Daily Gold Market Report

Gold drifts sideways in quiet pre-Fed decision trading

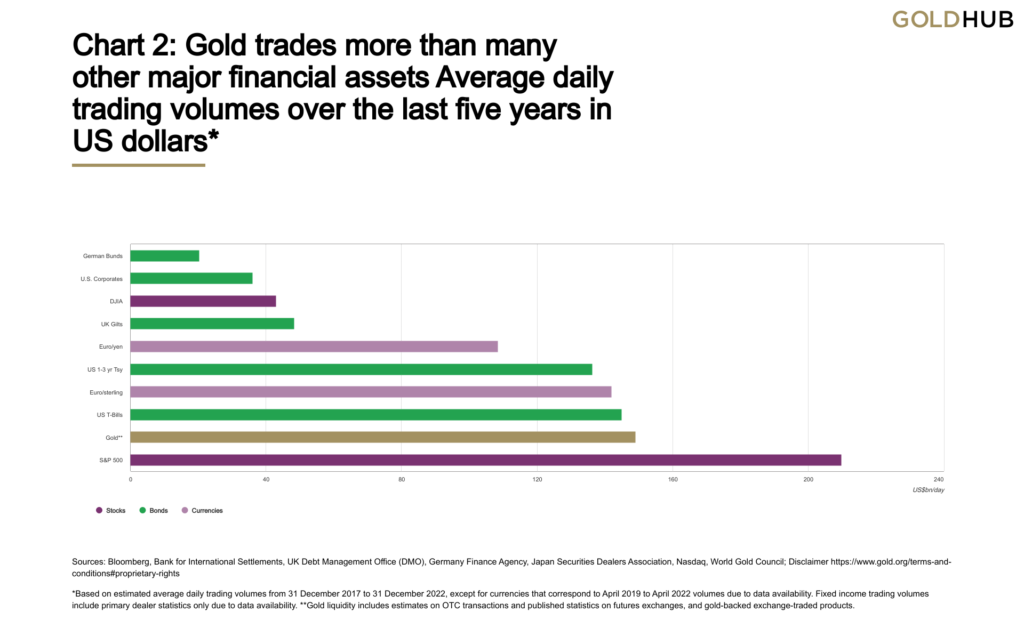

Global trading volumes for gold average $149 billion per day, second only to stocks

(USAGOLD – 5/3/2023) – Gold is drifting sideways in quiet pre-Fed decision trading. It is level at $2019. Silver is down 13¢ at $25.32. The relative calm follows sharp gains yesterday driven by growing instability in the US banking system. “It’s spooky. Thousands of banks are underwater,” Professor Amit Seru, a banking expert at Stanford University, told The Telegraph yesterday. “Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.” Such is the unsettling backdrop for the Fed’s rate decision, statement, and press conference later today.

Market liquidity is a crucial factor in judging any investment’s portfolio worthiness, especially when large amounts of money are at stake. Gold, says the World Gold Council in a recently released in-depth statistical profile, is “more liquid than many other major assets. Gold trading volumes averaged approximately US$149bn per day over the past five years, more than the Dow Jones Industrial Average and comparable to those of US 1–3-year treasuries and US T-Bills among primary dealers. The size of the market allows it to absorb large purchases and sales from both institutional investors and central banks without resulting in price distortions. And in stark contrast to many financial markets, gold’s liquidity has not dried up, even during times of financial stress, making it a much less volatile asset.”

Chart courtesy of the World Gold Council • • • Click to enlarge