Daily Gold Market Report

Gold takes breather after briefly trading at an all-time high yesterday

Another bank goes to the ropes, fuels surge in safe-haven gold demand

(USAGOLD – 5/4/2023) – Gold is taking a breather this morning after briefly trading at an all-time high yesterday of $2082. It is up $2 at $2043.50. Silver is down 3¢ at $25.64. No sooner had Fed chairman Powell declared that the banking system is “sound and resilient” at his press conference yesterday that another bank – this time PacWest Bancorp – went to the ropes. The news instantly fueled another surge in safe-haven gold demand that pushed prices past the old high-water mark before settling in the $2040 range.

Reflecting the level of apprehension in the banking business, former Atlanta Fed President, Dennis Lockhart, told Bloomberg yesterday, “It looks like the markets are moving from one bank to the other and vulnerable deer in the herd are being kicked off. But I would like to believe that Jay Powell has information that suggests that the situation is contained or containable.”

A little Ramirez humor to start your day……

Cartoon courtesy of MichaelPRamirez.com

Daily Gold Market Report

Gold drifts sideways in quiet pre-Fed decision trading

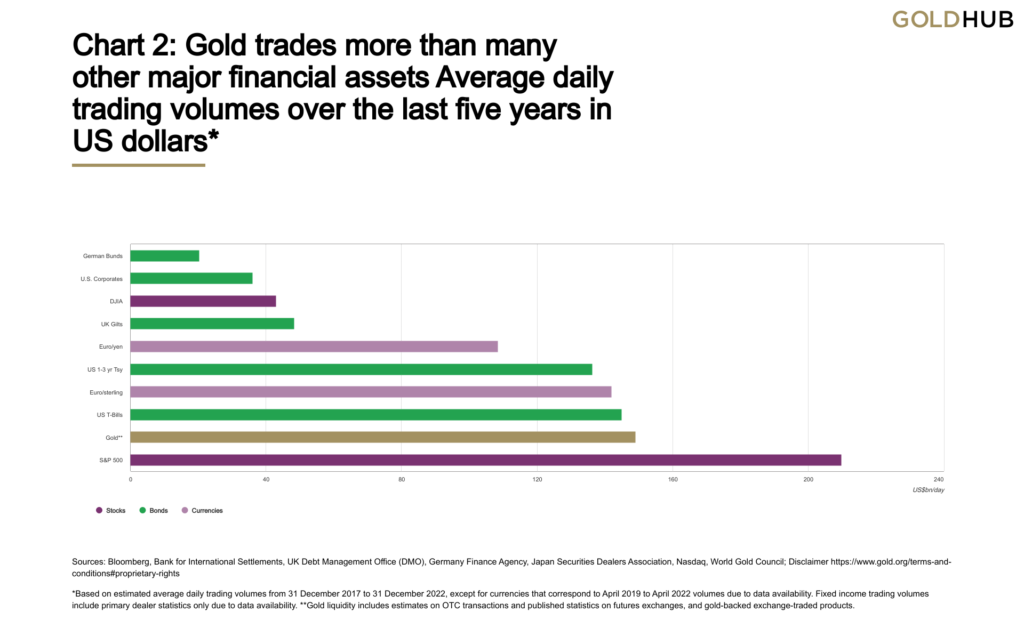

Global trading volumes for gold average $149 billion per day, second only to stocks

(USAGOLD – 5/3/2023) – Gold is drifting sideways in quiet pre-Fed decision trading. It is level at $2019. Silver is down 13¢ at $25.32. The relative calm follows sharp gains yesterday driven by growing instability in the US banking system. “It’s spooky. Thousands of banks are underwater,” Professor Amit Seru, a banking expert at Stanford University, told The Telegraph yesterday. “Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.” Such is the unsettling backdrop for the Fed’s rate decision, statement, and press conference later today.

Market liquidity is a crucial factor in judging any investment’s portfolio worthiness, especially when large amounts of money are at stake. Gold, says the World Gold Council in a recently released in-depth statistical profile, is “more liquid than many other major assets. Gold trading volumes averaged approximately US$149bn per day over the past five years, more than the Dow Jones Industrial Average and comparable to those of US 1–3-year treasuries and US T-Bills among primary dealers. The size of the market allows it to absorb large purchases and sales from both institutional investors and central banks without resulting in price distortions. And in stark contrast to many financial markets, gold’s liquidity has not dried up, even during times of financial stress, making it a much less volatile asset.”

Chart courtesy of the World Gold Council • • • Click to enlarge

Daily Gold Market Report

Gold up marginally as Fed meets amidst besieged US economy

Druckenmiller shorts the dollar, his only ‘high-conviction trade.’

(USAGOLD –5/2/2023) – Gold is up marginally this morning as the Fed begins its conclave amidst a range of stubborn problems besieging the US economy. It is up $6 at $1991. Silver is down 22¢ at $24.82. Stanley Druckenmiller, the highly regarded former hedge fund manager, recently called the current market environment the most uncertain he has seen in his 45-year career. “The Fed has shown some mettle over the last year,” he recently told Financial Times, “but historically I would not say [Federal Reserve chair] Jay Powell is a profile in courage.” Druckenmiller is betting against the US dollar calling it his only “high conviction trade.” He also said that “big asset classes like equities were likely to show little if any positive direction over the next 10 years.”

US Dollar Index

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold bolts higher as bank failure realities sink in

Bank of America strategist sees $2500 as a possibility before year-end

(USAGOLD – 5/1/2023) – Gold bolted higher in early trading as the realities of another significant bank failure and FDIC rescue began to sink in among investors. It is up $13.50 at $2006. Silver is up 69¢ at $25.83. Strong performances in gold and silver in the first half of April instigated by problems in the banking system gave way to profit-taking and choppy market action in the second half. Nevertheless, silver ended the month 4.43% higher. Gold was up 1.31%.

A Bank of America commodities analyst believes that with the strong influences already at work in the gold market, it will not take a significant influx of new buyers to push gold to the $2500 level this year. “Influenced by the recent banking turmoil,” said the strategist in a client note reviewed at Kitco News, “markets are pricing imminent rate cuts. At the same time, core inflation has been sticky and elevated price pressures, for example in shelter, highlight the risk of second-round effects. This confirms our long-held view: central banks have no silver bullet for fighting inflation and this should ultimately bring investors back to the market. The end of the hiking cycle will be critical for the yellow metal.”

Gold and silver price performance

(% price change April 2023)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold drifts marginally lower as attention turns to next week’s Fed meeting

Rosenberg predicts deflationary future, recommends ‘bond-bullion barbell’

(USAGOLD –4/28/2023) – Gold drifted marginally lower in today’s early going as markets turned their attention to next week’s Fed meeting. It is down $4 at $1986. Silver is down 14¢ at $24.90. The $2000 level for gold and the $25 level for silver have proven to be obstacles – at least for the moment. Still, as we close out April, gold is up 1.4% on the month; silver is up 7.5%.

David Rosenberg, the highly regarded Toronto-based investment analyst, says that the current trends point to “a deflationary, not inflationary environment.” He recommends Treasuries, cash, and gold as the best bets for a future that could include significant systemic risk. “The U.S. dollar,” he says In a Marketwatch interview published yesterday, “will come under downward pressure. Gold will be a great hedge against the declining greenback. I’ve been advocating the bond-bullion barbell. “

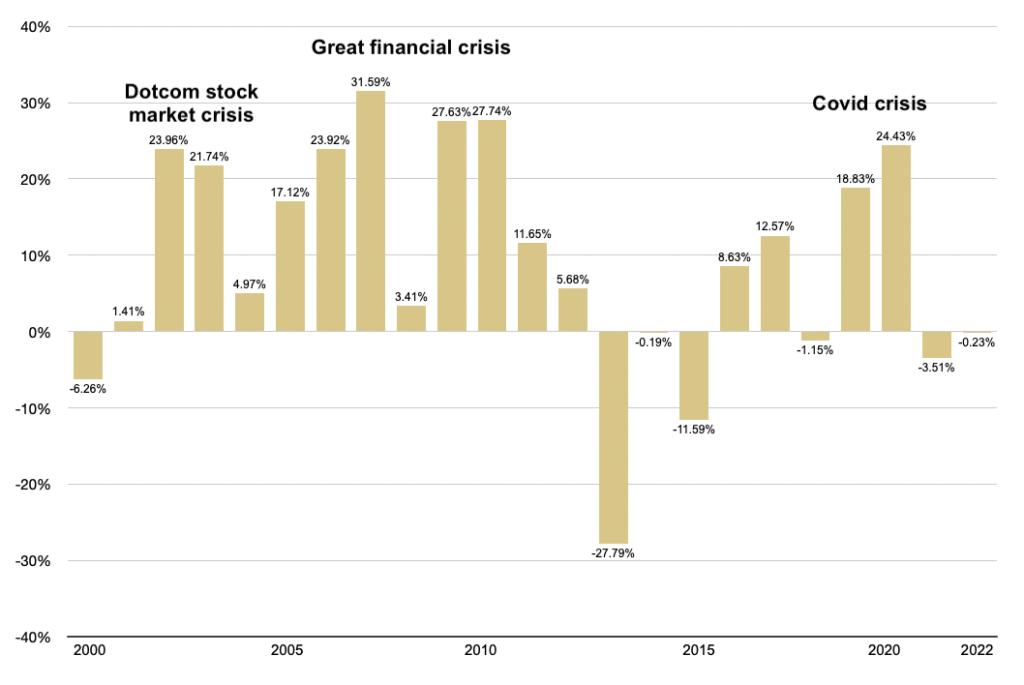

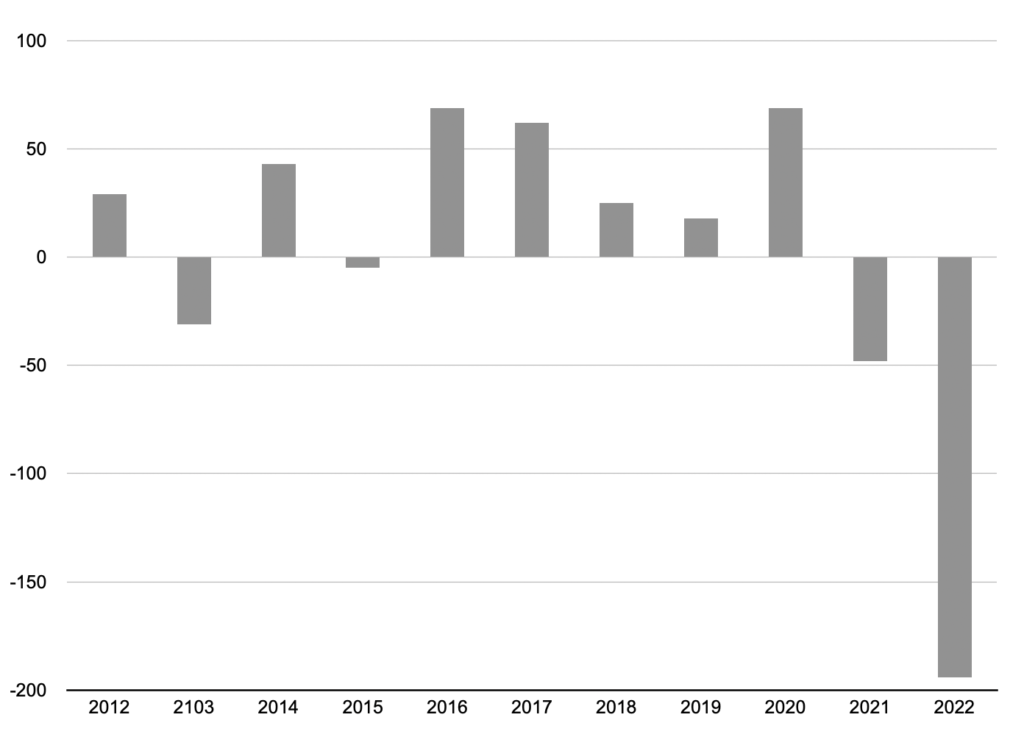

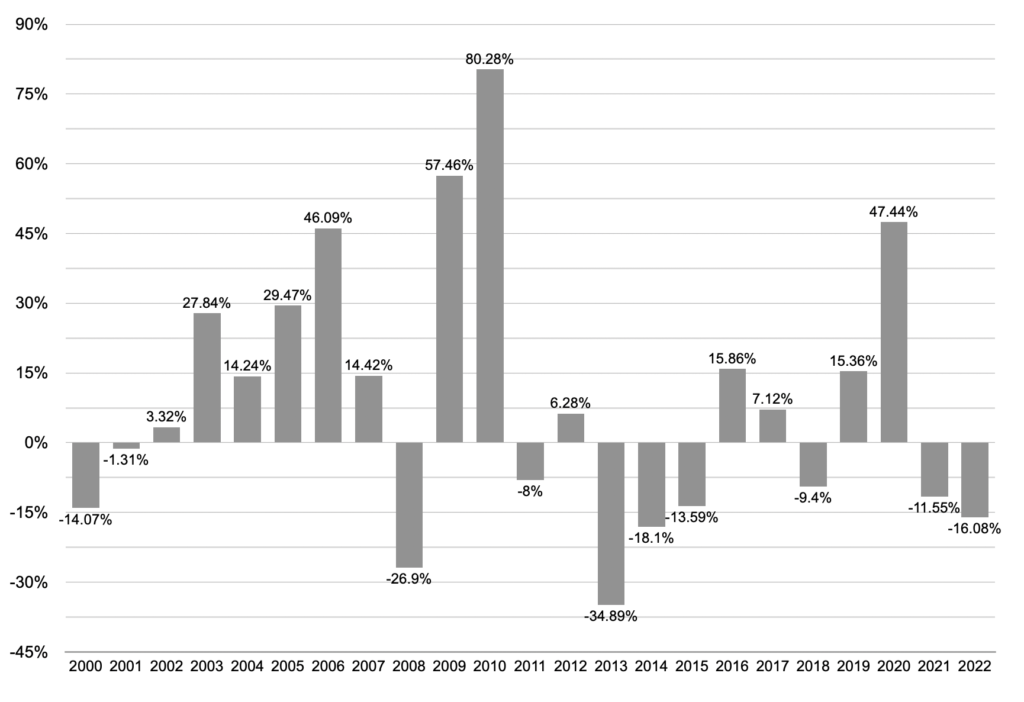

Editor’s note: As shown in the chart below, systemic crisis, not inflation, have generated the most substantial price gains for gold thus far in the 21st century.

Gold annual returns and crisis periods during the 2000s

(Year over year gains or loss, 2000 to present)

Sources: St. Louis Federal Reserve [FRED], ICE Benchmark Administration, USAGOLD • • • Click to enlarge

Daily Gold Market Report

Gold turns to the upside on banking system worries, general economic uncertainty

Aden Forecast says ‘once gold takes off, it will skyrocket’

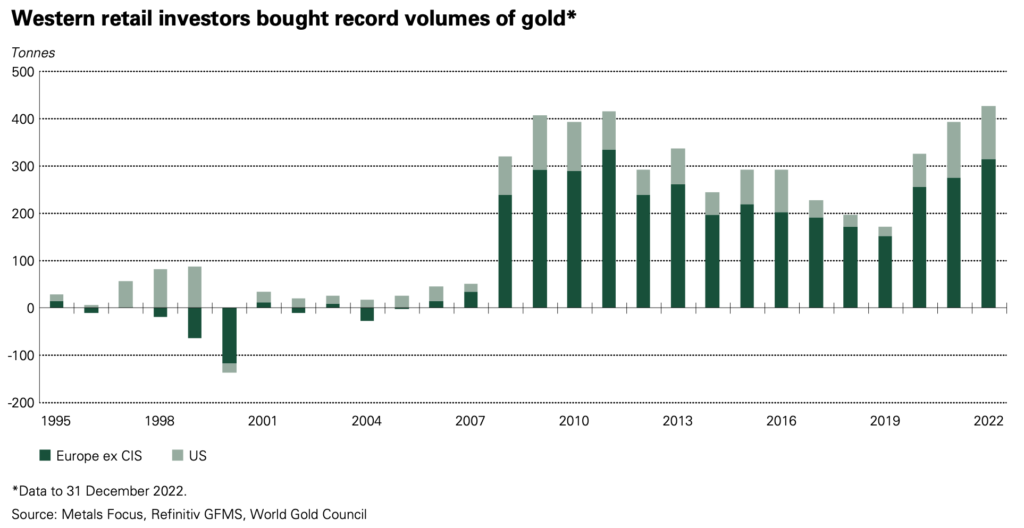

(USAGOLD – 4/27/2023) – Gold turned to the upside this morning as worry about the banking system and general economic uncertainty pushed back to the forefront. It is up $8.50 at $2000. Silver is up 16¢ at $25.07. The Aden sisters (Aden Forecast) have been a mainstay in financial circles for decades. Known for their straightforward market analysis, they now believe that a “big financial shift” is in the cards and that central banks and private investors are stockpiling gold to prepare for it.

“Everyone knows that gold is real money,” they say. “It has stood the test of time. It has a 5000-year track record and it’s essentially the only global currency in the world. It’s also the world’s favorite safe haven and that’s why central banks worldwide have been stocking up on gold and easing out of dollars. They see what’s happening on the economic and geopolitical fronts and they want to play it safe by accumulating real money. Private investors are starting to do the same. And once gold takes off, we believe it’s going to skyrocket.” [Source: Yahoo Finance]

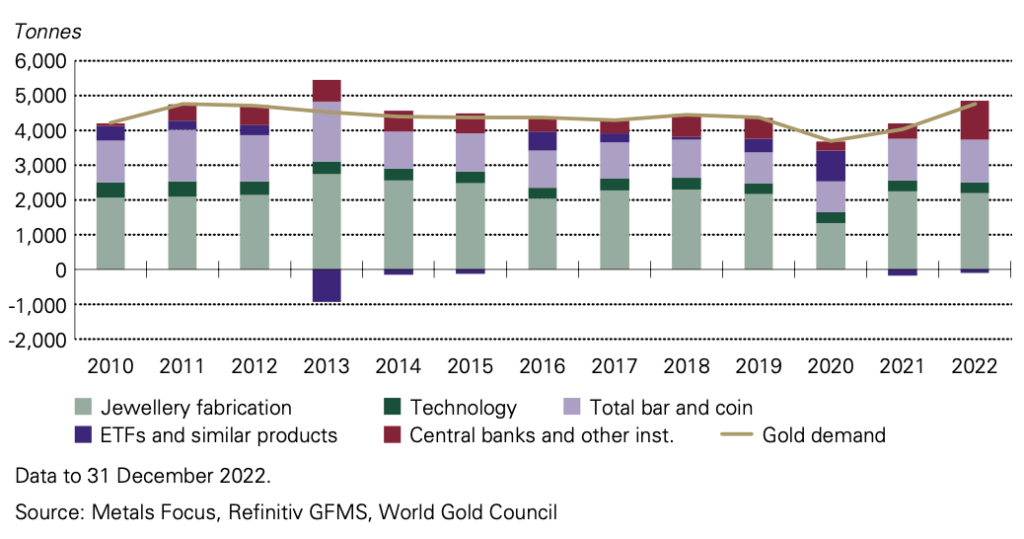

2022 gold demand led by private investors and central banks matched the 2011 record

Source: World Gold Council

Daily Gold Market Report

Gold up marginally this morning in muted reaction to run on First Republic Bank

Lombard Odier makes an important observation on changing gold market psychology

(USAGOLD – 4/27/2023) – Gold is up marginally this morning as the market reaction to the run on California’s First Republic Bank remains muted. It is up $2 at $2002. Silver is level at $25.11. In an analysis released yesterday, Lombard Odier’s Stephane Mornier makes an important observation about changing gold market psychology we thought worth passing along.

“What do the Singaporean, Turkish, and Chinese central banks have in common with jittery investors?” he asks. “Answer, they’ve been buying gold as a haven and diversifier from fears of a recession, a crisis of confidence in banking, and a weakening US dollar. We see this as an indication that economic factors are taking over from financial speculation as the main driver of demand for gold.” Real demand, it says, is pushing gold towards a new standard. The bank has raised its target price to $2100 by the end of the year.

Daily Gold Market Report

Gold loses momentum as traders test the downside

Felder: ‘Gold may be on the cusp of another major bull market.’

(USAGOLD – 4/25/2023) – Gold turned lower this morning as momentum faltered just below the psychologically important $2000 mark and traders tested the downside. It is down $11 at $1980. Silver is down 59¢ at $24.62. Jesse Felder, the veteran market analyst and former hedge fund manager, thinks gold may be on the cusp of another major bull market driven by the federal government’s rapidly deteriorating fiscal situation.

“[I]f history is any guide, the best protection against a deteriorating fiscal situation (mathematically guaranteed by rapidly growing social security and medicare spending) is gold,” he writes in a recently posted analysis. “The last time the deficit reversed from a narrowing trend and began a major widening trend, back in the early-2000’s, it coincided with a major top in the dollar index which evolved into a major bear market for the greenback that lasted roughly a decade. This was one of the primary catalysts for a major bull market in the price of gold which rose from a low of $250 in 2001 to a high of nearly $2,000 a decade later.”

Gold and the US federal debt

(1971 to present)

Chart courtesy of Trading View.com • • • Click to enlarge

Daily Gold Market Report

Gold off to slow start this morning in featureless trading

Sharma: ‘Gold is now a vehicle of central bank revolt against the dollar.’

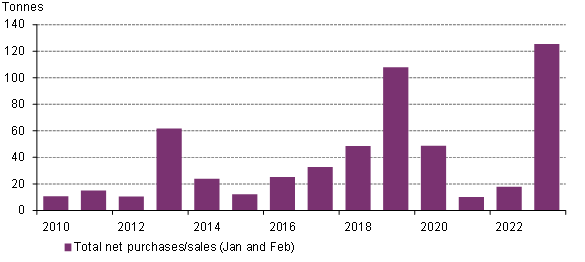

(USAGOLD – 4/24/2023) – Gold is off to a slow start this morning in featureless trading. It is up $1 at $1986.50. Silver is level at $25.16. In a Financial Times opinion piece over the weekend, Rockefeller International’s Ruchir Sharma says that there is “something new” in the gold market – “heavy” central bank gold buying driven by weaponization of the US dollar. He points out that central banks now account for a record 33% of monthly gold demand.

“[T]he oldest and most traditional of assets, gold,” he writes, “is now a vehicle of central bank revolt against the dollar. Often in the past, both the dollar and gold have been seen as havens, but now gold is seen as much safer.” Separately, the World Gold Council reports central banks picking up in the first two months of 2023 where they left off in 2022 – a record year for central bank offtake. Early-year demand was at a pace not seen since at least 2010, says WGC.

Central bank gold demand

(First two months of the year, 2010-2023)

Source: World Gold Council, IMF IFS, respective central banks

Daily Gold Market Report

Gold tracks lower in cautious end of week trading

Eurizon reports sharp decline in global dollar reserves, gold a beneficiary

(USAGOLD –4/21/2023) – Gold tracked lower this morning as uncertainty over the rate picture lingered, worry about the banking system cooled, and cautious end of week trading prevailed. It is down $17.50 at $1990. Silver is down 15¢ at $25.22. A recently released study by Eurizon SLJ Asset Management finds that the dollar’s share of total global reserves declined sharply in 2022 while its status as the dominant currency in international trade remained “unchallenged” – a differentiation we have not seen referenced by other analysts.

“In a Monday note, strategists Joana Freire and Stephen Jen calculated that the greenback accounted for about two-thirds of total global reserves in 2003, then 55% by 2021, and 47% last year. ‘This 8% decline in one year is exceptional, equivalent to 10 times the average annual pace of erosion in the USD’s market share in the prior years,’ the authors said.” [Source: Markets Insider, 4/17/2023)

Editor’s note: Gold has been one of the primary beneficiaries of that 8% shift in global reserves. The World Gold Council reports record central bank purchases of 1136 metric tonnes in 2022. “There has been a concerted shift away from over-reliance on the US dollar as a reserve currency in an environment of non-existent real yields on sovereign debt,” writes the Council’s Louise Street in a recent market review.

Cartoon courtesy of MichaelPRamirez.com

Daily Gold Market Report

Gold pushes back over the $2000 level in early trading

The Silver Institute says silver market is in a new era of structural deficits

(USAGOLD – 4/20/2023) – Gold pushed over the $2000 level this morning in an attempt to regain momentum lost in the sell-off of the past couple of days. It is up $13 at $2009.50. Silver is up 7¢ at $25.44. The Silver Institute says that the silver market is in a new era of structural deficits as demand reached a record 1.242 billion ounces in 2022. It forecasts a continuation of both trends in 2023.

“This year is expected to be another of solid silver demand,” it says in its World Silver Survey released yesterday. “Industrial fabrication should reach an all-time high, boosted by continued gains in the P.V. market and healthy offtake from other industrial segments. Although bar & coin demand and jewelry fabrication are expected to fall short of last year’s exceptional levels, both are forecast to remain historically high.…Adding up the supply shortfalls of 2021-2023, global silver inventories by the end of this year will have fallen by 430.9 Moz from their end-2020 peak. To put this into perspective, it is equivalent to more than half of this year’s forecasted annual mine production, and more than half of the inventories presently held in London vaults offering custodian services.”

Silver supply surpluses and deficits

(2012-2022)

Chart by USAGOLD [All rights reserved], Data source: Macrotrends.net

Daily Gold Market Report

Gold takes a sharp turn to the south on wavering rate sentiment

Saxo Bank’s Ole Hansen thinks a short-term consolidation might be in the works

(USAGOLD – 4/19/2024) – Gold took a sharp turn to the south this morning in what looks to be a general commodities sell-off driven by wavering sentiment on inflation and rates. It is down $34 at $1973. Silver is down 52¢ at $24.77. Persistently high inflation readings globally, this morning’s UK inflation report being the latest example, are fueling a perception that central banks will be forced to keep rates high for some time to come.

Saxo Bank’s Ole Hansen maintains a bullish outlook for gold and silver but thinks a short-term consolidation might be in the works. “Gold,” he says in an analysis released this morning, “reached a fresh cycle high last week at $2048/oz, coming within just 22 dollars of the 2022 record peak. Silver experiencing a 31% rally since early March, reached a one-year high above $26/oz before encountering profit-taking. After such strong gains, both metals are in need of consolidating their gains, especially after relative strength indicators began flashing overbought in both metals.”

Daily Gold Market Report

Gold turns to the upside after once again finding support just below $2000

London-based fund manager Ruffer offers investors a few words of wisdom

(USAGOLD – 4/18/2023) – Gold turned to the upside this morning after once again finding support just below the $2000 level. It is up $9 at $2006. Silver is up 5¢ at $25.18. Also helping gold along in today’s early going is a strong first-quarter GDP report out of China (+4.5%) led by domestic consumer demand. We came across the following bit of wisdom from London-based fund manager Jonathan Ruffer over the last weekend and thought it worth passing along, particularly in the context of declining bond markets. (The full essay is a gem and highly recommended.):

“The mischief will be centred on investment portfolios. To survive, one will have to be careful in the sorts of assets one owns. There is usually a sharp changing of the guard in markets after an event which involves illiquidity – when the refreshing waters return, it is not always to the old favourites. In the emergency, though, the jewels and the paste are all jettisoned together, and real money can be made by having the firepower to buy assets from distressed investors. This requires a strong ammunition cart of cash, or cash-equivalent: the latter has to be regularly checked to confirm that there is a genuine equivalence. I am a bit queasy writing this, in case the crisis happens… and we find ourselves locked into our ‘safe’ investments.”

Editor’s note: Though Ruffer does not mention gold in this essay (except in a historical context), his firm has recommended holding it in the past. [Please see: Gold Matters, September 2020.]

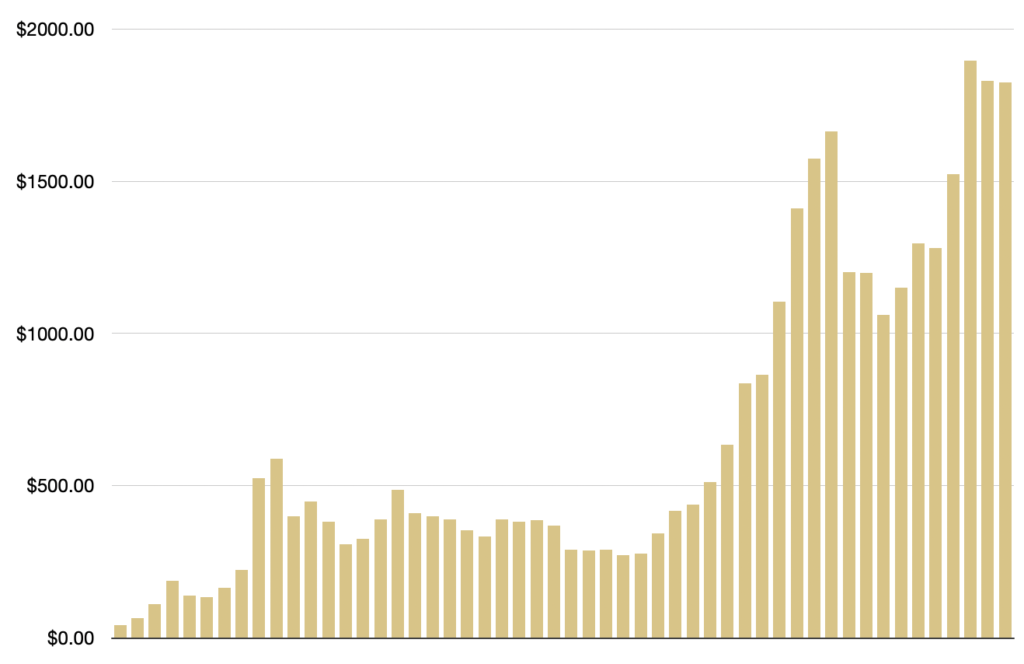

Gold Average Annual Prices

Chart by USAGOLD [All rights reserved], Data source: Macrotrends.net

Daily Gold Market Report

Gold attempts to regain footing after Friday’s yen-related selloff

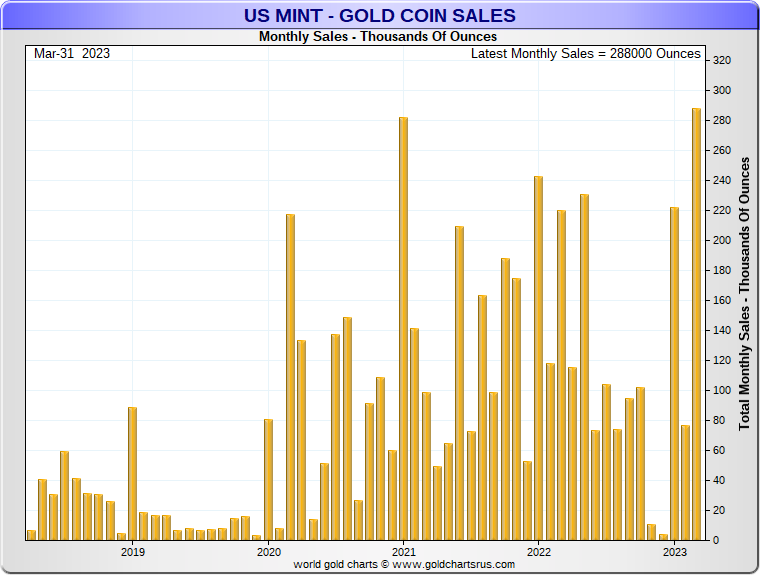

US Mint reports sharp gains in gold bullion coin sales in March

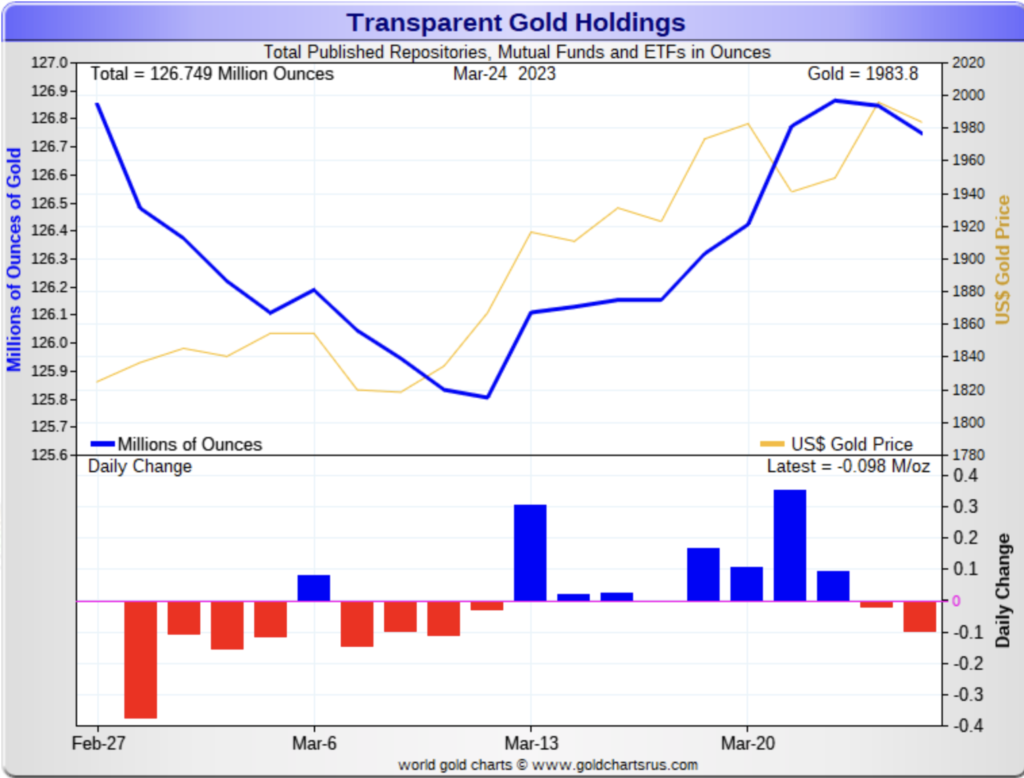

(USAGOLD – 4/1 7/2023) – Gold is attempting to regain its footing after Friday’s steep selloff led by a sharp decline in the Japanese yen. It is up $5 at $2012. Silver is up 7¢ at $25.50. Friday’s retreat aside, demand for gold and silver bullion coins is running strong, driven by safe-haven investors looking for an alternative to bank savings. The US Mint reports a 277% gain in sales of the American Eagle gold bullion coin over last month and a 38% gain over the same month last year, according to CoinNews. Demand for the American Eagle silver bullion coin in March was at par with last month, but ultra-high premiums have channeled strong global demand to lower premium alternatives like the Canadian Maple Leaf and the Austrian Philharmonics. Combined sales of American Gold Eagle and Buffalo gold bullion coins posted their best month in five years at just over 280,000 ounces.

Chart courtesy of GoldChartsRUs

Daily Gold Market Report

Gold looks to be taking a breather as it closes out strong week

AcheronInsight’s Yates says gold’s bull market is just getting started

(USAGOLD – 4/14/2023) – Gold looks to be taking a breather this morning as it closes out what has been a strong week for the precious metals. It is down $7 at $2036. Silver is up 13¢ at $26.03. On the week, gold is up 1.72%; silver is up 4.47%. Year to date, gold is up 11.5%; silver is up 8.3%. Gold’s resilience during a period of higher real yields has been “nothing short of remarkable,” says AcheronInsights’ Christopher Yates in an analysis posted yesterday at Seeking Alpha. Now he believes a developing shift in the real yield scenario is about to spill over to the gold market.

“Clearly, real yields look to be in the process of peaking for this cycle,” he says, “meaning we are likely in the early innings of a renewed bull market in precious metals. But, it may be a little too early to suggest they will roll over just yet, particularly if the Fed has one or two surprise hikes left in them as economic and inflation resilience remains for now. However, as growth is likely to slow materially in the second half of the year, there will be a time where nominal yields fall faster than inflation expectations, and thus, real yields roll over hard and fast. One would expect such an environment to be accompanied by a more accommodative Federal Reserve, thus ultimately setting the stage for a fundamentals-backed move higher in precious metals.”

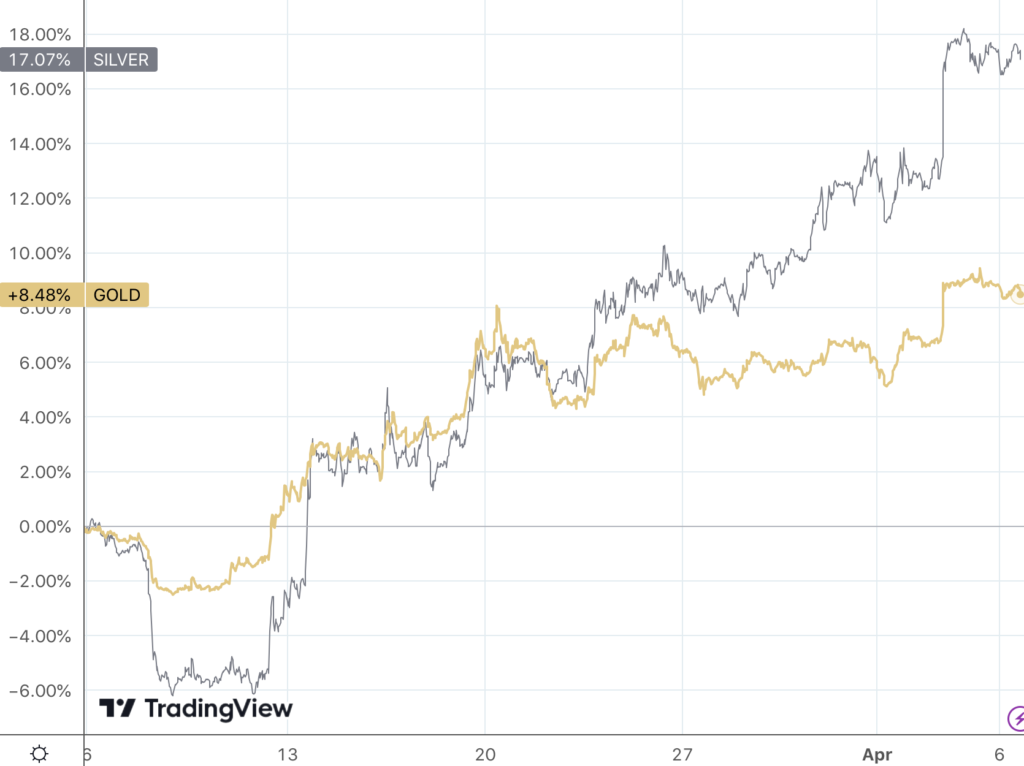

Gold and silver prices

(% gain, year to date)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold surges nearer all-time highs on Fed prospects, fresh safe-haven buying

Bank of America sees possibility of move to $2391/$2543 in 2023-2025

(USAGOLD – 4/13/2023) – Gold surged nearer all-time highs this morning on the prospect of Fed moderation assisted by this morning’s surprise drop of 0.5% in wholesale prices. It is up $29 at $2047. Silver is up 30¢ at $25.89. Fresh safe-haven and technical demand might also be playing a role in this morning’s upside. Bank of America updated its gold forecast yesterday, pointing to a bullish pennant chart pattern that favors a continuation of the current uptrend. “A new all-time closing high in gold prices above $2078 on daily and weekly charts,” it predicts, “would go a long way in signaling a significantly larger upside in 2023-2025 such as $2391/$2543.”

Daily Gold Market Report

Gold bolts higher as CPI comes in lower than expected

UBS predicts $2200 gold by March next year

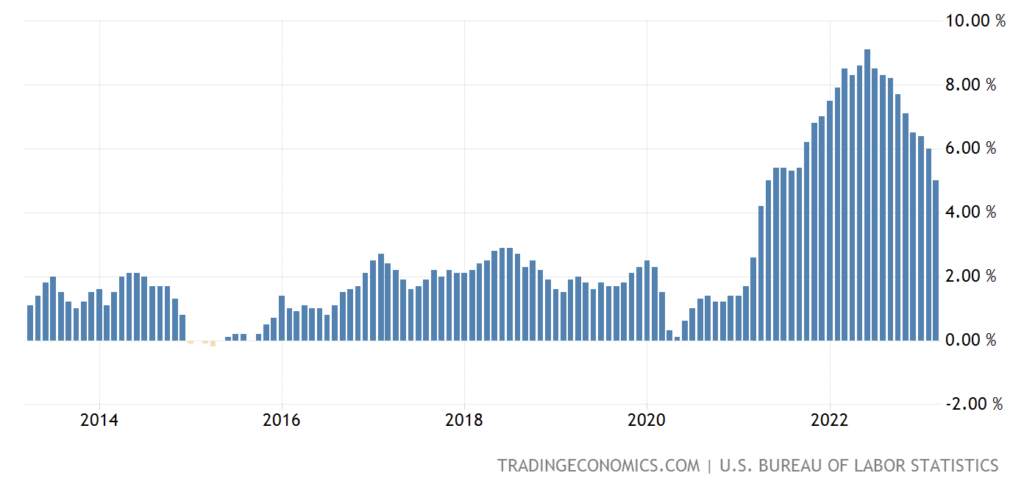

(USAGOLD – 4/12/2023) – Gold bolted higher after the US inflation report came in lower than expected at 5%. It is up $19 at $2025. Silver is up 54¢ at $25.67. The consensus was that the CPI would come in at 5.2%, an already steep drop from last month’s 6% reading. The markets are likely to read leeway for the Fed in today’s report, further weakening of the dollar, and the potential for more upside in precious metals prices.

Here are a couple of quick insights to start your day:

“Gold tends to rise when the US Dollar is weakening, and downside risks to the greenback have risen alongside money market pricing of Federal Reserve rate cuts. While volatility can be expected in the near term, we now expect the precious metal to hit $2,100 by year-end, and $2,200 by March 2024.” – UBS analysts [Source: ForexStreet]

“When the banking crisis emerged last month, I quoted Warren Buffet’s famous saying that ‘there’s never just one cockroach in the kitchen.’ While we don’t know what the next crisis will be, we — and gold — know that one is coming. Whether it’s a resumption of the banking crisis or some other event, you don’t raise interest rates at the steepest pace since Paul Volcker, after employing the easiest monetary policy in his- tory for well over a decade, without breaking something. Something else is going to break…at some point this year…and gold is telling us this now.” – Brien Lundin [Source: Gold Newsletter]

United States Inflation Rate

(2012 to present)

Chart courtesy of TradingEconomics.com

Daily Gold Market Report

Gold gains ground in advance of tomorrow’s inflation numbers

Singer warns we have moved ‘demonstrably closer to a tipping point,’ recommends gold

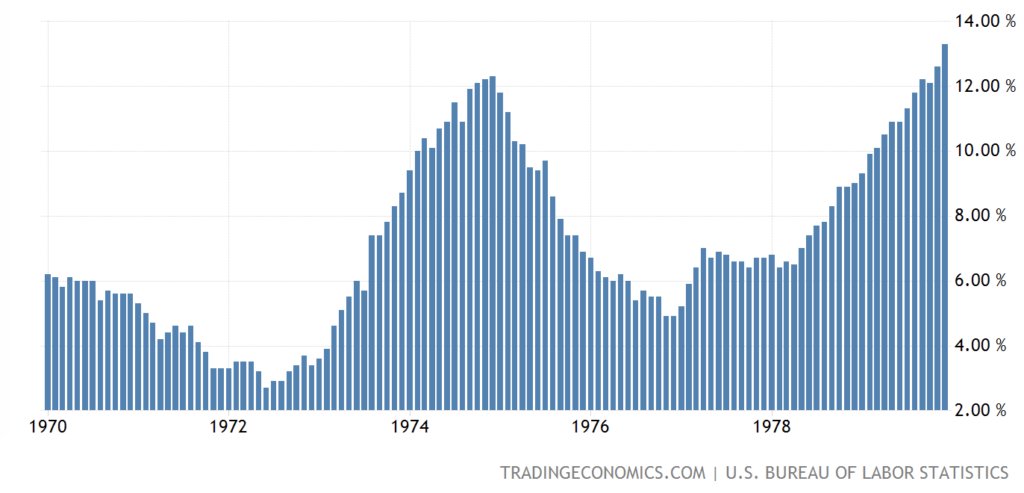

(USAGOLD – 4/11/2023) – Gold gained ground this morning in advance of tomorrow’s inflation numbers. It is up $10 at $2003. Silver is up 6¢ at $25.02. Trading Economics has the consensus CPI forecast at 5.2% annualized – a considerable drop from February’s 6% reading. Even though the inflation rate is moderating, Elliot Management’s Paul Singer reminds us that inflation retreated at times during the 1970s only to come back with a vengeance.

“We think it is very unlikely that central bankers will move to normalize monetary policy after the current emergency is over,” he wrote in his annual investor letter. “They did not normalize last time [2008 GFC] and the world has moved demonstrably closer to a tipping point after which money printing, prices and the growth of debt are in an upward spiral that the monetary authorities realize cannot be broken except at the cost of a deep recession and credit collapse.” Singer recommends owing gold saying “it is the only real money and has occupied that status for literally thousands of years.” [Source: Wall Street Journal]

US inflation rate

(1970-1979)

Chart courtesy of TradingEconomics.com

Daily Gold Market Report

Gold off to slow start ahead of Wednesday’s all-important inflation numbers

Authers: ‘Gold does like a good way to hedge the various alarming possibilities’

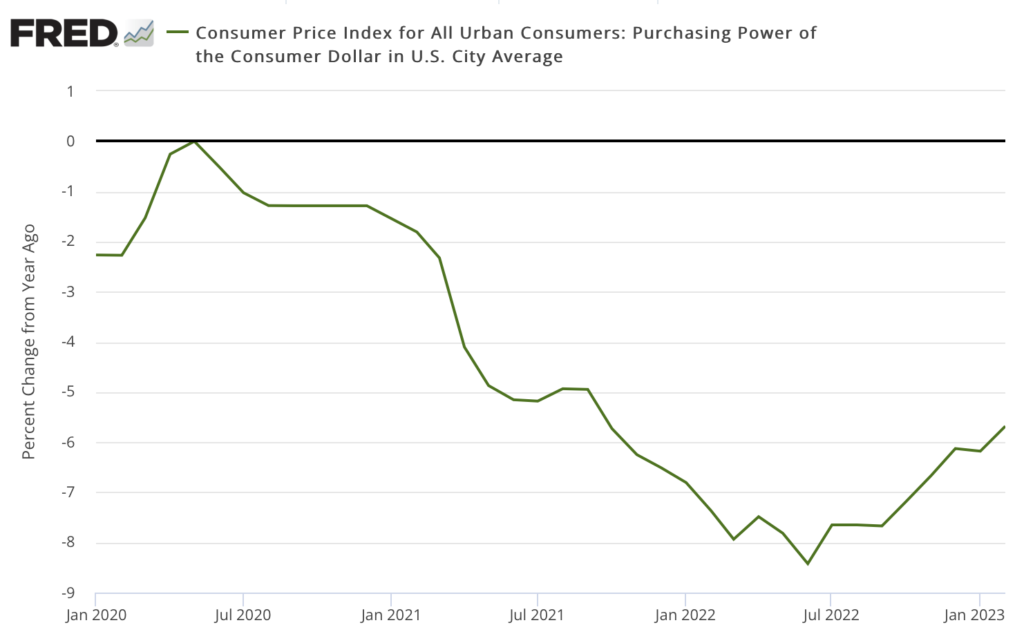

(USAGOLD – 4/10/20233) – Gold is off to a slow start this morning as the markets await Wednesday’s all-important consumer price report. It is down $7 at $2003. Silver is down 5¢ at $25.07. There seems to have been some calming of the animal spirits unleashed by the string of bank failures last month, though it might take some time to sort out the net impact of the Fed’s rescue plans on inflation and the future value of the dollar.

In his annual Passover Questions column, Bloomberg’s John Authers points to the latest bailout program as an important source of investor interest in gold. “It may have proved relatively easy to stopper up flights from deposits,” he writes, “but that has disturbing implications for the soundness of money. That will be particularly important for those most inclined to invest in gold…As we wait to see exactly how this rate-rising cycle will end, gold does look like a good way to hedge against the various alarming possibilities. And that’s true even though inflation is declining.”

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics

Daily Gold Market Report

Gold trades quietly as we head into the holiday weekend

Practical advice for new investors, those considering an addition to their holdings

(USAGOLD – 4/6/2023) – Gold is trading quietly this morning as we head into the holiday weekend. It is down $2 at $2020. Silver is down 2¢ at $25. Over the past thirty days, gold is up 8.5%; silver is up 17%. Many are asking if this is the long-awaited breakout in the precious metals. Sprott‘s Craig Hemke has some practical advice in that regard especially for those either entering the gold market for the first time or considering an addition to their holdings.

“[B]reakout rallies in COMEX gold and silver are coming in 2023,” he says. “They may have started already, or they may still be a few weeks away. The timing, however, only matters if you’re not correctly positioned before the event. As such, look around. Think for yourself and study history. Draw your own conclusions about where this is all headed and then prepare accordingly.”

(Editor’s note: USAGOLD is an excellent place to advance your education in the precious metals. For those looking to learn more about the rationale for owning gold and silver under current economic conditions, NEWS & VIEWS, our daily newsletter, offers much in the way of up-to-date independent analysis. If you wish to know more about the mechanics of investing in coins and bullion, simply review the menu at the top of the page. Much is offered there.)

Next DGMR: Monday, April 10, 2023

Gold and silver price performance

(%, 30-days)

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold marginally higher in follow-up to yesterday’s nearly $40 advance

‘Appears able to sustain momentum as dark clouds gather within the economy,’ says Norman

(USAGOLD – 4/5/2023) – Gold is marginally higher this morning following yesterday’s nearly $40 advance that took it over the $2000 mark. It is up $3 at $2026. Silver is down 23¢ at $24.85. London-based gold market analyst Ross Norman told Reuters that “the ‘third time’s the charm’ for gold, having probed above the $2,000 level in both August 2000 and March 2022. This time it appears to be able to sustain the momentum as dark clouds gather within the economy.” A recent poll conducted by Britain’s Royal Mint might be indicative of a trend that extends beyond UK’s borders.

“A poll of over 2,000 UK investors by The Royal Mint,” says Money Week‘s Tom Higgins, “found there is almost certainly a growing trend to buy gold, with one in four investors (23%) saying they plan to invest in gold this year, rising to 26% among Gen-X investors. Precious metals are the second most popular investment right now, only behind UK stocks and funds, with nearly a third of investors (30%) planning to invest in the asset class in 2023. Nearly one in six investors (16%) who haven’t previously invested in precious metals plan to in the future, further highlighting the increasing popularity of the asset class.”

Chart courtesy of the World Gold Council • • • Click to enlarge

Daily Gold Market Report

Gold down marginally in follow-up to yesterday’s solid gains

Frank Holmes cites three “unique catalysts” that could push gold higher

(USAGOLD –4/4/2023) – Gold is down marginally in early trading in the follow-up to yesterday’s solid gains influenced by OPEC’s production cut and lingering concerns about the banking system. It is down $3 at $1984. Silver is down 3¢ at $24.00. US Global Investors‘ Frank Holmes sees “dedollarization” as the critical factor that could push gold higher. In addition, he sees the return of quantitative easing and the developing cold war between the United States and China/Russia as catalysts for potentially higher gold prices.

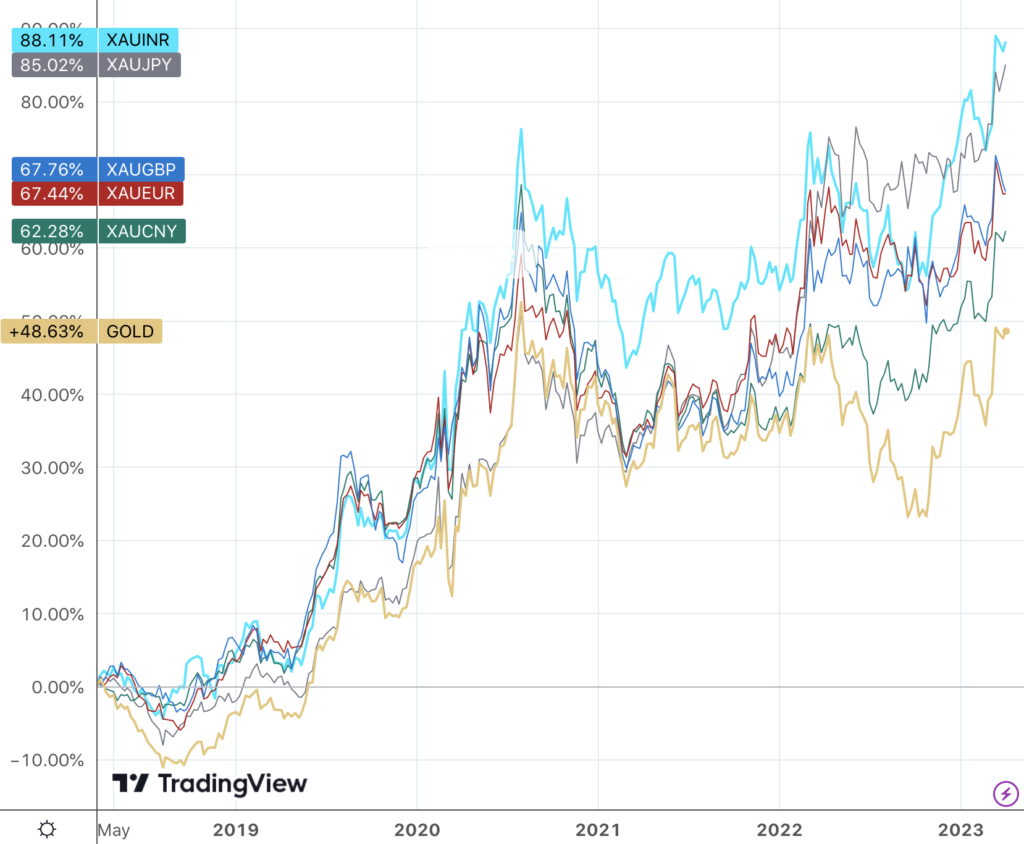

“Gold would be a direct beneficiary of dedollarization since it’s priced in the greenback,” he says. “Gold is trading at or near all-time highs in a number of currencies right now, including the British pound, Japanese yen, Indian rupee and Australian dollar, and it would likely be hitting new highs in USD terms as well were the dollar to be devalued.” He advises that” if you’re underexposed or have no exposure, it may be time to consider changing that.”

Gold price performance in key currencies

(%, five-year)

Chart courtesy of Trading View.com • • • Click to enlarge

Daily Gold Market Report

Gold pushes higher on surprise OPEC production cut

Gold currently experiencing ’round number resistance’ at $2000

(USAGOLD – 4/3/2023) – Gold pushed higher this morning in the wake of OPEC’s surprise declaration it would cut oil production by a million barrels per day – a move Bloomberg called an “inflationary jolt to the world economy.” It is up $8 at $1979.50. Silver is down 15¢ at $24.02. Down the Rabbit Hole says gold is currently experiencing “round-number resistance at $2000,” but nevertheless a “go-to asset” anchoring value within “a system that is changing, and may well be falling apart.”

“Gold,” continues DTRH, “is not a price vehicle and as such, it should not be cheered, rooted for, or otherwise pumped with stupid buzz sayings like ‘got Gold?’. It will get where it is going of its own value proposition. It is a rock and an anchor. As the system splits its seams the value of said rock (AKA insurance) gets marked up in the minds of newly, financially sober humans.”

Daily Gold Market Report

Gold trades sideways as it closes out an uneventful week

Silver is quietly on the rise ‘signaling a secular breakout’

(USAGOLD – 3/31/20230 – Gold is trading sideways this morning as it closes out an uneventful week. It is up $1 at $1984. Silver is up 2¢ at $24.02 and up 4% on the week. Quietly, silver has been on the rise. Though gold is the headline asset at the moment, silver has been the better performer – up 13.7% since the beginning of March compared to gold’s 7.9% gain. Investing Haven thinks silver is now “signaling a secular breakout.”

“it’s important to note,” it says in an article posted recently, “that the secular trendline is about to cross the 50% retracement… which is a significant milestone. Second, there is a physical supply crunch underway…These two factors combined suggest that a secular breakout is imminent, and investors who are positioned correctly could stand to benefit greatly. For those who are bullish on silver and are willing to take on some risk, the potential rewards could be significant.”

Average annual silver price

(1971-1922)

Chart by USAGOLD [All rights reserved] • • • Data source: Macrotrends.net

Silver price

(1971-present, log scale)

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold pushes quietly higher ahead of key reports due by the end of the week

Saxo Bank reports heavy capital flows into gold ETFs

(USAGOLD – 3/30/2023) – Gold pushed marginally higher this morning in quiet, uneventful trading ahead of a couple key reports due before the week is out – jobless claims later today and the PCE price index on Friday. It is up $4 at $1971. Silver is up 41¢ at $23.82. FX Empire’s Phil Carr says the recent pull-back in gold has to do with “end-of-quarter profit taking as traders square up their positions – ready to capitalize on precious metals’ next big move.” Saxo Bank reports seeing heavy capital flows into gold ETFs with almost $2 billion in net purchases over the past month, reversing months of selling.

Daily Gold Market Report

Gold takes a breather in quiet, uneventful trading

Morris says we’ve had four compelling times to buy gold in 100 years, and this is one of them

(USAGOLD – 3/29/2023) – Gold is taking a breather this morning in quiet, uneventful trading. It is down $6 at $1970. Silver is down 11¢ at $23.27. Over the past month, it is up 7.7% amidst lagging confidence about the financial system’s stability. Silver is up 11.2% over the same period. Byte Tree’s Charlie Morris says, “the next few years will be tricky for investors, and gold will have an important role to play in portfolios.”

“Over the past 100 years,” he says in a recent advisory, “there have been four compelling times to buy gold. In 1929 it proved to be a saviour ahead of the great depression. Then in 1969, it preceded the great inflation of the 1970s. In 2000, it cemented itself as the most liquid alternative asset of the 21st century in anticipation of the credit crisis. And just recently, gold is signaling strength ahead of what looks to be an emerging sovereign debt crisis.”

Gold price

(!834 to present, log scale)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold inches higher as it attempts to recover from technical selling

Former FDIC head says all banks vulnerable to mark-to-market losses – small and large

(USAGOLD – 3/28/2023) – Gold inched higher this morning as it attempts to recover from technical selling that began at the $2000 resistance level. It is up $3 at $1962. Silver is up 1¢ at $23.17. Before the sell-off, gold had made impressive gains primarily on safe-haven buying spurred by concern about unsettling probems in the banking sector. The press touted those problems as residing mainly in the regional and community banks, but former FDIC head Sheila Bair believes the problem goes much deeper than that.

“We need to be mindful of all unmarked securities at banks — small, medium, and large,” she recently told MarketWatch. In short, the same circumstance that brought down Silicon Valley Bank – an underwater, illiquid bond portfolio – could also affect the larger banks. The subsequent collapse of Credit Suisse, which ultimately failed for the same reasons, adds considerably to her argument. A recent Columbia University study pegged the unrealized, mark-to-market losses in the banking system at $2.2 trillion, rather than the FDIC’s $620 billion figure advanced early in the crisis. Since the new rescue plan began, the Fed has added almost $392 billion to its balance sheet, which now stands at $8.73 trillion.

Federal Reserve balance sheet and gold

(Log scale, 2008-present)

Chart courtesy of TradingView.com • • • Click to enlarge

Daily Gold Market Report

Gold loses ground after encountering resistance at $2000

Fund, institutional interest signals sustained rally in yellow metal, says FT

(USAGOLD –3/27/2023) – Gold lost ground this morning in what looks to be a technical sell-off after encountering resistance at the $2000 level. It is down $23 at $1957. Silver is down 19¢ at $23.12. Financial Times reports this morning that traders in futures contracts, options, and exchange-traded funds are signaling a sustained gold rally in the weeks ahead that will potentially break all-time highs, and stay there.

“Suki Cooper, precious metals analyst at Standard Chartered, said in the days immediately following the collapse of SVB and Signature there was a massive increase in ‘tactical’ positioning as traders looked for assets considered safe havens in times of crisis,” says FT. Such capital mobilizations on the part of funds and institutions, we will add, have served as a catalyst in the past for higher prices. Similarly, CNBC posted an article calling for all-time highs in the gold price soon. One analyst, CMC Markets Tina Teng, predicted a price of $2500 to $2600 on further declines in the US dollar and bond yields.

Chart courtesy of GoldChartsRUs.com

Daily Gold Market Report

Next DGMR Monday 3/27/2023.

_____________________________________________________

Gold trades cautiously lower ahead of crucial Fed policy meeting

Fed balance sheet surges almost $300 billion in week one of bailout program

(USAGOLD –3/21/2023) – Gold is trading cautiously lower ahead of crucial FOMC deliberations amidst what many investors see as the early stages of a full-blown banking crisis. It is down $11 at $1970. Silver is down 8¢ at $22.55. Fed chairman Powell is likely to face stiff questioning at his Wednesday press conference on the inflationary implications of a rescue plan JP Morgan predicts will add $2 trillion to the Fed’s balance sheet.

“Federal Reserve Total Assets surged $297 billion last week to $8.639 TN, in one week reversing four months – and over half – of recent QT (quantitative tightening). A $10 TN balance sheet by year end would not be surprising,” says Credit Bubble Bulletin’s Doug Noland in his regular Saturday update. “I appreciate that officials last weekend believed they needed to ensure all SVB and Signature depositors to stem a potential systemic bank run. Just as the Bernanke Fed had justification for opening the floodgate for unprecedented money printing… Where does it all end? For one thing, the Fed’s balance sheet will be getting much larger. I’ll assume global central bank balance sheets will also inflate.”

Federal Reserve total assets (balance sheet)

(millions of dollars as of 3/17/2023)

Source: United States Federal Reserve • • • Click to enlarge

Daily Gold Market Report

Gold vaults over $2000 mark in overnight trading, then reverses

Follow up to biggest single-day gain in recent memory

(USAGOLD – 3/20/2023) – Gold vaulted over the $2000 mark in overnight trading, reversed course back below $2000, and is now down $6.50 on the day at $1985. Silver is down 14¢ at $22.55. The overnight volatility followed on the heels of the Swiss National Bank’s controversial bailout of Credit Suisse and the announcement of new joint central bank measures to ease liquidity pressure on the international banking system. Gold is coming off its biggest single-day gain in recent memory (+$69) on Friday. On the week, it was up 6.75%; silver was up 10.7%.

“The Fed is broke,” says Wall Street notable Jeffrey Gundlach.”The Fed’s balance sheet is negative $1.1 trillion. There’s nothing they can do to fight any problems except for printing money.” He warns of a dollar collapse. “I think gold is a good long-term hold,” he adds, “gold and other real assets with true value, such as land, gold and collectibles.” [Source: Zero Hedge]

Gold and silver price performances

(%, 5-day)

Chart courtesy of TradingView.com • • • Click to enlarge

Interested in gold but struggling

to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

11:17 pm Thu. April 25, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115