Market Overview

Landscape mode is recommended for mobile phone viewing.

Market Data by TradingView

Delayed data except FOREX

_______________________________________________________________

To end right, start right.

Choose the right portfolio mix with the right firm at the right price.

Choose

USAGOLD

Coins & bullion since 1973

_______________________________________________________________

_______________________________________________________________________________________________________________

The Investment of Kings and the King of Investments

The Investment of Kings and the King of Investments

From the small investor just starting out to the high-net-worth individual hedging a multi-million dollar portfolio, we have helped many thousands add precious metals to their holdings in our nearly 50 years in the gold business – safely, economically and with the investor’s goals in mind.

No matter the size of your investment kingdom, we can help!

_______________________________________________________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

Reliably serving physical gold and silver investors since 1973

New to precious metals?

We put this page together just for you.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

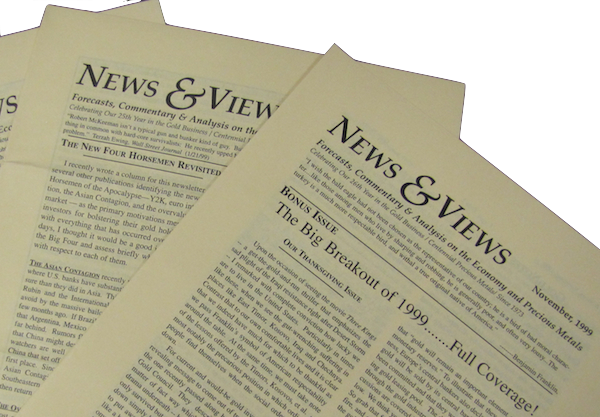

NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 50th year in the gold business

SPECIAL REPORT

Hedging the decline and fall of a currency

The baseline case for gold hasn’t changed much in 1700 years

Book Review

“We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius – an inflationary episode Jack Whyte, a writer of historical fiction, skillfully addresses in his latest novel, The Burning Stone …… Over the long run, gold in the modern era has maintained its purchasing power as it did in Roman times, while the dollar, like the denarius, has been steadily debased. So it is by the circuitous route just taken, you now know how Jack Whyte’s depiction of the Roman inflation in The Burning Stone reinforces the argument for gold ownership today. It also explains why we went to the trouble of presenting a review of this intriguing book in our monthly newsletter.”

Open access!

We think you will appreciate this timeless

News & View Special Report given recent events.

If you think you could benefit from a concise review of the latest news, analysis and opinion on the gold market from a variety of expert sources, then News & Views is the newsletter for you. Since the early 1990s, we have offered it free-of-charge as a monthly service to our regular clientele and as an incentive to prospective clients at no obligation. By subscribing, you will automatically receive future editions and occasional in-depth Special Reports by e-mail.

Prospective clients welcome.

FREE SUBSCRIPTION!

Favorite web pages

Gold and silver price predictions and analysis from prominent players

Curious about gold and silver’s future? This page catalogs price predictions and new analysis from top pundits and prognosticators – a casting of the runes updated regularly throughout the year as new additions surface.

We encourage your bookmark. We invite your return visits.

CLIENT ALERT

Beware MS70, MS69, PF70 ‘Perfect’ + ‘Certified’ + ‘First-Strike’ + ‘First-Release’ Gold and Silver American Eagles and American Buffalos

In 2006, the US Mint produced its first-ever .9999 fine gold coin in the form of the popular American Buffalo. The goal was to offer investors an American-made alternative to popular pure gold products like Canadian Maple Leafs, Austrian Philharmonics, and gold bars. While numerous dealers (USAGOLD was one) offered Buffalos as an alternative bullion coin at a competitive rate, the novelty of the coins coupled with feverish demand helped spawn a whole new spinoff in the gold business – the independently graded contemporary bullion coin.

On the surface, there is nothing wrong with having one’s contemporary bullion coins graded and housed permanently in hard plastic containers. It is when these items are then promoted as exceptionally rare and desirable and priced at very high, and often unsustainable, premiums over their gold content that it becomes a problem. In reality, as you will read below, the graded item, in most cases, is not substantially different (except for the container) from the typical bullion coin purchased daily by thousands of investors around the world.

After Buffalo hype wore off, our feeling was that this promotion, like many others that came before it, would fade away with waning interest. Yet here we stand many years later, rather than fading away, it has expanded and proliferated to include American Gold Eagles, American Silver Eagles, and US Mint Commemoratives. One need only search MS70 or PF70 “Perfect” American Eagles to see just how many companies offer these fictional “numismatics.” (MS is an abbreviation for mint state and PF for proof)

At USAGOLD, we could not be more emphatic in our warning against paying significant premiums above the metal content for these products. This includes common contemporary items sold as “first-strike,” “early issue,” “first release,” Mint State 69, Mint State 70, Proof 69, and Proof 70, as graded by the independent grading services, including the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Corporation (NGC). Below we have published the U.S. Mint’s official statement regarding “First Strike”/”First Release” designations and production quality controls.

|

Coin dealers and grading services may use these terms in varying ways. Some base their use on the dates appearing on United States Mint product packaging or packing slips, or on the dates of product releases or ceremonial coin strike events. Consumers should carefully review the following information along with each dealer’s or grading service’s definition of “first strike” or “first release” when considering purchasing coins with these designations. The United States Mint has not designated any coins or products as “first strikes” or “first releases,” nor do we track the order in which we mint coins during their production. The United States Mint strives to produce coins of consistently high quality throughout the course of production. Our strict quality controls assure that coins of this caliber are produced from each die set throughout its useful life. Our manufacturing facilities use a die set as long as the quality of resulting coins meets United States Mint standards and then replace the dies, continually changing sets throughout the production process. This means that coins may be minted from new die sets at any point and at multiple times while production of a coin is ongoing, not just the first day or at the beginning of production. United States Mint products are not individually numbered and we do not keep track of the order or date of minting of individual coins. Any dates on shipping boxes are strictly for quality control and accounting purposes at the United States Mint. The date on the box represents the date that the box was packed, verified and sealed, and the date of packaging does not necessarily correlate with the date of manufacture. The date on shipping labels and packing slips for coins that are sent directly to United States Mint customers from our fulfillment center is the date the item was packed and shipped by the fulfillment center. The other numbers on the shipping label and packing slip are used for tracking the order and for quality control. |

The statement of ‘consistently high quality throughout the course of production’ is critical. For example, at one of the top grading services, 100% of the one-ounce gold 2021 American Eagle (Type 2) business strikes submitted for review graded either Mint State 69 or Mint State 70 – the two highest grades at the services. Almost 95% of submissions received a Mint State 70 grade, the ultimate rating. As for the 2021 silver American Eagle one-ounce coins (Type 2), 99.9% of submissions made the top grades of Mint State 69 and Mint State 70, and a similar percentage of proof silver Eagles made the top grades of Proof 69 and Proof 70.

With the mint continually producing new coins at the same high quality that they always have, year after year, there is literally an ENDLESS supply of product. To be clear, you do not have to avoid buying these coins altogether. You just have to avoid paying an egregious dealer premium to do so. In fact, if you were so inclined as to desire ownership of graded bullion coins for future numismatic potential, we’d recommend simply purchasing bullion coins from us at our competitive premiums and submitting them to be graded (certified) on your own.

Content last updated on 11-12-2021

_______________________________________________________________________________________________________________

Looking to include gold and silver in your retirement plan?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

Need more information? Try –

What you need to know before you launch your gold and silver IRA

A telephone call from an old client and friend

‘Gold shone with the placid certainty of received tradition’

“I had the happy occasion recently of receiving a telephone call from an old client and friend – a physician safely retired near the sea and alongside one of the South’s oldest golf clubs. It was good to hear from this student of the markets – one of life’s steady and thoughtful practitioners. Back at the turn of the century, Doc foresaw much of what would happen economically in the United States and purchased what he considered enough gold to see him through it.”

[For the rest of Doc’s story we invite you to visit this link.]

___________________________________________________________________

Interested in starting the gold ownership process on the right footing?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Gold Classics Library

A Gold Classics Library Selection

Money and politics in the land of Oz

The extraordinary story behind the extraordinary story of

The Wonderful Wizard of Oz

by Professor Quentin Taylor, Rogers State University

Year in, year out, Money and politics in the land of Oz is among our most highly-visited Gold Classics Library selections. Here is the extraordinary story behind the extraordinary story of ‘The Wonderful Wizard of Oz’. Most have seen the movie version of this allegorical tale published in 1900, an election year, but few are aware of what the various characters, places and things represented in the mind of Frank Baum, the tale’s author. Though ‘The Wonderful Wizard of Oz’ was written 120 years ago, the themes will be recognizable to those with an interest in golden matters today. While many today consider gold an instrument of financial and personal freedom, in Baum’s tale, it is painted as a villain — the tool of oppression. So, as you are about to see, we have come full circle, and gold has traveled a yellow brick road of its own.

Ready to travel the yellow brick road?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100/[email protected]

ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Notable QuotableTemplate

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Favorite web pages

BlackSwansYellowGold

BlackSwansYellowGold

How gold performs during periods of deflation,

disinflation, stagflation and hyperinflation

“That men do not learn very much from the lessons of history is

the most important of all the lessons of history.”

–– Aldous Huxley ––

Though Huxley’s observation is readily applied to humanity collectively, it does not apply so easily to individual investors. As justification, we offer the ongoing (and long-term) success of the USAGOLD website as well as the soaring statistics on the growth of private gold ownership over the past decade both in the United States and abroad, inspired directly by the lessons learned from financial market upheaval. The following short essays are dedicated to the safe-haven gold investor who, like noted financial author Nicholas Taleb, believes that it is just as important to prepare for what we cannot foresee as what we can.

BlackSwansYellowGold Series

Gold as a hyperinflation hedge

Gold as the portfolio choice for all seasons

A chronology of panics, mania, crashes and collapses

(400 BC to present)

– USAGOLD’s widely acclaimed monthly client letter –

NEWS &VIEWS

Forecasts, Commentary and Analysis on the Economy and Precious Metals

The contemporary, web-based version of our client letter traces its beginnings to the early 1990s as a hard-copy newsletter mailed to our clientele. Its principal objectives have always been the same – to keep our clients informed on important developments in the gold market, condense the available gold-based news and opinion into a brief, readable digest, and to counter the traditional anti-gold bias in the mainstream media. That formula has won it a five-figure subscription base. In addition to our regular newsletters, we occasionally publish in-depth special reports that focus on events and developments of interest to gold owners. Valued for their insight, accuracy and reliability, our publications are linked and reprinted by a large number of websites both in the United States and around the globe.

______________________________________________________________________________________

Looking to get informed and stay informed on the gold market?

TRY A FREE SUBSCRIPTION TO OUR MONTHLY CLIENT LETTER.

No strings attached. Prospective clients welcome!

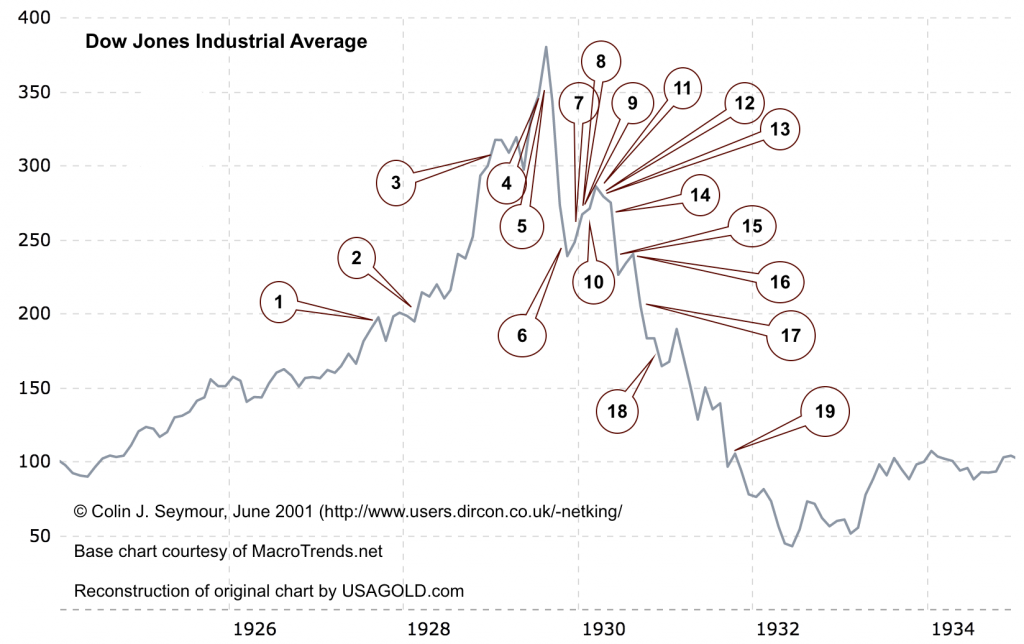

A Gold Classics Library Selection

Pompous Prognosticators

Optimism abounds as stock market crashes – 1928 to 1932

by Colin J. Seymour

May 2001 (Rev. August 29, 2001)

This classic study posted on the USAGOLD website in 2001 has received thousands of visits over the years. Seymour captures the essence of a period in stock market history not unlike our own through quotes from major market players, economists, and analysts from John Maynard Keynes to Bernard Baruch, Irving Fisher, and many other notables.

Worried about bubbling sentiment in today’s stock market?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

Page Upgrade

Gold Charts in Various Currencies and Timelines

Now features interactive bar charts of the gold price in Euro, Chinese yuan, British pound, Japanese yen, Swiss franc, Indian rupee, Australian dollar, Canadian dollar, US dollar. These charts update in real-time with date interval, percent change, and log format user options available.

Chart courtesy of TradingView.com

BlackSwansYellowGoldOODLinkPage

________________________________________________

BlackSwansYellowGold

BlackSwansYellowGold

How gold performs during periods of deflation,

disinflation, stagflation and hyperinflation

“That men do not learn very much from the lessons of history is the most important of all the lessons of history.” – Aldous Huxley

Though Huxley’s observation is readily applied to humanity collectively, it does not apply so easily to individual investors. As justification, we offer the ongoing (and long-term) success of the USAGOLD website as well as the soaring statistics on the growth of private gold ownership over the past decade both in the United States and abroad, inspired directly by the lessons learned over the past decade of financial market upheaval. The following short essays are dedicated to the safe-haven gold investor who, like noted financial author Nicholas Taleb, believes that it is just as important to prepare for what we cannot foresee as what we can.

BlackSwansYellowGold Series

Gold as the portfolio choice for all seasons

A chronology of panics, mania, crashes and collapses

(400 BC to present)

_______________________________________________

Looking for more than an e-commerce platform?

DISCOVER THE USAGOLD DIFFERENCE

"Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

9:11 am Fri. April 26, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115