NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 47th year in the gold business

ARCHIVES

Sign-up to receive free immediate access to our current issue and future issues by e-mail.

Prospective clients are welcome!

Steady wins the race

The experts weigh in on what it will take to break gold loose

Edward Moya and Fred Hickey

The Bank of Canada surprised markets with a lower-than-expected rate increase last week. The sudden dovishness prompted Oanda’s Edward Moya to suggest that “expectations are growing for the Fed to shift to a half-point pace in December and if that seems more likely after next week, gold could have a nice breakout above the $1700 level.” (MarketWatch) Similarly, High Tech Strategist’s Fred Hickey sees gold and the US dollar at turning points based on managed money positioning in futures markets.

Where we are now

Central bank policies are ‘shifting the tectonic plates beneath the world economy’

As we move into the final quarter of the year – a time when markets have been known to go bump in the night – finding an encouraging word on the gold and silver markets isn’t easy. As September ended, gold had broken below critical chart support levels after starting the month with promising moves to the upside. Of course, the precious metals are not alone in nursing deep wounds, for the most part, at the hands of a suddenly assertive Federal Reserve. Year to date, stocks (S&P 500) are down 24%; bonds (TLT) are down 28.3%, and crypto (Bitcoin) is down 57.4%. With those markets as points of comparison, silver (down 17%) looks respectable, and gold (down 7.6%) downright admirable. Only the US dollar – up 16.7% – has kept its head above water in 2022, but that gain is measured against the rest of the world’s lowly currencies. In the real world, where consumers must meet their living expenses and investors scramble to retain value, the US dollar has lost 8% of its purchasing power over the past two years.

A market edict delivered from Mount Sinai, or a repeat of the 1970s?

MarshMcClennan urges wealth managers, private banks, and family offices to think gold

In a recent interview with Financial Times, Henry Kaufman, the original “Dr. Doom” who spent most of his career as an economist at Salomon Brothers, expressed his fears that the current Fed under Jerome Powell is failing to combat inflation as Paul Volcker did in the 1980s. “I am still waiting for him to act boldly,” says Kaufman. “Today, the inflation rate is higher than interest rates. Back then, interest rates were higher than inflation rates. It’s quite a juxtaposition. We have a long way to go. Inflation has to come down or interest rates will go higher.” However, this kind of old-world thinking is not what moves Wall Street or other financial centers around the world. The new-world thinking is attached firmly to the notion of a pivot, but what if the Fed never really pivots? Or never really tightens? What if it simply continues to raise rates but never achieves full lift-off?

Dare to be different

Choose assets that ‘others haven’t flocked to and caused to be fully valued’

OakTree Capital’s Howard Marks is renowned for searching out bargains in investment markets. He’s made a career of it – one that has made him a billionaire whose opinions are frequently sought by financial media. He offered the following advice in a recent issue of his monthly newsletter: “If you seek superior investment results, you have to invest in things that others haven’t flocked to and caused to be fully valued. In other words, you have to do something different.… If everyone else is focusing on something that doesn’t matter and ignoring the thing that does, investors can profitably diverge from the pack by blocking out short-term concerns and maintaining a laser focus on long-term capital deployment.”

A general tendency towards more inflation

‘Ultimately, the power to create money is the power to destroy.’

(Photo by James K. W. Atherton/The Washington Post via Getty Images)

“They should have known inflation was broadening and becoming more entrenched,” LPL’s Quincy Krosby recently told CNBC. “Why haven’t you seen this coming? This shouldn’t have been a shock. That, I think, is a concern. I don’t know if it’s as stark a concern as ‘the emperor has no clothes.’ But it’s the man in the street vs. the PhDs.” What we find odd about all the complaints against the Fed and its tardiness in dealing with inflation (because an election happens to be around the corner) is that they ignore what might have happened had the Fed acted earlier. The same concerns about recession and unemployment would simply have surfaced then instead of now. If Washington is worried about inflation, wait for the public reaction when unemployment and bankruptcies begin to rise.

The avalanche of history

‘It’s a very, very difficult place for us to be in.’

Gold has held up well in response to what Ferguson calls the avalanche of history, while other assets covered in his lengthy analysis – most notably stocks, bonds, and bitcoin – have declined sharply. Commodities have been the star performer by far, and under such circumstances, we might have expected more from gold. Then again, it’s early in the game. Ferguson identifies the 1970s as the closest comparison to the present period but says “the analogy is far from perfect.” Like the 1970s, though, we should not “expect a rapid return to stability, whether in macroeconomic or geopolitical terms,” he says.

The Great Financial Shock of 2022

Today’s headlines serve as a constant reminder of why we own gold

Inflation, it has been said, comes as a thief in the night, and that it has. The famed British economist John Maynard Keynes warned of the dangers impressed upon an economy by inflation in his 1919 classic, The Economic Consequences of Peace. “Lenin was certainly right,” he wrote. “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” Now we are suddenly faced with what could very well go down in history as the great financial shock of 2022 – an inflation rate approaching double digits in just a few short months and a steady stream of headlines that serve as a constant reminder of why we own gold.

‘The world is being tested to the extreme.’

Protecting and building wealth in a new financial era

Interest Rate Observer’s James Grant referred to the current period as a “wild time in money.” Credit Suisse’s Zoltan Pozcar warned that “this crisis is not like anything we have seen since President Nixon took the US dollar off gold in 1971.” Mohamed El-Erian likened the Fed’s current monetary policy to that of a developing country central bank. “The Russian invasion of Ukraine and the corresponding Western sanctions and seizure of Russian FX reserves,” said long-time market analyst Lawrence Lepard, “are nothing short of a monetary earthquake.”

– MARCH 2022 –

Waiting for the Fed

“The biggest buyers in bond markets are poised to become sellers,” writes Tommy Stubbington and Kate Duguid in a recent Financial Times article, “as central banks that have bought trillions of dollars of debt since the 2008 financial crisis start trimming their vast portfolios.” If the Fed follows through with its quantitative tightening program, it will overturn a monetary policy regime in place for thirteen years. One London trader quoted in that FT article says the bond market is now trading in “cloud cuckoo land” – that investors have not in any way priced the impact of quantitative tightening. So what will be the outcome when QT-Day actually arrives?

– FEBRUARY 2022 –

Hedging the decline and fall of a currency

The baseline case for gold hasn’t changed much in 1700 years

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius – an inflationary episode Jack Whyte, a writer of historical fiction, skillfully addresses in his latest novel, The Burning Stone.

– JANUARY 2022 –

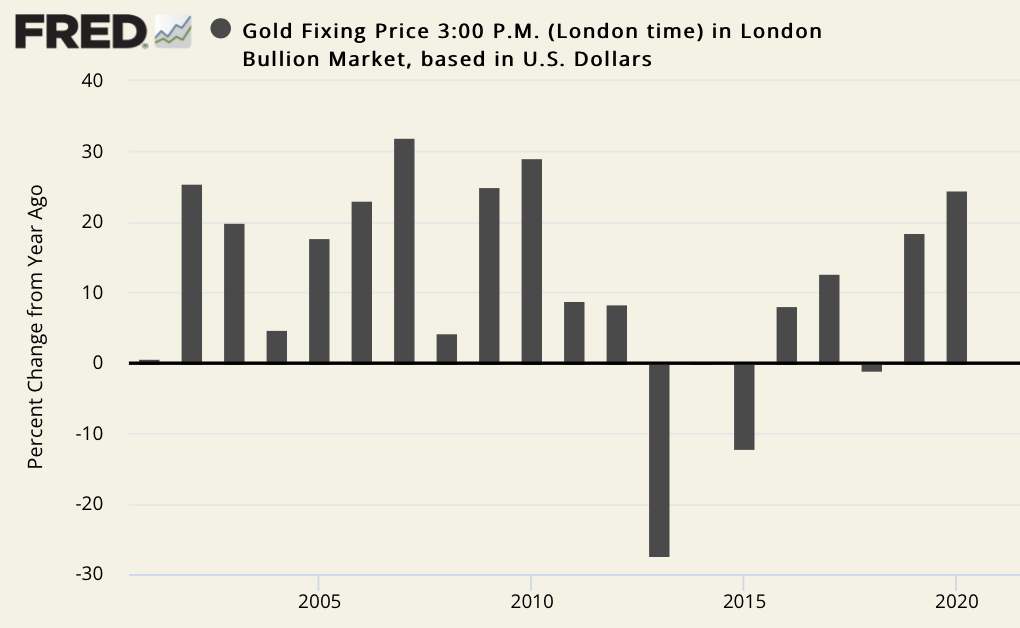

‘Complete paradigm shift will make gold the generational trade’

Billionaire investor says it will reach $3000 to $5000 as secular bull market resumes

Wall Street billionaire and financier Thomas Kaplan (who once said, “I’m no insect; gold is a great way to make a lot of money.”) is among the group of analysts who believes gold is in the early stages of a new up leg in its long-term secular bull market. Though Kaplan made his fortune in the mining business, he is also an Oxford-trained historian (with a Ph.D.) capable of putting gold’s current price trend in the context of a longer-term cycle – one he believes has not yet reached full maturity. (Please see chart below.)

– DECEMBER 2021 –

The Masters of the Universe and Gold

‘A bond issued by God’

That small group of investment bankers – those Tom Wolfe dubbed the Masters of the Universe – made its fortune trading U.S. Treasuries. It still plays the same role today it always has but no longer occupies the center stage for Wall Street’s bond market. Instead, that role now belongs to the Federal Reserve. Since the introduction of quantitative easing in 2008, it has built a $5.57 trillion stockpile of U.S. Treasuries – a holding equal to almost 20% of the nearly $29 trillion national debt. Even more troubling, it purchased a mind-boggling 60% t0 80% of the federal debt issued since 2010, according to a recent Wall Street Journal report.

– NOVEMBER 2021 –

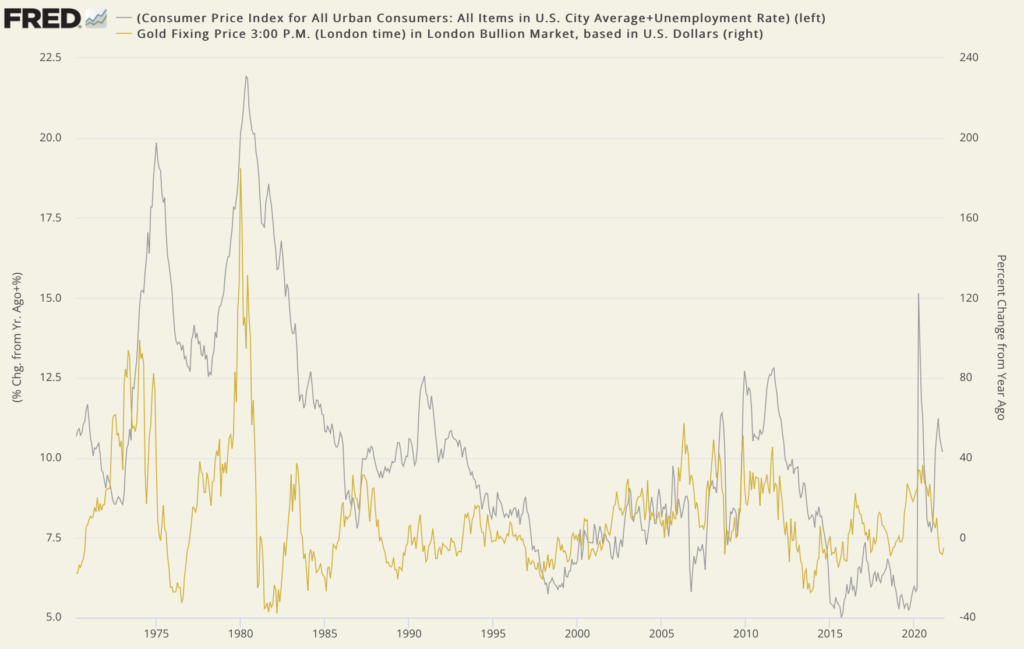

Gold and the Misery Index

Stagflation could force ‘a macro rotation into the precious sector’

Since the launch of the fiat money era in the early 1970s, when economies have gone very wrong, the unemployment and inflation rates have skyrocketed. On the campaign trail in the late 1970s, then-presidential candidate Ronald Reagan added the two numbers together and famously named the result the Misery Index. Subsequently, the Misery Index became the bellwether for stagflation – the combination of economic stagnation and runaway inflation.

– OCTOBER 2021 –

Gold’s Century

While stocks dominated headlines, gold quietly performed

– SEPTEMBER 2021 –

Facing down our investment fears

Courage comes from a strategy you can genuinely believe in

“As markets shake off their summer slumbers,” writes London-based analyst Bill Blain, “what should we be worrying about? Lots..! From real vs transitory inflation arguments, the long-term economic consequences of Covid, the future for Central Banking unable to unravel its Gordian knot of monetary experimentation, and the prospects for rising political instability in the US and Europe.”

– AUGUST 2021 –

The key to financial wisdom

To fully understand markets, understand gold. It is the key to financial wisdom. By learning of its role as a financial asset, one will discover universal truths about the value of money, and hence, the underlying value of all assets. It does not do much good, for example, to make a small fortune in the stock market, only to see it dwindle (or disappear overnight) in an inflationary storm or an implosion in financial markets.

– JULY 2021 –

Gold in the age of inflation

The star investment of the fifty-year era and the most reliable store of value

There has been considerable, and some would say tedious, discussion on the subject of inflation over the past several weeks. The Fed wants it. The markets await it. Investors and consumers worry about it. If it does come, the Fed thinks it will be transitory. Others believe it will persist.

– JUNE 2021 –

Inflation’s surprise spring offensive

Will the 2020s be a rerun of the 1970s?

Yale economist Stephen Roach sees Jerome Powell’s Federal Reserve as following along the same path it took during the stagflationary 1970s. “Memories can be tricky,” writes Roach in his essay posted recently at Project Syndicate, “I have long been haunted by the inflation of the 1970s. Fifty years ago, when I had just started my career as a professional economist at the Federal Reserve, I was witness to the birth of the Great Inflation as a Fed insider. That left me with the recurring nightmares of a financial post-traumatic stress disorder. The bad dreams are back. They center on the Fed’s legendary chairman at the time, Arthur F. Burns.” In particular, Roach reminds us that Burns “poured fuel on the [inflation] fire” by allowing real rates to go negative – a policy option the current Fed openly favors.

– MAY 2021 –

Super-rich doomsday preppers ahead of the times

And the not-so-super-rich are now following in their footsteps

We have always taken exception to the mainstream media’s portrayal of the ordinary gold owner as “the woodsman in the tinfoil hat”. . . etc. Many among the media are utterly amazed to learn that people like Steve Huffman (Reddit, CEO), Peter Thiel (PayPal founder), and the long roster of other luminaries mentioned in this New Yorker article are identified as “preppers” in one capacity or another. They would probably be even more amazed to learn that many of this same group are likely to be gold and silver owners. We say “likely” because precious metals owners by and large are a group reluctant to advertise their ownership.

– APRIL 2021 –

Joe Biden and the new era of big government

Bridgewater’s Dalio says stay clear of bonds, buy ‘stuff’

For many, the above headline accompanying a recent Financial Times “Big Read” will be welcome news. For others, it will serve as a warning. FT says the Biden administration’s economic program “echoes” Franklin Delano Roosevelt’s New Deal and Lyndon Johnson’s Great Society. “The passage of the [stimulus] bill in a deeply divided Congress…,” explains FT, “has a much broader significance. It cements a leftward shift in US politics and economics that has gained traction during the coronavirus crisis, affording government a far bigger role in solving problems in society than it has enjoyed in recent decades.” Part and parcel of that shift is a severe leftward tilt in Washington’s economic policy that poses a direct threat to the dollar’s longer-term value and stability in the bond market.

– MARCH 2021 –

Will the Ides of March bring a market panic?

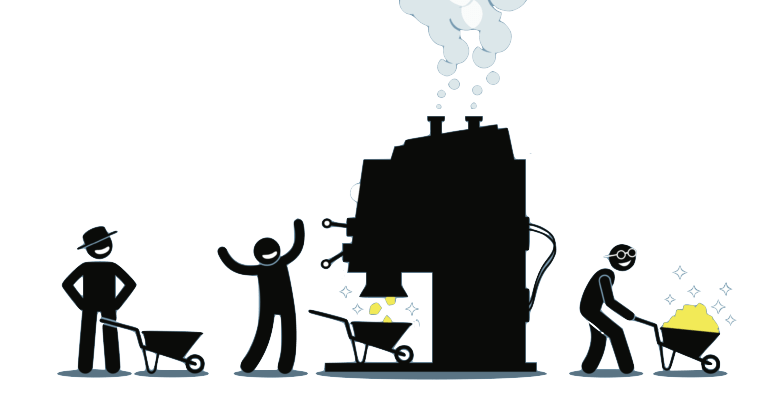

‘Owning the wheelbarrow might be better than the worthless cash it’s carrying’

One week before the recent bond market meltdown, Financial Times columnist John Dizard warned his readers to beware the Ides of March – that “some sort of panic in the US Treasury and mortgage-backed securities market” might develop. The high level of government borrowing in progress and about to be augmented by the $1.9 trillion stimulus program could be enough to send rates and money printing careening higher. “If my guess is right,” said Dizard, “we have the makings of another event like we saw a year ago.” That “liquidity” problem, as Fed chairman Jerome Powell described it at the time, was later labeled what it really was – a crisis that nearly collapsed the financial system.

– FEBRUARY 2021 –

Investor gold demand running at red hot levels

So why isn’t the price running through the roof?

Though gold has struggled to regain the momentum so far in 2021, silver and platinum are off to solid starts. Silver was up almost 2% in January, and platinum, almost 4%. Gold, though, was down just over 1%. Demand for gold and silver coins for delivery is running red hot exacerbated by tightening supplies and delayed releases of new coinage from sovereign mints. As a result, premiums – the amount investors pay over a coin’s melt value – have begun to move higher.

Stock market frenzy

Ride the bandwagon but be sure to take along some gold coins

When billionaire Sam Zell warned at the end of December that the dollar’s status as the world’s principal reserve currency was in jeopardy, it nudged something in the back of the mind about the number of billionaires over the past year who issued similar warnings. The wealthiest among us, it seems, are also the most vocal and proactive about the dangers they see dead ahead.

– DECEMBER 2020 –

The once and future Fourth Turning

Neil Howe predicted the financial crisis and pandemic.

What does he see coming next?

It has become our custom to annually post an update of Neil Howe’s thinking in advance of the new year. Howe, as many of you already know, is the co-author (along with William Strauss, now deceased) of The Fourth Turning – the prescient analysis of long-term, generational cycles that first hit the bookstores in 1997.

– NOVEMBER 2020 –

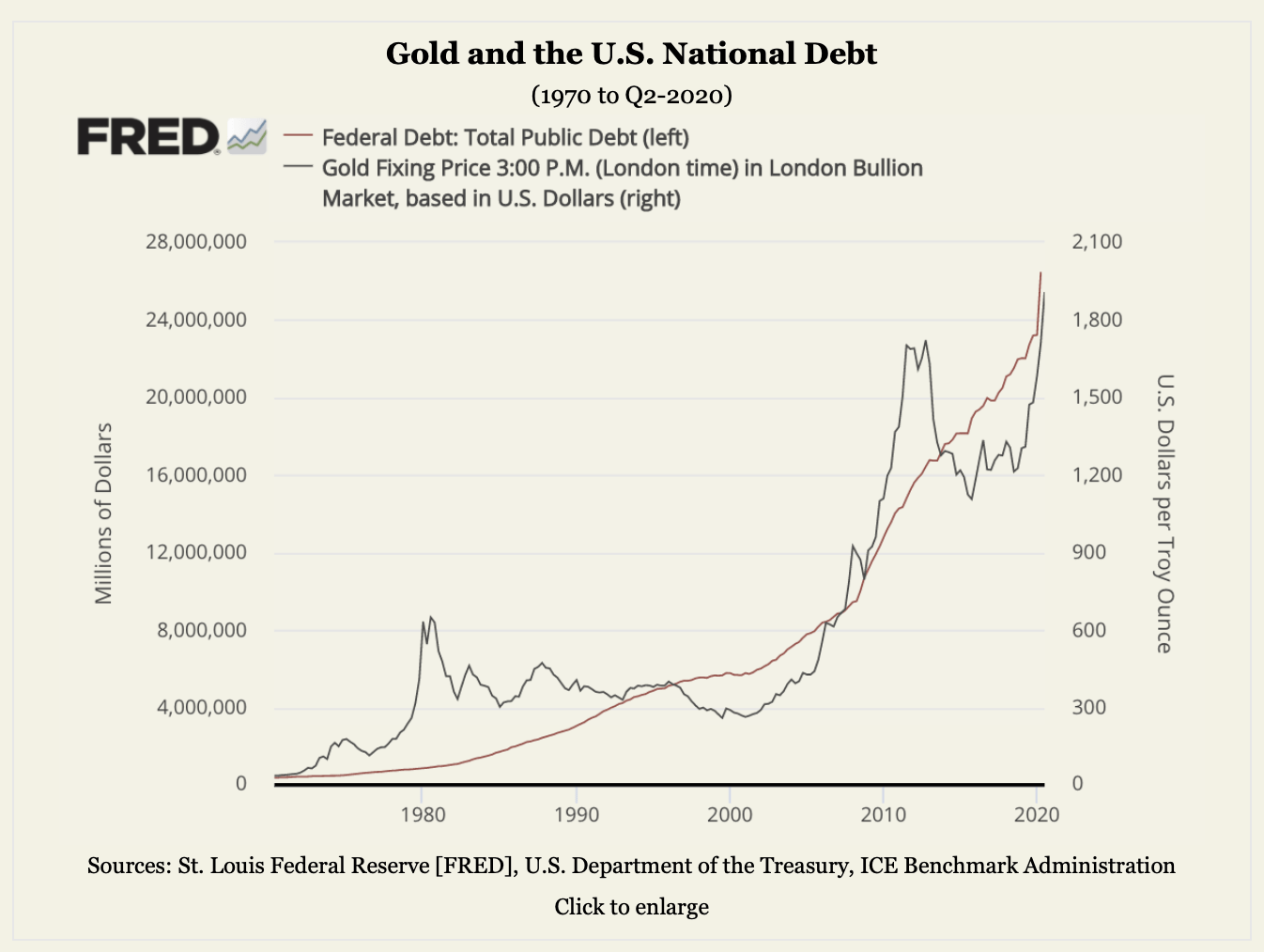

Stimulus, Debt and Gold

‘Stay in the stock market but build hedges’

Few at the corner of Wall Street and Main would quarrel with the extraordinary steps the central bank and federal government have taken given the current circumstances. At the same time, any new rescue effort will pile trillions of debt on the trillions already committed to combating the ill-effects of the coronavirus. As the World Bank’s Carmen Reinhart, best known for her study with Kenneth Rogoff on financial crises, put it: “While the disease is raging, what else are you going to do? First, you worry about fighting the war, then you figure out a way to pay for it.” A good many have taken precautions to counter the possibility of financial collateral damage from that war. …… (MORE)

– OCTOBER 2020 –

‘A complete paradigm shift will make gold the generational trade’

As we turn the calendar to October, often a daunting month for financial markets, the same toxic mix that has bedeviled the global economy for most of 2020 remains in full force – the pandemic, the crippled economy, the money printing, and the disheveled politics. For its part, gold held up under the pressure of a September consolidation that threatened at one point to become a full correction, but the selling dissipated, cautious buying re-entered the market and the price went back over the $1900 mark. …… (MORE)

– SEPTEMBER 2020 –

The law of long-term time preference and gold ownership

“Those who plan, invest and execute long-term win,’ says long-time market analyst R.E. McMaster in A Layman’s Guide to Golden Guidelines for Wise Money Management. “Win-win decisions, looking to the long term with short-term work and sacrifice, are historically the tickets to success in all areas of life – short-term sacrifice for long-term benefits, deferred gratification rather than instant gratification. This is the difference between wealth and poverty, between class and trash. Those who make primarily fear-based, ego-based, selfish, win-lose, lose-lose, emotional and/or short-term decisions as their primary mode of operation in life nearly always end up miserable, often as losers in a comprehensive sense in life. Such people are walking tornadoes to be avoided.” [The Law of Long-Term Time Preference] …… [MORE]

– AUGUST 2020 –

Gold’s relativity

Do not take your eye off the prize

Gold’s value is relative. It doesn’t really matter how many digits it takes to express the price. Its true value lies in what those digits represent in terms of purchasing power. During the post-World War I hyperinflation in Germany, for example, a 20-mark gold coin in 1918 purchased the equivalent of twenty marks worth of goods and services in the marketplace. By 1924 that same 20-mark gold coin (weighing roughly one-quarter troy ounces) provided the purchasing power of nearly 25 billion paper marks. By pointing out this example of gold’s constancy, we do not intend to imply that the United States is headed the way of the Weimar republic. What we do mean to say, though, is that those who track the nominal value of gold by itself without taking into account the current and future value of the currency in which it is measured take their eye off the prize …… [MORE]

– JULY 2020 –

“Mphm!”

Gold ownership as a lifestyle decision

These days opening the morning newspaper or switching on the evening news can be akin to an assault on mind and senses, as the media compete daily to see who will do the best job of ‘shocking and awing’ us. The sensual bombardment has risen to a new level upon the 2020’s visitation of the pandemic – as we all know. Quite often, we let that assault get the better of us – the blood pressure rises and the mood sours. Sandy McHoots, as Wodehouse describes him in the short profile quoted above, harbored a healthy, well-cultivated disdain for that sort of thing. My guess is that McHoots was not just the greatest living exponent of golf, he was also a gold owner. How could it be otherwise? …… [MORE]

– JUNE 2020 –

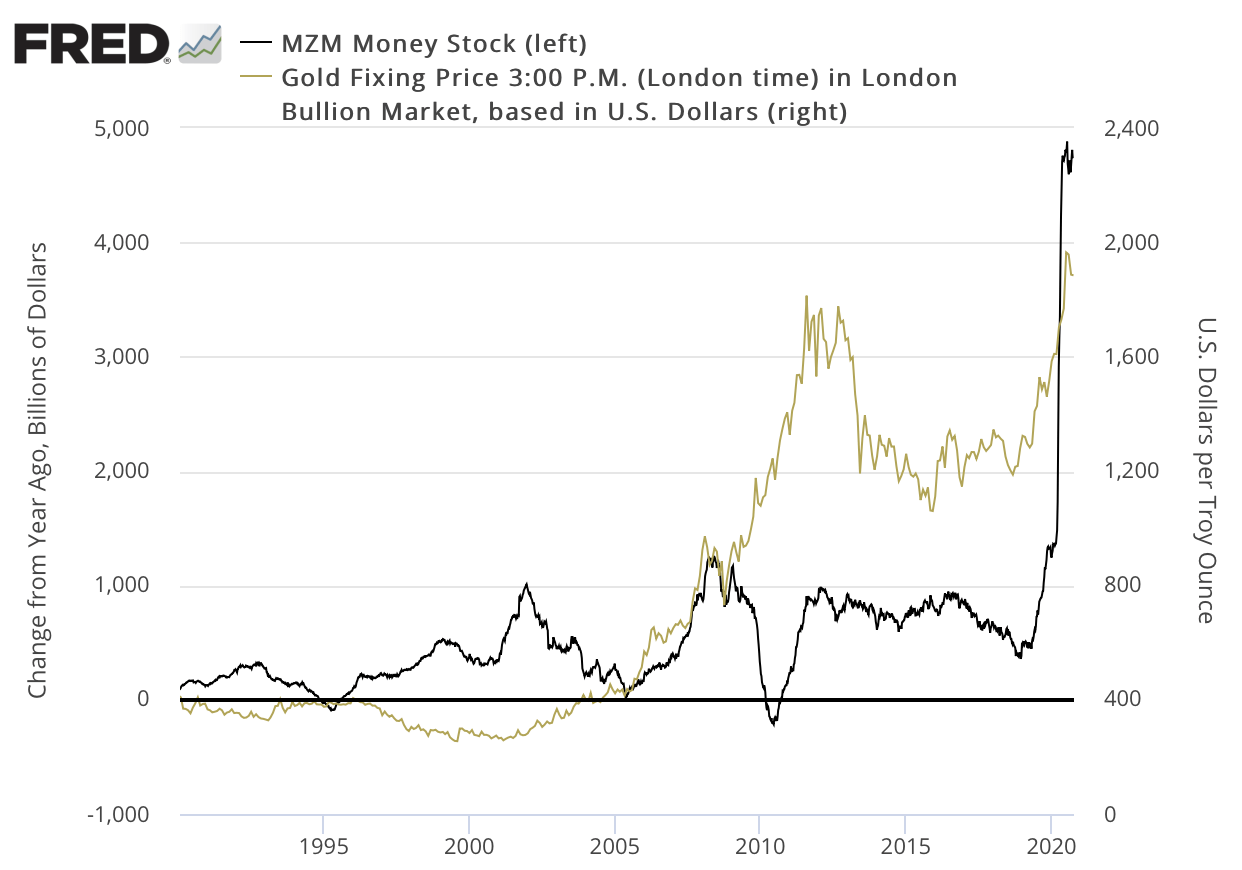

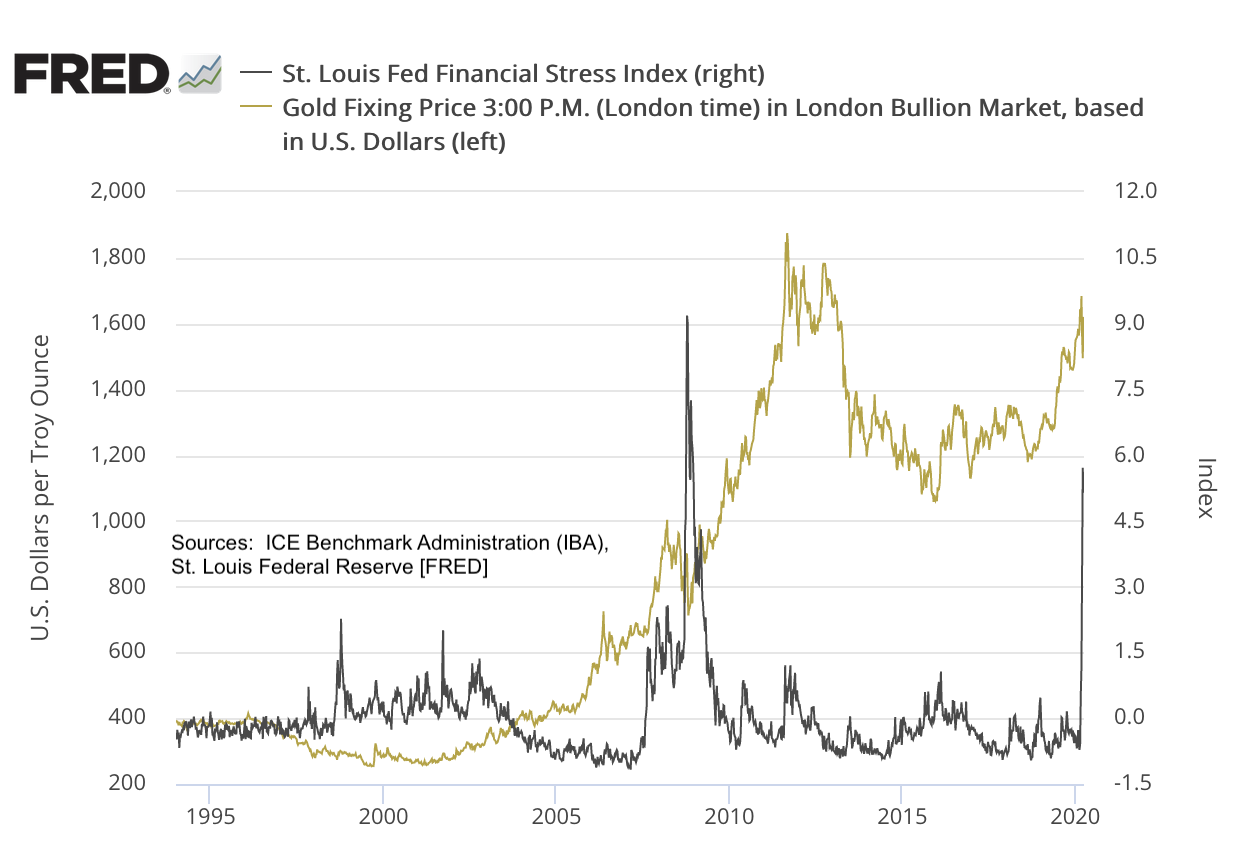

‘A mirror image of the early 1980s’

Source: Federal Reserve Bank of St. Louis, ICE Benchmark Administration (IBA)

Evidence is beginning to mount that the new paradigm Lightman Investment Management’s Rob Burnett describes – moving from disinflation to inflation – might not be too far off the mark. During the financial crisis that began in 2008, the Fed sterilized its money creation by routing money back to its coffers in the form of commercial bank excess reserves – a strategy that kept the inflation rate from running out of control …… [MORE]

– MAY 2020 –

Gold in the year of the pandemic

Cartoon courtesy of MichaelPRamirez.com

What it cannot do is cure the virus. What it could do, however, according to a good many analysts, is act as an effective hedge against its economic consequences. Since the beginning of the year through April, the metal was up 11.73% during probably the worst period in economic history since the 1930s Great Depression. Below we chronicle what top experts have to say about gold in the year of the pandemic – its portfolio role, its qualities as a disaster hedge, and its price potential …… [MORE]

– APRIL 2020 –

The crisis ready investment portfolio

In a recent essay published at Project Syndicate, Harvard economics professor Kenneth Rogoff sets an ominous tone. Humanity, he says “is facing something akin to alien invasion” – an apt analogy, we thought. “With each passing day,” he goes on, “the 2008 global financial crisis increasingly looks like a mere dry run for today’s economic catastrophe. The short-term collapse in global output now underway already seems likely to rival or exceed that of any recession in the last 150 years.” …… [MORE]

– MARCH 2020 –

SPECIAL REPORT

Hedging the decline and fall of a currency

The baseline case for gold hasn’t changed much in 1700 years

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius – an inflationary episode Jack Whyte, a writer of historical fiction, skillfully addresses in his latest novel, The Burning Stone. Set in Great Britain in the fourth century AD during the Roman occupation, The Burning Stone is a prequel to Whyte’s engaging, seven-book series on King Arthur – The Camulod Chronicles. Throughout the series, Whyte juxtaposes the rise of Arthur’s Camelot against Rome’s decline …… [MORE]

– FEBRUARY 2020 –

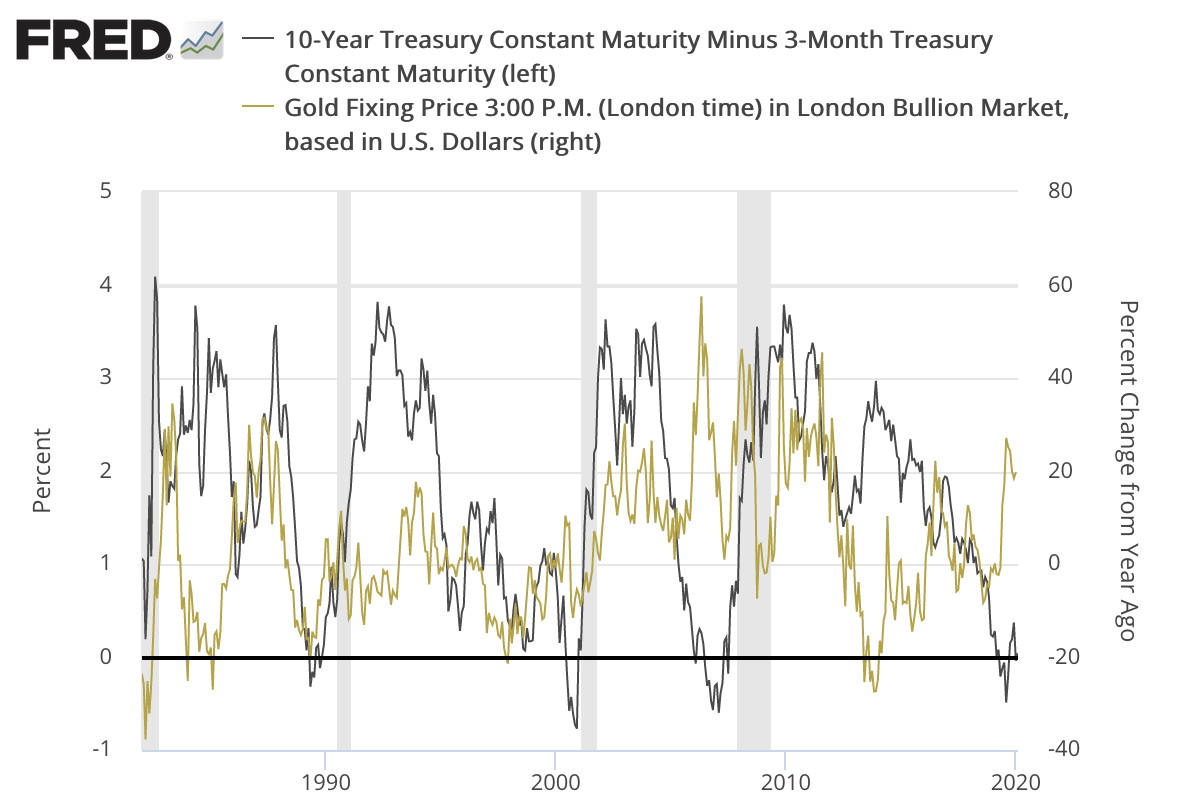

Yield inversions as a harbinger of recessions and higher gold prices

Source: St. Louis Federal Reserve [FRED]

During the course of the past several months, we have heard much about the inverted yield curve in three-month and ten-year Treasuries as a harbinger of recessions. Missed in the press reports is the fact that it has also been a harbinger of higher gold prices. In the chart above, please note the upward surges in the price of gold following the three most recent yield inversions in 1989, 2000 and 2006. Those price rallies, it is now well understood, came in response to aggressive central bank stimulus intended to beat back the ill effects of the recessions that followed in 1990, 2001 and 2008 …… [MORE]

– JANUARY 2020 –

Santa Claus rally in gold and silver crowns a very good year

It was a very good year for precious metals. Gold posted a nearly 19% gain and silver rose over 17%. As you can see in the chart below, the move higher began in early summer defying the annual summer doldrums, hit an impasse during autumn, then ended the year with a surprise Santa Claus rally that took it over the $1520 mark. Silver pushed briefly over the $18 mark in late December then settled at $17.78. Bloomberg Intelligence’s Mike McGlone offers a hopeful tone for our favorite precious metal as 2020 begins …… [MORE]

2019 ARCHIVES:

What we said then. What we say now. (December 2019)

2020 Vision – Five charts to contemplate as we prepare for the new year (November 2019)

What makes this gold market rally different from all others (October 2019)

Bank of England’s Carney delivers dollar shocker at Jackson Hole meeting (September 2019)

Gold responds to the trade and currency war (August 2019)

Summer doldrums turned upside down (July 2019)

Gold breaks to the upside (June 2019)

The Exter Inverted Pyramid of Global Liquidity (May 2019)

The inverted yield curve as a harbinger of higher gold prices (April 2019)

Gold in the age of high-speed electronic trading (March 2019)

Will 2019 be the year of the big breakout for gold? (February 2019)

Sign-up to receive immediate access to our current issue and future issues by e-mail.

Prospective clients are welcome!