Daily Gold Market Report

Gold down marginally in follow-up to yesterday’s solid gains

Frank Holmes cites three “unique catalysts” that could push gold higher

(USAGOLD –4/4/2023) – Gold is down marginally in early trading in the follow-up to yesterday’s solid gains influenced by OPEC’s production cut and lingering concerns about the banking system. It is down $3 at $1984. Silver is down 3¢ at $24.00. US Global Investors‘ Frank Holmes sees “dedollarization” as the critical factor that could push gold higher. In addition, he sees the return of quantitative easing and the developing cold war between the United States and China/Russia as catalysts for potentially higher gold prices.

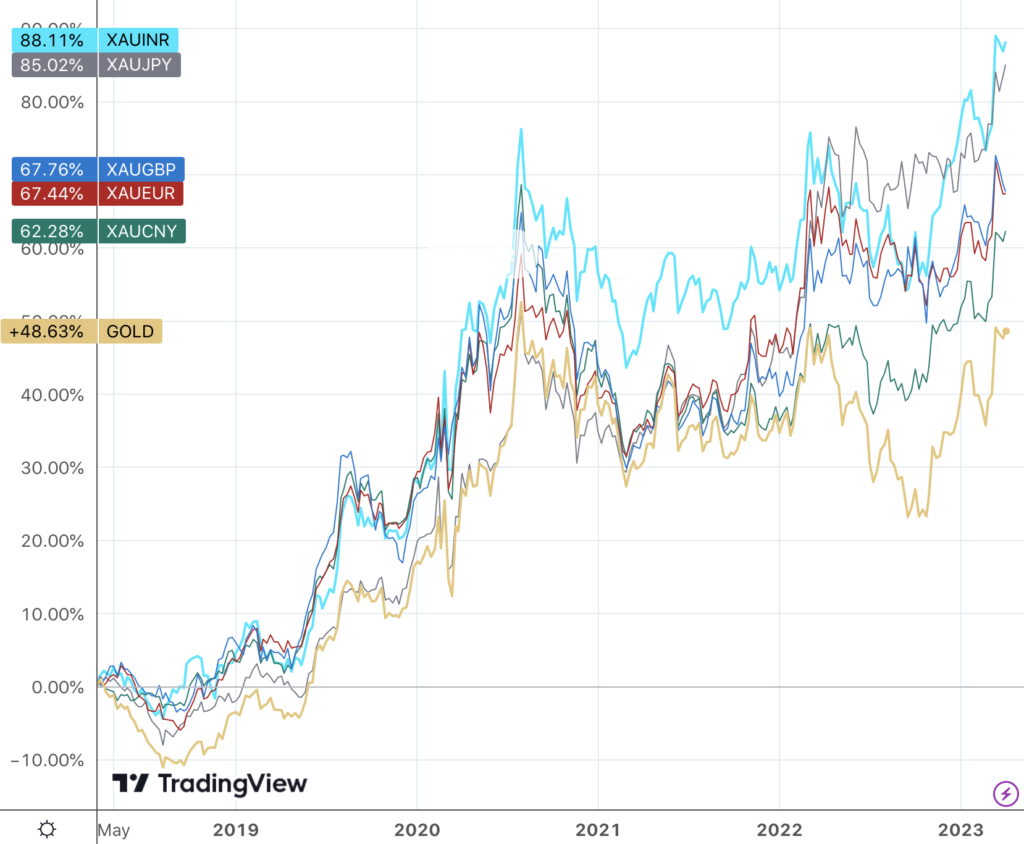

“Gold would be a direct beneficiary of dedollarization since it’s priced in the greenback,” he says. “Gold is trading at or near all-time highs in a number of currencies right now, including the British pound, Japanese yen, Indian rupee and Australian dollar, and it would likely be hitting new highs in USD terms as well were the dollar to be devalued.” He advises that” if you’re underexposed or have no exposure, it may be time to consider changing that.”

Gold price performance in key currencies

(%, five-year)

Chart courtesy of Trading View.com • • • Click to enlarge