Gold extends new year rally

China announced adding another 30 tonnes to its reserves in December

(USAGOLD –1/9/2023) – Gold extended its new year rally this morning as investors prepped for Thursday’s inflation data release, and commodities, led by oil, turned to the upside on the prospect of economic recovery in China. It is up $9 at $1877.50. Silver is up 10¢ at $24.02. Adding to the momentum, China announced the acquisition of another 30 tonnes of the yellow metal in December – the second month in a row it added to its coffers. Credit Bubble Bulletin‘s Doug Noland sees bubbles everywhere, each in its own unique stage of inflation or deflation. The one non-bubble in his scenario is gold at a time of “acute currency market uncertainty and instability.”

“[Will 2023] be the year of precious metals?” he asks. “Precious metals were generally out of the blocks quickly to begin the new year. Metals performed relatively well last year in the face of dollar strength and rising rates. A year of currency market uncertainty, persistent inflation, and ongoing expansion of non-productive Credit would seem to support the precious metals. After a 2022 inflection point, I would expect 2023 to provide more New Cycle momentum. There will be ebbs and flows, but the cycle of hard asset outperformance versus financial assets is in its infancy.”

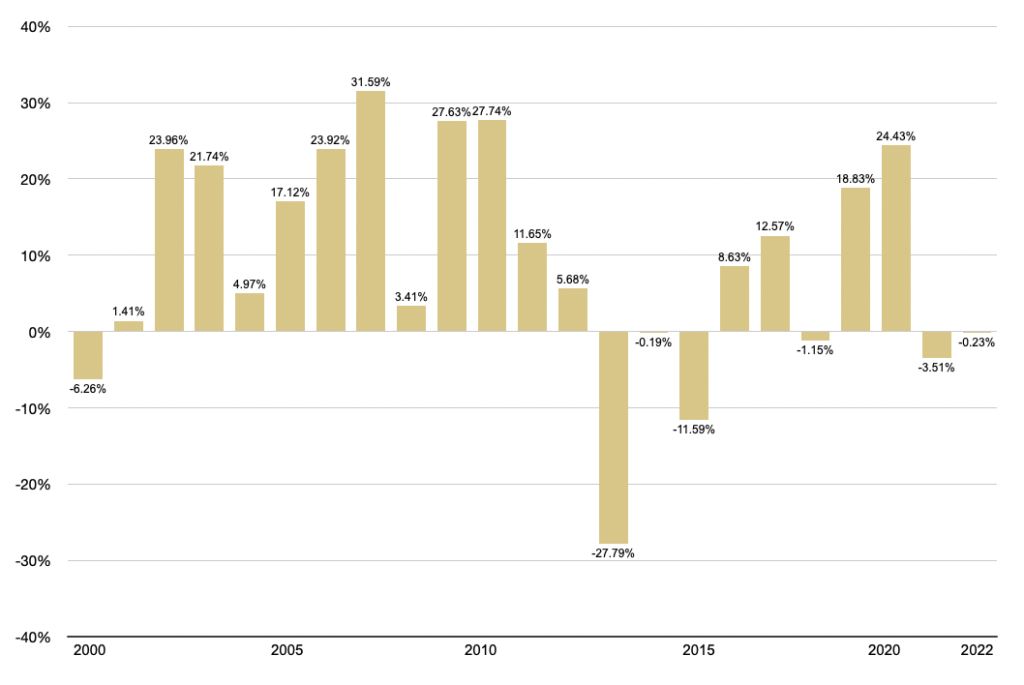

Gold annual returns

(%, 2000-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: MacroTrends.net • • • Click to enlarge