Daily Gold Market Report

Gold turns to the upside after once again finding support just below $2000

London-based fund manager Ruffer offers investors a few words of wisdom

(USAGOLD – 4/18/2023) – Gold turned to the upside this morning after once again finding support just below the $2000 level. It is up $9 at $2006. Silver is up 5¢ at $25.18. Also helping gold along in today’s early going is a strong first-quarter GDP report out of China (+4.5%) led by domestic consumer demand. We came across the following bit of wisdom from London-based fund manager Jonathan Ruffer over the last weekend and thought it worth passing along, particularly in the context of declining bond markets. (The full essay is a gem and highly recommended.):

“The mischief will be centred on investment portfolios. To survive, one will have to be careful in the sorts of assets one owns. There is usually a sharp changing of the guard in markets after an event which involves illiquidity – when the refreshing waters return, it is not always to the old favourites. In the emergency, though, the jewels and the paste are all jettisoned together, and real money can be made by having the firepower to buy assets from distressed investors. This requires a strong ammunition cart of cash, or cash-equivalent: the latter has to be regularly checked to confirm that there is a genuine equivalence. I am a bit queasy writing this, in case the crisis happens… and we find ourselves locked into our ‘safe’ investments.”

Editor’s note: Though Ruffer does not mention gold in this essay (except in a historical context), his firm has recommended holding it in the past. [Please see: Gold Matters, September 2020.]

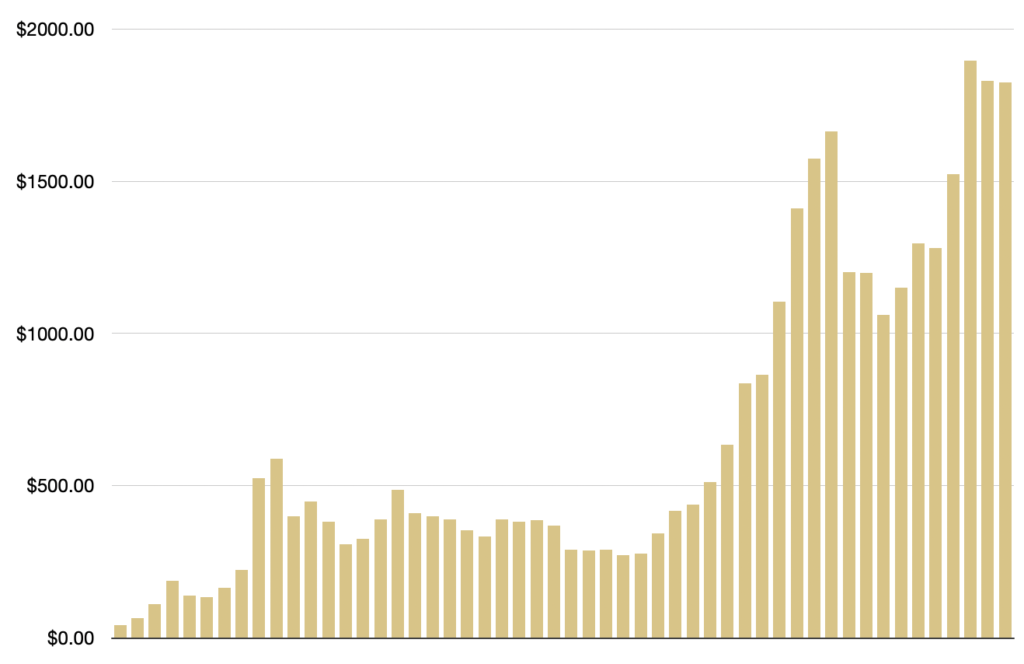

Gold Average Annual Prices

Chart by USAGOLD [All rights reserved], Data source: Macrotrends.net