Monthly Archives: December 2023

Daily Gold Market Report

Daily Gold Market Report

Shanghai Pioneers $14M e-CNY Gold Trade

A New Era for Precious Metals

(USAGOLD – 12/22/2023) Gold prices are almost up a percent this morning as an underlying measure of consumer prices rose in November by less than forecast, reinforcing the Federal Reserve’s pivot toward an outlook for lower interest rates next year. Gold is trading at $2061.01, up $15.06. Silver is trading at $24.43, up 1 cents. The completion of the first-ever $14M cross-border settlement for precious metals using China’s digital yuan (e-CNY) in Shanghai marks a significant milestone. Facilitated by the Shanghai Financial Exchange International Board and the Bank of China’s Shanghai branch, this transaction showcases the growing potential of central bank digital currencies (CBDCs) in enhancing the efficiency and security of international gold trades. While the digital yuan is spearheading pilot tests and expanding partnerships globally, this development also signals a shift towards a more digitized, streamlined approach in the precious metals market. As traditional gold transactions evolve with these technological advancements, it’s crucial to recognize and adapt to the potential impact and opportunities CBDCs present for future cross-border gold purchases and the broader trade environment.

Today’s top gold news and opinion

12/21/2023

Gold gains traction among country’s investment options (China Daily)

Wealth preservation and security exceeded in importance to increasing the value of China’s wealth

Using AI to inform next-generation trading strategies (Fow)

AI tools can deliver immediate value that can be used to improve services and internal processes, often through the automation of complex tasks

Warren’s surveillance legislation is tailor-made to help big banks (CoinTelegraph)

Warren’s Digital Asset Anti-Money Laundering Act would shut crypto providers down, playing into the hands of the banking industry.

Daily Gold Market Report

Taxing Unrealized Gains

How the Moore v. U.S. Case Could Shape Future U.S. Tax Policies

(USAGOLD – 12/21/2023) Gold prices are remaining range bound as we wait for a monthly report from the Bureau of Economic Analysis due Friday morning. Six-month annualized rate expected to fall to 2% in November PCE report. Gold is trading at $2038.41, up $7.02 cents. Silver is trading at $24.25, up 11 cents. Recently reported by the Epoch Times, the case of Moore v. U.S. before the Supreme Court holds particular significance, given its potential implications for wealth preservation and taxation strategies. This case scrutinizes the 2017 Tax Cuts and Jobs Act (TCJA) and its transition from a worldwide to a territorial tax system, specifically regarding the taxation of unremitted foreign corporation profits. For gold enthusiasts, who often seek assets that retain value outside traditional currency systems and resist undue taxation, the core issue here is whether the increase in value of assets (like gold) should be considered taxable income before any actual realization event, such as a sale.

Daily Gold Market Report

Oklahoma’s Bold Move

Introducing Gold and Silver Depository for Everyday Transactions

(USAGOLD – 12/20/2023) Gold prices are remaining range bound for the time being. Gold is trading at $2035.67, down $4.68 cents. Silver is trading at $24.37, up 32 cents. It seems now that several states within a week are preparing to challenge the Federal Reserve’s monopoly on money and reintroduce gold and silver as viable, everyday currencies. A bill filed in the Oklahoma Senate (Senate Bill 1351) would establish a gold and silver bullion depository in the state. This initiative, modeled after a similar law in Texas, is designed to provide a secure storage for precious metals and to facilitate their use in financial transactions. The bill proposes a system where individuals can deposit gold and silver and use them electronically, similar to cash, through a debit card linked to their bullion account.

The bill will be introduced in the Oklahoma legislature in February for further consideration.

Daily Gold Market Report

LME to Integrate ShFE Prices in New Contracts

New Era in Global Metals Market Dynamics

(USAGOLD – 12/19/2023) Gold prices remained muted on Tuesday, with a minor increase in the dollar offsetting support from declining Treasury yields. Investors are anticipating U.S. economic data expected later this week, which could provide more clarity on the Federal Reserve’s approach to interest rates. Gold is trading at $2021.69, up $2.07 cents. Silver is trading at $23.86, flat on the day. The London Metal Exchange (LME) is set to introduce new metals contracts that will use pricing from the Shanghai Futures Exchange (ShFE), Reuters reports. This is a move that marks a significant shift in global metals markets and highlights China’s increasing influence. This initiative, termed cross-listing, involves LME metal contracts being settled against ShFE prices. This development follows a strategic change in Chinese exchanges, driven by government pressure to innovate and extend their global influence, particularly in controlling commodity prices. While the specific metals involved are not specified, copper and aluminium are likely candidates due to their high trading volume on both exchanges. The process will allow easier access to Chinese market prices for LME members but raises concerns about dependency on Chinese regulatory practices and the risks of potential future policy changes by ShFE. The success of these new contracts will depend on their ability to attract sufficient trading volume and liquidity, noting that many recent LME contract launches have struggled to achieve traction.

Daily Gold Market Report

Gold’s Bright Future

How Fed’s Shift to Rate Cuts and QE Underlines Its Value

(USAGOLD – 12/18/2023) Gold prices are staring the week flat as the market reacts to the Fed’s decision last week and as we wait for GDP data on Thursday. Gold is trading at $2021.69, up $2.07 cents. Silver is trading at $23.86, flat on the day. The Federal Reserve’s shift towards potential rate cuts in 2024 and a return to Quantitative Easing (QE) indicates a continuation of expansive monetary policy. This change is driven by the Treasury’s significant borrowing, putting upward pressure on interest rates. The Fed’s reliance on the reverse repo market to regulate liquidity has proven inadequate, necessitating a shift back to QE. This scenario mirrors the financial troubles of the 1970s, where similar policies led to severe inflation, only controlled by drastic measures under Fed chair Paul Volker. The Fed’s actions, influenced by political pressures, are likely to repeat these past mistakes, emphasizing the need for gold as a hedge against inflation and currency devaluation.

Today’s top gold news and opinion

12/18/2023

Costco gold bars were a hot holiday buy — while they lasted (Business Insider)

Sales of the one-ounce bars are limited to two per membership and sell out “within a few hours.”

Falling inflation might not dent gold’s rally (FT)

TPrecious metal can gain even if the US economy heads to a soft landing

Peak Gold—Evidence And Implications (Forbes)

Experts think peak gold may have been reached in 2018. In that year, production fell by 1%.

Daily Gold Market Report

Florida Considers Bills to Recognize Gold and Silver as Legal Tender

Floridians To Use Gold Or Silver In Both Physical And Electronic Form As Money

(USAGOLD – 12/15/2023) Gold prices are flat this morning after a highly volatile week. Gold is trading at $2035.53, down 83 cents. Silver is trading at $24.02, down 16 cents. The Florida House and Senate have proposed bills (House Bill 697 and Senate Bill 750) aimed at treating gold and silver as legal tender, potentially challenging the Federal Reserve’s monopoly on money. These bills define “specie legal tender” as specie coins issued by the Federal Government or other specie designated by the Chief Financial Officer. This legal tender could be used to pay private debts, taxes, and fees. The bills also propose the elimination of state and local taxes on gold and silver sales, thereby treating them more like money than commodities. Additionally, the legislation includes establishing a state-run bullion depository, allowing Floridians to use gold and silver for electronic transactions and daily purchases, similar to using cash. These bills will be formally introduced when the Florida legislature convenes on January 9 and must pass through committee stages to progress. Passage into law would make Florida the 12th state to have passed legislation to recognize gold and silver as legal tender, with varying degrees of implementation and provisions regarding taxation and usage.

Today’s top gold news and opinion

12/152023

Gold touches 10-day high as Fed hints at lower US rates next year (Reuters)

Palladium advances 11% in best session since March 2020

Bank of America: Bullish on gold into summer (CNBC)

The “Halftime Report” Investment Committee debate their top metal picks

China’s gold market in November: premium elevated, gold reserves rose further (WGC)

Pushing its reported gold reserves up by 12t to 2,226t

Today’s top gold news and opinion

12/14/2023

Gold’s premature FOMO surge leaves it short-term challenged (Saxo)

Gold remains on track for its best year since 2020

A Paradigm Shift in Japan’s Gold Market (SMBA)

Gold is garnering more attention in Japan than ever before

Monthly Gold Compass December 2023 (Incememtum)

Data Visualized as of end of November

Daily Gold Market Report

Gold Gains Momentum Following Fed’s Rate Hold

Markets Anticipate Rate Cuts and Lower Inflation

(USAGOLD – 12/14/2023) Gold prices are continuing upwards this morning even as the European Central Bank continues to hold interest rate steady. Gold is trading at $2038.71, up $10.97. Silver is trading at $24.13, up 32 cents. Gold prices increased by over 1% yesterday following the U.S. Federal Reserve’s announcement of a potential end to its interest rate hikes and the possibility of rate cuts in the coming year. Spot gold rose to around $2,027 per ounce. The Federal Reserve maintained current interest rates, with projections suggesting a decrease by the end of 2024. The Fed’s recognition of diminishing inflationary pressures and expectations of interest rate cuts led to a drop in yields and the dollar, boosting gold and silver prices. The dollar index fell 0.6%, making gold more affordable for international buyers. Market expectations now lean towards a 60% chance of U.S. rate cuts by March 2024. This scenario enhances the attractiveness of gold. Federal Reserve Chair Jerome Powell noted that inflation has eased without a significant increase in unemployment, though the full impact of monetary tightening may not be fully realized yet. Recent data showed stable U.S. producer prices in November, signaling a continued decrease in factory-gate inflation. Gold’s future movements could be influenced by upcoming policy meetings of the European Central Bank and the Bank of England. Meanwhile, prices of silver, platinum, and palladium also experienced increases.

Daily Gold Market Report

Growing Blockchain Tokenization of Assets

A Potential Risk to Financial Stability

(USAGOLD – 12/13/2023) Gold prices are flat as the marketplace is quiet just ahead of the end of the FOMC meeting. Gold is trading at $1982.86, up $3.32. Silver is trading at $22.64, down 13 cents. The Bank of England (BOE) has recently raised concerns about the growing trend of asset tokenization on blockchains. The BOE’s Financial Stability report highlights that while banks are increasingly positive about using crypto technologies for tokenizing money and real-world assets, this rise in asset tokenization could lead to greater systemic risks in the financial environment. “Tokenization, the process of issuing a digital representation of an asset, is a growing part of the crypto ecosystem and is forecast to become a $10 trillion market by 2030, according to asset management company 21.co,” reported by CoinDesk. These risks include increased interconnectedness between crypto and traditional financial markets and direct exposure of systemic institutions. Although the current risks are limited, the BOE emphasizes the need for continuous monitoring and global cooperation in regulation to manage potential cross-border spillovers and market fragmentation.

Today’s top gold news and opinion

12/13/2023

Commodities Outlook 2024: Cautious optimism (ING)

Precious metals are likely to move higher next year, and we see gold trading to new record highs in 2024

Inflation will have to get a lot worse to justify gold’s current price (Morningstar)

Inflation is not nearly high enough to justify gold’s recent rise to a new all-time high

Asset Tokenization on Blockchains Could Increase Systemic Risks: BOE (CoinDesk)

“International coordination can reduce the risks of cross-border spillovers, regulatory arbitrage, and market fragmentation”

Today’s top gold news and opinion

12/12/2023

China faces the risk of a debt-deflation loop (FT)

“Sustained deflation can be highly destructive to a modern economy and should be strongly resisted.”

Gold is settling after its brief burst of life; silver has a speculative overhang (City Index)

Now is the time for gold to pause for a breath, with technical factors deteriorating.

Saudi targets one million ounces of gold production by 2030 (Zawya)

Mining revenues soar by 35%

Daily Gold Market Report

Pandemic’s Psychological Impact

Disconnect Between US Economy and Public Sentiment

(USAGOLD – 12/12/2023) Gold prices are flat with the consumer price index report for November coming in at up 3.1%, with the core rate (minus food and energy) coming in at up 4.0%. Gold is trading at $1981.58, down 37 cents. Silver is trading at $22.85, up 3 cents. Reuters published an article citing a Chicago Federal Reserve study that found a disconnect between the U.S. economy’s performance and public sentiment since the onset of the COVID-19 pandemic in spring 2020. Researchers noticed a decline in optimism for economic outcomes, a change from the historical correlation between economic conditions and consumer and small business sentiment. Possible reasons include higher price levels and altered unemployment expectations. The pandemic’s psychological impact and its influence on economic behavior, has cut deep. In its Stress in America 2023 report last month, the APA said the country was “recovering from collective trauma” that may be rooted in the pandemic but has sources far beyond it, including economic ones.

Daily Gold Market Report

China’s Economic Downgrade

A Deep Dive into Soaring Debts and Global Impacts

(USAGOLD – 12/11/2023) Gold and silver prices have slightly decreased in early trading on Monday in the U.S. Recently, the short-term chart positions for both metals have worsened, particularly for silver. Gold is trading at $1992.68, down $11.99 cents. Silver is trading at $22.88, down 12 cents. Attributed to the country’s soaring government debt and sluggish economy, Moody’s lowered its outlook for China’s sovereign bond rating from stable to negative. Government debt is a growing global concern, statistics from the IMF are showing alarming levels of debt in various economies: the Euro Zone at 85% of GDP, Britain at 98%, the US at 150%, and Japan at 263%.

Today’s top gold news and opinion

12/11/2023

Further consolidation required? (Goldmoney)

Conditions are set to remain tight in physical markets

Gold Has Been An Excellent Barometer In The 2000s (Forbes)

The great missed opportunity of the 1980s and 1990s was not to reintroduce a formal gold standard when gold was low..

Gold’s Fickleness Makes It Bitcoin for Boomers (Bloomberg)

The yellow metal has become untethered from financial fundamentals

…

Daily Gold Market Report

World Gold Council: Gold Outlook 2024

The Global Economy Faces Three Likely Scenarios In 2024

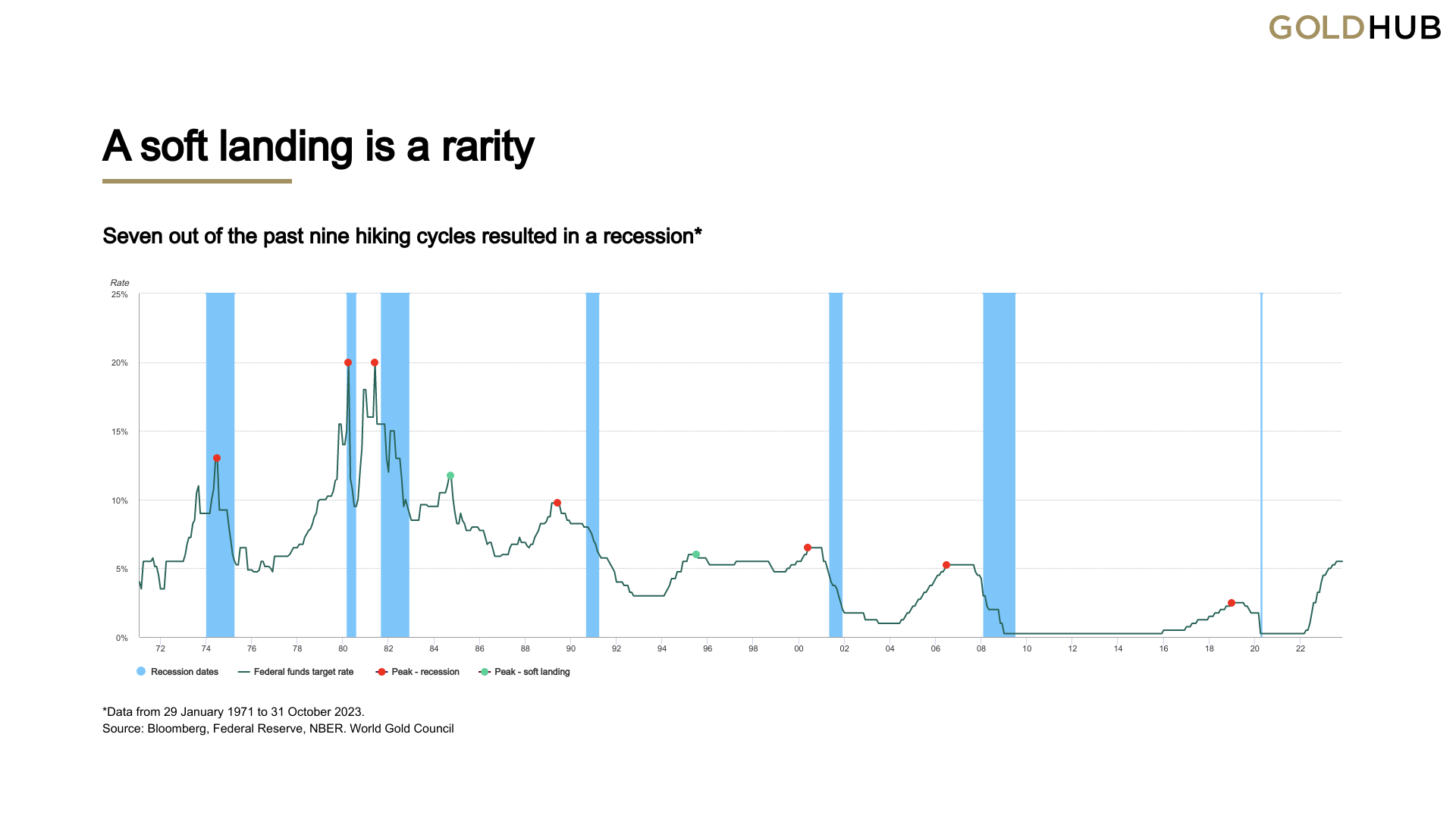

(USAGOLD – 12/08/2023) The gold market is experiencing significant downward pressure due to the U.S. economy’s unexpected surge in job creation, which is concurrently reducing the unemployment rate. Gold is trading at $2,010.15, down $18.32 cents. Silver is trading at $23.35, down 45 cents. The “Gold Outlook 2024” report by the World Gold Council presents three potential scenarios for the global economy in 2024: a soft landing with moderate economic slowdown and stable to slightly decreasing gold prices; a recession, where gold may rise in value as a safe-haven asset; and a less likely no landing scenario, with continued economic growth and persistent inflation, where gold’s behavior could vary based on inflation rates and investor sentiment. Each scenario reflects different impacts on gold prices, influenced by economic conditions and market responses.economic conditions and investor behavior.

While the markets lean towards the Federal Reserve achieving a soft landing, this outcome is challenging to attain. In the past five decades, the Fed has only successfully managed a soft landing twice in nine tightening cycles, with the remaining seven leading to a recession. This trend is expected, as prolonged higher interest rates typically exert pressure on financial markets and the broader economy.

Today’s top gold news and opinion

12/08/2023

Gold could hit $2,200 by the end of 2024: UBS (CNBC)

why macroeconomic factors, not geopolitics, will send gold prices higher in 2024

Silver Price Forecast (Nasdaq)

Silver Attempts to Stabilize

The Ghost of Vibecessions Past Is Haunting Our Holidays (Bloomberg)

Biden administration officials telling voters the economy is in excellent shape only adds insult to injury….