Author Archives: Opinion

‘Last hike of the cycle’: economists predict Federal Reserve is done with interest rate rises

Financial Times/Colby Smith/7-26-2023

USAGOLD note: The tussle between an adamant Fed and a dubious Wall Street continues ………

FOMZZZZ… But an inflation spike could wake us yet

Bloomberg/John Authers/7-27-2023

“The Fed promised us a nonevent and it delivered — give or take a few comments. The Federal Open Market Committee did indeed raise the benchmark fed funds rate by 25 basis points to the highest level in 22 years at 5.5%. But as that outcome had been rated a 99% probability when Wednesday dawned, it came as no surprise.”

There’s a weird link between money and bees, and it goes back thousands of years

Science Alert/Adrian Dyer/7-25-2023

USAGOLD note: All about the connections between bees, honey, and money……

Fitch’s US debt-rating downgrade is bad news for stocks.

MarketsInsider/George Glover/8-2-2023

USAGOLD note: Biden’s track record wasn’t exactly glowing before the Fitch announcement. A good many analysts have warned of late that the government’s fiscal stance – and that includes both the Biden administration and Congress – has become a danger to the economy and financial markets. The yield on the 10-year Treasury jumped from 4.01% to 4.105% after the Fitch announcement.

One hell of a head fake on gold

MishTalk/Mish Shedlock/7-31-2023

USAGOLD note: Mish posts a thumbnail analysis of the current gold market and concludes: “If you have faith in central banks, sell your gold. Otherwise, I suggest hanging onto it.” Worth a visit……

Monetary vs fiscal dissonance and the return of QE

Zero Hedge/Crescat Capital/7-23-2023

“Following the COVID era, we have entered a period of fiscal dominance among major developed economies. Hence, the escalating debt burden is already near historical levels and compounding at an alarming pace. To sustain the current government spending deluge, we believe it is inevitable that the Fed and other monetary authorities reassume their fundamental role as the primary financiers of government debt.”

USAGOLD note: Crescat predicts “capital will divert away from US Treasuries and flow into gold.”

Chart courtesy of VisualCapitalist.com

The US reserve currency and commodities

Goehring & Rozencwajg/7-24-2023

USAGOLD note: In this in-depth study, Goehring & Rozencwajg say the coming rally and eventual overvaluation in commodities will likely be led by gold.

A long-time market bear who called the 2000 and 2008 crashes warns the S&P 500 could plummet 64%, bursting a historic bubble

MarketsInsider/Zahra Tayeb/7-25-2023

USAGOLD note: Hussman is not impressed by the stock market rally thus far this year. “Yes, this is a bubble in my view,” he says. “Yes, I believe it will end in tears.”

Air pockets, free falls, and more cowbells

Hussman Funds/John Hussman/July 2023

USAGOLD note: Hussman tells in detail how the stock market is breaking down and why it should be taken seriously.

It’s all about the lags

LinkedIn/David Rosenberg/7-27-2023

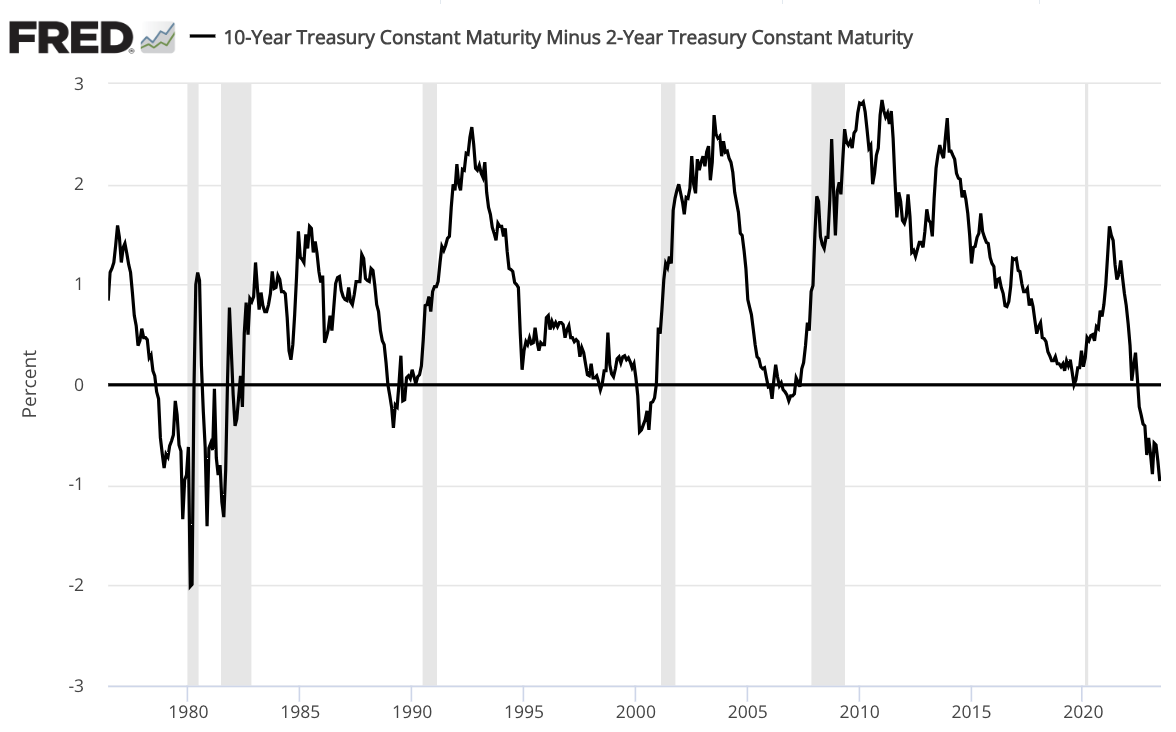

“The fact that Fed-induced curve inversions have presaged recessions 100% of the time in the past is never respected. Always a case of hope triumphing over experience. Thing is — very rarely do recessions occur in the same month as the onset of the inverted yield curve. There are lags, and that typically can be a year or longer. Think back to 2007. But like the story of the boy who cried wolf, the wolf did show up in the end.”

USAGOLD note: A heads up from Rosenberg……

Recessions follow inverted yield curves with a lag

(Grey bars = recessions)

Source. US Federal Reserve [FRED]

Citi says it’s ‘only a matter of time’ before gold hits a record

Bloomberg/Renjeetha Pakiam/7-20-2023

“The metal is benefiting from loose monetary policy, low real yields, record inflows into exchange-traded funds and increased asset allocation, the bank’s analysts including Aakash Doshi and Ed Morse said in a report. Gold is expected to climb to an all-time high in the next six-to-nine months, and there’s a 30% probability it’ll top $2,000 an ounce in the next three-to-five months.”

USAGOLD note: The report points out that prices for the metal have already posted new highs in every other G-10 and major emerging market currency this year. Silver, it says, will benefit from “demand for a store of wealth.

Our primal instinct for gold

Money Week/Dominic Frisby/7-20-2023

USAGOLD note: Frisby examines mankind’s age-old attachment to gold.

Oil markets will face ‘serious problems’ as demand from China and India ramps up, IEF secretary general says

CNBC/Charmaine Jacob/7-22-2023

USAGOLD note: Rising oil prices could have a profound effect on the inflation rate as it settles in, assuming McMonigle is right.

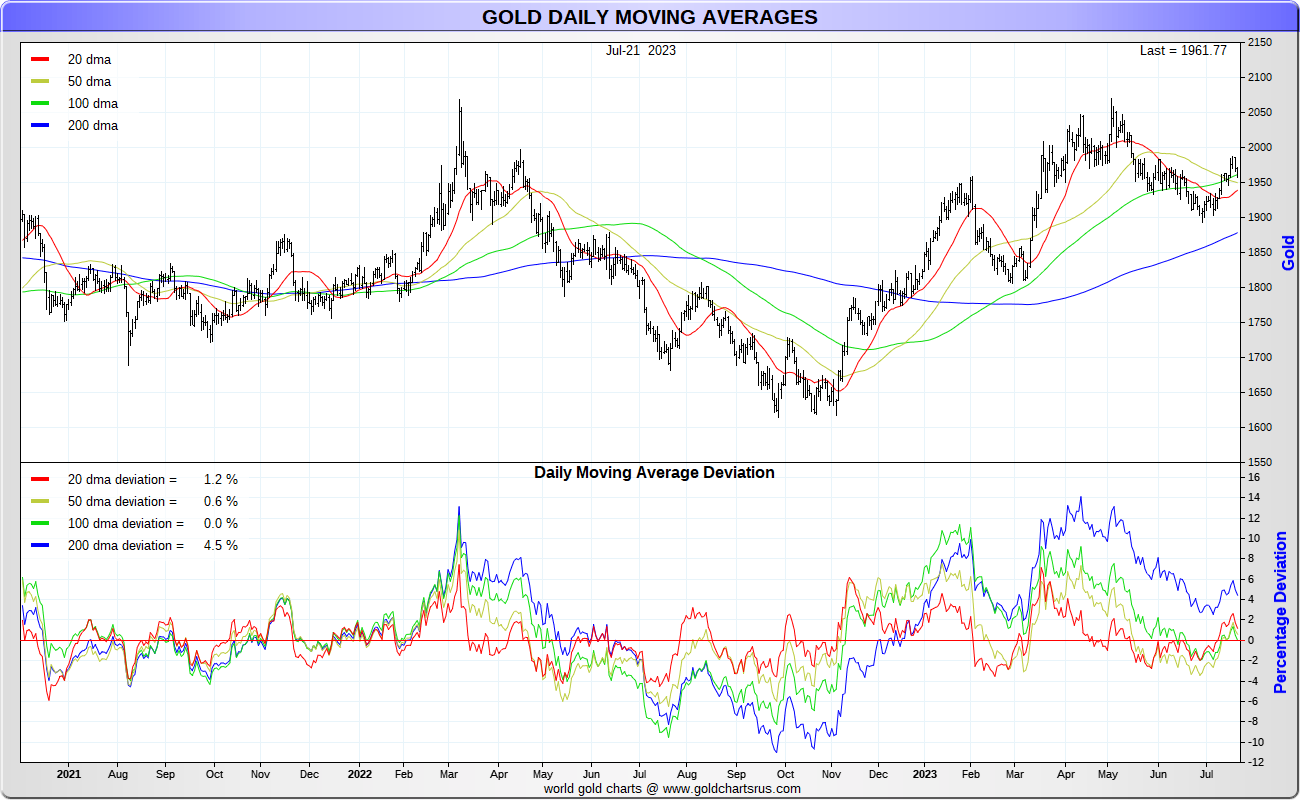

Buy gold and sell U.S. dollars, this strategist says. Here’s why.

MarketWatch/Frances Yue/7-21-2023

“When a global slowdown has been lacking, the dollar has declined at a per annum rate of -1% whereas gold has gained 10% per annum…” – Tim Hayes, Ned Davis Research, chief global investment strategist

USAGOLD note: Ned Davis Research recently downgraded the U.S. dollar from neutral to bearish and upgraded gold from neutral to bullish. It points to an important technical indicator as further evidence of the changing dollar-gold scenario. In January, gold achieved “a golden cross, when its 50-day moving average rose above the index’s 200-day moving average, while the U.S. dollar saw a death cross.” Since the January crossover, gold is up 7.75%, and the US dollar index is down 2.2%.

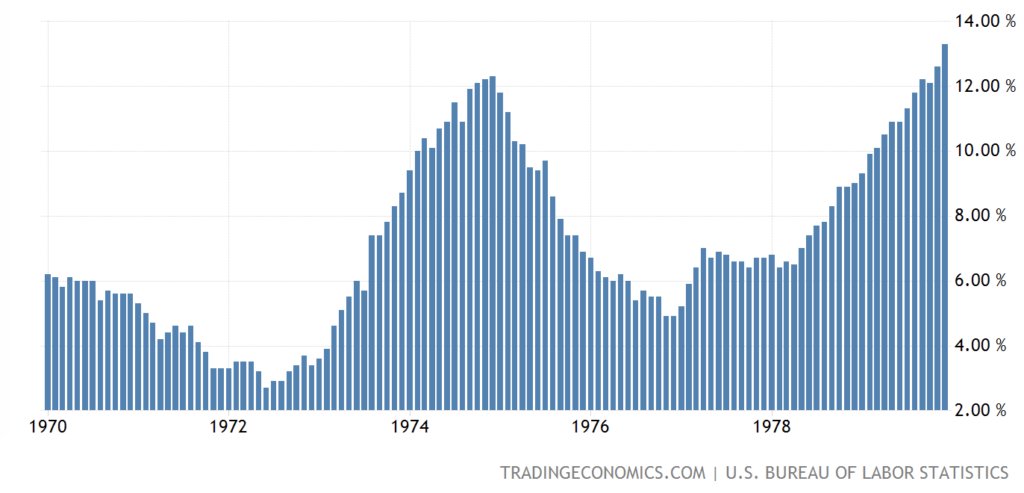

The inflation giant has awakened. Why price growth will persist.

Barron’s/Brian Swint/7-23-2023

“To the contrary, inflation is likely to be a more persistent threat than it has been in decades, owing to the long list of powerful forces that have driven prices higher, and the limits of central-bank efforts to control it.”

USAGOLD note: Anyone who lived through the decade of the 1970s can tell you that claims that inflation had been tamed were often wildly overblown.

Inflation rate 1970s

Chart courtesy of TradingEconomics.com

The role of gold in central bank reserves

USAGOLD note: Steele provides historical background on gold’s role as a central bank reserve asset and offers seven monetary functions that encourage it. All seven have to do with gold’s status as the ultimate store of value and final means of payment.

The Fed’s newfound focus on data is bad news for the sliding dollar

MarketsInsider/George Glover/7-29-2023

USAGOLD note: The most important data, as pointed out in this article, provide reasons for lowering rates which would continue to fuel the dollar’s slide against other currencies.

Defective Fed policy ensures inflation’s revival

ZeroHedge-Bloomberg/Simon White/7-28-2023

USAGOLD note: Yet another under-the-radar analysis predicting more inflation down the road – second coming……

The collapse of the risk-free delusion: Implications for the $133 trillion bond market

International Man/Nick Giambruno/July 2023

USAGOLD note: Giambruno warns that “It may be tempting to think the worst is over for bonds – it’s not. As you’ll see, the pain for bondholders is just starting.” The result he says will be a mass movement over time to reliable stores of value.

Details in multiple reports are telegraphing inflation will become a big issue in months ahead

Zero-Hedge-Bloomberg/Alyce Anders/7-28-2023

USAGOLD note: The current situation has the feel of the run-up to the inflation surge in 2020. Then purchasing managers were warning of price increases before the general public became aware of the burgeoning problem.