Daily Gold Market Report

Gold drifts marginally lower as attention turns to next week’s Fed meeting

Rosenberg predicts deflationary future, recommends ‘bond-bullion barbell’

(USAGOLD –4/28/2023) – Gold drifted marginally lower in today’s early going as markets turned their attention to next week’s Fed meeting. It is down $4 at $1986. Silver is down 14¢ at $24.90. The $2000 level for gold and the $25 level for silver have proven to be obstacles – at least for the moment. Still, as we close out April, gold is up 1.4% on the month; silver is up 7.5%.

David Rosenberg, the highly regarded Toronto-based investment analyst, says that the current trends point to “a deflationary, not inflationary environment.” He recommends Treasuries, cash, and gold as the best bets for a future that could include significant systemic risk. “The U.S. dollar,” he says In a Marketwatch interview published yesterday, “will come under downward pressure. Gold will be a great hedge against the declining greenback. I’ve been advocating the bond-bullion barbell. “

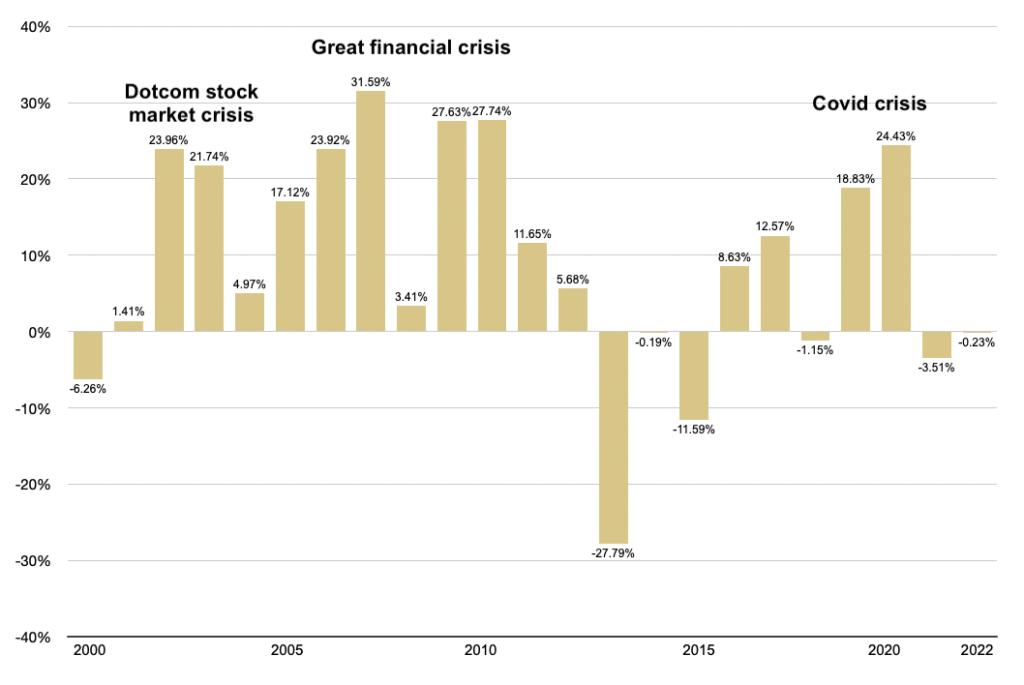

Editor’s note: As shown in the chart below, systemic crisis, not inflation, have generated the most substantial price gains for gold thus far in the 21st century.

Gold annual returns and crisis periods during the 2000s

(Year over year gains or loss, 2000 to present)

Sources: St. Louis Federal Reserve [FRED], ICE Benchmark Administration, USAGOLD • • • Click to enlarge