Monthly Archives: April 2022

Here’s the playbook if the rest of the world breaks free from the U.S. dollar, says Credit Suisse’s monetary plumbing guru

MarketWatch/Steve Goldstein/4-13-2022

“Without price stability, there is no exorbitant privilege or dollar supremacy, says Pozsar.”

USAGOLD note: And the currency markets, we would guess, turn into some version of a monetary wild west where anything goes in the pursuit of commodities. He says to short the dollar, among a handful of trading options. The standard approach for accomplishing that objective is to buy precious metals, as Pozcar himself has indicated from time to time.

Gold slides under generally subdued market conditions

Saxo Bank says gold now getting ‘directional input’ from oil

(USAGOLD – 4/21/2022) – Gold slid further this morning under generally subdued conditions in most markets. It is down $10 at $1950. Silver is down 40¢ at $24.88. The downtrend of the past few days aside, Saxo Bank’s Ole Hansen sees gold’s performance thus far this year (+8%) as “impressive” against the backdrop of rising yields and a firmer U.S. dollar. He believes its strength has to do with investors seeking safe haven from multiple uncertainties present long before the Ukraine war began – trends now exacerbated by the conflict.

“…The actual impact of sharply higher prices of everything,” he says in a report released yesterday, “is now increasingly being felt across the world. In response to this investors are increasingly waking up to the fact that the good years which delivered strong equity returns and stable yields are over. … Instead of real yields, we have increasingly seen gold take some of its directional input from crude oil, a development that makes perfect sense. The ebb and flow of the oil price impacts inflation through refined products such as diesel and gasoline while its strength or weakness also tell us something about the level of geopolitical risks in the system.”

Chart courtesy of TradingEconomics.com

Gold ETP inflows hit record high of $11.3bn in March

Financial Times/Steve Johnson/4-6-2022

“Purchases of gold exchange-traded products hit an all-time record in March, while investors pulled record amounts from domestically listed European equity funds as the fallout from Russia’s invasion of Ukraine ripped through markets.”[/caption]

USAGOLD note: Missed this one when it first came out and thought it important enough to pass along. The article states that net inflows into gold exchange-traded products rose five times month over month, according to BlackRock data. Growth in ETF stockpiles generally signals renewed interest on the part of funds and institutions.

Issing says ECB lived in inflation fantasy, now trapped

MarketsInsider/Hamza Fareed Malik/4-12-2022

“One of the founding fathers of the euro believes the European Central Bank has been far too slow in responding to inflation and risks tilting the single currency bloc into ‘stagflation’, where prices continue to rise, while growth slows.”

USAGOLD note: Issing joins a growing number of heavyweight economists and analysts worried about stagflation. We recall that Alan Greenspan, a long-time advocate of gold ownership, warned as early as 2018 that we were headed for stagflation. Few paid attention. Few agreed. Now the concern is commonplace. Gold was the star investment of the stagflationary 1970s while stocks and bonds languished.

The Fed should be ready to backstop the commodities market

BloombergOpinion/Steven Kelly/4-12-2022

USAGOLD note: The trouble with black swans is that the fact they are….well, black swans. No one knows where the next one will originate. Apparently, some are worried about the commodities market since the nickel debacle on the London Metals Exchange. Now, we hear rumblings of similar problems in the zinc market (Reuters). But do we really want to go down the bailout road again? Create even more moral hazard than we already have?

How to invest in an environment of rising inflation and unpredictable central bank policy

MoneyWeek/John Stepek/4-9-2022

USAGOLD note: For the old-fashioned portfolio, gold remains a tried and true alternative for hedging a variety of negative events. Even as bond prices have dropped, a circumstance that has historically corresponded with lower gold prices, “gold has performed well,” writes Stepek. “They have now decoupled,” he says.

Gold attempts to stabilize after yesterday’s sell-off

Greenlight’s Einhorn skeptical of the recent blitz in hawkish Fed rhetoric

(USAGOLD – 4/20/2022) – Gold is attempting to stabilize after yesterday’s sell-off driven by short-selling/profit-taking near the $2000 level, a firming dollar, and hawkish comments from Fed governor James Bullard. It is level at $1953. Silver is up 3¢ at $25.29. Greenlight Capital’s David Einhorn is among the group of Wall Street veterans skeptical of the recent blitz in hawkish Fed rhetoric. “[I]s the Fed doing whatever it takes or is it just talking tough, while in reality implementing a weak initial response that could exacerbate the problem?” he asks in his just-released quarterly review of markets. “We think it is clearly the latter. … [T]his feels like trying to figure out whether it’s best to clear a foot of snow from your driveway with a soup ladle vs. an ice cream scooper. This certainly isn’t doing whatever it takes.”

Germany reports record producer price inflation

Trading Economics/Staff/4-20-2022

“Annual producer inflation in Germany jumped to 30.9% in March of 2022, breaking a fresh record high for a 4th straight month and much higher than 25.9% in February and forecasts of 28.2%. The figures reflect the effects of the war in Ukraine for the first time, with energy prices remaining the biggest upward contributor (83.8%), namely distribution of natural gas (144.8%), electricity (85.1%), mineral oil products (61.3%). Excluding energy, producer prices increased 14% yoy. Other significant price increases were seen for intermediate goods (23.3%), namely metals (39.7%), fertilisers and nitrogen compounds (+87.2 %), wooden containers (68.8%); and non-durable consumer goods (9.6%), namely food (12.2%); and capital goods (5.8%, the biggest increase since 1975). Compared to the previous month, producer prices increased 4.9%.”

USAGOLD note: These runaway inflation numbers are likely to keep German gold demand running at very high levels. Note fertilizer prices rising 87.2% – nearly doubling.

Germany producer price inflation

(%, year over year)

Source: tradingeconomics.com

War and stagflation threaten global economy as pandemic recovery slows

Financial Times/Chris Giles/4-18-2022

USAGOLD note: This article appeared on the front page of the Financial Times. We would gather from that it is now official. Stagflation is the wolf at the doorstep.

Weak yen hits demand for Treasuries as traders weigh up hedging costs

Financial Times/Eric Platt and Joe Rennison/4-11-2022

USAGOLD note: China and Japan, as a memory refresher, are the two largest holders of U.S debt and for many years constituted the bulk of external demand for U.S. Treasuries. China has already pretty much vacated the market and now Japanese interest is threatened by the high cost of hedging currency volatility. A strategist at Deutsche Bank goes to the heart of the matter asking “Who is the marginal buyer of Treasury issuance going to be after the Fed?”

Martin Lewis warns of ‘civil unrest’ amid U.K. cost-of-living crisis

BloombergAlana Carter/4-9-2022

USAGOLD note: Though we see Lewis’ warning as a bit hyperbolic, particularly when you consider Britain’s normally composed national demeanor, we do sense that the public reaction to inflation could be unpredictable and problematic for the political sector. All eyes will be on the upcoming French election on this score, as it will be the first political contest in a developed economy determined under the cloud of inflation.

Putin’s invasion reminds us that we live in a finite world

Seeking Alpha/Jeremy Grantham/4-7-2022

USAGOLD note: The author of this piece is the same Jeremy Grantham who says the stock market is highly overvalued and due for a resounding crash. Though he doesn’t mention it, silver is often cited as one of the direct beneficiaries of the decarbonization he advocates.

Monetary policy must serve the real economy not just financial markets

Financial Times/Mohamed El Erian/4-12-2022

“The situation is particularly acute for the Fed given its gross mischaracterisation of inflation for most of last year, together with its failure to act decisively when it belatedly recognised that price instability had taken root under its watch.”

USAGOLD note: Has the Fed really strayed that far from its original thesis that inflation was transitory and would simply go away?

Gold trades listlessly amidst a steady blitz of hawkish Fed rhetoric

Jupiter’s Naylor-Leyland outlines what might trigger gold’s next breakout

(USAGOLD – 4/19/2022) – Gold is trading listlessly this morning as markets, in general, reflect caution amidst a steady blitz of hawkish rhetoric from Fed members. It is down $1 at $1980. Silver is up 3¢ at $25.97. Both metals are mounting challenges of psychologically important price levels – $2000 for gold and $26 for silver. Jupiter Asset Management’s Ned Naylor-Leyland thinks that there will be a break out in the gold price and that “the trigger may be when inflation surprises to the upside, or the market accepts that seven interest rate hikes in the US is a bit too aggressive.” He also believes that when the breakout occurs silver will outperform gold and “very dramatically so.”

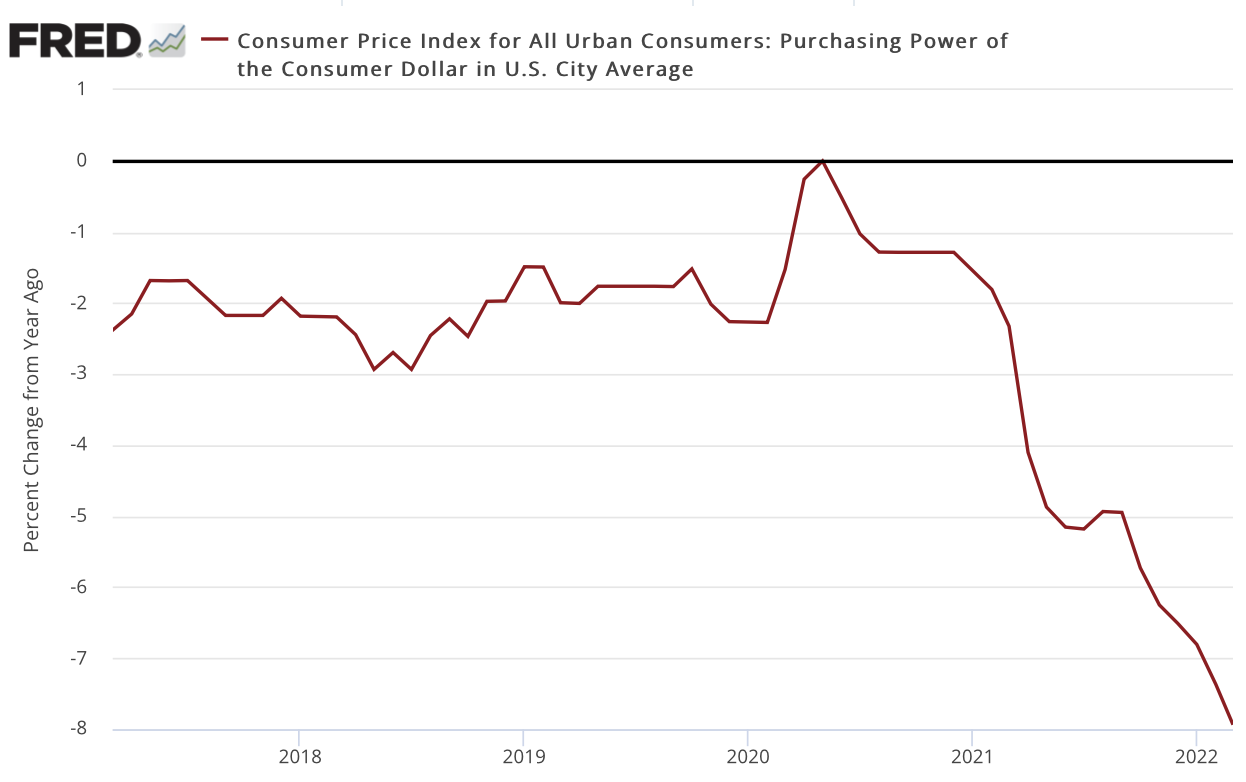

“People are interested in gold because they are worried about future purchasing power,” he writes in an article posted at Gulf News. “The market is still considering whether the US Federal Reserve (Fed) will be able to raise interest rates as much as seven times this year and whether or not inflation will materially weaken. In my view, this is why gold hasn’t broken out properly yet — the market is focused on relatively hawkish observations.” Many of our readers will be surprised by the chart posted below. The dollar has lost 8% in purchasing power over the past year.

Purchasing power of the U.S. dollar

(Percent change year over year)

Sources: St. Louis Federal Reserve [FRED]. U.S. Bureau of Labor Statistics

April could be a great month for stocks — if you believe in magic

MarketWatch/Mark Hulbert/4-9-2022

USAGOLD note: Hulbert writes an instructive short commentary on the human propensity to force the randomness in markets into something seemingly more predictable, i.e., to “discover a pattern,” as Hulbert puts it, “where none exists.” In our estimation, the understanding that markets and the economy as a whole is foundational to the rationale for gold and silver ownership.

How the Federal Reserve became must see Kardashian-style reality TV

Financial Times/Gary Silverman/4-9-2022

“As US central bankers confront the most serious inflationary surge since Volcker’s time, they have become relentlessly chatty, appearing on stage and screen to discuss the latest economic data and the implications for the policymaking Federal Open Market Committee. The result is the Wall Street equivalent of Keeping Up with the Kardashians — must-see reality TV.”

USAGOLD note: The problem with the high degree of “transparency” at the Fed is that neither Wall Street nor Main Street can fully put together what it translates to. One research analyst says that the Fed members who frequent the media speak not to Main Street but to portfolio managers. The portfolio managers often respond in knee-jerk fashion pushing financial markets willy-nilly simply because they have more capital at their disposal than they should. The markets move accordingly but not always in concert with reality. The comparison to the Kardashians is justified. We should learn to take these Fed-member public forays with a grain of salt and concentrate on what the Fed does, not what it says.

Peter Thiel’s ‘sociopaths’ know something he doesn’t

USAGOLD note: We were surprised that Ron Insana would have nice things to say about gold. We can’t remember if he has ever said anything positive about “the hard currency for most of the planet” before. We were also surprised that the usually staid Mr. Thiel would go nuclear on what he calls the ‘finance gerontocracy” (Warren Buffett, Jamie Dimon, and Larry Fink). Perhaps what really has him so irked is bitcoin’s poor performance of late – down over 35% from its early November peak.

A $430 billion cautionary tale inside Japan’s central bank

Bloomberg/Min Jeong Lee and Toru Fujioka/4-7-2022

USAGOLD note: The problem, according to Bloomberg, is liquidating those assets without cratering the target market – an asset trap of sorts that makes the central bank a semi-permanent to permanent holder of the securities in question. Why wouldn’t the Fed, some might ask, find itself in a similar situation with U.S. Treasuries and mortgage-backed securities? Japan in this regard is indeed a cautionary tale ……

Gold surges on war, inflation and bond market concerns

Van Eck says the metal has emerged as ‘an uncontested store of value’ for central banks

(USAGOLD – 4/15/2022) – Gold surged in early trading on a familiar trio of concerns – the escalating conflict in Ukraine, broadening inflation, and declining global bond markets. It is up $18 at $1994. Silver is up 31¢ at $26.05. Gold closed out last week up 1.34%. Silver finished the week up 3.5%. Van Eck Funds, the global investment firm, believes that gold has emerged as an “uncontested store of value” in the eyes of the world’s central banks.

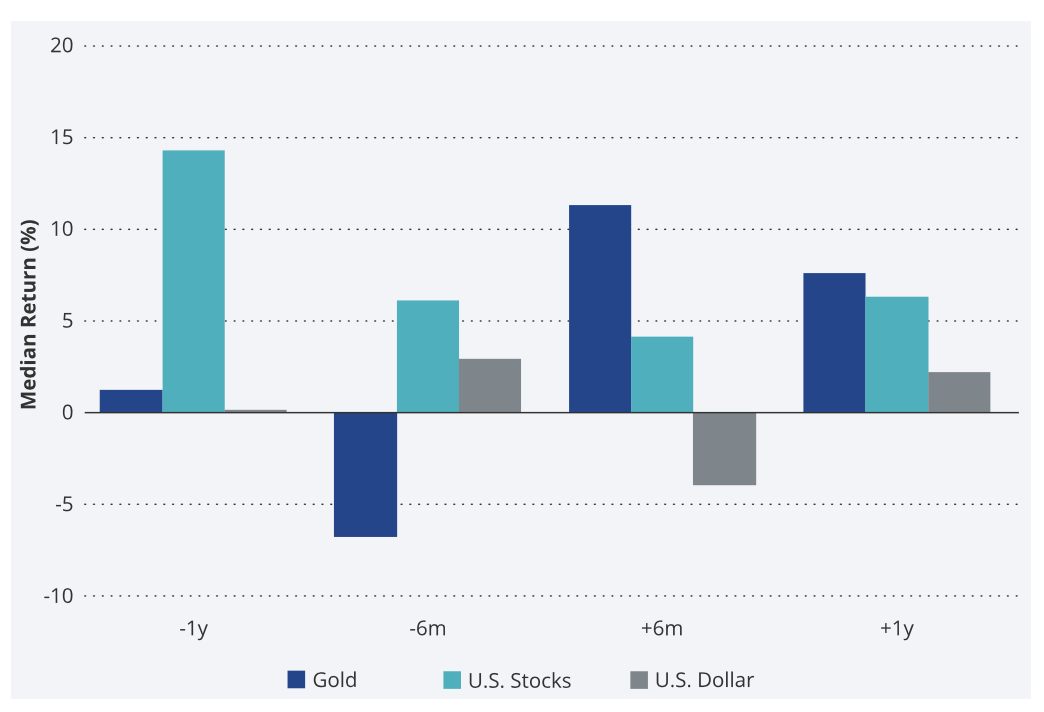

Further, it says in a report posted Wednesday at Seeking Alpha, “the gold price will likely continue to be driven by the effects and risks brought about by the ongoing war, its potential for expansion beyond Ukraine, and residual, negative impacts on the world economy. In addition, gold markets will be watching the Fed in its fight against inflation.” It concludes that “both persistent inflation and/or a recession would be positive for gold.” Last, it points out that during the last four tightening cycles (1994, 1999, 2004 and 2015) gold outperformed stocks and the U.S. dollar “in the six months and the twelve months after the first hike of the cycle, even though it underperformed in the months ahead of it.”

Gold, US stocks, and US Treasuries over the past four Fed tightening cycles

(%, median return)

Chart note: Median returns based on the past four tightening cycles starting in February 1994, June 1999, June 2004, and December 2015. US dollar performance based on the Fed trade-weighted dollar index prior to 1997 and the DXY index thereafter, due to data availability.

Four financial questions for Passover and Easter

Bloomberg/John Authers/4-14-2022

USAGOLD note: Authers starts by questioning why recession is a major concern when unemployment is so low and ends by asking why stocks are up and bonds down when it is historically the other way around in times of war. Authers makes an attempt at some answers while surfacing much food for thought throughout ……