Monthly Archives: April 2022

‘Big Short’ investor Michael Burry warns even the best growth stocks can crash

MarketsInsider/Theron Mohamed/4-22-2022

“‘Remember when Amazon fell 95%?’ he continued, referring to the e-commerce company’s stock plummeting after the dot-com bubble burst. ‘But the Fed? But the Fed didn’t have inflation like this hanging over its head then either,’ the Scion Asset Management boss added.”

USAGOLD note: Burry infers that the Fed might not be able to come riding to the rescue this time around. We post the chart below for those who weren’t around for the dot.com crash and those who were but may have forgotten how aggressive a stock market decline can become. Between 2000 and late 2002, the NASDAQ dropped 78% from peak to trough.

Sources: St. Louis Federal Reserve [FRED], NASDAQ OMX Group

Fed’s hawkish tone feeds market anxiety over runaway inflation

Financial Times/Tommy Stubbington and Colby Smith/4-23-2022

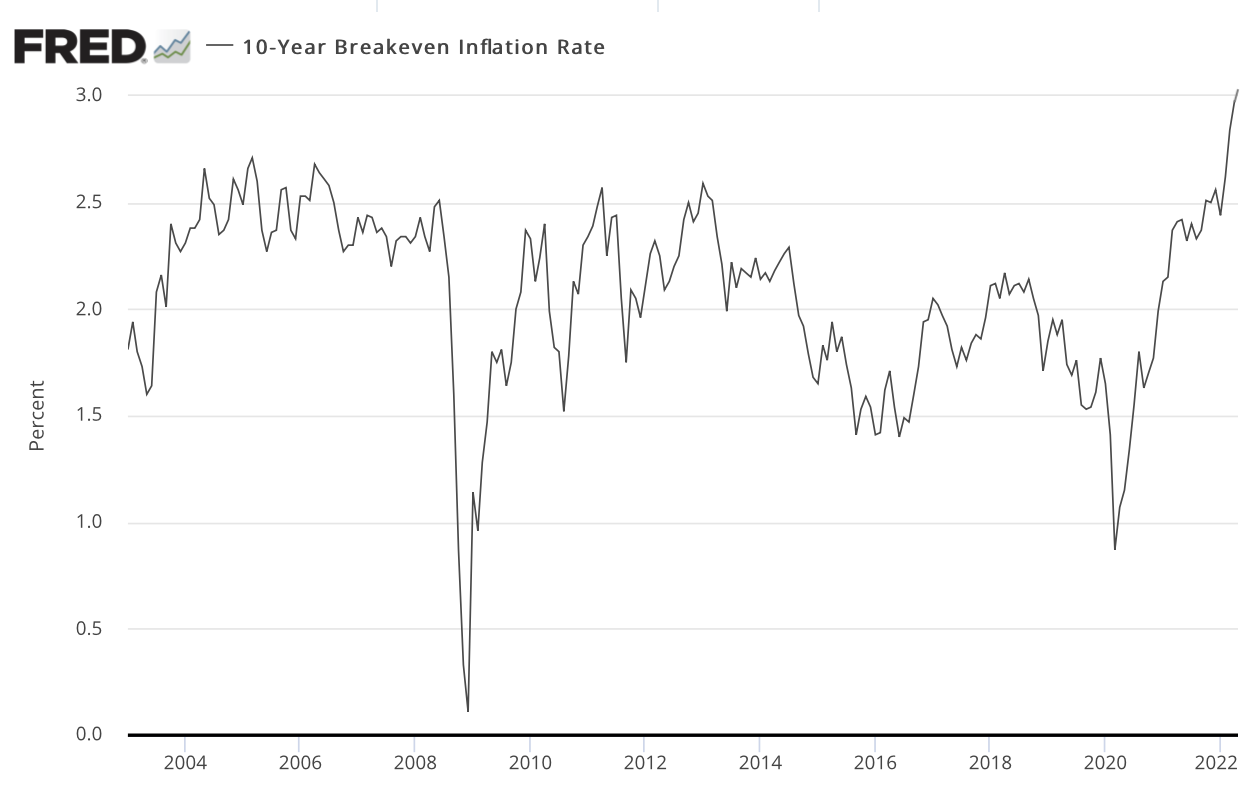

“Investors’ expectations for US inflation have shot to their highest level in decades even as the Federal Reserve signaled that an aggressive tightening of monetary policy was imminent, underscoring the challenge central banks face in convincing markets they can tame runaway price growth.

USAGOLD note: The last print on consumer prices came in 8.5% higher year over year – nearly 5.5% over expectations at 3.08% and the highest in twenty years. Though central banks rely on the 10-year breakeven rate for policy decisions, a good many knowledgeable investors are looking at much higher numbers to cover inflation’s bite.

Source: St. Louis Federal Reserve [FRED]

Treasury bond massacre, mortgage rates hit 5.35%, highest since 2009, and its only April

Wolf Street/Wolf Richter/4-19-2022

“The interesting thing is that no one at the Fed is trying to talk down those spikes in Treasury yields and mortgage rates. It shows that those yields are going where the Fed wants them to go, and that the Treasury market is coming around to the Fed’s rate-hike plan, and that those yields have a long ways to go, given that CPI inflation is 8.5%, a gigantic mess that has unfolded over the past 15 months, finally, after 12 years of money-printing.”

USAGOLD note: The low down on the bond market massacre and rising rates – cause and effect without the media spin.

BOJ must keep ‘aggressive’ easing even as yen drops, Kuroda says

Bloomberg/Toru Fujioka and Matthew Boesler/4-22-2022

“Governor Haruhiko Kuroda said the Bank of Japan must keep applying monetary stimulus given the more subdued inflation dynamics in the country compared with the U.S., in remarks Friday that omitted any reference to the yen’s depreciation.”

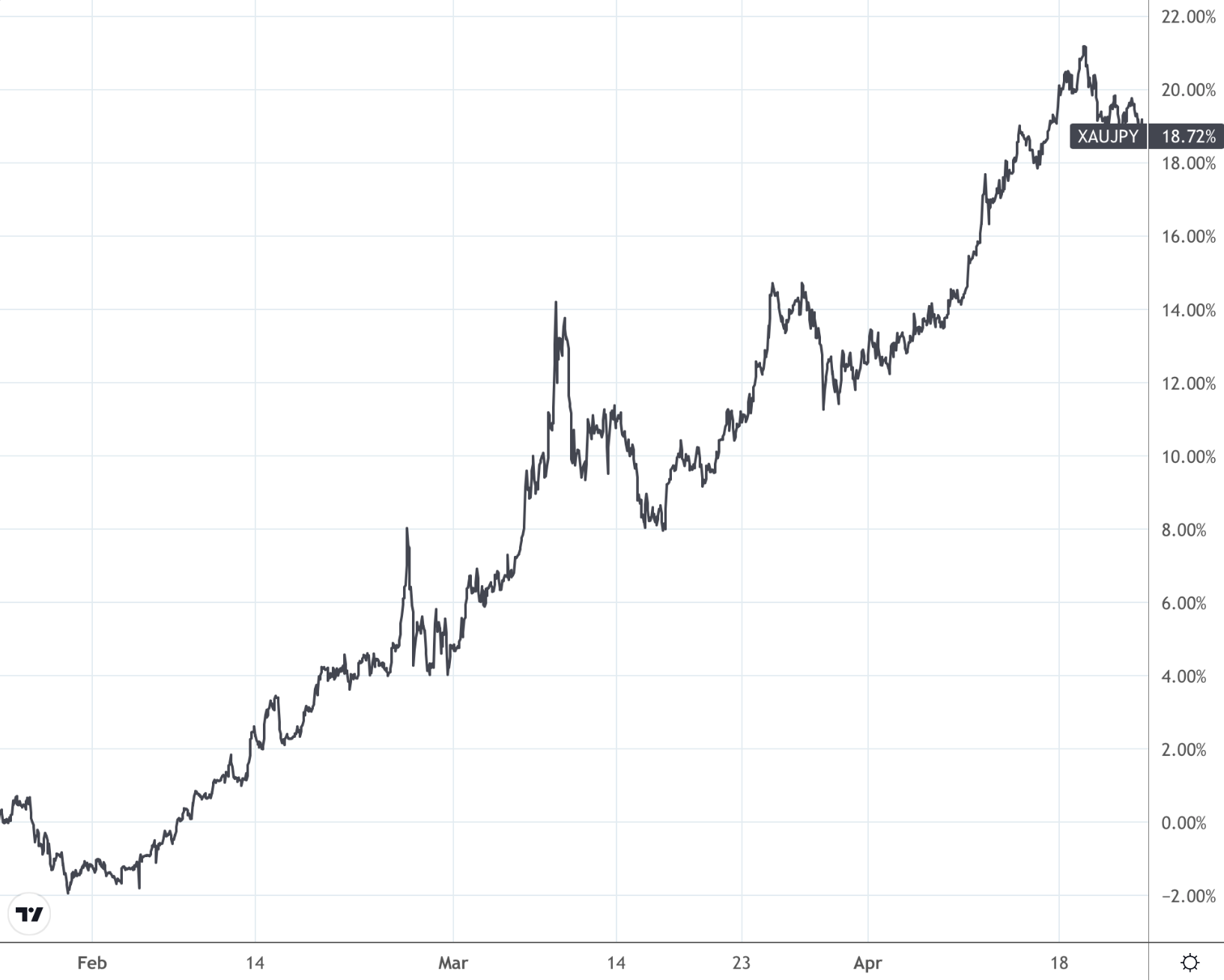

USAGOLD note: The price of gold is skyrocketing in Japanese yen as the BOJ pursues its aggressive easing policy. Gold is up almost 19% in yen over the past three months while the yen is down about 12% against the dollar over the same period ….. While the collapsing yen has contributed to a bullish gold market in Japan, it has also contributed to dollar strength and gold’s downtrend over the past several days.

Gold in Japanese yen

(%, three months)

Chart courtesy of TradingView.com

Gold rallies on weaker dollar, yesterday’s negative GDP number

Crescat sees ‘probable step-function devaluation of fiat currency systems’ against gold

(USAGOLD – 4/29/2022) – Gold rallied this morning on firmer Asian currencies and a somewhat delayed response to yesterday’s negative GDP print. It is up $21 at $1918. Silver is up 22¢ at $23.45. Gold looks like it will finish April down about 1%. Always more volatile, silver is setting up to finish the month down 6%. The World Gold Council released its Gold Demand Trends report for the first quarter yesterday, and it shows overall demand up 34% over last year’s first quarter, with soaring investment demand (up 203%) leading the way. That uptick, in turn, was led by increased ETF demand as funds and institutions returned to the market. In a recent detailed analysis posted at Seeking Alpha, Crescat Capital suggests that we are entering a new era for the global monetary system but that it might not be what is popularly envisioned.

“Contrary to much gold conspiracy thought, it does not mean that we are facing the demise of the Western banking system nor the rise of authoritarian economies and their fiat currencies. It doesn’t necessarily mean the rise of non-government backed intangible currencies either. Governments will maintain legal authority and power over currency systems. Individuals and businesses will use those currencies. The strongest fiat currencies are likely to continue to be those in advanced economies where the principles of liberty, justice, democracy, entrepreneurship, and free markets reign. The macro setup today portends a deleveraging of the global economy through inflation, including a probable step-function devaluation of all fiat currency systems relative to gold, a persistent phenomenon throughout world history.”

(Editor’s note: The accompanying chart supports Crescat’s argument. Over the past five years, gold is up 50.5% against the dollar; 44% against the Chinese yuan; 55.5% against the British pound; 55.8% against the euro; 75.7% against the Japanese yen; and 79% against the Indian rupee, with a notable acceleration in those trends since the beginning of 2022.)

Gold in major national currencies

(%, five-year)

Chart courtesy of TradingView.com • • • Click to enlarge

Boomers are leaving the stock market. Here’s what comes next, says this strategist.

MarketWatch/Barbara Kollmeyer/4-28-2022

USAGOLD note: This article supports the point made in our post yesterday on this same subject. Isn’t that what the Fed did in the 1930s and precisely for the same reason – raised rates to weaken equities? Boomers, this article reports, are moving to cash. As the stagflationary chickens come home to roost, the boomer generation, having lived through the 1970s, might recall that cash does not do particularly well as the cost of living skyrocketed. Certain alternative investments akin to cash did very well as pointed out at the link in this post note.

The end of an economic illusion

Project Syndicate/John H. Cochrane/4-15-2022

“Moreover, this inflation is clearly rooted in excessively expansive fiscal policies. While supply shocks can raise the price of one thing relative to others, they do not raise all prices and wages together. A lot of wishful thinking will have to be abandoned, starting with the idea that governments can borrow or print as much money as they need to spray at every problem.”

USAGOLD note: Cochrane offers advice as to how the government and central bank should proceed, but it is doubtful the White House is listening.

Why gold will benefit from the inevitable reshaping of the international monetary system

GoldSwitzerland/Ronni Stoferle/4-15-2022

“The ‘militarization of currency reserves’ has deprived the world’s reserve currency, the US dollar, of its neutrality, a neutrality that is indispensable for a universal currency. The euro and other Western countries who are potential competitors for the US dollar’s position have taken themselves out of the game immediately. … Therefore, 50 years after the closing of the gold window, the chances are that gold may play a role again in the inevitable reshaping of the world monetary order. Gold is politically neutral, it does not belong to any state, political party or institution. This neutrality could serve as a bridge of trust between the geopolitical power blocs that currently seem to be emerging.”

USAGOLD note: In order for gold to play a meaningful role in the reorganization of the international monetary system, the price will have to be adjusted upwards, according to Stoferle – perhaps radically upward. We recommend the full analysis at the link. It offers considerable food for thought. We will add that gold serves the same purposes in the private investment portfolio that it does in the reserve holdings of nation-states and their central banks.

Elon Musk says he thinks inflation is worse than reported and likely to continue through 2022

USAGOLD note: Musk says some Tesla suppliers have bumped prices 20% to 30% – numbers that rival the inflation rate Europe is experiencing. He goes on to say that “we don’t control the macroeconomic environment” or what will happen if “governments keep printing vast amounts of money.”

U.S. economy unexpectedly contracts in first quarter

“The American economy contracted an annualized 1.4% on quarter in the first three months of 2022, well below market forecasts of a 1.1% expansion and following a 6.9% growth in Q4 2021 mostly due to a record trade deficit and a decline in inventory investment. Together, net exports and inventories subtracted about 4 percentage points from growth. The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment increased.”

United States GDP growth rate

Source: tradingeconomics.com

USAGOLD note: Some economists, recalling the late 1920s monetary episode, will question raising rates in the teeth of what looks to be an economic slowdown. The surprise GDP contraction lays the groundwork for an interesting Fed policy meeting next week. At the moment, it appears that the markets believe the Fed will stick to its guns on a tightening cycle.

Gold level as sharp dollar advance continues

‘The last time this happened markets got very wobbly.’

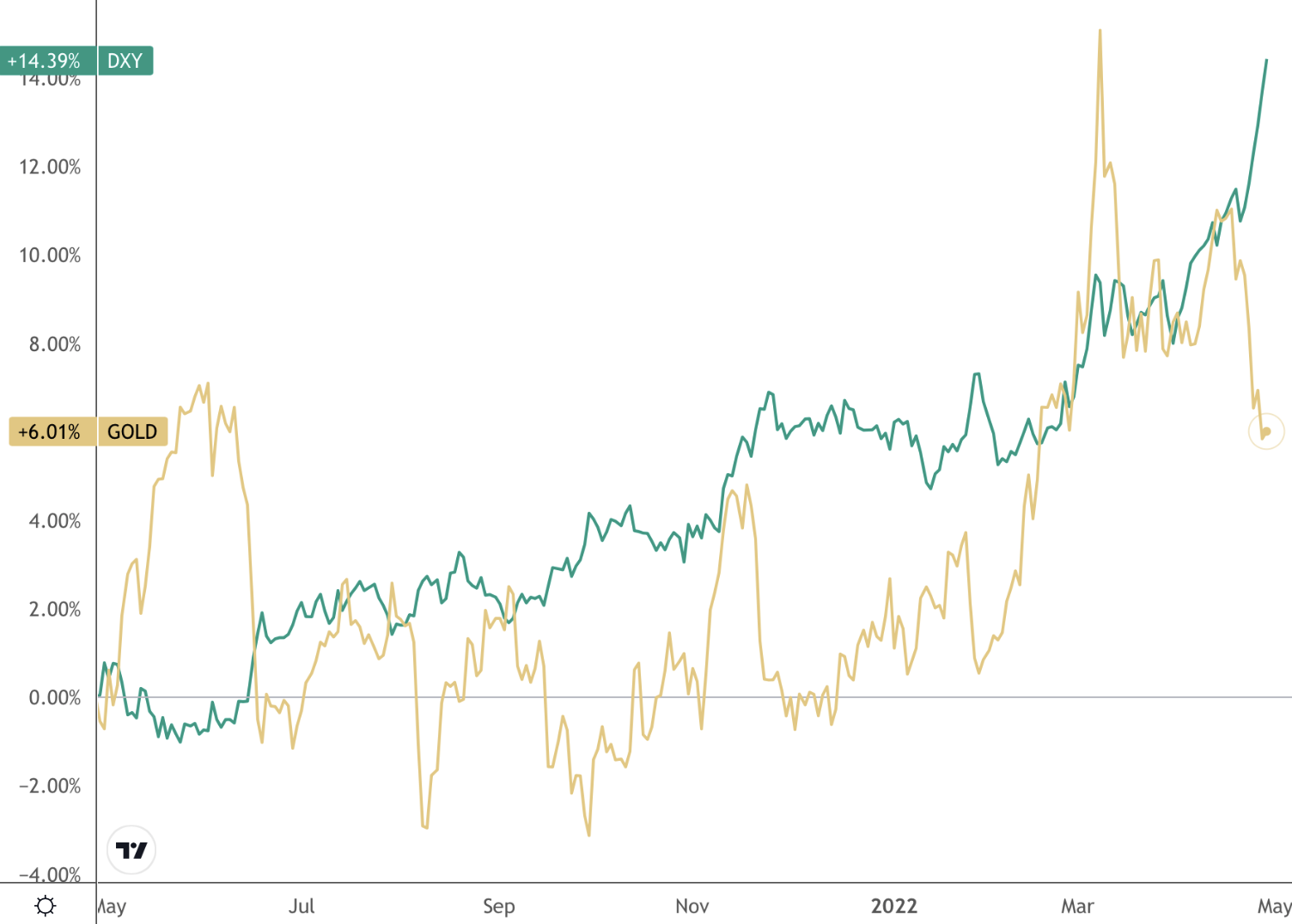

(USAGOLD – 4/28/2022) – Gold is level this morning as the dollar advanced sharply against both the Japanese yen and Chinese yuan, and the markets awaited this morning’s GDP number expected to come in at an anemic 1.1% for the first quarter. It is trading at $1888 in the early going. Silver is down 30¢ at $23.08. Gold and the dollar generally advanced in tandem over the past year as investors positioned themselves defensively in response to weakening global bond markets. That all changed over the past month when the Japanese, Chinese, and European central banks advertised looser monetary policies while the Federal Reserve signaled the polar opposite. In response, the dollar index took a sharp turn to the upside (up 14% over the past year), while gold weakened from near all-time highs (though, as a matter of perspective, it is still up about 6% over the past year).

“China,” writes Money Week’s John Stepek in an analysis posted Tuesday, “is now on the wrong side of the central bank rate-raising cycle. (Ed. note: The same might be said for Japan and Europe.) China’s slowdown means it’s not going to raise interest rates – but the US is, and, all else being equal (it never is, but rates matter more than most things) higher rates will attract more money than lower rates. Anyway, last time this happened markets got very wobbly, which is one reason why central banks decided against raising rates. As you may well have noticed, markets are pretty wobbly right now as well. So a few questions arise from all this.” Stepek advises sticking with inflation bets. “I’d hold some gold (it’s handy to have in a panic),” he concludes, “and I’d make sure you allocate more to cash than usual simply to have it around in case you need it or want it to take advantage of any opportunities.”

Gold and the U.S. Dollar Index

(%, 12-months)

Chart courtesy of TradingView.com

Wealthy investors aren’t convinced big stock market losses mean it’s a buy-the-dip moment

“It’s been a tough year to be an investor, and the wealthy are no exception. Losses in both stock and bond markets this year have made portfolio conversations between Wall Street investment advisors and clients more challenging. The most conservative portfolios have done as poorly if not worse than the riskiest portfolios, with bonds offering little in the way of protection. But if there’s a moment when the majority of wealthy, experienced investors call an all-clear on recent equities’ volatility and buy-the-dip in stocks, this isn’t looking like it.”

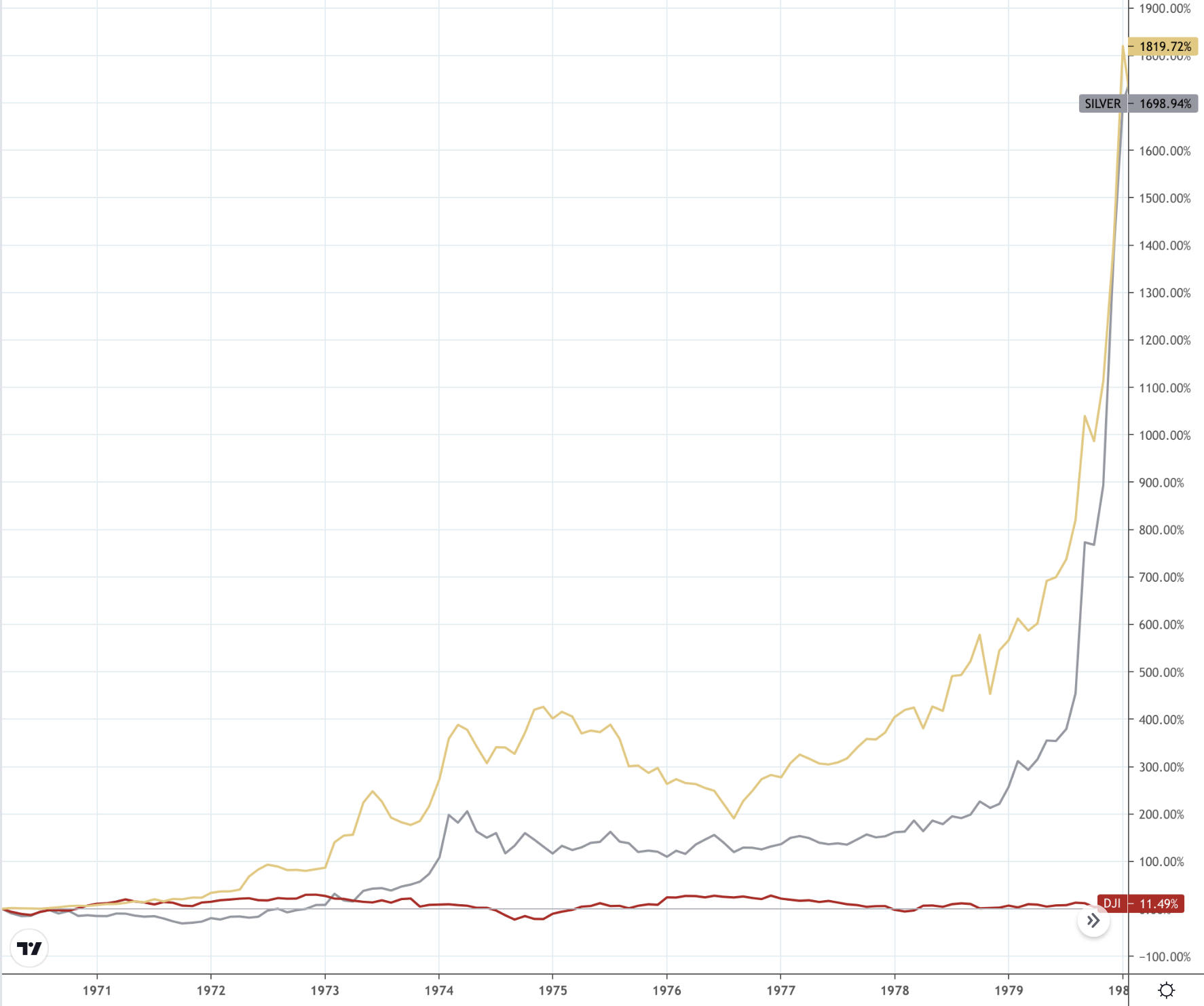

USAGOLD note: For certain, the current period is looking to the older crowd a lot like the 1970s. They are likely to recall that buying the dip did not work out all that well back then – a lesson many will pass on to younger members of the family, friends and acquaintances. Gold and silver, on the other hand, did quite well during the period, as the chart immediately below shows.

Gold, silver and stocks price performance

(%, 1971-1980)

Chart courtesy of TradingView.com • • • Click to enlarge

Mises Institute’s Jeff Deist interviews famed investor Jim Rogers

Mises Institute/Jeff Deist/4-25-2022

USAGOLD note: It may surprise many of our readers to learn that Jim Rogers embraces the Austrian School of Economics. In this interview, he explains why and how its philosophical tenets contribute to a better understanding markets and investments. He also tells why he thinks now is the time to own commodities.

Israel adds yuan to $206 billion reserves in ‘philosophy’ change

YahooFinance/Daniel Avis/4-20-2022

USAGOLD note: Is this the shape of things to come? There is little doubt that Israel’s example will be taken seriously by emerging country central banks. Some analysts have suggested that eventually gold will come into play as central bank reserve diversification proceeds.

Real rates: How exactly do you measure reality?

Bloomberg/John Authers/4-19-2022

“In times of inflation, real rather than nominal values grow far more important. How well has a price or return delivered for you, after taking inflation into account? In markets, it’s real rates that most matter. But how exactly do you measure reality?”

USAGOLD note: Authers verbalizes what a good many investors have been thinking. Is the manner in which the real rate of return is calculated – using “inflation expectations,” for example, rather than the inflation rate itself – an accurate measure of investment returns? The chart below shows the yawning gap between the headline inflation rate and the yield on 10-year Treasuries. The mainstream financial media often explain gold market sell-offs as a response to rising yields. In our view, it is quite the opposite. A considerable amount of gold demand comes from investors liquidating bonds and moving to gold as the last safe haven left standing in an increasingly inflationary environment.

10-year Treasury yield vs. the headline inflation rate

Chart courtesy of TradingView.com

Commodity prices are going haywire, prompting fears of the next financial crisis

MaketWatch/Chris Matthews/4-19-2022

USAGOLD note: There are so many fires lit in the financial markets these days, that it will be difficult for the Fed to determine which one it should put out first. Some are worried about a speculative crisis suddenly enveloping the commodities space. “… [I]nstead of enacting position limits that work, which would bring prices more in line with supply and demand,” warns one analyst, “we have large banks advising clients to shift more of their portfolios into commodities as a so-called inflation hedge.”

Oil could jump to $185 a barrel if the EU agrees to an immediate ban of Russian crude exports, says JPMorgan

MarketsInsider/Carla Mozee/4-19-2022

“A full and immediate embargo would displace 4 million barrels per day of Russian oil, sending Brent crude to $185 a barrel as such a ban would leave ‘neither room nor time to re-route [supplies] to China, India, or other potential substitute buyers,’ the investment bank said in a note. That would mark a 63% surge from Brent’s close of $113.16 on Monday.”

USAGOLD note: JPMorgan explains the ramifications of a European oil embargo, including the developing logistical problems that could drive prices higher … $185 oil could present a major problem. Nothing fans the inflationary fires like a rising oil price. In the long-term chart below (drawn in log scale), please note the spike in oil prices during the 1970s inflationary crisis.

Brent crude oil price

(Log scale, 1948 to present)

Chart courtesy of TradingView.com

Gold continues to seesaw around $1900 as the dollar hits a two-year high

Deutsche Bank sees higher inflation as the “defining macro story of the decade”

(USAGOLD – 4/27/2022) – Gold continued to seesaw around the $1900 with a firmer dollar – now at two-year highs – the dominant feature in this morning’s trading. It is down $4 at $1904. Silver is up 15¢ at $23.71. As next week’s Fed meeting draws near, concern mounts over the prospect of global stagflation. In an analysis reviewed this morning at Zero Hedge, Deutsche Bank doubles down on its recent prediction that “higher inflation” will be the “defining macro story of the decade” and that sentiment is now “skewed heavily to the downside risk of a significant recession.” The prospect of an inflationary recession, though, simply tops a lengthy list of investor concerns that includes further escalation in the Ukraine war, the China lockdowns, a more hawkish Fed, supply disruptions – etc. According to a Reuters report yesterday, Swiss gold exports to the United States “rocketed” higher in March to their highest level since the early days of the pandemic in 2020 as investors “stocked up on bullion.”

The gathering stagflationary storm will rattle markets, economies and societies

MarketWatchOpinion/Nouriel Roubini/4-25-2022

USAGOLD note: A bleak assessment from Dr. Doom …”The new reality with which many advanced economies and emerging markets must reckon,” he says, “is higher inflation and slowing economic growth.” In light of the gathering stagflationary storm, he has come over to gold’s side in recent months.