Gold garners marginal support at $1900

Sprott’s Brady expects Fed to pull another 180 on quantitative tightening

(USAGOLD – 4/26-2022) – Gold garnered marginal support at the $1900 level this morning as markets continued to worry about the lockdowns in China, a more aggressive Fed, and a possible stagflationary recession. It is up $6 at $1906.50. Silver is up 13¢ at $23.75. Sprott Money’s David Brady sees gold’s current difficulties as a temporary blip in a Fed-inspired longer-term uptrend.

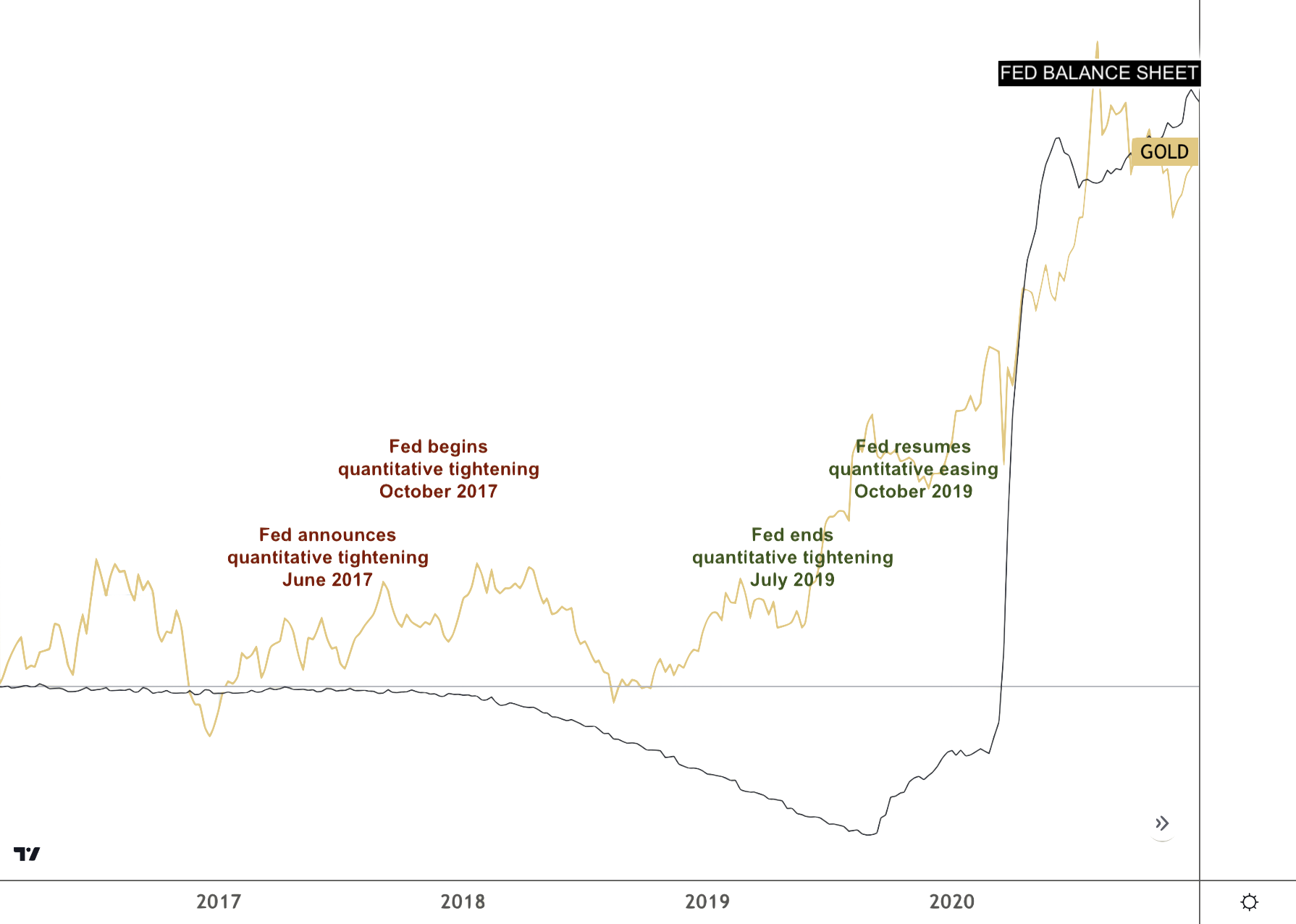

“Note that various markets are tagging levels last seen in March 2020, December 2018, and 2007-08,” he says in a Seeking Alpha article posted before yesterday’s descent to the $1900 level. “What happened next in each of those circumstances? The Fed turned on the printing presses. I fully expect them to do so again. It’s just a question of when. My best guess is around the September to October timeframe, typically the worst time for stocks. The alternative is the collapse of everything. When the Fed pulls its next 180, watch real yields plummet and gold, silver, and the miners go parabolic, IMHO. In the meantime, we could suffer more downside. 1900 is the key support level in gold that needs to hold in order to avoid a deeper dive. Whether it holds 1900 and we go straight up or we get a bigger drop and then head higher, the ultimate destination is the same, just as it was post-March 2020, December 2018, and 2007-08.”

Gold and the Fed Balance Sheet

(2016-2021)

Chart courtesy of TradingView.com • • • Click to enlarge