Monthly Archives: April 2022

‘Ominous’ signs show the SP 500 is set to fall sharply and join the bear market within weeks, Morgan Stanley says

Markets Insider/Shalini Nagarajan/4-26-2022

USAGOLD note: Morgan Stanley unexpectedly joins the bears …… The firm’s top equity strategist Mike Wilson says that inflation has “likely peaked” (we disagree), and some see that as bullish for stocks. “We would like to send a clear warning,” he says, “Be careful what you wish for.”

Are gold prices heading for another breakout past $2,000/oz?

GulfNews/Ned Naylor-Leyland/4-18-2022

“People are interested in gold because they are worried about future purchasing power. The market is still considering whether the US Federal Reserve (Fed) will be able to raise interest rates as much as seven times this year and whether or not inflation will materially weaken. In my view, this is why gold hasn’t broken out properly yet — the market is focused on relatively hawkish observations.”

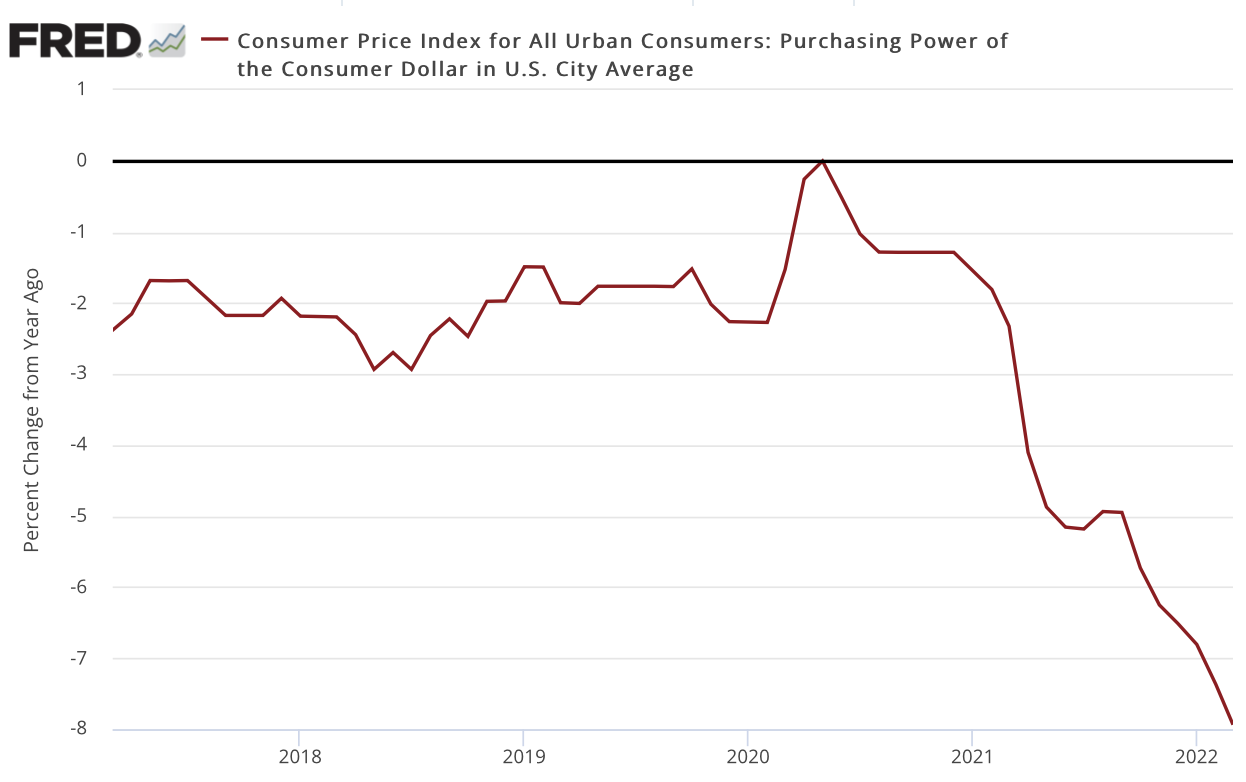

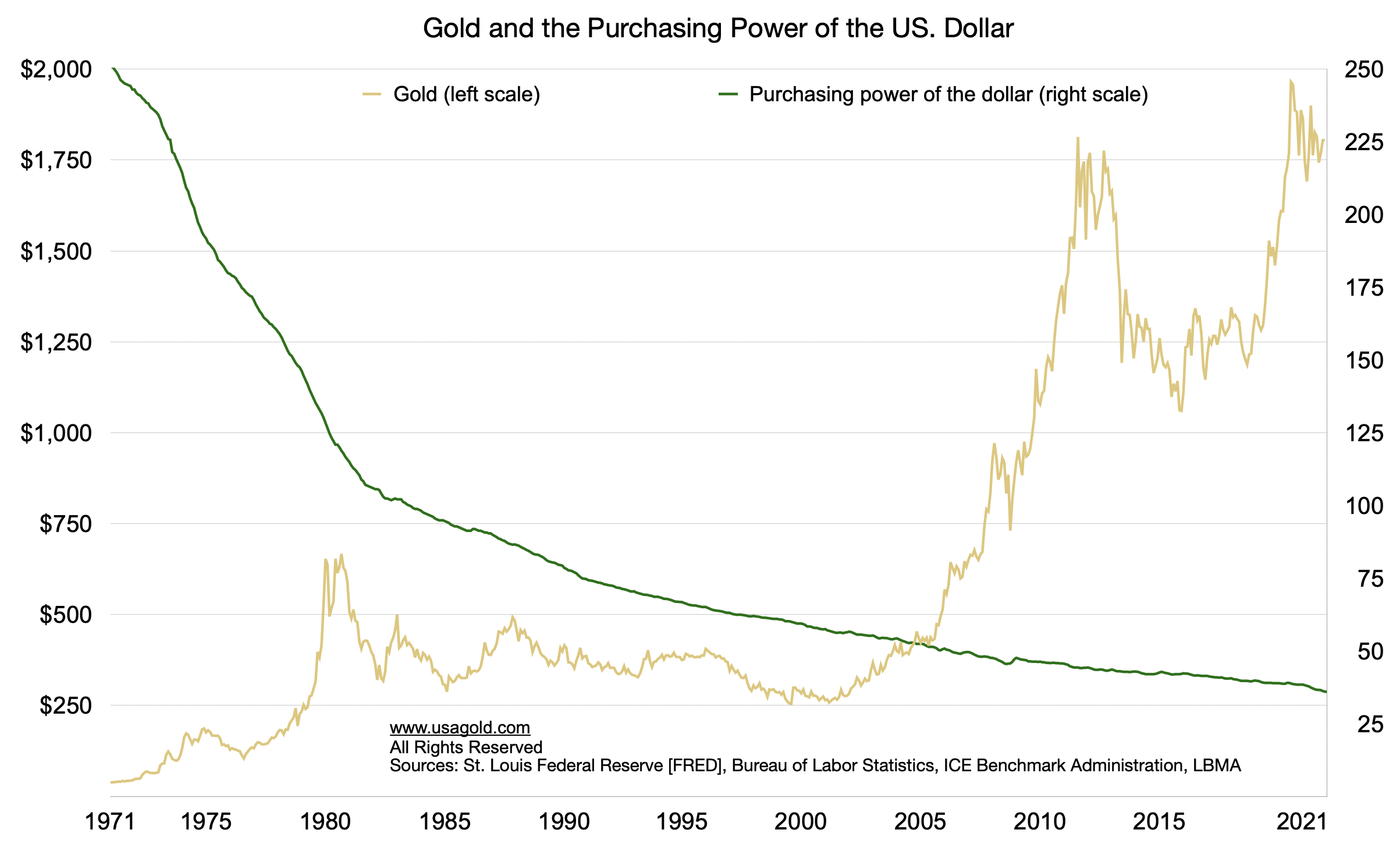

USAGOLD note: Naylor-Leyland lays out why investors and central banks own gold. It is not simply because it shines and is beautiful to look at. We referenced this report in Tuesday’s Daily Market Report and repost it here for those who may have missed it. Many of our readers will be surprised by the graph below. The U.S. dollar has lost 8% of its purchasing power over the past year.

Purchasing power of the U.S. dollar

(Percent change year over year)

Sources: St. Louis Federal Reserve [FRED]. U.S. Bureau of Labor Statistics

Perma-bulloney

Pento Portfolio Strategies/Michael Pento/4-14-2022

“The economy is faltering, and markets are becoming chaotic. In spite of this, the mainstream financial media is busy convincing investors that the bull market is solidly intact.”

USAGOLD note: Bright, flashing, red warning lights from Michael Pento …… Credit markets are significantly more leveraged and closer to contraction than in 2008 – the opposite of what bullish Wall Street analysts tell the public. He calls it the “recession cover-up story.” Details at the link ……

Here’s what 10 elite investors have said about the war in Ukraine

MarketsInsider/Theron Mohamed/4-17-2022

“Russia’s invasion of Ukraine continues to rattle financial markets and disrupt the global economy. Several top-flight investors have weighed in on the crisis, warning it could worsen inflation, plunge the US economy into recession, and even transform the world order.”

USAGOLD note: Grantham, Dalio, Rubenstein, O’Leary, Buffett, Munger, Icahn, Cooperman, Lasry, and Woods weigh-in on the possibilities, vulnerabilities, etc.

Bitcoin looks soft in the era of hard assets to hedge inflation

Bloomberg/Joanna Ossinger/4-18-2022

“Bitcoin’s negative correlation with commodity markets is providing more fodder for critics of its suitability as a hedge for inflation. A 50-day correlation coefficient for Bitcoin and gold is around minus 0.4, the lowest since 2018…”

USAGOLD note: Bloomberg hits on an observation we have consistently passed along at USAGOLD. Bitcoin acts more like a tech stock than it does a safe haven. Its negative correlation to gold speaks volumes. Year to date, gold is up over 10.5% and bitcoin is down over 28%. That aside, we find it remarkable how quickly we have gone from talking about rising prices as “transitory” to an “era” of inflation. “[I]nvestors are choosing tradition over a new frontier. Gold has been an inflation hedge for millennia,” says Oanda Asia-Pacific’s Jeffrey Halley.

Gold and bitcoin price performance

(%, Year-to-date)

Chart courtesy of TradingView.com

Gold garners marginal support at $1900

Sprott’s Brady expects Fed to pull another 180 on quantitative tightening

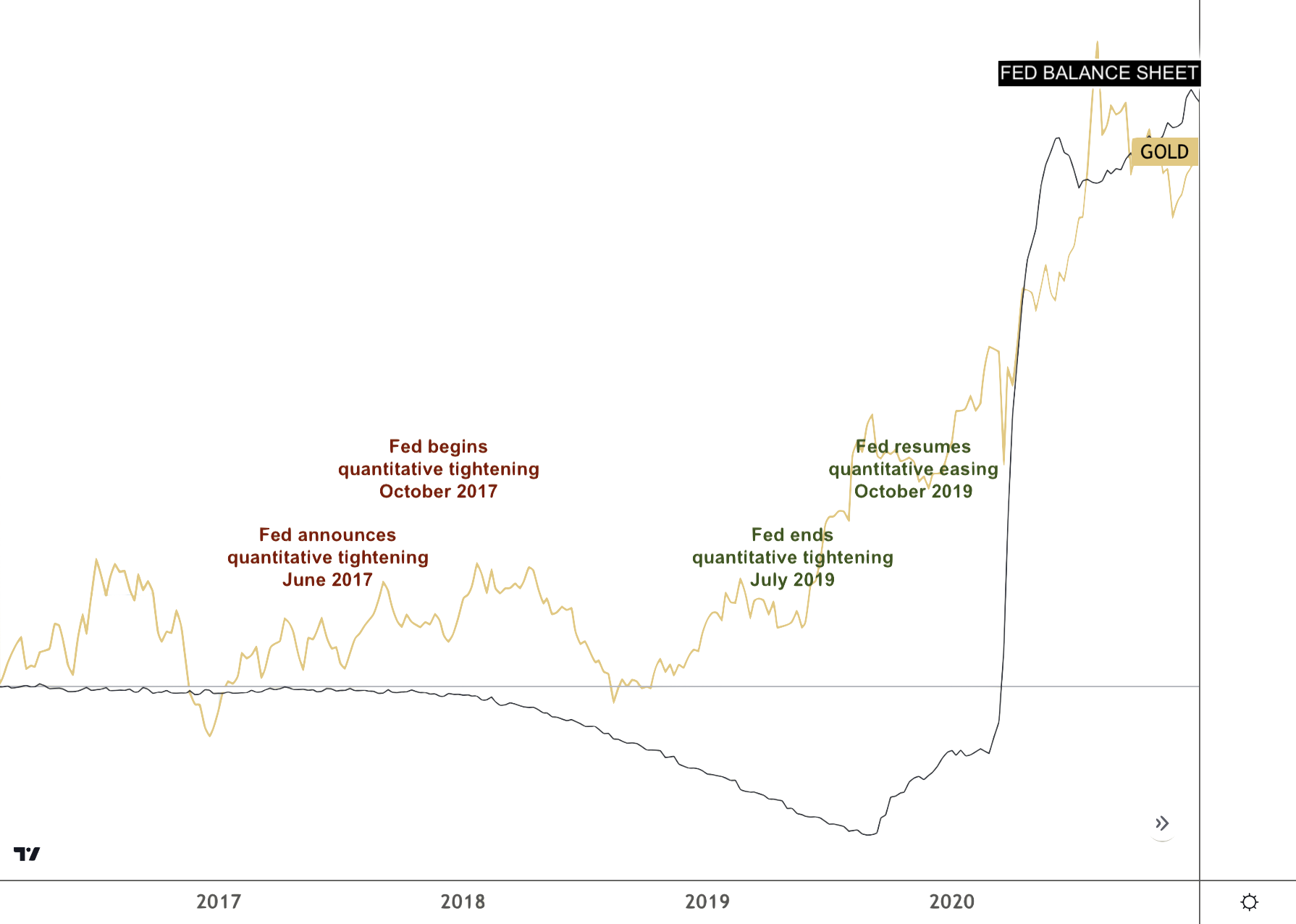

(USAGOLD – 4/26-2022) – Gold garnered marginal support at the $1900 level this morning as markets continued to worry about the lockdowns in China, a more aggressive Fed, and a possible stagflationary recession. It is up $6 at $1906.50. Silver is up 13¢ at $23.75. Sprott Money’s David Brady sees gold’s current difficulties as a temporary blip in a Fed-inspired longer-term uptrend.

“Note that various markets are tagging levels last seen in March 2020, December 2018, and 2007-08,” he says in a Seeking Alpha article posted before yesterday’s descent to the $1900 level. “What happened next in each of those circumstances? The Fed turned on the printing presses. I fully expect them to do so again. It’s just a question of when. My best guess is around the September to October timeframe, typically the worst time for stocks. The alternative is the collapse of everything. When the Fed pulls its next 180, watch real yields plummet and gold, silver, and the miners go parabolic, IMHO. In the meantime, we could suffer more downside. 1900 is the key support level in gold that needs to hold in order to avoid a deeper dive. Whether it holds 1900 and we go straight up or we get a bigger drop and then head higher, the ultimate destination is the same, just as it was post-March 2020, December 2018, and 2007-08.”

Gold and the Fed Balance Sheet

(2016-2021)

Chart courtesy of TradingView.com • • • Click to enlarge

Inflation psychology has set in. Dislodging it won’t be easy.

University of Michigan/Richard Curtin/4-15-2022

USAGOLD note: Curtin, who has headed up the University of Michigan’s oft-cited consumer sentiment surveys since 1976, offers a concise, easy-to-read assessment of the new inflation. His bona-fides are bolstered by having lived through and reported on the inflation of the 1970s. “Another critical characteristic of the earlier inflation era,” he says, “was frequent temporary reversals in inflation, only to be followed by new peaks. That same pattern should be expected in the months ahead.”

Hedge-fund giant Man Group questions whether 60/40 ever worked

Bloomberg/Vildana Hajric and Michael P. Regan/4-16-2021

“Where we are now is a bit different. We’re in a universe of equities and bonds going down together. There’s a lot of instability. That instability is disconcerting. If they’re both going down, I need to find things that don’t behave like bonds and equities, which means commodities.” – Peter van Dooijeweert, Managing Director, Man Group

USAGOLD note: During a time of secular currency debasement, both stocks and bonds lose value simply on a purchasing-power basis if they do not keep up with or better inflation. Bonds, at present, are in particularly dire straits losing both principal and purchasing power at the same time. In a separate study posted last June, Man Group lists gold and silver as two assets to which investors fled during past episodes of inflation and were rewarded with double-digit returns. The firm also suggest acting sooner rather than later. Man Group is the world’s second largest hedge fund behind Bridgewater Associates. Bridgewater also holds a large position in commodities.

Basel Accord spells opportunity for gold

OPINION

Rogue Economics/Nomi Prins/4-12-2022

USAGOLD note: There has been considerable discussion on the impact of the new Basel III accords on the gold market over the past couple of years. It all takes on renewed importance, though, with inflation now part of the equation. Nomi Prins offers a solid overview of how commercial banks might perceive gold once the accords take effect in January of next year. Worth the review………at the link. She says one of the simplest ways to take advantage of what she sees as a positive outcome for the yellow metal is to own gold bullion coins like the American eagle or Canadian Maple Leaf.

Short & Sweet

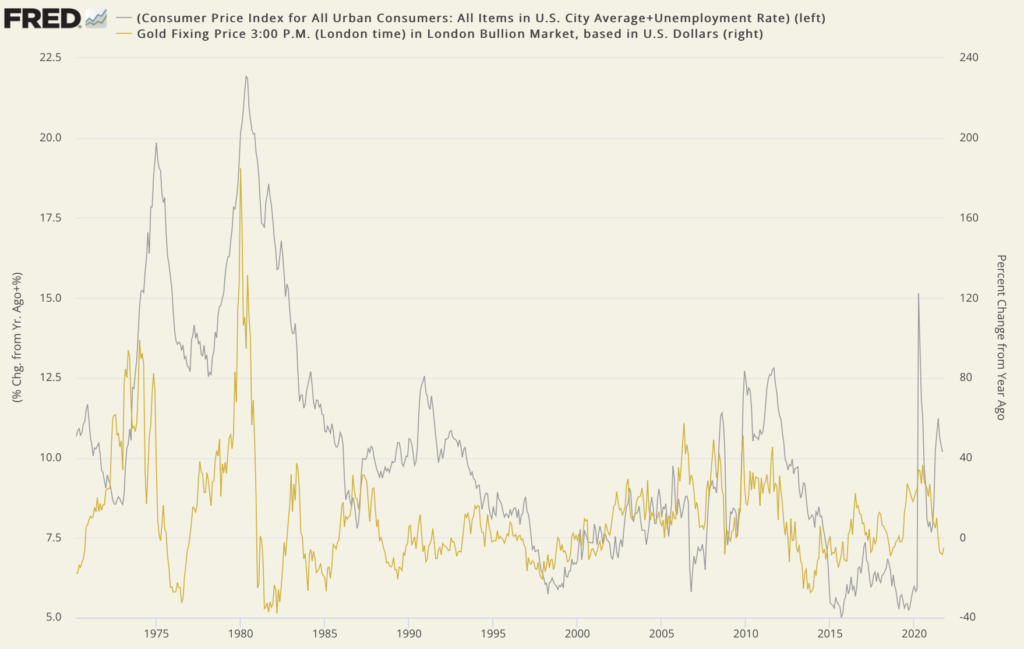

Gold and the Misery Index

Stagflation could force ‘a macro rotation into the precious sector’

Since the launch of the fiat money era in the early 1970s, when economies have gone very wrong, the unemployment and inflation rates have skyrocketed. On the campaign trail in the late 1970s, then-presidential candidate Ronald Reagan added the two numbers together and famously named the result the Misery Index. Subsequently, the Misery Index became the bellwether for stagflation – the combination of economic stagnation and runaway inflation.

With stagflation rising once again to the top of investor concerns, the Misery Index has made something of a comeback. Accordingly, we thought it would be a matter of interest to build a chart showing changes in the index plotted against changes in the price of gold. Though we had an inkling of the result, the uncanny long-term correlation between the two data sets took us by surprise. At a glance, the chart tells the story of gold as a runaway stagflation hedge. Gold also closely tracked the index more recently during the 2008 credit crisis and the 2020 pandemic-driven breakdown. Curiously, though, it has lagged the surge in the Misery Index over the past year and a half. This divergence probably has to do with Wall Street until recently largely buying into the Fed’s contention that inflation is transitory.

With the word “transitory” now officially banned from the Fed lexicon, the financial world is suddenly forced to consider the dual nature of stagflation and adjust investment portfolios accordingly. MKS Switzerland’s Nicki Shiels recently advised that a “stagflation would force a macro rotation out of typical reflation assets or commodities like oil and copper, and into the precious sector.”

“There’s going to be a realization in early 2022,” says Weiss Ratings’ Mike Larson in a report posted at Finbold, “that the Fed is not going to be able to be aggressive. People need to realize that this Fed is very tentative. It’s a Fed that has a lot of political pressure to favor the employment side of its mandate over inflation. … I don’t think it’s going to be a runaway where you’re talking about $4,000 gold, but you know, $2,200, $2,300 or $2,400, somewhere in that range, I think in sort of a corresponding moving silver, I think it is likely on the table. And again, it’s going to come from the release of that Fed fear, pressure valve, whatever that’s been keeping people from, getting involved.”

Misery Index and Gold

(% change, year over year, 1971- to present)

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration

Click to enlarge

(For a real-time version of the Misery Index-Gold chart, please visit USAGOLD’s Gold Trends and Indicators.)

‘Long time, if ever’ before dollar replaced as key global currency – Yellen

Reuters/David Lawder and Andrea Shalai/4-13-2022

“U.S. Treasury Secretary Janet Yellen said it would be ‘a long time, if ever’ before the U.S. dollar was replaced as the key reserve currency in the global economy.”

USAGOLD note: We will file this quote from the Treasury Secretary in the same folder with the one from 2017 when as Fed chair, she asked, “Would I say there will never, ever be another financial crisis? You know probably that would be going too far, but I do think we’re much safer, and I hope that it will not be in our lifetimes, and I don’t believe it will be.” And the one from May 2021 when she told the Wall Street Journal CEO Council that inflation was “transitory” and did not anticipate it would be a problem for the U.S. economy.

Gold weighed down by a stronger dollar, Fed hawkishness, China lockdowns

Blain says the markets are ‘significantly underestimating’ Ukraine consequences

(USAGOLD – 4/25/2022) – Gold continued its decline this morning, weighed down by a stronger dollar, perceived Fed hawkishness, and growing concern over the lockdowns in China. It is down $23 at $1911. Silver is down 53¢ at $23.69. Despite the market weakness (or perhaps because of it), Saxo Bank’s Ole Hansen reports strong demand for the metal coming from “asset managers seeking protection against rising inflation, lower growth, geopolitical uncertainties as well as elevated volatility in stocks and not least bonds.” The net effect over the past week has been a gradual slide in gold and a much steeper one in silver as investors attempt to sort out the conflicting signals. Shard Capital’s Bill Blain is convinced that the markets are “significantly underestimating how the rollover from Ukraine consequences will hit the global economy.”

“The waves of tectonic economic instability unleashed by the Ukraine conflict,” he writes in a recent advisory, “have shocked and caught the global commentariat of politicians, central bankers, economists and investment analysts off guard. Inflation from agribusinesses, energy and supply chains is spinning unchecked – and, like a nuclear reaction, they are triggering a host of follow up consequences. It feels a little bit Chernobyl – the reactor is going critical! Our cosy assumptions about how the interconnected globalised economy was supposed to work are being rocked to the core.”

Is America booming or busting? Hard to tell as the numbers speak from both sides of their mouth

Barron’s/Randall W. Forsythe/4-15-2022

“What one encounters more often than not on financial television appears to be the inverse [of considering two opposing ideas at the same time] – simplistic analysis that leads to an apparently inevitable (and usually bullish) conclusion.”

USAGOLD note 1: Forsythe sifts through the thinking of a number of analysts without really answering the question posed in the headline. Toward the end of his column, he does provide a clue to where he thinks this all might be headed by passing along Zoltan Pozsar’s observation that central banks “cannot print oil to heat or wheat to eat or large tankers to transport oil.”

USAGOLD note 2: Stagflation does have a way of speaking out of both sides of its mouth – divergent signals from both inflation and stagnation at the same time. It confuses investors who think narrowly in terms of stocks, bonds and real estate as the only options. During the stagflationary 1970s, investors successfully resolved the cognitive dissonance Forsythe laments through ownership of gold and silver, both of which performed admirably during the period.

‘Big Short’ investor Michael Burry says the Fed isn’t trying to curb rising prices

MarketsInsider/Theron Mohamed/4-14-2022

USAGOLD note: Dennis Lockhart, former president of the Atlanta branch of the Federal Reserve, is worried that policy will undershoot the situation allowing inflation to “really seep into every crack of the economy and become really deeply embedded in the psychology…” (Financial Times/Can the Fed stamp out US inflation without causing a recession?/4/14/2022)

The dirty secret in markets is that nobody pays attention to details

ZeroHedge/Michael Every/4-14-2022

“Details matter. Or they should. In reality the dirty secret in markets is that nobody actually pays attention to them. … [A] case in point is US CPI, which you would have to be getting an 8% yield on a gold coin to keep up with. US headline inflation hit 8.5% y/y yesterday, a tick higher than expected, but the market focus was on the 0.3% m/m core print, which was 2 ticks lower than consensus. Along with the recent dip in oil prices, the sudden view was again that we have seen ‘peak inflation’. Happy days!”

USAGOLD note: That reference to the required yield on gold coins to keep up with inflation is a classic – and one that goes straight to the heart of the problem the Fed is up against. Peak inflation? “[T]oday we have entrenched inflation,” writes Every, “a Fed prepared to ‘meticulously’ ensure it becomes unentrenched, and a geopolitical backdrop that favors decoupling [important trade relationships], which cannot be anything other than inflationary.” Rather than paying attention to detail and making an objective assessment, the tendency even among seasoned hedge fund operators is to run with the crowd instead.

Metal stockpiles shrink as energy prices hit production

Financial Times/Neil Hume/4-12-2022

“Inventories of aluminum, copper, nickel and zinc — four of the main contracts traded on the London Metal Exchange — have plunged by as much as 70 percent over the past year, as traders and big consumers have tapped warehouses for material.”

USAGOLD note: Another layer of the hidden crisis building in the commodities trade and the inflation crisis building in the global economy ……

Gold tracks south as diverging central bank policies push the dollar higher

James Turk: ‘Gold preserves purchasing power over long periods of time.’

(USAGOLD – 4/22/2022) – Gold is tracking south this morning as a combination of hawkish Fed policy and dovish tilts in Japan and China pushes the dollar higher. It is down $15 at $1939. Silver is down 34¢ at $24.40. Though the dollar is in an uptrend against other currencies, its purchasing power in terms of goods and services is in sharp decline – and that, in the end, is what most concerns U.S.-based investors. Veteran market analyst James Turk made some insightful comments on that score in a recent interview posted at Epoch Times. Gold, he says, “does not suffer from entropy; it cannot be destroyed.”

“All the gold mined throughout history,” he continues, “still exists in its aboveground stock, which if formed in a cube could slide under the arches of the Eiffel Tower. Gold is mined and then accumulated because its greatest use is money. … Importantly, gold preserves purchasing power over long periods of time. Doing so enables sound economic calculation – namely, measuring prices – and that is essential to economic activity. For example, though the price of crude oil is rising in terms of euros, dollars, pounds, and the other national currencies, there is no inflation when prices are calculated in weights of gold. … A gram of gold buys essentially the same amount of crude oil as it did in 1950. This result occurs because the aboveground stock of gold grows by approximately the same rate as world population, causing the supply and demand for gold to remain in balance with the supply and demand of the goods and services humanity needs. Nature provides everything humanity needs to advance, including money.”

We offer two charts this morning to support Turk’s argument. The first shows the performance of gold against the long-term decline of the dollar. The second shows the sharp acceleration in that decline over the past eighteen months.

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics

Summers says recession more likely than soft landing

Bloomberg/Michael Sasso/4-14-2022

“[W]e had about 35 years price stability between the mid-eighties and 2021. And by that definition, we have lost price stability in the U.S. Inflation is now the number one economic issue. It’s driving vast erosion in confidence in government. And the Fed has to do what’s necessary to restore a sense of price stability. I can’t say exactly what that means in numerical terms, but I know that we are well away from it now in the judgment of the American people.”

USAGOLD note: Summers continues to channel Paul Volcker in his approach to inflation, even stating he “would like to see the Fed signal a commitment to raise interest rates until real rates are clearly positive, or until it’s clear that price stability has been restored.” Thus far, the Fed has offered no indication of pushing policy toward a positive real rate of return.

‘Calamity’ may be coming, stock-market setup similar to 1999: Jeffrey Gundlach

MarketWatch/Christine Idzellis/4-12-2022

USAGOLD note: We keep a close eye on what Gundlach has to say in that Wall Street and the rest of the investment community holds him in high regard. He points to the yield curve set-up much like 1999 as a warning that something might be about to break.

We worry about the wrong things – its energy, food and commodities that matter!

Blain’s Morning Porridge/Bill Blain/4-12-2022

USAGOLD note: Blain takes a look at Zoltan Pozsar’s Bretton Woods III analysis and concludes that “if central banks remove the easy liquidity driving the commodities markets, you risk not just a market crash, but a real-world economic crash.” … More at the link.