Favorite web pages

Why financial advisers should line their portfolios with gold

More and more, it is becoming a mainstay in the financial business that the wise investor and/or financial advisor embrace gold as a means to capital preservation in a rapidly changing and increasingly dangerous investment climate. In Cazenove Capital’s case, it is emphasizing gold as a hedge against geopolitical turbulence. “Speaking at a Schroders breakfast briefing yesterday (January 22),” reports Financial Times, “Janet Mui, global economist at Cazenove Capital, said she thought investing in gold was the best way for advisers and fund managers to hedge the risks in their portfolios. She said: ‘Gold has the feature of portfolio hedging and diversification. Gold should be in your portfolio.’”

Related, please see:

Precious metals for financial planners and advisors

___________________________________________________________________________

Looking to help your clients add gold coins and bullion to their holdings?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Favorite web pages

What you need to know before you invest in gold

Initial guidelines for first-time investors from one of America’s top gold experts

New to the idea of including gold in your investment portfolio?

If so, this is the page for you.

If you are new to the idea of gold ownership, you might be looking for a little guidance. We, at USAGOLD, have been in the gold business for a good many years, and the one thing that stands out to us in working with so many over the years is how often investors, for one reason or another, get off to a bad start.

That is why we developed a question and answer page many years ago that delves into the subject of GETTING OFF TO THE RIGHT START. We update it regularly as things can change rapidly in the gold and silver markets. The page is linked above, and we recommend that newcomers spend the few minutes it takes to get through it.…

This page receives considerably high-ranking from Google on a number of important searches, and we like to think it’s because of the cause it serves – providing some positive direction to investors trying to get off to a solid start in their pursuit of gold ownership.

Favorite web pages

Gold and silver price predictions and analysis from prominent players

Curious about gold and silver’s future? This page catalogs price predictions and new analysis from top pundits and prognosticators – a casting of the runes updated regularly throughout the year as new additions surface.

We encourage your bookmark. We invite your return visits.

Favorite web pages

Gold Trading Hours

Whenever the gold market gets active, we have a large increase in visitors at our Gold Trading Hours page. Investors want to see which markets – Asian, European or American – are the focal point for price movement. They also want to know when a particular market is going to open or close in areas where gold might experience an influx of buyer or seller interest. That is why we designed this popular page with market hours and a live clock showing the local time in that particular market and all the other major gold markets. Gold Trading Hours is one of the quiet pages at USAGOLD that garners significant global interest. We also invite you to return here regularly – to this Live Daily Newsletter page – for up-to-the-minute gold market news, opinion and analysis as it happens.

We invite your visit. We encourage your bookmark.

USAGOLD’s

Gold Trading Hours

London – New York – Sydney – Hong Kong – Shanghai – Tokyo – Zurich

Favorite web pages

Charles DeGaulle’s famous ‘Criterion’ speech

____________________________________________________________________________________________________

Are you ready to add the criterion of value to your investment portfolio?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Favorite Web Pages

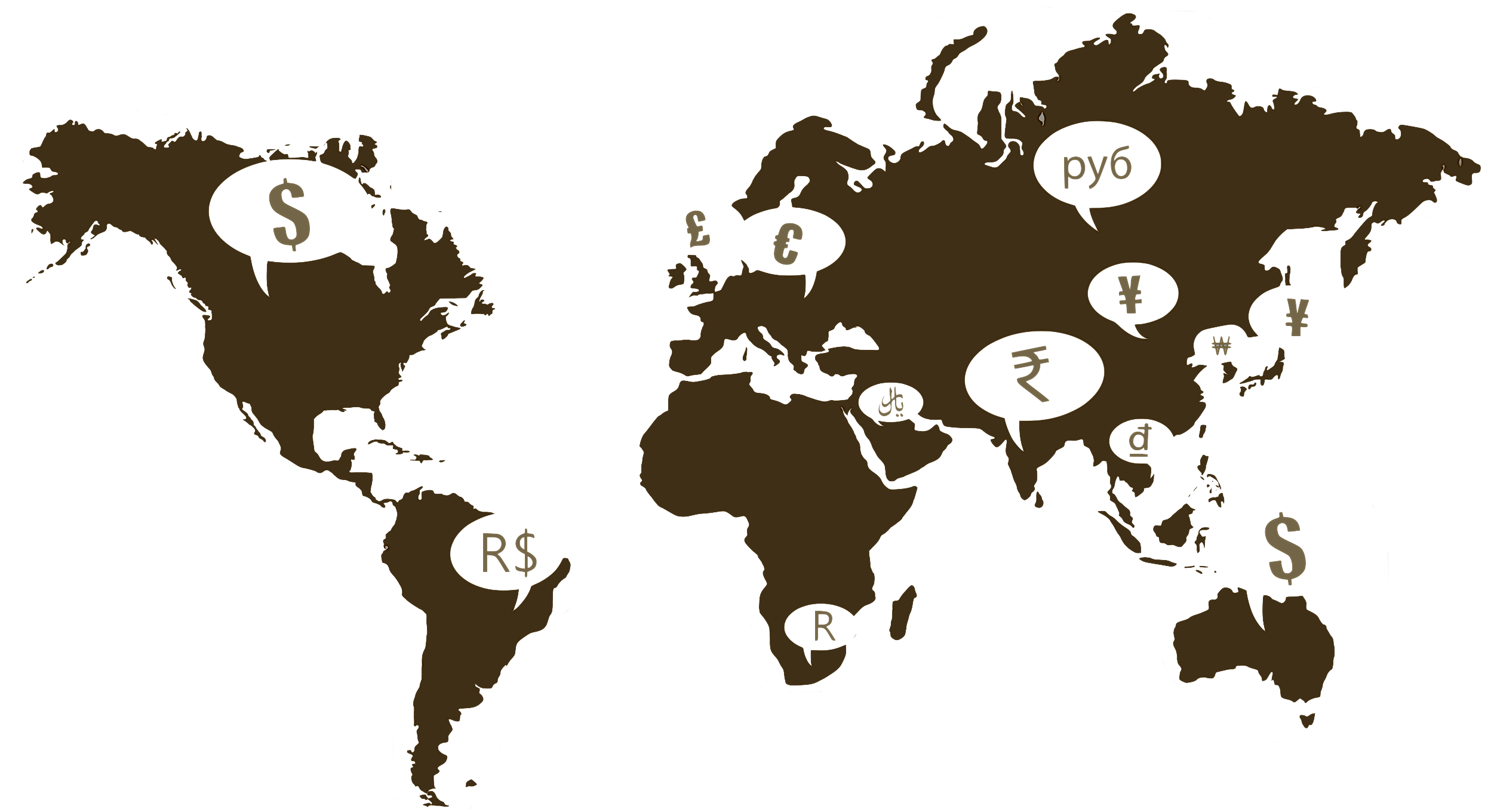

Gold Charts in Various Timelines and Currencies

Euro, Chinese yuan, British pound, Japanese yen, Swiss franc, Indian rupee, Australian dollar, Canadian dollar, U.S. dollar

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

USAGOLD was among the first to offer charts that tracked gold in various currencies and timelines. These live charts have always attracted a steady stream of U.S. and international visitors. As a result, we recently streamlined and upgraded the page to make it more user-friendly and included more currencies in the mix.

We invite your visit and bookmark.

Top ten producers, in metric tonnes

2004 – 2022

Source: U.S. Geological Survey

Favorite web pages

Daily gold and silver price history

1968 to present

Our Daily Gold and Silver Price History pages are among the heaviest traffic pages at the USAGOLD website. The archived data is licensed from the ICE Benchmark Administration and the London Bullion Market Association and Netdania Creations and run from 1968 to present. FOREX prices for the day are posted as a live feed and then frozen at the end of each trading day. These pages are frequented by data gatherers of all descriptions from professors and their students to market professionals and investors – all interested in gold’s price performance both over the long run and within specific time constraints for their own research purposes.

Daily Gold and Silver Price History is another of the quiet pages at USAGOLD that garners significant global interest particularly when the market is moving or breaking news warrants more than average interest. We also invite you to return here regularly – to this Live Daily Newsletter page – for up-to-the-minute gold market news, opinion, and analysis as it happens.

We invite your visit. We encourage your bookmark.

USAGOLD’s

Daily gold and silver price history pages

Favorite web pages

Black SwansYellowGold

A chronology of panics, mania, crashes, and collapses

–– 400 BC to present ––

Those who think it can’t happen here, or that it’s different this time around, should take note of the number of black swan events in American history alone. The record is formidable. Gold ownership is traditionally a form of battening down the hatches against these recurring storms and, for the minority who adhere to it, an effective and ever-ready defense. Historian Stanford University historian Niall Ferguson summed up what a good many were thinking in the wake of the 2008 meltdown when he said, “Those few goldbugs who always doubted the soundness of fiat money – paper currency without a metal anchor – have in large measure been vindicated. But why were the rest of us so blinded by money illusion?” Why indeed. . . And why is that blindness still at play in the current crisis?

NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

“Wisdom is not a product of schooling but of the lifelong attempt to acquire it.”

Albert Einstein

We invite you to review past issues of our monthly newsletter. It’s worth the visit.

Favorite web pages

BlackSwansYellowGold

BlackSwansYellowGold

How gold performs during periods of deflation,

disinflation, stagflation and hyperinflation

“That men do not learn very much from the lessons of history is

the most important of all the lessons of history.”

–– Aldous Huxley ––

Though Huxley’s observation is readily applied to humanity collectively, it does not apply so easily to individual investors. As justification, we offer the ongoing (and long-term) success of the USAGOLD website as well as the soaring statistics on the growth of private gold ownership over the past decade both in the United States and abroad, inspired directly by the lessons learned from financial market upheaval. The following short essays are dedicated to the safe-haven gold investor who, like noted financial author Nicholas Taleb, believes that it is just as important to prepare for what we cannot foresee as what we can.

BlackSwansYellowGold Series

Gold as a hyperinflation hedge

Gold as the portfolio choice for all seasons

A chronology of panics, mania, crashes and collapses

(400 BC to present)

Favorite web pages

Gold Trends and Indicators

Live charts that make it easy to monitor gold market history and correlations

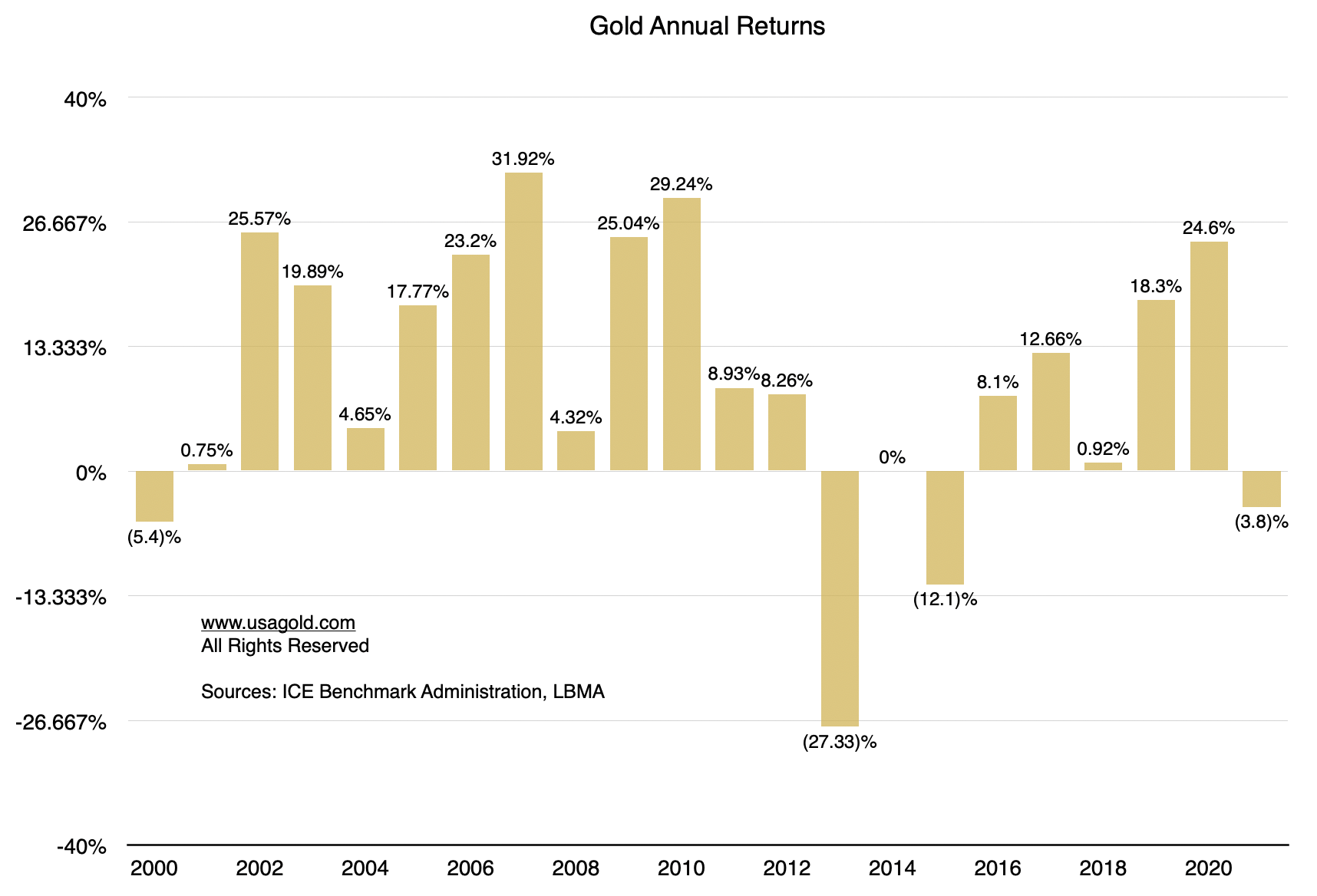

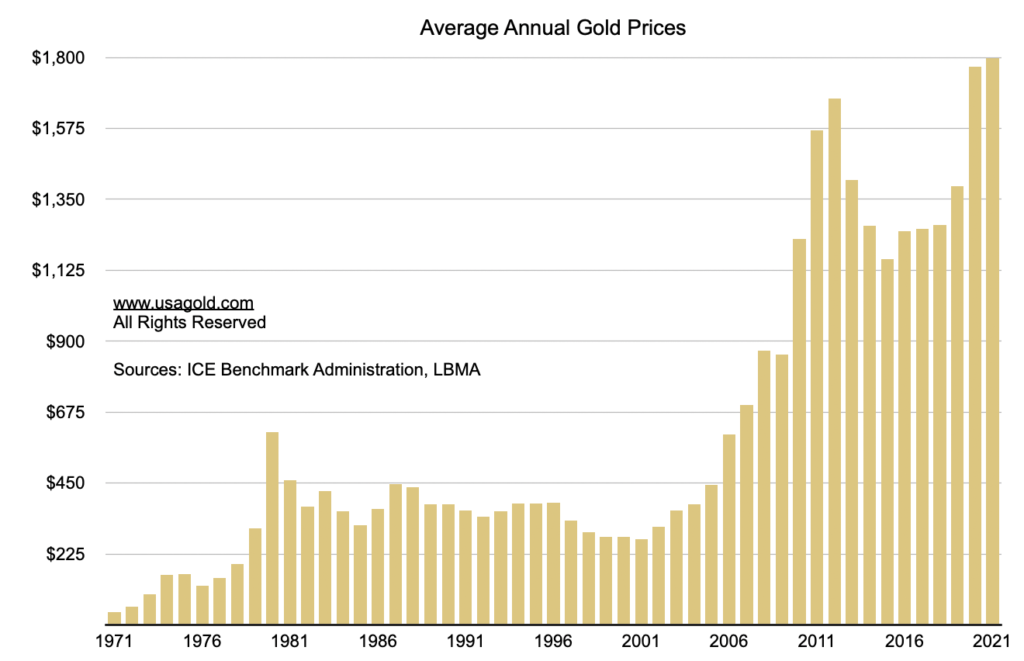

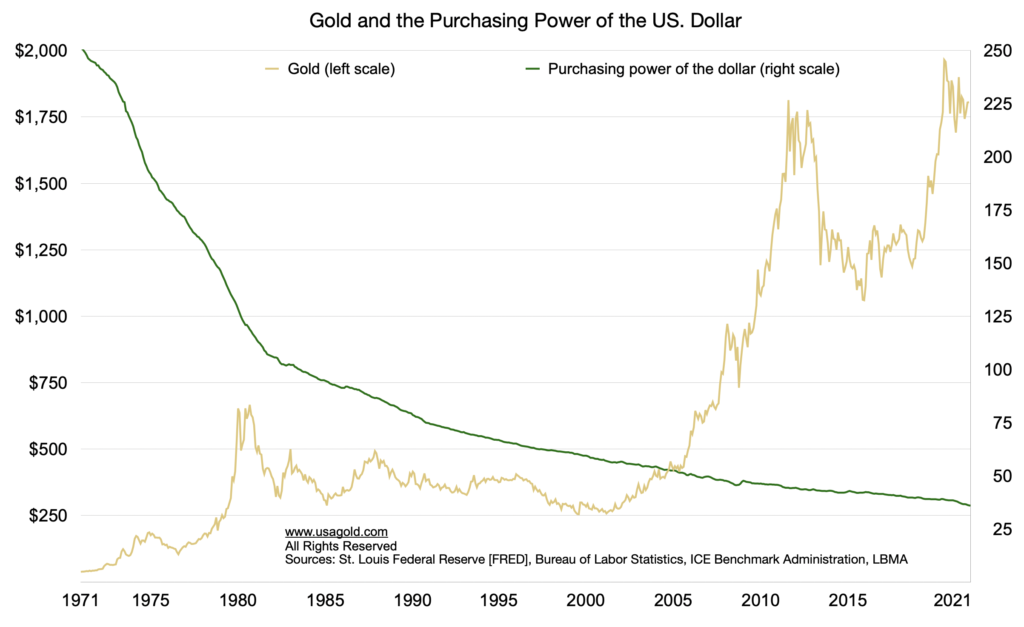

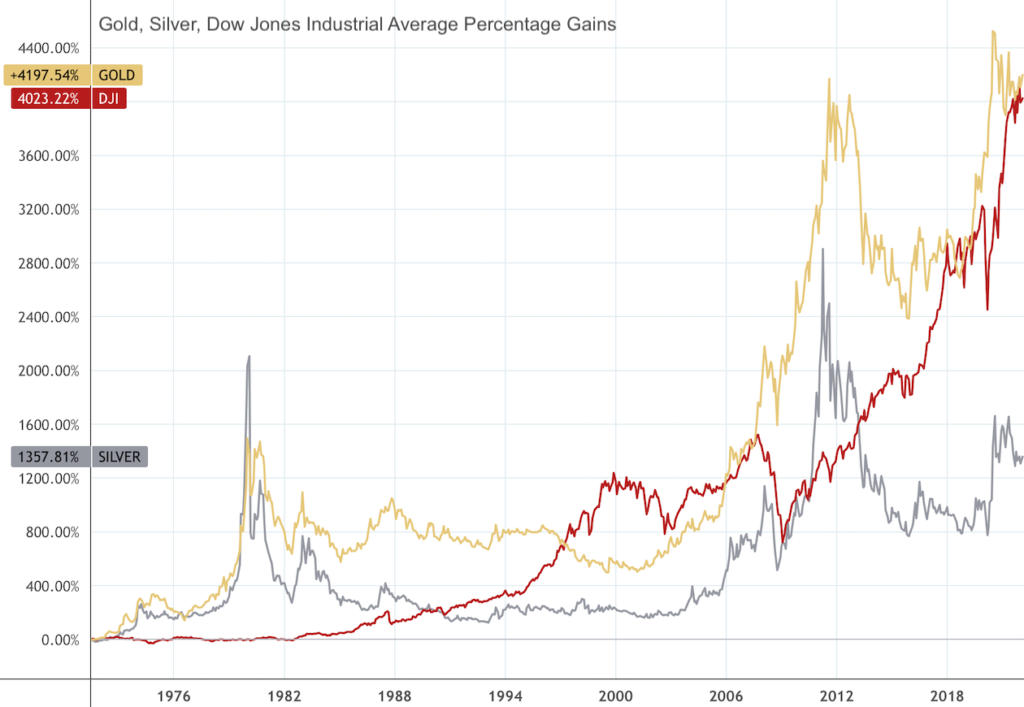

Our Gold Trends and Indicators page was first constructed many years ago to serve a specific need. At the time, there was no single place a client, or prospective client, could go to monitor statistical categories and correlations relevant to gold ownership. This page filled that need with interactive, automatically updating charts that featured gold’s annual returns; one-year, ten-year, and long-term price charts; correlations like gold and the purchasing power of the dollar, gold and the S&P 500 and gold and the volatility index (to name a few); and, real rates of return over the long term on gold and the dollar. It remains a favorite reference among serious investors and students of the gold market to this day. We believe it to be particularly useful to the prospective gold buyer who wants to understand the history of gold under various circumstances as part of the due diligence process.

Gold Trends and Indicators is another of the quiet pages at USAGOLD that garners significant global interest particularly when the market is moving or breaking news warrants more than average interest. We also invite you to return here regularly – to this Live Daily Newsletter page – for up-to-the-minute gold market news, opinion, and analysis as it happens.

We have recently added to new correlation charts:

• The Misery Index and Gold

• The Fed’s Balance Sheet and Gold

__________________________________________________________________________________

We invite you to also check out our other chart page:

Monetary Trends and Indicators

Charts offered in conjunction with the St. Louis Federal Reserve and the ICE Benchmark Administration

GoldTrendsChartStudy

Gold Trends and Indicators

This chart grouping introduces first-time buyers to gold’s long-term, safe-haven appeal.

Source: tradingeconomics.com

Source: tradingeconomics.com

Source: tradingeconomics.com

Source: TradingView.com

Interested in gold but struggling

to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

2:22 pm Sat. April 27, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115