buffalo gold bullion coins posted their best month in five years at just over 280,000 ounces.

Chart courtesy of GoldChartsRUs

The gold bull market is just getting started

Seeking Alpha/Christopher Yates/4-13-2023

USAGOLD note: A well-constructed argument calling for a bull market in gold based on an erosion in the real rate of return……

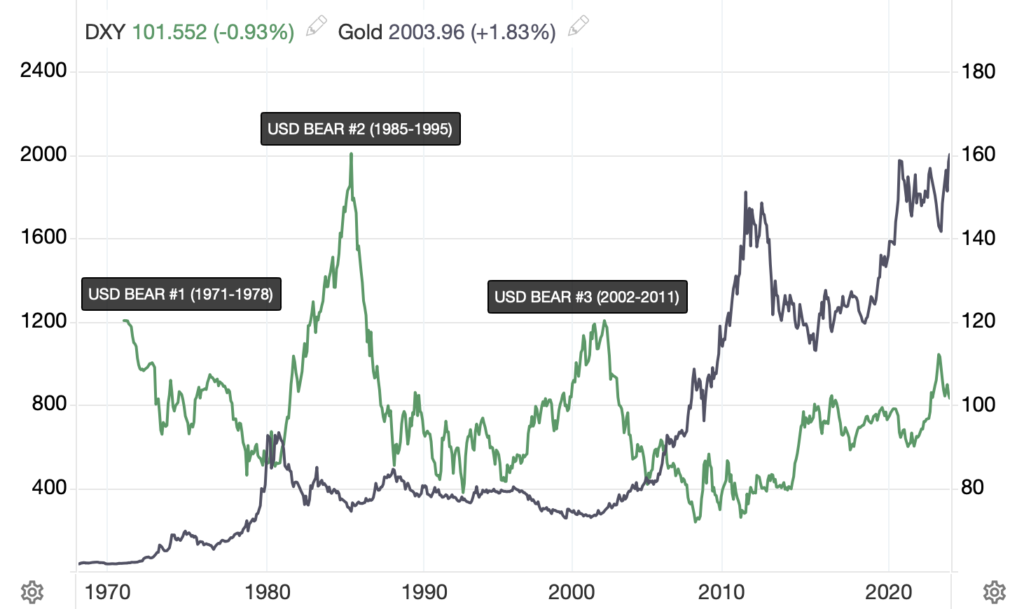

Bank of America’s Hartnett sees 20% dollar selloff, turns bullish on gold

Markets Insider/Benzinga/4-14-2023

“According to the most recent ‘The Flow Show’ from Hartnett, markets are entering a new period of conflict, geopolitical isolationism, populism, fiscal excess, state intervention, regulation and redistribution. These factors will result in a world with 3%-4% inflation and 3%-4% interest rates.”

USAGOLD note: Hartnett is highly respected on Wall Street, so this forecast will not be taken lightly……He sees the dollar entering its fourth bear market in the last 50 years. The chart below shows the relationship between the US Dollar Index (DXY) and gold. A 20% decline would take the DXY back to the 80 level, implying the potential for an upside move in the gold price.

US Dollar Index and Gold

(1970 to present)

Chart courtesy of TradingEconomics.com • • • Click to enlarge

Why bitcoin will never eclipse gold

MoneyWeek/Merryn Somerset Webb/4-11-2023

“Imagine, says [Orbis’ Alec] Cutler, that a divine ruler had written a white paper for gold, just as the inventor of bitcoin apparently did for his new currency. Humanity will, he might have thought, need ‘a convenient and reliable vehicle for the preservation of wealth and universally trusted medium of exchange, for both government-issued and peer-to- peer transactions’, one that ‘will maintain its value for all eternity.'”

Hedge-fund billionaire Paul Singer still sees dangerous ‘bubble securities, bubble asset classes’ in markets

MarketWatch/Joy Wiltermuth/4-10-2023

USAGOLD note: In the original Wall Street Journal this article summarizes, Singer reminds us that the Fed never “normalized” policy after the last crisis. That failure sent “money printing, prices and growth of debt into an “upward spiral.” “Many believe their portfolio should have some gold,” he says, “as it is the only real’ money and has occupied that status for literally thousands of years.”

_______________________

Photo attribution: World Economic Forum, CC BY-SA 2.0 <https://creativecommons.org/licenses/by-sa/2.0>, via Wikimedia Commons

Ready to move from education to action?

DISCOVER THE

USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

12:51 am Sat. April 27, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115