Short & Sweet

‘He clung to that which he could really trust, really own, really control’

In an analysis posted at Daily Reckoning, Jeffery Tucker offered an opinion on inflation shared by a good many economists and investors. “Gradually,” he writes, “we’ve come to see the light. There will be no rolling back those price increases in general. There will be declines in the pace of increase here or there but overall prices have shifted upward, permanently.” With that in mind, he shares some family history: “There is nothing we can take for granted in this inflationary crazy economic environment, no rules of thumb that can really guide us. My father was a thrifty man, a truly great man, but also a believer in long-term value and truth. Yes, he loved gold and silver coins too, and very much so. He accumulated them throughout his life. As I look at that today, it is extremely obvious that this was one of his best financial decisions. He was never a day trader or a rah-rah techno champion. He clung to that which he could really trust, really own, really control. That seems like a good way to think even now.”

_______________________________________________________________________

Looking for something you can really trust, really own, really control?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Two legendary central bankers embrace gold

In The End of Alchemy (2017), Mervyn King, the former governor of the Bank of England, writes of central banks’ frustration in dealing with the persistently stagnant global economy. “Central banks,” he says, “have thrown everything at their economies, and yet the results have been disappointing, Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced. . . [W]ithout reform of the financial system, another crisis is certain – sooner rather than later.”

“Our problem,” Alan Greenspan once said, “is not recession which is a short-term economic problem. I think you have a very profound long-term problem of economic growth at the time when the Western world, there is a very large migration from being a worker into being a recipient of social benefits as it is called. And this is legally mandated in all of our countries.” The western world, he concludes, is headed to “a state of disaster.”

It is interesting to note that both Greenspan and King, two of the most respected central bankers in modern times, have embraced gold since leaving their respective posts. The former Fed chairman has consistently suggested that gold is “a good place to put money these days given the policies of governments.”

The former governor of the Bank of England says that he is “very struck by the fact that over many, many years, central banks, governments and individuals have always, despite the protestations of economists, held some gold in their portfolio…[W]hen unexpected things happen, particularly when governments rise and fall, then gold is a means of payment that everyone is always prepared to accept. And I think that’s why even central banks have always had a role in their portfolios for gold.”

_____________________________________________________________________________

Are you ready to embrace gold?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Only real intrinsic money survives the test of time

Here is a timeless observation from the now-deceased Richard Russell (Dow Theory Letter):

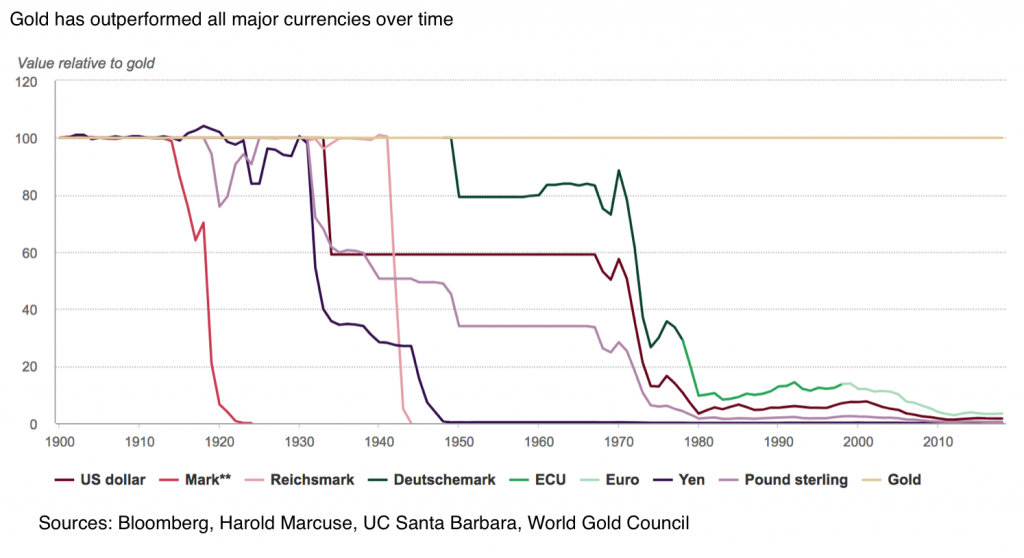

“Paper money is now being created wholesale throughout the world. Stated simply, all paper currency is now valued against each other. But more important, ultimately ALL paper is ultimately valued against the only true, intrinsic money – gold. In world history, no irredeemable paper currency has ever survived. Since all the world’s currency is now irredeemable (in gold), this means that in the end, the only form of money that will survive is real intrinsic money – gold. It’s not a question of whether gold will survive, it’s a question of when the world’s current paper money will deteriorate and finally die. I can tell you that irredeemable paper will not survive – but obviously I can’t tell you when it will die. The timing is the only uncertainty.”

The chart below from the World Gold Council speaks to Russell’s point. It shows the performance of various currencies – past and present – against gold over the long term. When the end comes, as the chart illustrates, it can come abruptly and without warning. For those who stick to the proposition that gold is not really an inflation hedge, or that it is not really a safe-haven against currency debasement, the chart offers instruction. For those who already own gold as a safe-haven, it provides justification. For those who do not own gold, it serves as an incentive. As the old saying goes: All is well until it isn’t.

Chart courtesy of the World Gold Council

________________________________________________________________________

Ready to begin or add to your precious metals holdings?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Inflation is a process not an event

But history, as we are learning now, shows runaway inflation can come suddenly and without warning

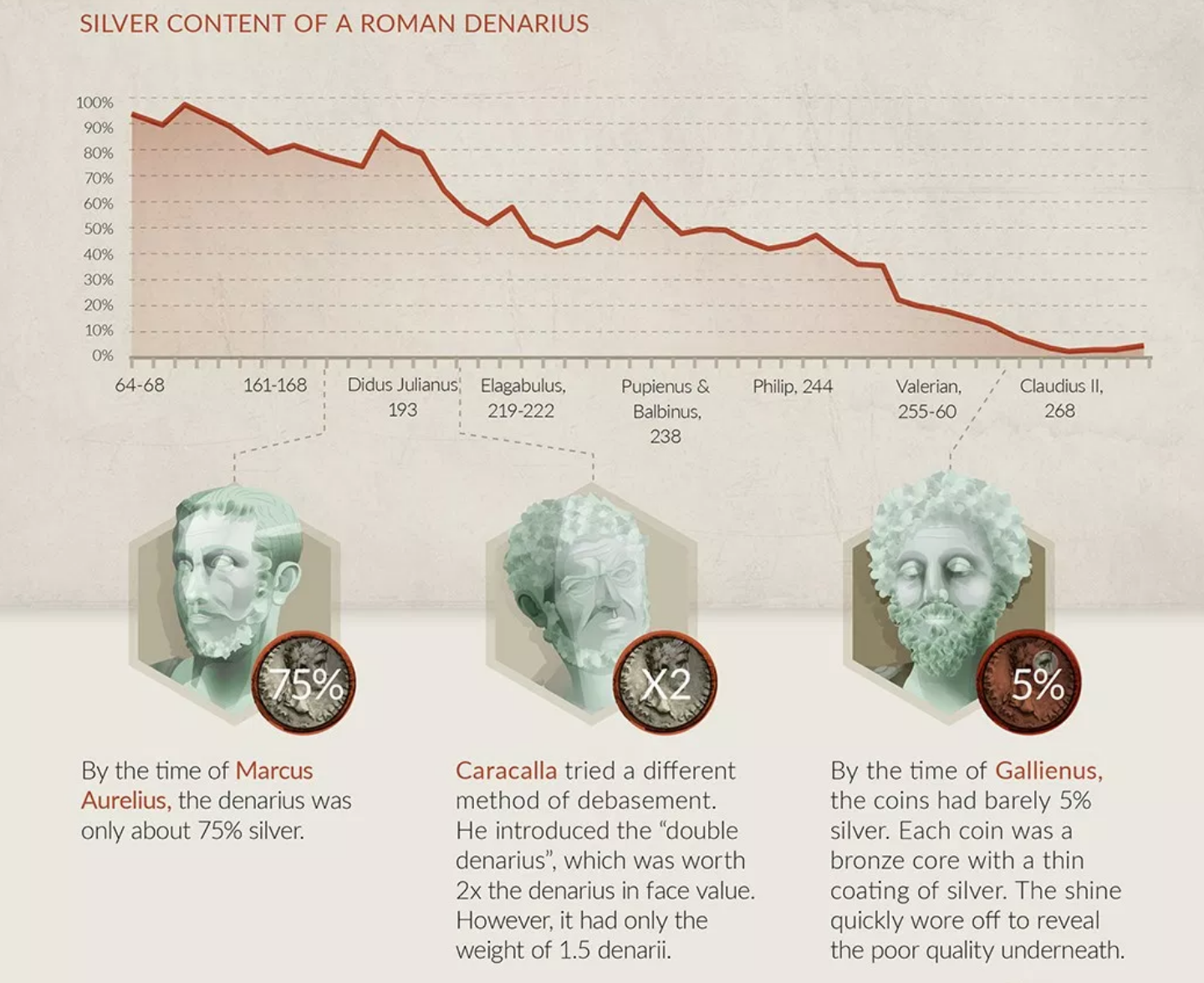

Image courtesy of Visual Capitalist • • • Click to enlarge

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius. The Roman citizen who had the wisdom to hedge that process by going to gold at nearly any point along the way ended up preserving some portion, if not all, of his or her wealth. Those who did not suffered its debilitating effects. In the inflationary process, the line between cause and effect is not always a straight one, and its timing difficult to discern. History teaches us, though, that when runaway inflation does arrive, it comes suddenly, without notice, and with a vengeance. That is why it pays to view gold as a permanent and constantly maintained aspect of the investment portfolio. “A change of fortune,” Ben Franklin tells us, “hurts a wise Man no more than a change of the Moon.”

_________________________________________________________________

(Related please see: News & Views Special Report / March 2020 / Hedging the decline and fall of a currency – The baseline case for gold hasn’t changed much in 1700 years)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to prepare your portfolio for whatever uncertainty lies ahead

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

“Bear markets are sneaky beasts. . .”

King World News called the late, great Richard Russell – who regaled us with his wisdom in the Dow Theory Letter for nearly half a century – “the greatest financial writer in history.” We can only guess what Russell would have had to say about the current state of affairs, but the quote above provides a clue. Never predictable in his opinions, he was rock solid on one axiom throughout his career – the necessity and transcendence of gold as a permanent component of the well-balanced investment portfolio. As he said, so often, it helped him sleep at night.

Looking to prevent the beastly bear from sneaking up on your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Worry about the return ‘of’ your money, not just the return ‘on’ it

There is an old saying among veteran investors to worry not just about the return on your money but the return of your money. In the wealth game, emphasize defense when you need to, offense when it makes sense. At all times, remain diversified. And by that, we mean real diversification in the form of physical gold and silver coins and/or bullion outside the current fiat money system – not just an assortment of stocks and bonds denominated in the domestic currency. Keep in mind – if the currency erodes in value, the underlying value of those assets erodes along with it. A proper, genuine diversification addresses that problem now and in the future.

Are you ready to deploy genuine diversification in your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100• • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short & Sweet

The true nature of inflation

“The nature of inflation is widely misunderstood and misinterpreted,” writes analyst Dave Kranzler in an Investing.com overview, “‘Inflation’ and ‘currency devaluation’ are tautological—they are two phrases that mean the same thing. … Dollar devaluation has been occurring since the early 1970’s. The value of the dollar relative to gold (real money) has declined 98%. In 1971, $40,000 would buy a 4,000 square foot home in a good suburb. Now it takes $700,000 on average to buy that same home. Price inflation is the evidence of currency devaluation. The CPI is not a real measure of price inflation. The CPI is methodically massaged – starting with the Arthur Burns Federal Reserve (it was his idea) to hide the real degree of currency devaluation from all of the money that has been printed since 1971.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Worried about what currency devaluation is doing to the value of your savings?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Structuring your portfolio for the rest of the 2020s

“Precious metals are and always have been the ultimate insurance,” says Pro Aurum’s Robert Hartman in an interview with Claudio Grass. “They provide protection both against state failures and against mistakes in the monetary policy of the central banks. Every investor who looks into the history books sees that both have happened over and over again in the past centuries. From that perspective, investing in physical gold and silver is a common-sense precaution and a necessary part of any wealth preservation plan. Investors and ordinary savers ignore this at their peril and the failure to include precious metals in one’s portfolio is pure negligence.”

There are essentially two broad schools of thought alive and well in the gold market. The first holds that crisis is around the corner and, as a result, precious metals should be owned to profit from the event. The second holds that crisis is a permanent fixture in the market dynamic and that the portfolio should always include precious metals as the ultimate safe haven. The first buyer sees precious metals as investment products, i.e., buy now and sell later when the time is right. The second considers gold and silver, like Hartmann, as insurance products to be held for the long run. Some combine the two, allocating one part of their precious metals portfolio for trading purposes and another as a permanent, or semi-permanent, store of value. The novice precious metals owner must decide where he or she stands in this regard because it determines, in turn, which products to include in the portfolio and to what degree.

Investors often ask about the percentage commitment one should make to precious metals in a well-balanced investment portfolio. Analyst Michael Fitzsimmons offered an interesting take on that subject in a Seeking Alpha editorial last fall, “Assuming a well-diversified portfolio (which does include cash for emergencies),” he says, “my belief is that middle-class investors (net worth under $1 million), should own at least 5-10% in gold. I also believe that as an American investor’s net worth climbs, the higher that percentage should be because, in my opinion, he or she simply has more to lose by a falling US$. For instance, an investor with a net worth of $2-5 million might have a 15-20% exposure to gold; $10 million, perhaps a 30-40% exposure.” As it has for many years, USAGOLD recommends a diversification of between 10% and 30% depending on your view of the risks at large in the economy and financial markets.

Looking to structure your portfolio for the rest of the 2020s?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

New smart money queues up in the gold market

First institutions and funds came over to gold’s corner, then central banks. Now, a whole new grouping of professional investors – pension funds, private wealth management, insurance companies, and sovereign wealth funds. “It’s a bit like what happened to big tech,” says highly respected economist Mohammed El-Erian. “People like [gold] because it’s defensive. People like it because it’s a reflation trade. People like it because it’s inflation protection. What we are starting to see with the narrative about gold is starting to be like the narrative about big tech. It gives you everything.” These groups bring considerable purchasing power and market savvy to the table. One immediate result might be more buying interest on price dips. Another might be a better blend of investment psychology and objectives that could have a settling effect on the market overall.

Ready to include a safe haven in your portfolio plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100• • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short & Sweet

‘The world is being tested to the extreme.’

Protecting and building wealth in a new financial era

Interest Rate Observer’s James Grant referred to the current period as a “wild time in money.” Credit Suisse’s Zoltan Pozcar warned that “this crisis is not like anything we have seen since President Nixon took the US dollar off gold in 1971.” Mohamed El-Erian likened the Fed’s current monetary policy to that of a developing country central bank. “The Russian invasion of Ukraine and the corresponding Western sanctions and seizure of Russian FX reserves,” said long-time market analyst Lawrence Lepard, “are nothing short of a monetary earthquake.” Larry Fink, who manages BlackRock, the world’s largest investment fund, said the invasion marked “a turning point in the world order” and the end of globalization. Finally, George Soros went to the dark side calling Russia’s invasion of Ukraine “the beginning of World War III with the potential to destroy our civilization.”

If we have indeed embarked upon a new and turbulent financial era, as the above suggests, investors will be tasked with protecting and building their wealth under extraordinary and unpredictable circumstances. “History,” says James Grant, “would counsel us to be humble, prepared to listen and interpret correctly.” Swiss-based investment analyst Claudio Grass took a similarly philosophical approach (and one that we have counseled over many years). “It really does go a lot deeper than a comparison between gold and stocks, or considering the better ‘play’ for one’s portfolio performance,” he said. “The real counter-question now is ‘What is your peace of mind worth?’” Long-time money manager Stephen Leeb believes “the world is being tested to the extreme…Right now, as individuals, the best thing you can do for yourself is to buy protection, and that means investing in gold. Even under the best scenarios, a lot of turmoil lies ahead before we reach the other side, and gold will be the best way to get through it in good shape.”

_______________________________________________________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

|

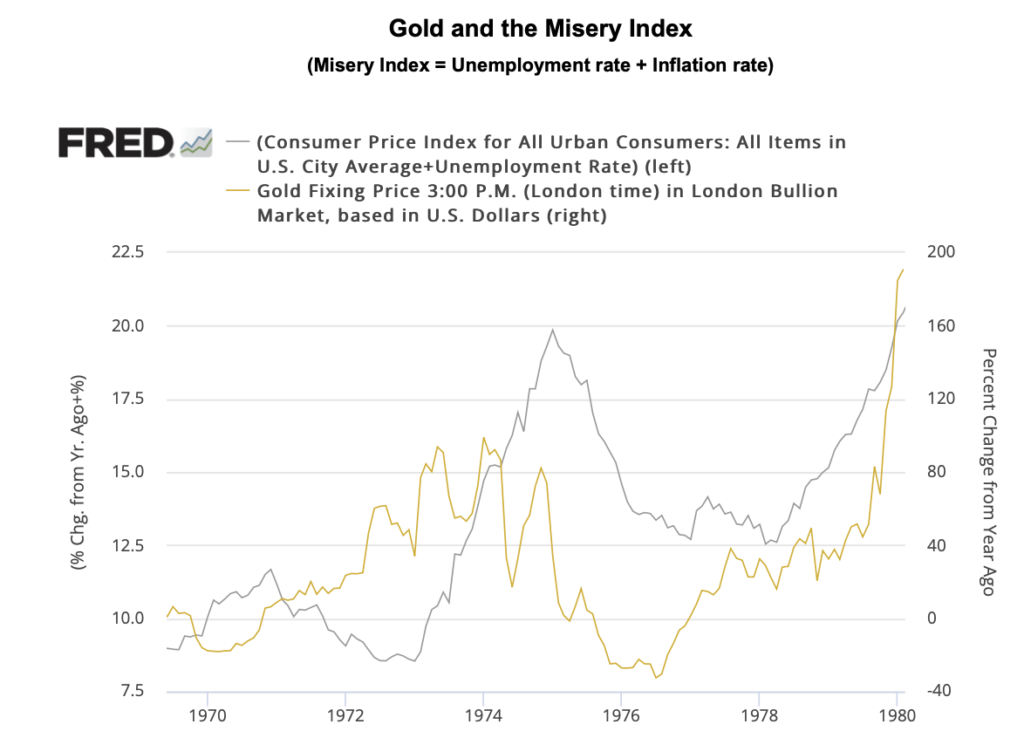

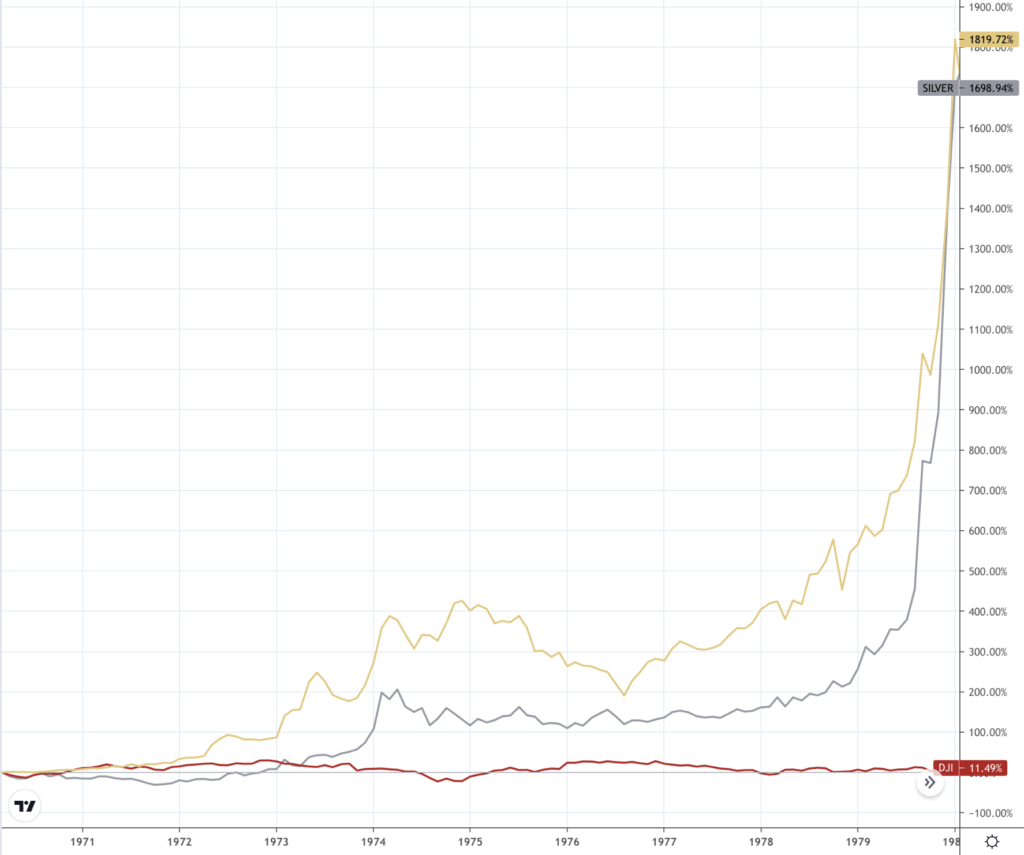

Queens’ College President Mohamed El Erian warned recently that the world could slip into stagflation. Alan Greenspan was among the first to warn that the economy could be headed into a repeat of the staglationary 1970s, and that was back in late 2018. Now, not a day goes by that some analyst or economist somewhere warns of its return. Stagflation is the combination of high inflation and high unemployment, i.e., what Ronald Reagan called the Misery Index. At its height in 1980, the Misery Index reached 22%. As of the most recent government reports, it now stands at 12.1% and climbing, driven chiefly by inflation’s rapid rise. As our second chart shows, gold and silver were top performers during the stagflationary 1970s. Gold rose 1820%. Silver rose 1699%. The Dow Jones Industrial Average rose 11.5%. Warnings about a stock market capitulation dominate the flow of financial opinion as Wall Street boards up the windows in advance of what JP Morgan’s Jamie Dimon called an approaching “economic hurricane.” Since that early June warning, stocks and bonds have tracked steadily to the south. Sprott analyst John Hathaway says we have gotten to a place where “the Fed doesn’t have a dial. It’s an either on or off switch. They’re either switching off the economy and crashing financial assets and the economy, or their crying uncle and caving in, which will likely open the door to more inflation. I think either outcome is positive for gold.… Year to date, it’s up a little bit while the S&P is down 12% or 13% (6/15/2022). It’s shown that it can be uncorrelated and help defend capital during difficult times in the markets. If the Fed cries uncle and pivots, my guess is before the end of the summer, we’re off to the races, and I think we’ll see new highs in the gold price, which would be around $2,200.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Worried about a return to the stagflationary 1970s? ORDER DESK Reliably serving physical gold and silver investors since 1973

USAGOLD

USAGOLD |

Short and Sweet

For gold . . .’It is not a question of if, but when’

The lesson is one as old as the gold market itself: The best time to buy is when the market is quiet – a strategy that requires both discipline and conviction. As an old friend and client used to say (he passed away years ago): “It is not a question of if, but when.” He accumulated a large hoard of the metal in the 1990s and early 2000s between $300 and $600 per ounce and lived to see his prediction come true. His estate though was the ultimate beneficiary of his wisdom. He was not one to sell gold once he had acquired it. We chatted regularly on the phone back then and I told him that I had used the story just told in one of my newsletters. He was in his late 80s at the time. “Tell them,” he said resolutely, “that I bought my first ounce of gold at $35.”

“The possession of gold has ruined fewer men than the lack of it.”

– Thomas Bailey Aldrich –

_______________________________________________________________________________________

Are you looking to solidify your hard-earned wealth for the long run?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

For the record……

Gold in the age of inflation

The star investment of the fifty-year era and the most reliable store of value

“Remember what we’re looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.”

Alan Greenspan, November 2014

On Friday, August 13, 1971, then-president Richard Nixon, after a secret meeting at Camp David, devalued the dollar, suspended gold convertibility, and thereby launched the fiat money system and the age of inflation. Shortly thereafter, the president commented, “we are all Keynesians now.” (Please scroll to “The great Keynesian coup of August 1971” for more detail.) It is a notable coincidence – perhaps even fitting – that we would mark the 50th anniversary of the “Nixon shock” on Friday, August 13, 2021. To mark the occasion, we reprint the following from the July 2021 issue of News & Views, our monthly newsletter:

There has been considerable, and some would say tedious, discussion on the subject of inflation over the past several weeks. The Fed wants it. The markets await it. Investors and consumers worry about it. If it does come, the Fed thinks it will be transitory. Others believe it will persist. That said, the current discussion ignores an established historical reality: We already live and have lived with it for a very long time. The Age of Inflation began in August of 1971 when the United States disengaged the dollar from gold and ushered in the fiat money era. Thereafter, the inflationary process has progressively eaten away at our wealth and the purchasing power of our money. Now, some of the best minds in the investment business tell us that it is about to accelerate and that if we ignore it, we do so at our own peril.

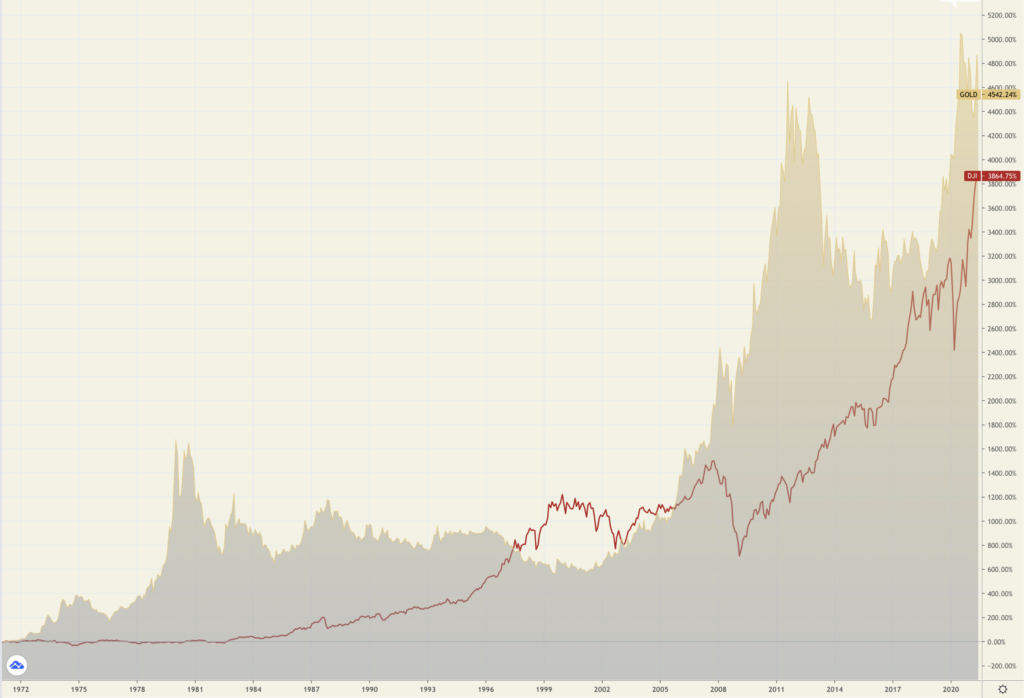

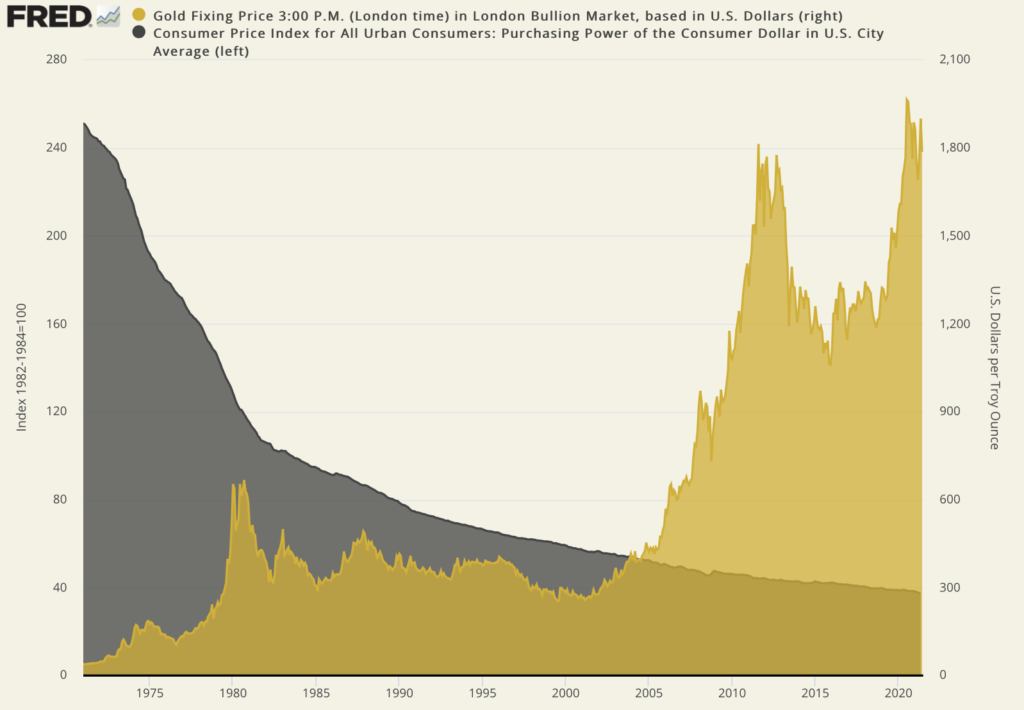

To mark the occasion of the fiat money system’s golden anniversary, we offer two instructive charts. One is something of a myth-buster in that gold has decisively outperformed stocks during the fiat money era. Many will be surprised to learn that gold is up 4,500% since 1971, while stocks have played second fiddle at 3,375%. The other reveals at a glance the pernicious, ongoing debasement of the dollar and gold’s role as a hedge against it. The dollar lost 85% of its purchasing power since 1971, while gold, as just mentioned, gained nearly 4500%. If that does not serve as vindication of gold’s portfolio role in the era of fiat money, I don’t know what will. At the same time, consensus has it that cyclically, stocks are closer to a top than a bottom, and gold is closer to a bottom than a top.

Gold and stocks price performance

Chart courtesy of TradingView.com • • • Click to enlarge

Gold and the purchasing power of the dollar

(1971 to present)

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration • • • Click to enlarge

Looking to get informed and stay informed on the gold market?

TRY A FREE SUBSCRIPTION TO OUR MONTHLY CLIENT LETTER.

No strings attached. Prospective clients welcome!

Short and Sweet

Novice precious metals owners must decide where they stand on this important issue

“Precious metals are and always have been the ultimate insurance,” says Pro Aurum’s Robert Hartman in an interview with Claudio Grass. “They provide protection both against state failures and against mistakes in the monetary policy of the central banks. Every investor who looks into the history books sees that both have happened over and over again in the past centuries. From that perspective, investing in physical gold and silver is a common-sense precaution and a necessary part of any wealth preservation plan. Investors and ordinary savers ignore this at their peril and the failure to include precious metals in one’s portfolio is pure negligence.”

There are essentially two broad schools of thought alive and well in the gold market. The first holds that crisis is around the corner and, as a result, precious metals should be owned to profit from the event. The second holds that crisis is a permanent fixture in the market dynamic and that the portfolio should always include precious metals as the ultimate safe haven. The first buyer sees precious metals as investment products, i.e., buy now and sell later when the time is right. The second sees gold and silver, like Hartmann, as insurance products to be held for the long run. Some combine the two, allocating one part of their precious metals portfolio for trading purposes and another as a permanent, or semi-permanent, store of value. The novice precious metals owner must decide where he or she stands in this regard because it determines, in turn, which products to include in the portfolio and to what degree.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to prepare your portfolio for whatever uncertainty lies ahead?

DISCOVER THE USAGOLDDIFFERENCE

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Hubris at the Fed and original sin

John Mauldin and company offers some deep thinking on how we got where we are and where we might be headed in a must-read posted at GoldSeek …… “The Fed’s actions under Yellen and Powell,” he writes, “were the natural progression of Greenspan’s original sin: thinking the Fed could and should use its power over interest rates to produce desirable economic outcomes. To be fair, low rates had some positive effects. But the future was unevenly distributed and certainly not permanent. Fed leaders thought this time was different. It wasn’t. So here we are, facing maybe not the worst inflation in history, but probably the widest inflation in history.” Mauldin ends by saying he just met with several financial notables in New York City (names you would recognize), and the recurring question was, “how does this end?” – to which he answers: “No one really knows.”

__________________________________________________________________________________

From that same article –

“Because we all know exactly how this Old Story ends, right? We know that when prideful human leaders lift themselves and their people up to unnatural heights by stealing what is not rightfully theirs, their society is struck down in retribution. We’ve seen this movie a thousand times before.” – Ben Hunt, Epsilon Theory, Hollow Men, Hollow Markets, Hollow World

“At the meeting, Volcker publicly agreed with Fed Chair Yellen*. But only a few months later I asked Volcker in person whether he stood by his words. ‘No,’ he replied, ‘of course there’s a bubble. My grandchildren can’t afford to buy apartments in New York City. I just didn’t want to say so in front of The Wall Street Journal .’” – Ed Chancellor, author, The Price of Time: The Real Story of Interest

* That we are not in a financial bubble

__________________________________________________________________________________

Worried about how the ‘wildest inflation’ in history might end?

DISCOVER THE USAGOLD DIFFERENCE

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Facing down our investment fears

Courage comes from a strategy you can genuinely believe in

“As markets shake off their summer slumbers,” writes London-based analyst Bill Blain, “what should we be worrying about? Lots..! From real vs transitory inflation arguments, the long-term economic consequences of Covid, the future for Central Banking unable to unravel its Gordian knot of monetary experimentation, and the prospects for rising political instability in the US and Europe.”

Facing down your investment fears can only come from a strategy you can genuinely believe in. One of the great quotes on gold ownership came many years ago from Richard Russell, the now-deceased editor of the Dow Theory Letters. “I still sleep better at night,” he wrote, “knowing that I hold some gold. If or when everything else falls apart, gold will still be unquestioned wealth.” It is not a complicated strategy, but it can be an effective one.

Though rarely discussed, gold ownership has as much to do with personal philosophy and how we wish to conduct our lives as it does finance and economics. In many ways, it is a rational portfolio decision that suits the times, but it is also a lifestyle decision that provides some peace of mind no matter what happens with inflation, the banking system, the mania on Wall Street, or the political maneuvering in Washington D.C.

Looking to sleep better at night?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100/[email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Of 17th-century tulips, 21st-century stocks and ageless gold

During the Dutch Tulipmania, the price of one special, rare type of tulip bulb called Semper Augustus sold for 1000 guilders in 1623, 1200 guilders in 1624, 2000 guilders in 1625, and 5500 guilders in 1637. Shortly thereafter, the bottom fell out of the market and prices plummeted to 1/200 of their peak price – a mere 27 guilders. In the artwork above an individual, portrayed in fool’s garment, is shown trading a hefty pouch of gold for a handful of tulip bulbs. It is no mystery who got the better part of that bargain. History teaches us that no era is immune to financial mania including our own. As a matter of fact, a good many believe that we are fully immersed in a stock market mania (wherein many include cryptocurrency) right now.

Since the earliest days of the USAGOLD website (the mid-1990s), we have enshrined a quote from Thomas Bailey Aldrich at our home page: “The possession of gold has ruined fewer men than the lack of it.” Aldrich’s axiom has held true down through the ages. It applied in ancient Greece and Rome, in 11th century China, in the time of the Medicis, the Dutch Tulipmania, the South Seas Bubble and French fiat money mania, during the long string of panics in the late nineteenth and early 20th centuries (Aldrich’s time), the spate of post World War I and II hyperinflations (Austria, Germany, Greece, Hungary, et al) and it still applies today.

_____________________________________________________________

Ready to swap tulips for gold?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

Gold, vanadium, europium reveal the existence of a mysterious particle

“Atomo de oro”/Galarza Creador

“To observe the Majorana fermions,” reports Mining.com, “a team of physicists from the Massachusetts Institute of Technology, the Institute of Technology at Delhi, the University of California at Riverside, and the Hong Kong University of Science and Technology, scientists designed and built a material system that consists of nanowires of gold grown atop a superconducting material, vanadium, and dotted with small, ferromagnetic ‘islands’ of europium sulfide, which is a ferromagnetic material that is able to provide the needed internal magnetic fields to create the Majorana fermions. When the researchers applied a tiny voltage and scanned the surface near the islands, they saw signature signal spikes near-zero energy on the very top surface of gold that, according to theory, should only be generated by pairs of Majorana fermions.”

This must have been what Ben Bernanke was talking about years ago when he said he didn’t understand gold. [Smile] Gold’s allure, to be sure, is a mystery to some, but for those who understand the ever-present dangers imposed by the money printing press, the only mystery is why so few own it.

____________________________________

Image attribution: Galarza Creador, Atomo de oro, CC BY 3.0 <https://creativecommons.org/licenses/by/3.0>, via Wikimedia Commons

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to hedge your portfolio against the mysteries of current monetary policy?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

‘Everyone knows they need a safe haven’

“Last March and April (2020),” writes the Systemic Risk Council’s Paul Tucker in a piece published recently at Financial Times, “the fabric of our financial system was stretched almost beyond endurance. Only intervention from the north Atlantic central banks seems to have averted some kind of disaster triggered by markets grasping the pandemic was serious.”

The most important lesson from that brush with disaster is that the financial authorities did not even bother to disclose to the public (and the investment community) just how dangerous the situation had become until months after the fact. It was labeled, you might recall, a “liquidity problem” that the Fed was addressing – no need to worry. Such circumstances argue strongly for having a hedge in place at all times just in case the wheels actually do come off.

MoneyWeek’s Merryn Somerset Webb posted a reminder of gold’s baseline portfolio role during times of market uncertainty in a separate Financial Times’ opinion piece in early January. “Think of the reasons to hold gold,” she wrote. “If inflation is coming (and it probably is) you want to hold a real asset that can hedge against it — one that can’t be inflated away by relentless money creation and currency debasement.…[E]veryone knows they need a safe haven, but everyone also knows the traditional ones (government bonds) no longer offer that safe haven. That turns us to gold, the one asset that has a 3,000-year record of protecting purchasing power. No wonder the gold price is up around 40 percent since 2018. I hold a lot of gold for all these reasons.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you looking for a long-term safe haven?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Gold coins, hoofs found in 2,000 year old Chinese tomb

These gold artifacts were found along with a portrait of Confucius, perhaps the oldest known. Wisdom and gold make easy company. Confucius once said something that has current applicability: “In a country well governed, poverty is something to be ashamed of. In a country badly governed, wealth is something to be ashamed of.” Or at the very least, well-hedged ………

Is the wisdom of a hedge in your financial future?\

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Ready to move from education to action?

DISCOVER THE

USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

2:42 pm Wed. April 24, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115