Author Archives: USAGOLD

Short & Sweet

‘The world is being tested to the extreme.’

Protecting and building wealth in a new financial era

Interest Rate Observer’s James Grant referred to the current period as a “wild time in money.” Credit Suisse’s Zoltan Pozcar warned that “this crisis is not like anything we have seen since President Nixon took the US dollar off gold in 1971.” Mohamed El-Erian likened the Fed’s current monetary policy to that of a developing country central bank. “The Russian invasion of Ukraine and the corresponding Western sanctions and seizure of Russian FX reserves,” said long-time market analyst Lawrence Lepard, “are nothing short of a monetary earthquake.” Larry Fink, who manages BlackRock, the world’s largest investment fund, said the invasion marked “a turning point in the world order” and the end of globalization. Finally, George Soros went to the dark side calling Russia’s invasion of Ukraine “the beginning of World War III with the potential to destroy our civilization.”

If we have indeed embarked upon a new and turbulent financial era, as the above suggests, investors will be tasked with protecting and building their wealth under extraordinary and unpredictable circumstances. “History,” says James Grant, “would counsel us to be humble, prepared to listen and interpret correctly.” Swiss-based investment analyst Claudio Grass took a similarly philosophical approach (and one that we have counseled over many years). “It really does go a lot deeper than a comparison between gold and stocks, or considering the better ‘play’ for one’s portfolio performance,” he said. “The real counter-question now is ‘What is your peace of mind worth?’” Long-time money manager Stephen Leeb believes “the world is being tested to the extreme…Right now, as individuals, the best thing you can do for yourself is to buy protection, and that means investing in gold. Even under the best scenarios, a lot of turmoil lies ahead before we reach the other side, and gold will be the best way to get through it in good shape.”

_______________________________________________________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 50th year in the gold business

SPECIAL REPORT

Hedging the decline and fall of a currency

The baseline case for gold hasn’t changed much in 1700 years

Book Review

“We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius – an inflationary episode Jack Whyte, a writer of historical fiction, skillfully addresses in his latest novel, The Burning Stone …… Over the long run, gold in the modern era has maintained its purchasing power as it did in Roman times, while the dollar, like the denarius, has been steadily debased. So it is by the circuitous route just taken, you now know how Jack Whyte’s depiction of the Roman inflation in The Burning Stone reinforces the argument for gold ownership today. It also explains why we went to the trouble of presenting a review of this intriguing book in our monthly newsletter.”

Open access!

We think you will appreciate this timeless

News & View Special Report given recent events.

If you think you could benefit from a concise review of the latest news, analysis and opinion on the gold market from a variety of expert sources, then News & Views is the newsletter for you. Since the early 1990s, we have offered it free-of-charge as a monthly service to our regular clientele and as an incentive to prospective clients at no obligation. By subscribing, you will automatically receive future editions and occasional in-depth Special Reports by e-mail.

Prospective clients welcome.

FREE SUBSCRIPTION!

Favorite web pages

Why financial advisers should line their portfolios with gold

More and more, it is becoming a mainstay in the financial business that the wise investor and/or financial advisor embrace gold as a means to capital preservation in a rapidly changing and increasingly dangerous investment climate. In Cazenove Capital’s case, it is emphasizing gold as a hedge against geopolitical turbulence. “Speaking at a Schroders breakfast briefing yesterday (January 22),” reports Financial Times, “Janet Mui, global economist at Cazenove Capital, said she thought investing in gold was the best way for advisers and fund managers to hedge the risks in their portfolios. She said: ‘Gold has the feature of portfolio hedging and diversification. Gold should be in your portfolio.’”

Related, please see:

Precious metals for financial planners and advisors

___________________________________________________________________________

Looking to help your clients add gold coins and bullion to their holdings?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

|

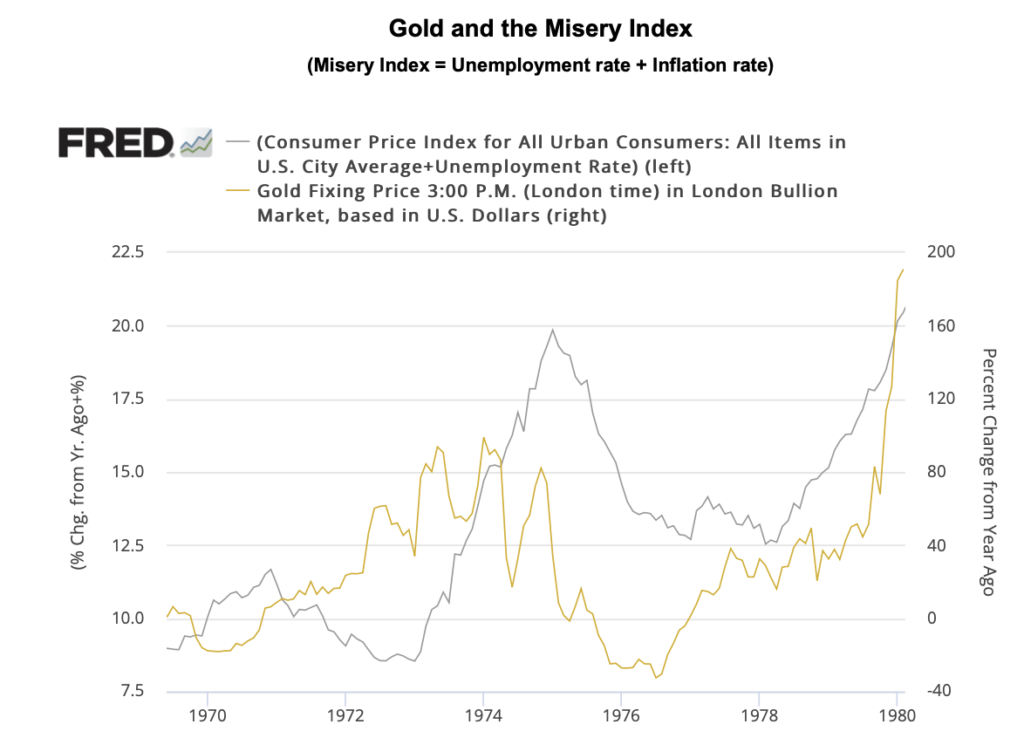

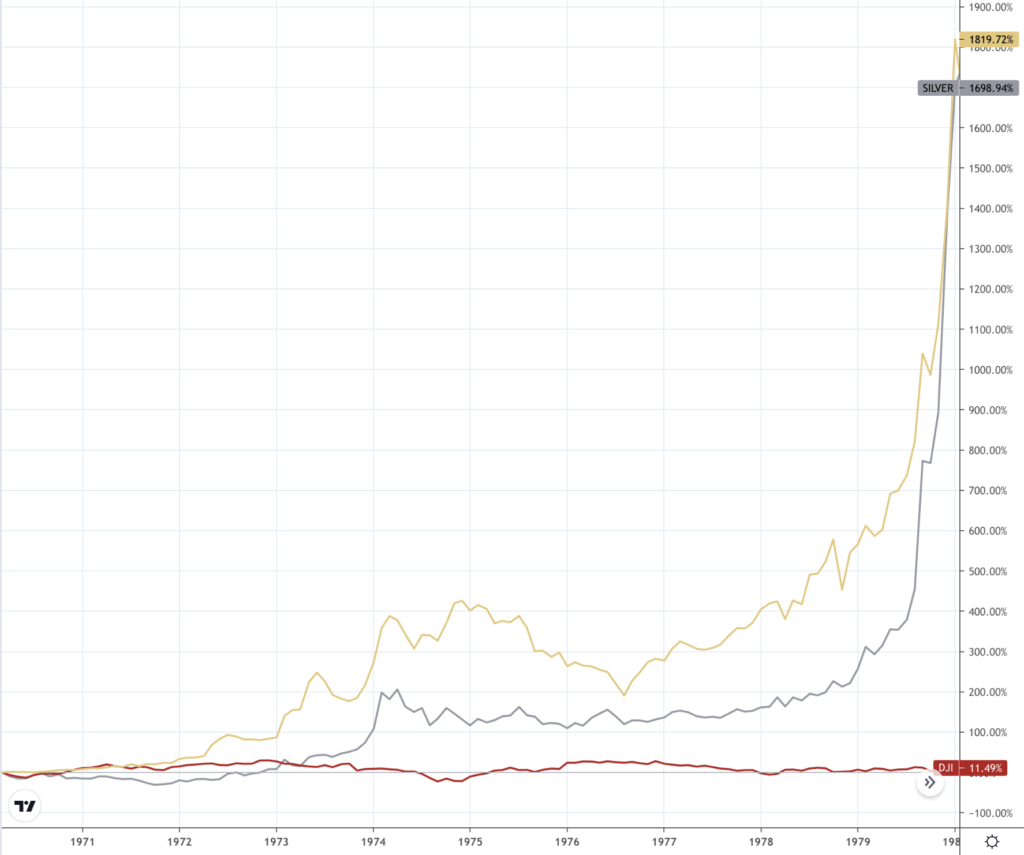

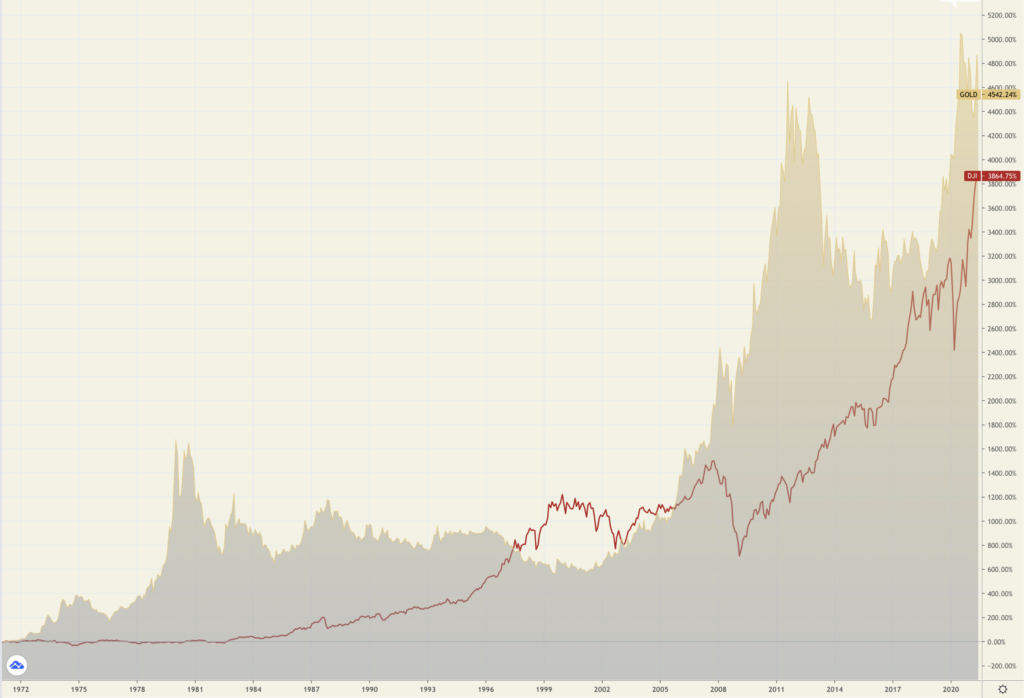

Queens’ College President Mohamed El Erian warned recently that the world could slip into stagflation. Alan Greenspan was among the first to warn that the economy could be headed into a repeat of the staglationary 1970s, and that was back in late 2018. Now, not a day goes by that some analyst or economist somewhere warns of its return. Stagflation is the combination of high inflation and high unemployment, i.e., what Ronald Reagan called the Misery Index. At its height in 1980, the Misery Index reached 22%. As of the most recent government reports, it now stands at 12.1% and climbing, driven chiefly by inflation’s rapid rise. As our second chart shows, gold and silver were top performers during the stagflationary 1970s. Gold rose 1820%. Silver rose 1699%. The Dow Jones Industrial Average rose 11.5%. Warnings about a stock market capitulation dominate the flow of financial opinion as Wall Street boards up the windows in advance of what JP Morgan’s Jamie Dimon called an approaching “economic hurricane.” Since that early June warning, stocks and bonds have tracked steadily to the south. Sprott analyst John Hathaway says we have gotten to a place where “the Fed doesn’t have a dial. It’s an either on or off switch. They’re either switching off the economy and crashing financial assets and the economy, or their crying uncle and caving in, which will likely open the door to more inflation. I think either outcome is positive for gold.… Year to date, it’s up a little bit while the S&P is down 12% or 13% (6/15/2022). It’s shown that it can be uncorrelated and help defend capital during difficult times in the markets. If the Fed cries uncle and pivots, my guess is before the end of the summer, we’re off to the races, and I think we’ll see new highs in the gold price, which would be around $2,200.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Worried about a return to the stagflationary 1970s? ORDER DESK Reliably serving physical gold and silver investors since 1973

USAGOLD

USAGOLD |

Short and Sweet

For gold . . .’It is not a question of if, but when’

The lesson is one as old as the gold market itself: The best time to buy is when the market is quiet – a strategy that requires both discipline and conviction. As an old friend and client used to say (he passed away years ago): “It is not a question of if, but when.” He accumulated a large hoard of the metal in the 1990s and early 2000s between $300 and $600 per ounce and lived to see his prediction come true. His estate though was the ultimate beneficiary of his wisdom. He was not one to sell gold once he had acquired it. We chatted regularly on the phone back then and I told him that I had used the story just told in one of my newsletters. He was in his late 80s at the time. “Tell them,” he said resolutely, “that I bought my first ounce of gold at $35.”

“The possession of gold has ruined fewer men than the lack of it.”

– Thomas Bailey Aldrich –

_______________________________________________________________________________________

Are you looking to solidify your hard-earned wealth for the long run?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short and Sweet

For the record……

Gold in the age of inflation

The star investment of the fifty-year era and the most reliable store of value

“Remember what we’re looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.”

Alan Greenspan, November 2014

On Friday, August 13, 1971, then-president Richard Nixon, after a secret meeting at Camp David, devalued the dollar, suspended gold convertibility, and thereby launched the fiat money system and the age of inflation. Shortly thereafter, the president commented, “we are all Keynesians now.” (Please scroll to “The great Keynesian coup of August 1971” for more detail.) It is a notable coincidence – perhaps even fitting – that we would mark the 50th anniversary of the “Nixon shock” on Friday, August 13, 2021. To mark the occasion, we reprint the following from the July 2021 issue of News & Views, our monthly newsletter:

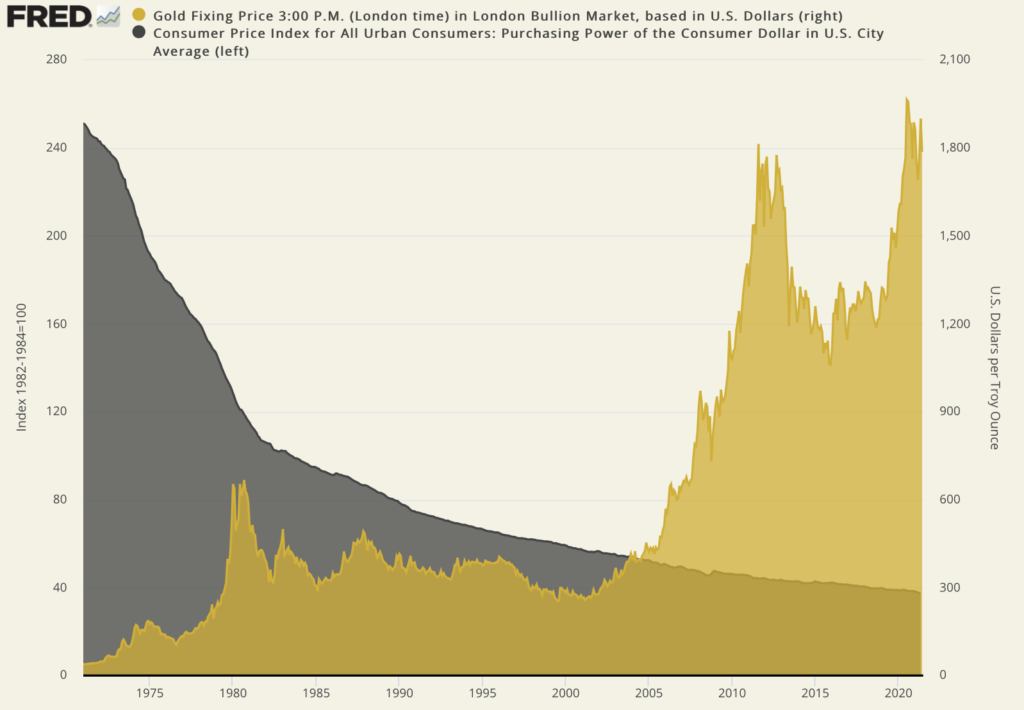

There has been considerable, and some would say tedious, discussion on the subject of inflation over the past several weeks. The Fed wants it. The markets await it. Investors and consumers worry about it. If it does come, the Fed thinks it will be transitory. Others believe it will persist. That said, the current discussion ignores an established historical reality: We already live and have lived with it for a very long time. The Age of Inflation began in August of 1971 when the United States disengaged the dollar from gold and ushered in the fiat money era. Thereafter, the inflationary process has progressively eaten away at our wealth and the purchasing power of our money. Now, some of the best minds in the investment business tell us that it is about to accelerate and that if we ignore it, we do so at our own peril.

To mark the occasion of the fiat money system’s golden anniversary, we offer two instructive charts. One is something of a myth-buster in that gold has decisively outperformed stocks during the fiat money era. Many will be surprised to learn that gold is up 4,500% since 1971, while stocks have played second fiddle at 3,375%. The other reveals at a glance the pernicious, ongoing debasement of the dollar and gold’s role as a hedge against it. The dollar lost 85% of its purchasing power since 1971, while gold, as just mentioned, gained nearly 4500%. If that does not serve as vindication of gold’s portfolio role in the era of fiat money, I don’t know what will. At the same time, consensus has it that cyclically, stocks are closer to a top than a bottom, and gold is closer to a bottom than a top.

Gold and stocks price performance

Chart courtesy of TradingView.com • • • Click to enlarge

Gold and the purchasing power of the dollar

(1971 to present)

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration • • • Click to enlarge

Looking to get informed and stay informed on the gold market?

TRY A FREE SUBSCRIPTION TO OUR MONTHLY CLIENT LETTER.

No strings attached. Prospective clients welcome!

Short and Sweet

Novice precious metals owners must decide where they stand on this important issue

“Precious metals are and always have been the ultimate insurance,” says Pro Aurum’s Robert Hartman in an interview with Claudio Grass. “They provide protection both against state failures and against mistakes in the monetary policy of the central banks. Every investor who looks into the history books sees that both have happened over and over again in the past centuries. From that perspective, investing in physical gold and silver is a common-sense precaution and a necessary part of any wealth preservation plan. Investors and ordinary savers ignore this at their peril and the failure to include precious metals in one’s portfolio is pure negligence.”

There are essentially two broad schools of thought alive and well in the gold market. The first holds that crisis is around the corner and, as a result, precious metals should be owned to profit from the event. The second holds that crisis is a permanent fixture in the market dynamic and that the portfolio should always include precious metals as the ultimate safe haven. The first buyer sees precious metals as investment products, i.e., buy now and sell later when the time is right. The second sees gold and silver, like Hartmann, as insurance products to be held for the long run. Some combine the two, allocating one part of their precious metals portfolio for trading purposes and another as a permanent, or semi-permanent, store of value. The novice precious metals owner must decide where he or she stands in this regard because it determines, in turn, which products to include in the portfolio and to what degree.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to prepare your portfolio for whatever uncertainty lies ahead?

DISCOVER THE USAGOLDDIFFERENCE

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Hubris at the Fed and original sin

John Mauldin and company offers some deep thinking on how we got where we are and where we might be headed in a must-read posted at GoldSeek …… “The Fed’s actions under Yellen and Powell,” he writes, “were the natural progression of Greenspan’s original sin: thinking the Fed could and should use its power over interest rates to produce desirable economic outcomes. To be fair, low rates had some positive effects. But the future was unevenly distributed and certainly not permanent. Fed leaders thought this time was different. It wasn’t. So here we are, facing maybe not the worst inflation in history, but probably the widest inflation in history.” Mauldin ends by saying he just met with several financial notables in New York City (names you would recognize), and the recurring question was, “how does this end?” – to which he answers: “No one really knows.”

__________________________________________________________________________________

From that same article –

“Because we all know exactly how this Old Story ends, right? We know that when prideful human leaders lift themselves and their people up to unnatural heights by stealing what is not rightfully theirs, their society is struck down in retribution. We’ve seen this movie a thousand times before.” – Ben Hunt, Epsilon Theory, Hollow Men, Hollow Markets, Hollow World

“At the meeting, Volcker publicly agreed with Fed Chair Yellen*. But only a few months later I asked Volcker in person whether he stood by his words. ‘No,’ he replied, ‘of course there’s a bubble. My grandchildren can’t afford to buy apartments in New York City. I just didn’t want to say so in front of The Wall Street Journal .’” – Ed Chancellor, author, The Price of Time: The Real Story of Interest

* That we are not in a financial bubble

__________________________________________________________________________________

Worried about how the ‘wildest inflation’ in history might end?

DISCOVER THE USAGOLD DIFFERENCE

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Favorite web pages

What you need to know before you invest in gold

Initial guidelines for first-time investors from one of America’s top gold experts

New to the idea of including gold in your investment portfolio?

If so, this is the page for you.

If you are new to the idea of gold ownership, you might be looking for a little guidance. We, at USAGOLD, have been in the gold business for a good many years, and the one thing that stands out to us in working with so many over the years is how often investors, for one reason or another, get off to a bad start.

That is why we developed a question and answer page many years ago that delves into the subject of GETTING OFF TO THE RIGHT START. We update it regularly as things can change rapidly in the gold and silver markets. The page is linked above, and we recommend that newcomers spend the few minutes it takes to get through it.…

This page receives considerably high-ranking from Google on a number of important searches, and we like to think it’s because of the cause it serves – providing some positive direction to investors trying to get off to a solid start in their pursuit of gold ownership.

Gold Classics Library

A Gold Classics Library Selection

A Layman’s Guide to Golden Guidelines for Wise Money Management

by R.E. McMaster, former editor of The Reaper newsletter

There is an old saying that not all that glitters is gold — as in the gold coins many of you have held in your hands. There is another kind of gold that inhabits the practical wisdom of the ages. In today’s “go-get-’em,” “read-it-and-forget-it” world of everyday web browsing, it can be a challenge to separate the run of the mill from the meaningful. It is with that thought in mind we offer this compendium of the rules and laws of finance and investment by long-time market analyst R.E. McMaster. Formerly the writer/editor of the widely-circulated The Reaper newsletter, McMaster is known for his occasional forays into the realm of economic philosophy and history. I think you will agree with me that these skillfully condensed descriptions are indeed meaningful — a wellspring of knowledge worth reading, re-reading, and passing along to friends and family, especially the kids and grandkids.

(Illustrations by Ed Stein)

Short & Sweet

Facing down our investment fears

Courage comes from a strategy you can genuinely believe in

“As markets shake off their summer slumbers,” writes London-based analyst Bill Blain, “what should we be worrying about? Lots..! From real vs transitory inflation arguments, the long-term economic consequences of Covid, the future for Central Banking unable to unravel its Gordian knot of monetary experimentation, and the prospects for rising political instability in the US and Europe.”

Facing down your investment fears can only come from a strategy you can genuinely believe in. One of the great quotes on gold ownership came many years ago from Richard Russell, the now-deceased editor of the Dow Theory Letters. “I still sleep better at night,” he wrote, “knowing that I hold some gold. If or when everything else falls apart, gold will still be unquestioned wealth.” It is not a complicated strategy, but it can be an effective one.

Though rarely discussed, gold ownership has as much to do with personal philosophy and how we wish to conduct our lives as it does finance and economics. In many ways, it is a rational portfolio decision that suits the times, but it is also a lifestyle decision that provides some peace of mind no matter what happens with inflation, the banking system, the mania on Wall Street, or the political maneuvering in Washington D.C.

Looking to sleep better at night?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100/[email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Why does the cycle move as it does? What causes these periodic alternations, this ebb and this flow, in the national priorities? If it is a genuine cycle, the explanation must be primarily internal. Each phase must flow out of the conditions – and contradictions – of the phase before and then itself prepare the way for the next recurrence. A true cycle is self-generating. It cannot be determined, short of catastrophe, by external events. Wars, depressions, inflations may heighten or complicate moods, but the cycle itself rolls on, self-contained, self-sufficient and autonomous. . .The roots of cyclical self sufficiency lies deep in the natural life of humanity. There is a cyclical pattern in organic nature — in the tides, in the seasons, in night and day, in the systole and diastole of the human heart.”

Arthur M. Schlesinger, Jr.

The Cycles of American History

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Short and Sweet

Of 17th-century tulips, 21st-century stocks and ageless gold

During the Dutch Tulipmania, the price of one special, rare type of tulip bulb called Semper Augustus sold for 1000 guilders in 1623, 1200 guilders in 1624, 2000 guilders in 1625, and 5500 guilders in 1637. Shortly thereafter, the bottom fell out of the market and prices plummeted to 1/200 of their peak price – a mere 27 guilders. In the artwork above an individual, portrayed in fool’s garment, is shown trading a hefty pouch of gold for a handful of tulip bulbs. It is no mystery who got the better part of that bargain. History teaches us that no era is immune to financial mania including our own. As a matter of fact, a good many believe that we are fully immersed in a stock market mania (wherein many include cryptocurrency) right now.

Since the earliest days of the USAGOLD website (the mid-1990s), we have enshrined a quote from Thomas Bailey Aldrich at our home page: “The possession of gold has ruined fewer men than the lack of it.” Aldrich’s axiom has held true down through the ages. It applied in ancient Greece and Rome, in 11th century China, in the time of the Medicis, the Dutch Tulipmania, the South Seas Bubble and French fiat money mania, during the long string of panics in the late nineteenth and early 20th centuries (Aldrich’s time), the spate of post World War I and II hyperinflations (Austria, Germany, Greece, Hungary, et al) and it still applies today.

_____________________________________________________________

Ready to swap tulips for gold?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Favorite web pages

Gold and silver price predictions and analysis from prominent players

Curious about gold and silver’s future? This page catalogs price predictions and new analysis from top pundits and prognosticators – a casting of the runes updated regularly throughout the year as new additions surface.

We encourage your bookmark. We invite your return visits.

A Gold Classics Library Selection

Uses and Abuses of Gresham’s Law in the History of Money

by Robert Mundell, Nobel Prize for Economics, 1999

Now deceased, Dr. Robert Mundell, the highly influential Columbia University economist, was well-known for his advocacy of a gold component in monetary systems, including circulating gold coinage. But he also has written voluminously on a wide range of other topics. As early as 1961, Mundell proposed reducing tax rates and improving monetary discipline as the best means to achieve greater and more stable economic growth. His theories on this subject led to the Kennedy tax cuts, which propelled the U.S. economy of the 1960s and later became the supply-side basis for much of Reaganomics. Mundell also wrote early on of the constant realignment problems which would attend a world monetary system of free-floating currencies. His prescient work on the desirability of regional currencies was, in fact, fundamental to the creation of the euro. When Mundell was awarded the 1999 Nobel Prize for economics, Princeton University economist Peter Kenen said, “Bob was modeling the world of the 1990s through the work he did in the 1960s.” Our thanks go to Dr. Mundell for his kind permission to reprint Uses and Abuses of Gresham’s Law in the History of Money in its entirety.

Short and Sweet

‘Everyone knows they need a safe haven’

“Last March and April (2020),” writes the Systemic Risk Council’s Paul Tucker in a piece published recently at Financial Times, “the fabric of our financial system was stretched almost beyond endurance. Only intervention from the north Atlantic central banks seems to have averted some kind of disaster triggered by markets grasping the pandemic was serious.”

The most important lesson from that brush with disaster is that the financial authorities did not even bother to disclose to the public (and the investment community) just how dangerous the situation had become until months after the fact. It was labeled, you might recall, a “liquidity problem” that the Fed was addressing – no need to worry. Such circumstances argue strongly for having a hedge in place at all times just in case the wheels actually do come off.

MoneyWeek’s Merryn Somerset Webb posted a reminder of gold’s baseline portfolio role during times of market uncertainty in a separate Financial Times’ opinion piece in early January. “Think of the reasons to hold gold,” she wrote. “If inflation is coming (and it probably is) you want to hold a real asset that can hedge against it — one that can’t be inflated away by relentless money creation and currency debasement.…[E]veryone knows they need a safe haven, but everyone also knows the traditional ones (government bonds) no longer offer that safe haven. That turns us to gold, the one asset that has a 3,000-year record of protecting purchasing power. No wonder the gold price is up around 40 percent since 2018. I hold a lot of gold for all these reasons.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you looking for a long-term safe haven?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Gold coins, hoofs found in 2,000 year old Chinese tomb

These gold artifacts were found along with a portrait of Confucius, perhaps the oldest known. Wisdom and gold make easy company. Confucius once said something that has current applicability: “In a country well governed, poverty is something to be ashamed of. In a country badly governed, wealth is something to be ashamed of.” Or at the very least, well-hedged ………

Is the wisdom of a hedge in your financial future?\

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Favorite web pages

Gold Trading Hours

Whenever the gold market gets active, we have a large increase in visitors at our Gold Trading Hours page. Investors want to see which markets – Asian, European or American – are the focal point for price movement. They also want to know when a particular market is going to open or close in areas where gold might experience an influx of buyer or seller interest. That is why we designed this popular page with market hours and a live clock showing the local time in that particular market and all the other major gold markets. Gold Trading Hours is one of the quiet pages at USAGOLD that garners significant global interest. We also invite you to return here regularly – to this Live Daily Newsletter page – for up-to-the-minute gold market news, opinion and analysis as it happens.

We invite your visit. We encourage your bookmark.

USAGOLD’s

Gold Trading Hours

London – New York – Sydney – Hong Kong – Shanghai – Tokyo – Zurich

Short and Sweet

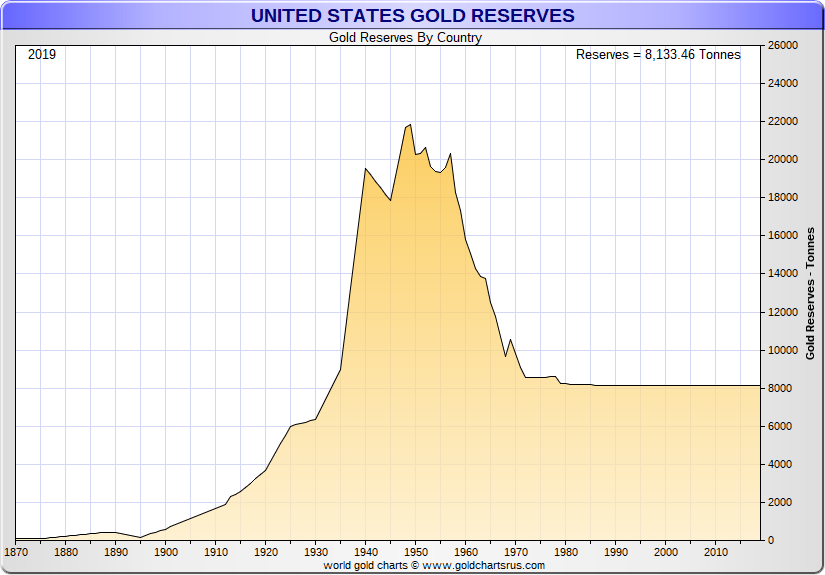

When the United States owned most of the gold on Earth

Chart courtesy of GoldChartsRUs

Few Americans know that the United States owned most of the official sector gold bullion on Earth just after World War II – about 22,000 metric tonnes or 80% of the world total. As part of the 1944 Bretton Woods Agreement, though, the United States allowed unrestricted redemptions from its reserves at the benchmark rate of $35 per ounce. Then, in the 1960s, a group of European countries, led by Germany and France, got the idea that U.S. trade and fiscal deficits had undermined the dollar, making gold a bargain at the $35 benchmark price. Steadily over the next decade, they exchanged dollars for gold at the U.S. Treasury’s gold window. By the early 1970s, 14,000 tonnes of gold – or 64% of the stockpile – had departed the U.S. Treasury never to return (See the chart above).

The transfer of gold finally ended in 1971 when President Nixon halted redemptions, devalued the dollar, and freed the greenback to float against other currencies. The era of global fiat money with the dollar as its centerpiece had begun. Gold transformed from its official role as backing the dollar to serving as a hedge against its depreciation. Since that role reversal, gold has risen in fits and starts from the $35 official benchmark in 1971 to a peak of over $1900 in 2011. It is trading now in the $1700-1800 range. For the central banks and private investors who redeemed their dollars for gold at $35 per ounce, the gains have been extraordinary – over 5000% at current prices or 8.2% annually compounded over the 49-year period. Simultaneously, the 1971 dollar has lost more than 84% of its purchasing power.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to protect the value of your savings over the long run?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973