Daily Gold Market Report

Gold gains ground in advance of tomorrow’s inflation numbers

Singer warns we have moved ‘demonstrably closer to a tipping point,’ recommends gold

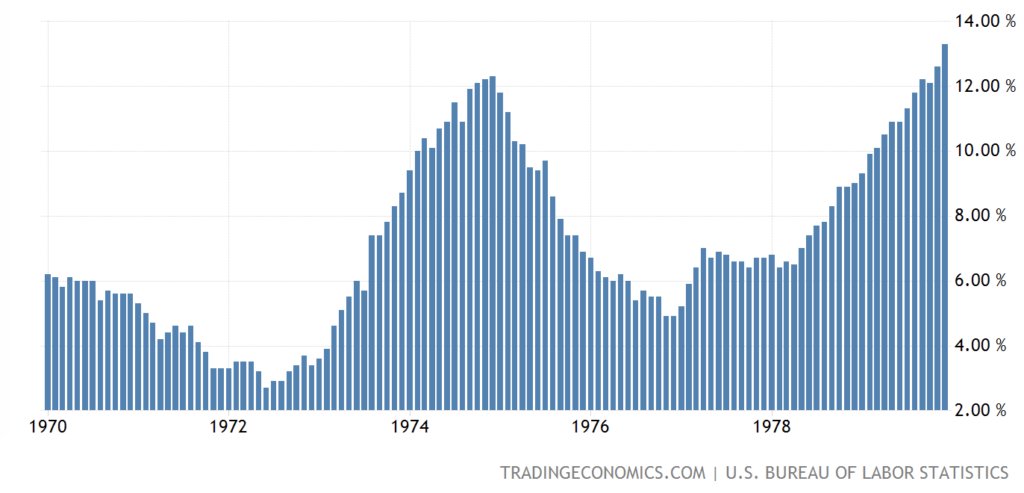

(USAGOLD – 4/11/2023) – Gold gained ground this morning in advance of tomorrow’s inflation numbers. It is up $10 at $2003. Silver is up 6¢ at $25.02. Trading Economics has the consensus CPI forecast at 5.2% annualized – a considerable drop from February’s 6% reading. Even though the inflation rate is moderating, Elliot Management’s Paul Singer reminds us that inflation retreated at times during the 1970s only to come back with a vengeance.

“We think it is very unlikely that central bankers will move to normalize monetary policy after the current emergency is over,” he wrote in his annual investor letter. “They did not normalize last time [2008 GFC] and the world has moved demonstrably closer to a tipping point after which money printing, prices and the growth of debt are in an upward spiral that the monetary authorities realize cannot be broken except at the cost of a deep recession and credit collapse.” Singer recommends owing gold saying “it is the only real money and has occupied that status for literally thousands of years.” [Source: Wall Street Journal]

US inflation rate

(1970-1979)

Chart courtesy of TradingEconomics.com