Daily Gold Market Report

Gold bolts higher as CPI comes in lower than expected

UBS predicts $2200 gold by March next year

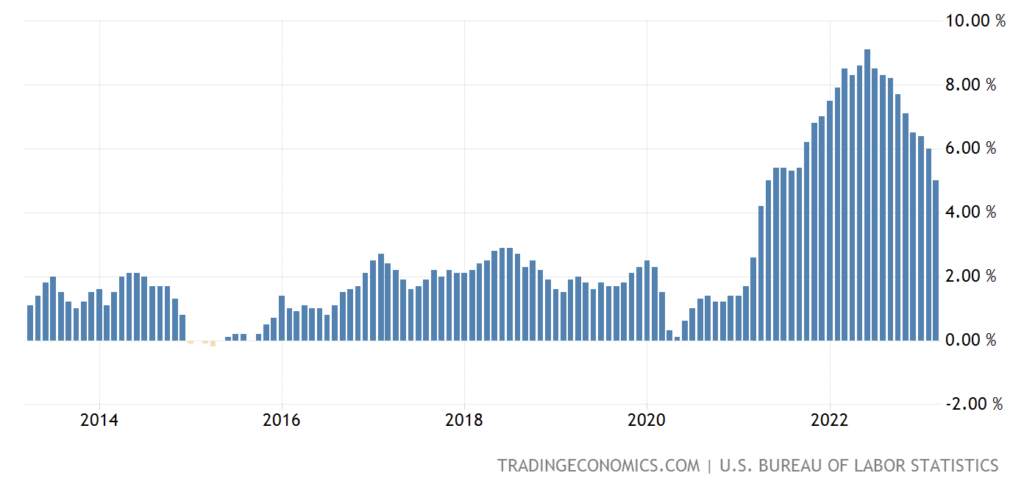

(USAGOLD – 4/12/2023) – Gold bolted higher after the US inflation report came in lower than expected at 5%. It is up $19 at $2025. Silver is up 54¢ at $25.67. The consensus was that the CPI would come in at 5.2%, an already steep drop from last month’s 6% reading. The markets are likely to read leeway for the Fed in today’s report, further weakening of the dollar, and the potential for more upside in precious metals prices.

Here are a couple of quick insights to start your day:

“Gold tends to rise when the US Dollar is weakening, and downside risks to the greenback have risen alongside money market pricing of Federal Reserve rate cuts. While volatility can be expected in the near term, we now expect the precious metal to hit $2,100 by year-end, and $2,200 by March 2024.” – UBS analysts [Source: ForexStreet]

“When the banking crisis emerged last month, I quoted Warren Buffet’s famous saying that ‘there’s never just one cockroach in the kitchen.’ While we don’t know what the next crisis will be, we — and gold — know that one is coming. Whether it’s a resumption of the banking crisis or some other event, you don’t raise interest rates at the steepest pace since Paul Volcker, after employing the easiest monetary policy in his- tory for well over a decade, without breaking something. Something else is going to break…at some point this year…and gold is telling us this now.” – Brien Lundin [Source: Gold Newsletter]

United States Inflation Rate

(2012 to present)

Chart courtesy of TradingEconomics.com