Daily Gold Market Report

Gold off to slow start ahead of Wednesday’s all-important inflation numbers

Authers: ‘Gold does like a good way to hedge the various alarming possibilities’

(USAGOLD – 4/10/20233) – Gold is off to a slow start this morning as the markets await Wednesday’s all-important consumer price report. It is down $7 at $2003. Silver is down 5¢ at $25.07. There seems to have been some calming of the animal spirits unleashed by the string of bank failures last month, though it might take some time to sort out the net impact of the Fed’s rescue plans on inflation and the future value of the dollar.

In his annual Passover Questions column, Bloomberg’s John Authers points to the latest bailout program as an important source of investor interest in gold. “It may have proved relatively easy to stopper up flights from deposits,” he writes, “but that has disturbing implications for the soundness of money. That will be particularly important for those most inclined to invest in gold…As we wait to see exactly how this rate-rising cycle will end, gold does look like a good way to hedge against the various alarming possibilities. And that’s true even though inflation is declining.”

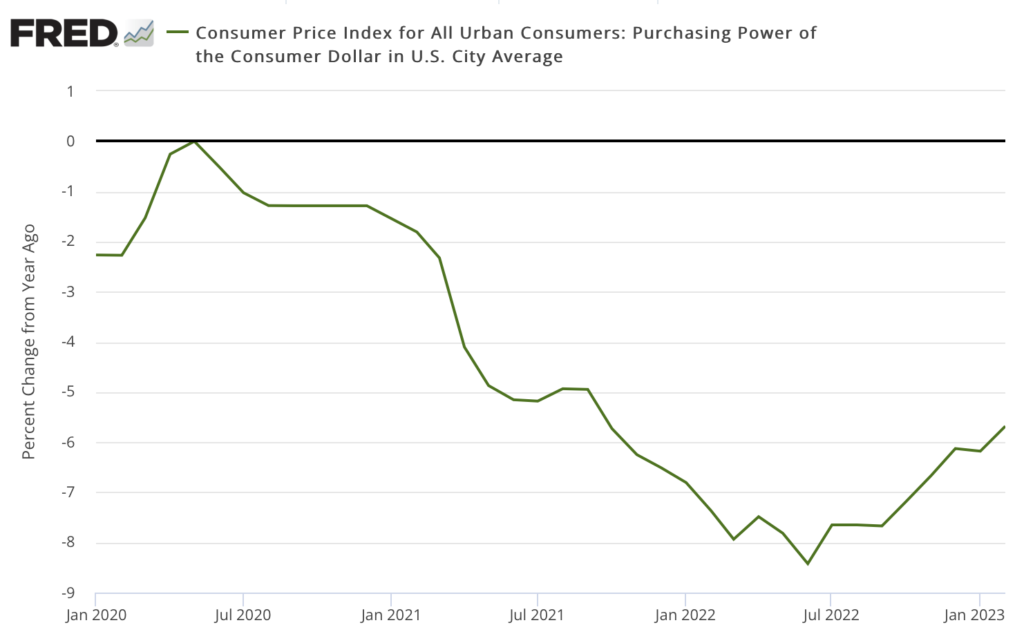

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics