Featuring top analysts. Updated regularly.

Gold is getting its glitter back

Bloomberg/Merryn Somerset Webb/1-15-2023

USAGOLD note: Webb says the market has “kneecapped” the idea of cryptocurrency rivaling gold and says if you want to own gold, you will need to buy gold.”That being the case,” she adds,” the question is not have you too much, but have you enough — the very same question the head of the PBoC is clearly asking himself right now.”

‘Dr. Doom’ Nouriel Roubini says the Fed will wimp out on its inflation fight and gold is the best protection as volatility batters the economy

MarketInsider/Jennifer Sor/1-13-2023

“‘There is so much debt in the system that an attempt to reduce inflation not only causes an economic crash, it causes also a financial crisis,’ Roubini said. ‘They will feed on each other, and faced with an economic and financial crash, the Fed and other central banks are going to have to wimp out, blink, and not raise interest rates as much.'”

USAGOLD note: Roubini recommends gold as “the best bet” to hedge what he sees as an oncoming financial disaster. He says it has the potential to reach $3000 per ounce by 2028, and has become increasingly vocal about his gold recommendation in recent weeks.

Go for gold, and a few other investing tips for surviving years of financial repression

Toronto Star/Russell Napier/1-2-2023

USAGOLD note: A must-read from Russell Napier – a market analyst widely followed by other market analysts.…… Napier believes gold will glitter in an atmosphere in which central banks keep interest rates below the inflation rate. The rise in inflation, he says, will not be matched by a rise in interest rates. He describes the process as “financial repression” and predicts it will be in place for at least a decade.

Gavekal touts emerging markets and gold for 2023

the market NZZ/Mark Dittli interview of Louis-Vincent Gavekal/12-23-2022

USAGOLD note: Gavekal is the widely followed founder of Hong Kong-based research group bearing his name. “I think we have seen peak hawkishness,” he says,” but we haven’t seen peak inflation. We don’t have a lot of modern examples of inflation in the industrialised world, and nobody who is still active in markets really remembers the Seventies”

Long-time gold bear JC Parets turns bullish; $5,000 possible

Forbes/Simon Constable/12-27-2022

USAGOLD note: It’s always heartening to hear that a long-time bear has gone bullish. In Paret’s case, he does it in a big way.

Gold buyers binge on biggest volumes for 55 years

Financial Times/Harry Dempsey/12-30-2022

USAGOLD note: We have likened the current central bank gold-buying spree to a similar event in the late 1960s when European nation-states drained gold from the U.S. Treasury to buttress their reserves against dollar debasement. FT makes the same reference in this article. Ultimately, the United States was forced to devalue the dollar and dismantle the Bretton Woods monetary architecture, giving birth to the fiat money and launching a decade-long bull market in gold. The World Gold Council estimates central banks bought 673 tonnes thus far in 2022 – the largest annual amount in 55 years.

Goldman says commodities will gain 43% in 2023 as supply shortages bite

Bloomberg/Paul Wallace/12-15-2022

“Commodities will be the best-performing asset class once again in 2023, handing investors returns of more than 40%, according to Goldman Sachs Group Inc. The Wall Street bank said that while the first quarter may be “bumpy” due to economic weakness in the US and China, scarcities of raw materials from oil to natural gas and metals will boost prices after that.”

USAGOLD note: If Goldman is right that commodity prices are about to reignite, it will blow a hole in the peak inflation narrative now making the rounds. It predicts oil will go to $105/barrel from the current $82, and that copper will go from its current price of $8400 per tonne to $10,050. Gold and silver are not mentioned in this article.

Chart courtesy of TradingEconomics.com

The precious metals sector may have started a sustainable bull cycle

Investment Research Dynamics/Dave Kranzler/12-12-2022

USAGOLD note: Kranzler delves into some of the behind-the-scenes developments lending themselves to an improved technical picture for the yellow metal.

Gold Outlook 2023: The global economy at a crossroads

World Gold Council/Staff/12-8-2022

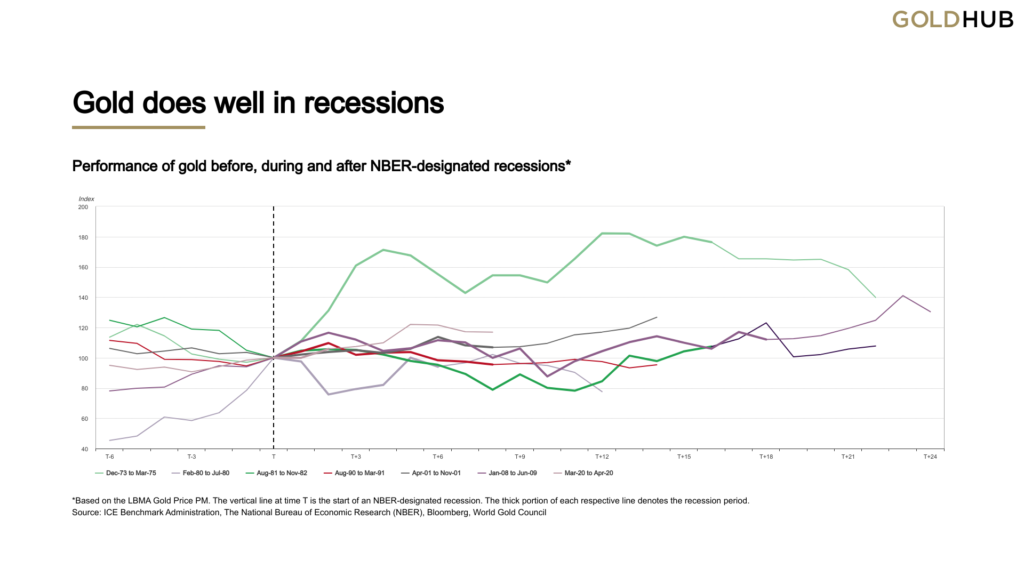

“[Gold] could provide protection as it typically fares well during recessions, delivering positive returns in five out of the last seven recessions (See chart below). But a recession is not a prerequisite for gold to perform. A sharp retrenchment in growth is sufficient for gold to do well, particularly if inflation is also high or rising.”

USAGOLD note: WGC goes on to say that the economy might not follow a “well-telegraphed path” in 2023 warning that “hypervigilant central banks” might overtighten resulting in “more severe economic fallout and stagflationary conditions.” That would be “a considerably tough scenario,” it says, “for equities with earnings hit hard and greater safe-haven demand for gold and the dollar.” It goes to say that the “interplay between inflation and central-bank intervention” will be a key determinant in gold’s performance. It sees challenges ahead for global central banks “as the prospect of slower growth collides with elevated, albeit declining inflation” – in short, the early stages of stagflation.

Chart courtesy of the World Gold Council • • • Click to enlarge

Extracting gold trend signals from the futures market

Seeking Alpha/World Gold Council/8-6-2022

USAGOLD note: In that the price of gold is determined in the futures market, this analysis from the World Gold Council takes on special meaning. For more on this report, please see yesterday’s DMR.

Why gold will benefit from the inevitable reshaping of the international monetary system

GoldSwitzerland/Ronni Stoferle/4-15-2022

“The ‘militarization of currency reserves’ has deprived the world’s reserve currency, the US dollar, of its neutrality, a neutrality that is indispensable for a universal currency. The euro and other Western countries who are potential competitors for the US dollar’s position have taken themselves out of the game immediately. … Therefore, 50 years after the closing of the gold window, the chances are that gold may play a role again in the inevitable reshaping of the world monetary order. Gold is politically neutral, it does not belong to any state, political party or institution. This neutrality could serve as a bridge of trust between the geopolitical power blocs that currently seem to be emerging.”

USAGOLD note: In order for gold to play a meaningful role in the reorganization of the international monetary system, the price will have to be adjusted upwards, according to Stoferle – perhaps radically upward. We recommend the full analysis at the link. It offers considerable food for thought. We will add that gold serves the same purposes in the private investment portfolio that it does in the reserve holdings of nation-states and their central banks.

Commodity prices are going haywire, prompting fears of the next financial crisis

MaketWatch/Chris Matthews/4-19-2022

USAGOLD note: There are so many fires lit in the financial markets these days, that it will be difficult for the Fed to determine which one it should put out first. Some are worried about a speculative crisis suddenly enveloping the commodities space. “… [I]nstead of enacting position limits that work, which would bring prices more in line with supply and demand,” warns one analyst, “we have large banks advising clients to shift more of their portfolios into commodities as a so-called inflation hedge.”

Are gold prices heading for another breakout past $2,000/oz?

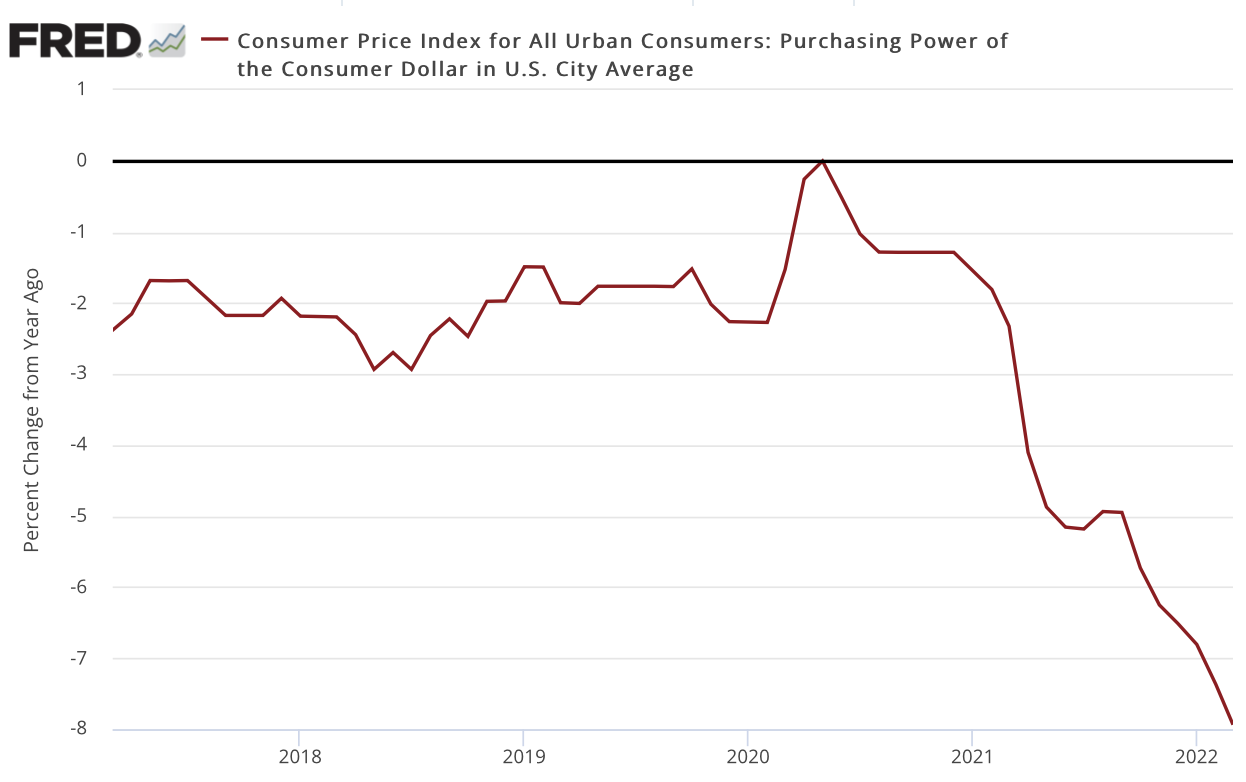

GulfNews/Ned Naylor-Leyland/4-18-2022

“People are interested in gold because they are worried about future purchasing power. The market is still considering whether the US Federal Reserve (Fed) will be able to raise interest rates as much as seven times this year and whether or not inflation will materially weaken. In my view, this is why gold hasn’t broken out properly yet — the market is focused on relatively hawkish observations.”

USAGOLD note: Naylor-Leyland lays out why investors and central banks own gold. It is not simply because it shines and is beautiful to look at. We referenced this report in Tuesday’s Daily Market Report and repost it here for those who may have missed it. Many of our readers will be surprised by the graph below. The U.S. dollar has lost 8% of its purchasing power over the past year.

Purchasing power of the U.S. dollar

(Percent change year over year)

Sources: St. Louis Federal Reserve [FRED]. U.S. Bureau of Labor Statistics

Hedge-fund giant Man Group questions whether 60/40 ever worked

Bloomberg/Vildana Hajric and Michael P. Regan/4-16-2021

“Where we are now is a bit different. We’re in a universe of equities and bonds going down together. There’s a lot of instability. That instability is disconcerting. If they’re both going down, I need to find things that don’t behave like bonds and equities, which means commodities.” – Peter van Dooijeweert, Managing Director, Man Group

USAGOLD note: During a time of secular currency debasement, both stocks and bonds lose value simply on a purchasing-power basis if they do not keep up with or better inflation. Bonds, at present, are in particularly dire straits losing both principal and purchasing power at the same time. In a separate study posted last June, Man Group lists gold and silver as two assets to which investors fled during past episodes of inflation and were rewarded with double-digit returns. The firm also suggest acting sooner rather than later. Man Group is the world’s second largest hedge fund behind Bridgewater Associates. Bridgewater also holds a large position in commodities.

Basel Accord spells opportunity for gold

OPINION

Rogue Economics/Nomi Prins/4-12-2022

USAGOLD note: There has been considerable discussion on the impact of the new Basel III accords on the gold market over the past couple of years. It all takes on renewed importance, though, with inflation now part of the equation. Nomi Prins offers a solid overview of how commercial banks might perceive gold once the accords take effect in January of next year. Worth the review………at the link. She says one of the simplest ways to take advantage of what she sees as a positive outcome for the yellow metal is to own gold bullion coins like the American eagle or Canadian Maple Leaf.

Here’s the playbook if the rest of the world breaks free from the U.S. dollar, says Credit Suisse’s monetary plumbing guru

MarketWatch/Steve Goldstein/4-13-2022

“Without price stability, there is no exorbitant privilege or dollar supremacy, says Pozsar.”

USAGOLD note: And the currency markets, we would guess, turn into some version of a monetary wild west where anything goes in the pursuit of commodities. He says to short the dollar, among a handful of trading options. The standard approach for accomplishing that objective is to buy precious metals, as Pozcar himself has indicated from time to time.

Zoltan Pozsar sees a world of problems money can’t solve

Bloomberg/Joe Wiesenthal and Tracy Alloway/4-7-2022

“Out of this, I think this ‘Bretton Woods III’ that I started to kind of develop and run with, is a world where we are, again, going to go back to commodity-backed money — where gold, once again, is going to play a big role. And not just gold, but I think all forms of commodities.” – Zoltan Pozsar, Credit Suisse

Gold and recessions: What you need to know

Munknee/Lorimer Wilson/3-30-2022

“Depending on the length of the recession and the factors affecting the gold price, including inflation, currency value, demand and supply, there can be some fluctuations within the recessionary period but, in general, in recent history, the price of gold has maintained its value or outperformed other asset classes during times of economic instability …”

USAGOLD note: We live in a time when even money market accounts can become destabilized as a result of a credit market breakdown. In the early months of a recession investors seek gold as a safe-haven and hedge against systemic risk and financial market weakness. Thereafter, the demand can accelerate, as it did in 2009, if and when the Fed steps in with more quantitative easing (i.e, money printing) to turn the recessionary tide, or better put, to save the financial system.

A new world of currency disorder looms

Financial Times/Martin Wolf/3-29-2022

“Useful monies are those of open economies with liquid financial markets, monetary stability and the rule of law. Yet the weaponisation of those currencies and of the financial systems that handle them undermines those properties for any holder who fears being targeted.”

USAGOLD note: For attuned investors and nation-states alike, “a new world of currency disorder” translates to gold ownership. Under the new rules of the game, those who manage national reserves would be considered imprudent if they neglected the potential for their economy to be so targeted. And, yes, we do think that the demand for physical gold in the official sector will be a likely result. Wolf mentions gold as one of “four replacements to today’s globalized national securities,” the others being private currencies like bitcoin, a global fiat currency, or another national currency, “most obviously China’s.” An important read at the link ……

The newest case for gold

Daily Reckoning/James Rickards/3-23-2022

USAGOLD note: We referenced Rickards’ latest on gold in yesterday’s Daily Market Report and repost the link here today for those who may have missed it. Rickards, to put it in a nutshell, is not as optimistic as some on Wall Street or in the press. “It’s important to buy gold now,” he says, “because this process is just beginning.”

Ukraine war accelerates the stealth erosion of dollar dominance

Financial Times/Barry Eichengreen/3-28-2022

USAGOLD note: The dollar has gone from 70% of reserves in 2002 to 59% today, the result of a deliberate move on the part of central banks to diversify away from the U.S. currency. Eichengreen believes we are moving toward a multi-polar reserve system. He does not mention gold, but it is difficult to think about central banks moving away from the dollar in a serious manner without considering gold the prime substitute – the one currency that cannot be printed into existence.

U.S. Mint sees strongest gold bullion demand in 23 years

Kitco News/Neils Christensen/4-4-2022

USAGOLD note: “Physical as well as investment demand remains solid for the simple reason investors (retail and professional) see inflation everywhere.” says Saxo Bank’s Ole Hansen. And few see that input changing anytime soon.

Opinion: Russia just made a case for owning gold — and nobody noticed

MarketWatch/Brett Arends/3-28-2022

“Much more interesting was Zavalny’s main point, even though it has been mostly overlooked. If other countries want to buy oil, gas, other resources or anything else from Russia, he said, ‘let them pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency.’”

USAGOLD note: The implication, according to Arends, is that Russia would convert those hard currencies to gold. He goes on to say that he is “gold agnostic” but that there should be “at least some gold in a long term investment portfolio. “Gold is gold,” he says, “and someone will always take it.”

When it comes to buying silver, mint’s hands are tied

Numismatic News/Patrick Heller/3-25-2022

USAGOLD note: Heller puts his finger on the real reason the Mint is having problems securing silver for coin production. It’s always been a case of the paper market tail wagging the physical dog in precious metals pricing. When demand booms, shortages occur and premiums rise – precisely what is occurring in the silver market as this note is written.

Commodity traders sound alarm on plunging market liquidity

YahoonFinance/Bloomberg-Archie Hunter and William Manthis/3-24-2022

USAGOLD note: This report sheds light on a situation that previously was developing under the radar. These are the sorts of problems the Fed has stepped in to defray in the past with quick liquidity. The worry here is the potential contagion effect as margin calls beget margin calls. The potential for a major crisis looms……Beware the black swan.

Don’t trust the banks. Buy gold.

LinkedIn/Stephen Leeb/3-23-2022

“Do not trust the paper price being quoted for commodities. Evidence of resource scarcities is pervasive and can be seen on a chart of nearly any commodity. The commodity indexes I pay most attention to are spot indexes that report on actual prices paid by end-users. These are a better guide to what is going on than paper and future prices, which are subject to speculation and even manipulation.”

USAGOLD note: Leeb ends by saying that the best thing you can do for yourself right now is to buy protection and that means investing in gold and silver.

Gold and the CRB Index

(One year)

Chart courtesy of TradingEconomics.com

The bubble in gold and silver is about to begin

Munknee/Lorimar Wilson/3-18-2022

USAGOLD note: Wilson goes on to say that the World Economic Forum is calling for an asset bubble burst sometime between 2023 and 2025. “This,” he says, “means that the sky is the limit for gold and silver” with the risk that we head lower first. We recommend the link at the top for the full rationale.

Inflation-obsessed investors can’t get enough of commodities

Bloomberg/Alex Longley and Mark Burton/2-23-2022

“Investors are pumping more money into commodity funds than at any time in the last decade, enticed by red-hot inflation and a futures market offering big profits.”

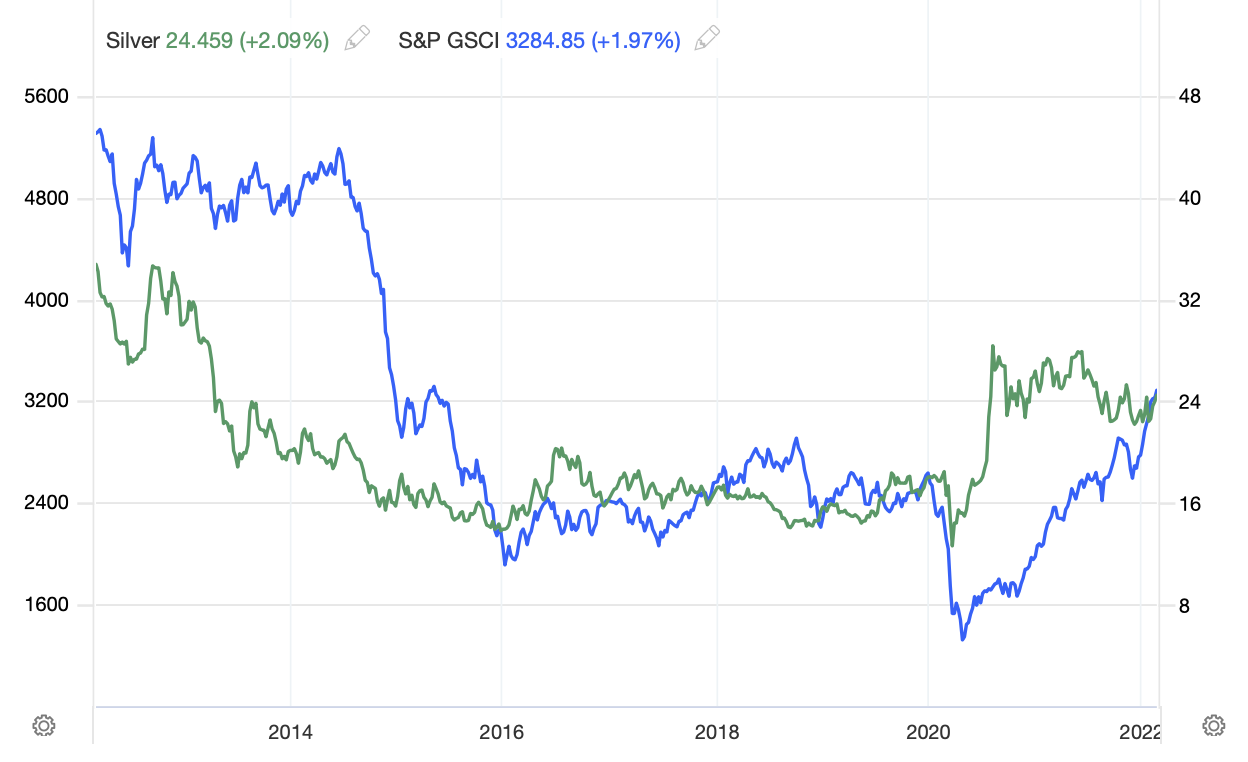

USAGOLD note: We referenced this important article in yesterday’s Daily Market Report and repost it here for those who may have missed it. Silver can serve as a viable proxy for those who would like to participate in the potential commodities boom in a simplified way. The chart below shows that it has a history of trading in concert with the commodities complex – though not with unerring exactness. In addition to the commodities market exposure, you get the added benefit of owning what many now view as a safe haven and store of value alternative to gold. Too, you can buy and take delivery of the metal itself – something you could not do with most commodities unless you happened to own a very large warehouse. We can help you set up an allocated safe storage account enabling you to buy and sell the metal with a phone call.

Silver and the S&P Goldman Sachs Commodity Index

(Ten-year)

Chart courtesy of TradingEconomics.com

Where we are in the big cycle of money, credit, debt and economic activity and the changing value of money

“Most people worry about whether their assets are going up or down; they rarely pay much attention to the value of their currency. Think about it. How worried are you about your currency declining? And how worried are you about how your stocks or your other assets are doing? If you are like most people, you are not nearly as aware of your currency risk as you need to be.”

USAGOLD note: Dalio goes on to recommend gold as one of the ways to preserve wealth when the currency is deteriorating.

Gold thrives in rate-hike cycles

Seeking Alpha/Adam Hamilton/2-19-2022

“Gold-futures speculators’ most-feared hobgoblin is Fed-rate-hike cycles. These super-leveraged traders wielding outsized influence on gold prices flee in terror when rate hikes loom. The resulting heavy selling hammers gold sharply lower, damaging sentiment. But these myopic speculators apparently have no history books, as gold actually thrives during Fed-rate-hike cycles! They’ve proven very bullish for this asset.”

USAGOLD note: Hamilton states the thesis per the above, then lays out the proof in full detail. “Investors flock back to gold during Fed-rate-hike cycles,” he concludes, “because they are bearish for stock markets and threaten or trigger economic recessions. Gold is remembered and bought since it tends to power higher on balance as stock markets weaken. Gold’s upside potential in this next hiking cycle is way bigger than normal due to the raging inflation the Fed’s extreme money printing unleashed, driving bubble-valued stocks.”

Gold price hits record in Japan on fear of yen stagflation

NikkeiAsia/Harukr Kitagawa/2-22-2022

“The price of gold in Japan rose to its highest level ever on Monday, driven by what analysts say is a combination of geopolitical risk and worries over a weakening yen.”

USAGOLD note: Stagflation is a global concern. One analyst is quoted as saying that even young people are buying gold “out of concern about being able to maintain purchasing power into retirement.” Keep in mind that Japan has been mired in a near deflationary economy for decades. Is gold’s record-breaking performance in terms of yen a sign of things to come for other currencies?

Gold price in Japanese yen

Chart courtesy of TradingView.com

Gold outperforms stocks and bonds as traders seek haven assets

Financial Times/Neil Hume/2-19-2022

USAGOLD note: Over the past week, a narrative has developed around gold that it could become a primary beneficiary whatever policy direction the Fed takes. That, some say, is the reason for gold’s strong showing thus far this year. If the Fed fails to tighten sufficiently, inflation rages, and gold goes on a tear as a currency hedge. If it tightens too much, the prospect of credit failures and black swan events moves front and center, and gold goes on a tear as a safe-haven alternative. Hume’s article emphasizes the latter, citing strong inflows at gold ETFs comparable to previous times “when recession fears were at the front of investors’ minds.”

Fred Hickey on Ukraine crisis and gold

USAGOLD note: Fred Hickey offers a thought on the limits of central banking worth filing for future reference. It’s not just the Ukraine crisis we need to worry about. The limitations apply across the boards.

Fed rate hike will cause hyperinflationary Great Depression

USAWatchdog/Greg Hunter interview of John Williams/2-8-2022

USAGOLD note: Though we see a hyperinflationary depression as an outlier, we do think runaway stagflation is a legitimate concern. Williams says you can address the possibility of a hyperinflationary depression by “personally holding gold and silver.” The same worked well as a hedge during stagflationary1970s – a lesser version of Williams’ worst-case scenario.

Frank Giustra – “I have always loved real, tangible assets such as gold, commodities and real estate.”

King World News/Frank Giustra/2-3-2022

USAGOLD note: We like to keep up with what Canadian billionaire Frank Giustra is thinking, so this King World News article was a welcome sight. Giustra runs through the gamut of investment possibilities and comes down solidly on the side of hard assets.

‘It’s going to be a year where we are shocked by the volatility,’ BofA’s Savita Subramanian warns

CNBC/Stephanie Landsman/2-2-2022

USAGOLD note: Bank of America raises the warning flag …… A “sideways” market and a little volatility is probably tolerable in the collective mindset, but a declining market and much volatility would likely be a much more explosive mix.

Will the world run out of gold in two decades?

USAGOLD note: The rate of growth in international gold demand is overtaking the rate of growth in global mine reserves. Sooner or later, it will likely impact the price unless other sources of supply are found. With major producers like China and Russia keeping their production within their borders, industry experts expect this trend to continue for the foreseeable future. Historically, central banks – another source of supply – have filled the gap between mine supply and demand, but all that has changed over the past several years. Central banks are now a major force on the demand side of the equation.

Gold has performed well in past four rate hike cycles

U.S. Global Investors/Frank Holmes/1-31-2022

“It’s a smart move. Gold has historically performed well in times of not only higher inflation but also rising rates, according to the World Gold Council (WGC). If we look at the past four Fed tightening cycles, between February 1994 and December 2015, the yellow metal underperformed in the months leading up to the Fed’s first rate hike but then outperformed U.S. stocks and the dollar six months and one year following liftoff.”

USAGOLD note: As Holmes explains, the data does not support the widely held notion that gold will be hurt by rising rates. He says that now – before the hiking cycle begins – may be the best time to buy gold.

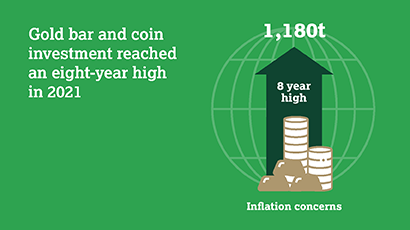

Gold demand trends full year 2021

World Gold Council/Staff/1-28-2022

“Global holdings of gold ETFs fell by 173t in 2021 in sharp contrast to 2020’s record 874t increase. Q4 outflows of just 18t were a fraction of the much larger outflows seen in Q4 2020. Bar and coin investment maintained its momentum, jumping 31% to an eight-year high of 1,180t. Q4 2021 demand of 318t, meanwhile, was the highest for a fourth quarter since 2016. Central banks accumulated 463t of gold in 2021, 82% higher than the 2020 total and lifting global reserves to a near 30-year high. The pace of buying slowed in the second half, with a 22% y-o-y decline in Q4.”

USAGOLD note: Though the price of gold declined 4% in 2021, demand was strong across all categories except gold ETFs.

Looking for more than an e-commerce platform?

DISCOVER THE USAGOLD DIFFERENCE

"Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

1:30 pm Mon. May 6, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115