Gold Outlook 2023: The global economy at a crossroads

World Gold Council/Staff/12-8-2022

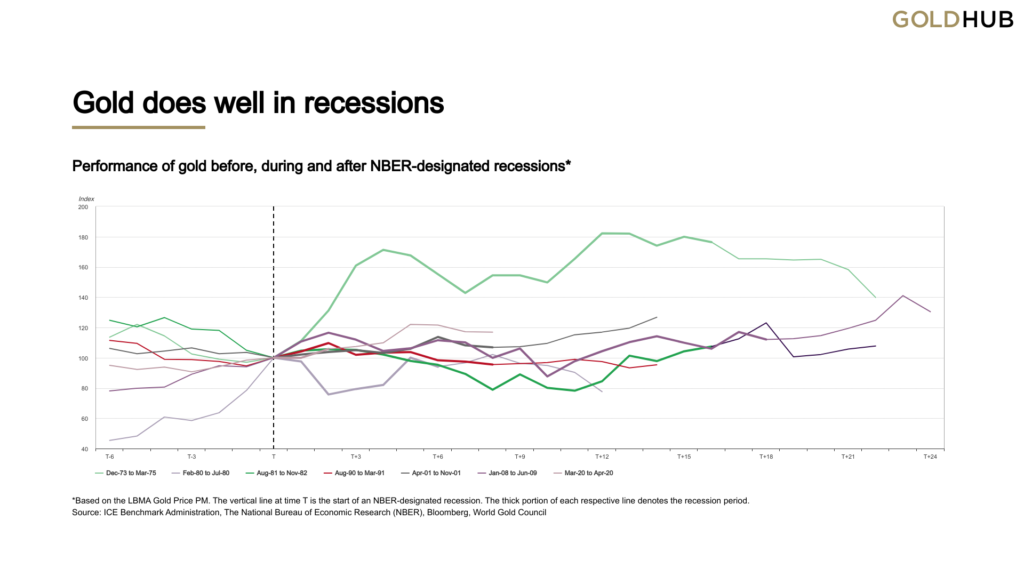

“[Gold] could provide protection as it typically fares well during recessions, delivering positive returns in five out of the last seven recessions (See chart below). But a recession is not a prerequisite for gold to perform. A sharp retrenchment in growth is sufficient for gold to do well, particularly if inflation is also high or rising.”

USAGOLD note: WGC goes on to say that the economy might not follow a “well-telegraphed path” in 2023 warning that “hypervigilant central banks” might overtighten resulting in “more severe economic fallout and stagflationary conditions.” That would be “a considerably tough scenario,” it says, “for equities with earnings hit hard and greater safe-haven demand for gold and the dollar.” It goes to say that the “interplay between inflation and central-bank intervention” will be a key determinant in gold’s performance. It sees challenges ahead for global central banks “as the prospect of slower growth collides with elevated, albeit declining inflation” – in short, the early stages of stagflation.

Chart courtesy of the World Gold Council • • • Click to enlarge