Gold trades listlessly amidst a steady blitz of hawkish Fed rhetoric

Jupiter’s Naylor-Leyland outlines what might trigger gold’s next breakout

(USAGOLD – 4/19/2022) – Gold is trading listlessly this morning as markets, in general, reflect caution amidst a steady blitz of hawkish rhetoric from Fed members. It is down $1 at $1980. Silver is up 3¢ at $25.97. Both metals are mounting challenges of psychologically important price levels – $2000 for gold and $26 for silver. Jupiter Asset Management’s Ned Naylor-Leyland thinks that there will be a break out in the gold price and that “the trigger may be when inflation surprises to the upside, or the market accepts that seven interest rate hikes in the US is a bit too aggressive.” He also believes that when the breakout occurs silver will outperform gold and “very dramatically so.”

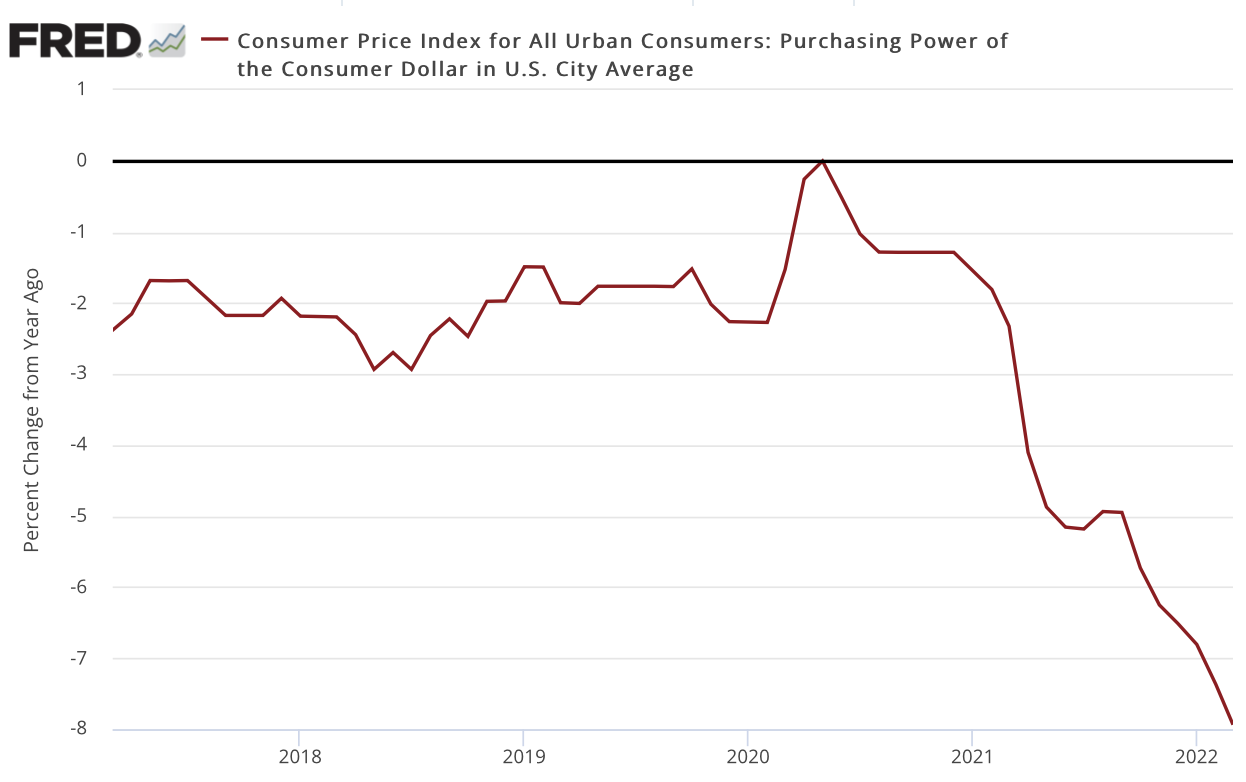

“People are interested in gold because they are worried about future purchasing power,” he writes in an article posted at Gulf News. “The market is still considering whether the US Federal Reserve (Fed) will be able to raise interest rates as much as seven times this year and whether or not inflation will materially weaken. In my view, this is why gold hasn’t broken out properly yet — the market is focused on relatively hawkish observations.” Many of our readers will be surprised by the chart posted below. The dollar has lost 8% in purchasing power over the past year.

Purchasing power of the U.S. dollar

(Percent change year over year)

Sources: St. Louis Federal Reserve [FRED]. U.S. Bureau of Labor Statistics