Gold trades sideways ahead of next week’s Fed decision

Bill Blain: Buy gold now to finance future bottom-fishing in other markets

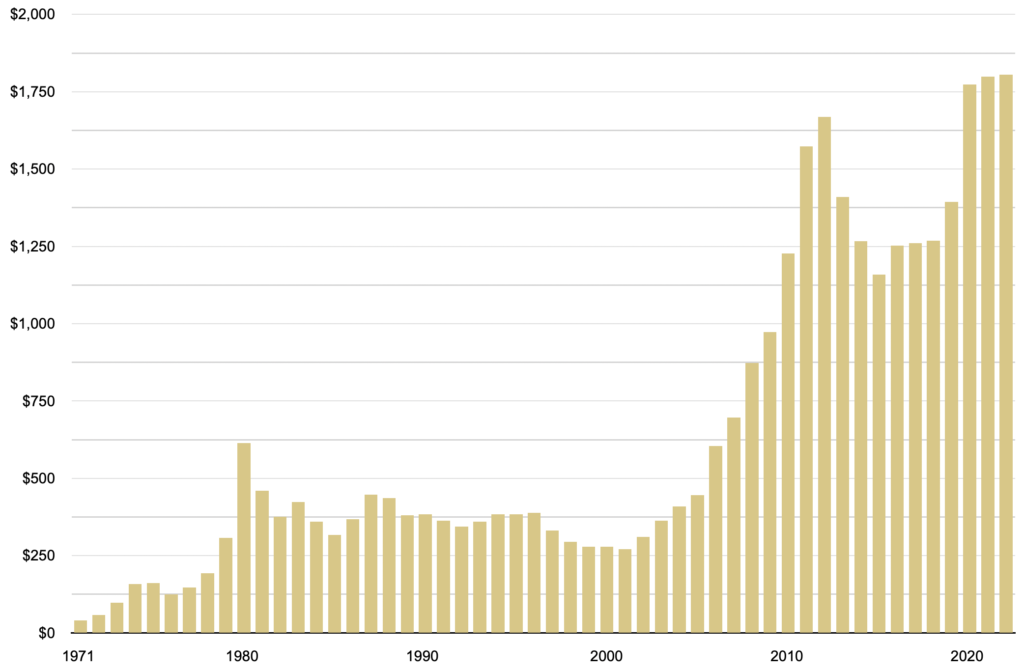

(USAGOLD – 1/27/2023) –Gold is trading sideways as we go into the weekend and next week’s Fed decision. It is up $2 at $1933.50. Silver is down 19¢ at $23.79. Morning Porridge’s Bill Blain believes having some gold stuck away to finance future bottom fishing in other markets is a good thing. “That’s when the liquidity of gold is a marvelous thing,” he says. “In times of market uncertainty it’s a beneficial asset to hold.” (In the chart below, please note the price levels during times of economic uncertainty.)

“My colleague Ashley Boolell, Shard’s head of commodities, reckons gold is going to a new record level this year,” he says in a lengthy analysis on gold posted at Zero Hedge yesterday, “fuelled by a number of factors – not least being the ongoing market uncertainty. Each time we get another unexpected market number, or a corporate shock, it chips way confidence. In uncertain markets gold is seen as the safe-haven investment – especially when there is the threat of the technical US default on the back of the debt-ceiling being blocked by the Alt-Right of the Republican Party.”

Gold annual average prices

(1971 – 2022)