Gold extends new year rally into second day

Napier says rate increases will not keep up with inflation; gold will benefit

(USAGOLD – 1/4/2023) – Gold took its new year rally into its second day on rising hopes that inflation is on the fade and the Fed will begin dialing down interest rate increases. It is up $16 at $1858. Silver is up 20¢ at $24.27. Russell Napier, the highly regarded markets analyst, is at odds with the building sentiment on inflation and rates. He says inflation will not be matched by rate increases – a process he calls “financial repression” that will remain in place for at least a decade. Gold, he believes, will be among the beneficiaries.

“Gold has long seemed a better bet in an environment when inflation would be rising faster than interest rates,” he writes in an analysis published Monday in the Toronto Star. “Going forward, the more investors focus on governments’ need to ensure that interest rates remain below the rate of inflation, the more the price of gold is likely to rise. This will be particularly true when central bankers begin to reduce interest rates. Should a financial repression require capital controls to coral investors into local currency government bonds, the rise in the gold price will accelerate.”

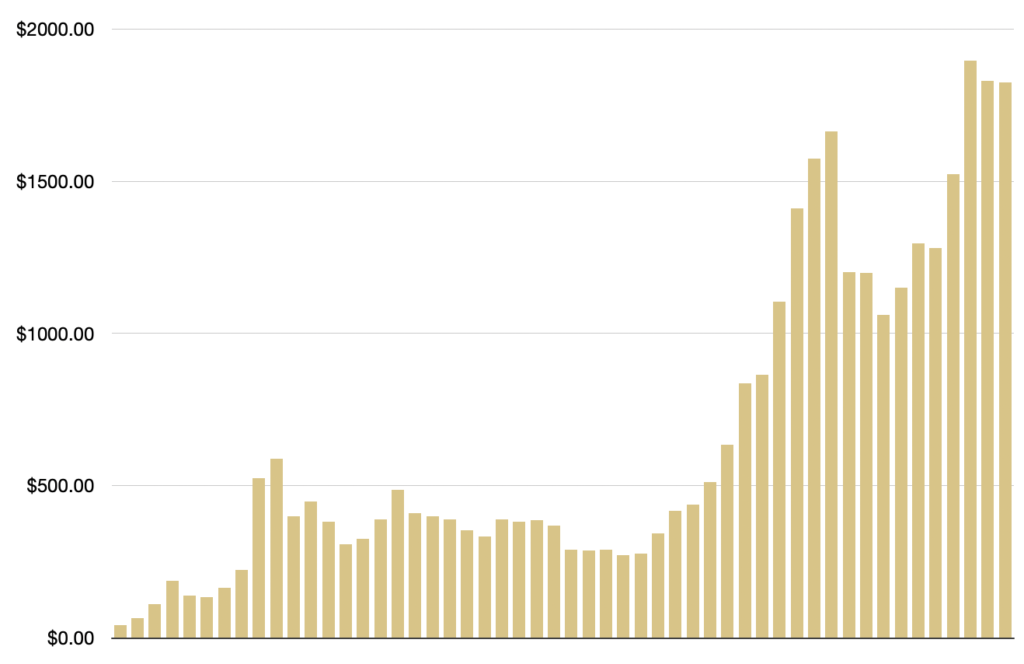

Gold average annual price

(1971-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: MacroTrends.net