NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 46th year in the gold business

SPECIAL REPORT

March 2020

[Scroll below for a subscriber-only special gold offer.]

Hedging the decline and fall of a currency

The baseline case for gold hasn’t changed much in 1700 years

The baseline case for gold 320 AD

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius – an inflationary episode Jack Whyte, a writer of historical fiction, skillfully addresses in his latest novel, The Burning Stone.

Set in Great Britain in the fourth century AD during the Roman occupation, The Burning Stone is a prequel to Whyte’s engaging, seven-book series on King Arthur – The Camulod Chronicles. Throughout the series, Whyte juxtaposes the rise of Arthur’s Camelot against Rome’s decline. This particular story is told through the lens of a young Roman from a wealthy family with banking, political and military interests who flees to Britain after his immediate family is murdered for reasons that remain a mystery for most of the novel.

After a series of fateful events involving his future wife, he becomes a blacksmith forging and fashioning the highest quality swords. Even as he assumes the life of tradesman-entrepreneur, he keeps contact with the Roman military in Britain and goes about the business of reordering his affairs as an expatriate Roman citizen albeit one who wishes to keep a low profile. The young blacksmith, Quintus Publius Varrus, one day receives a scroll from his uncle, an admiral in Rome’s navy, advising him to expect an important shipment from the continent in the near future.

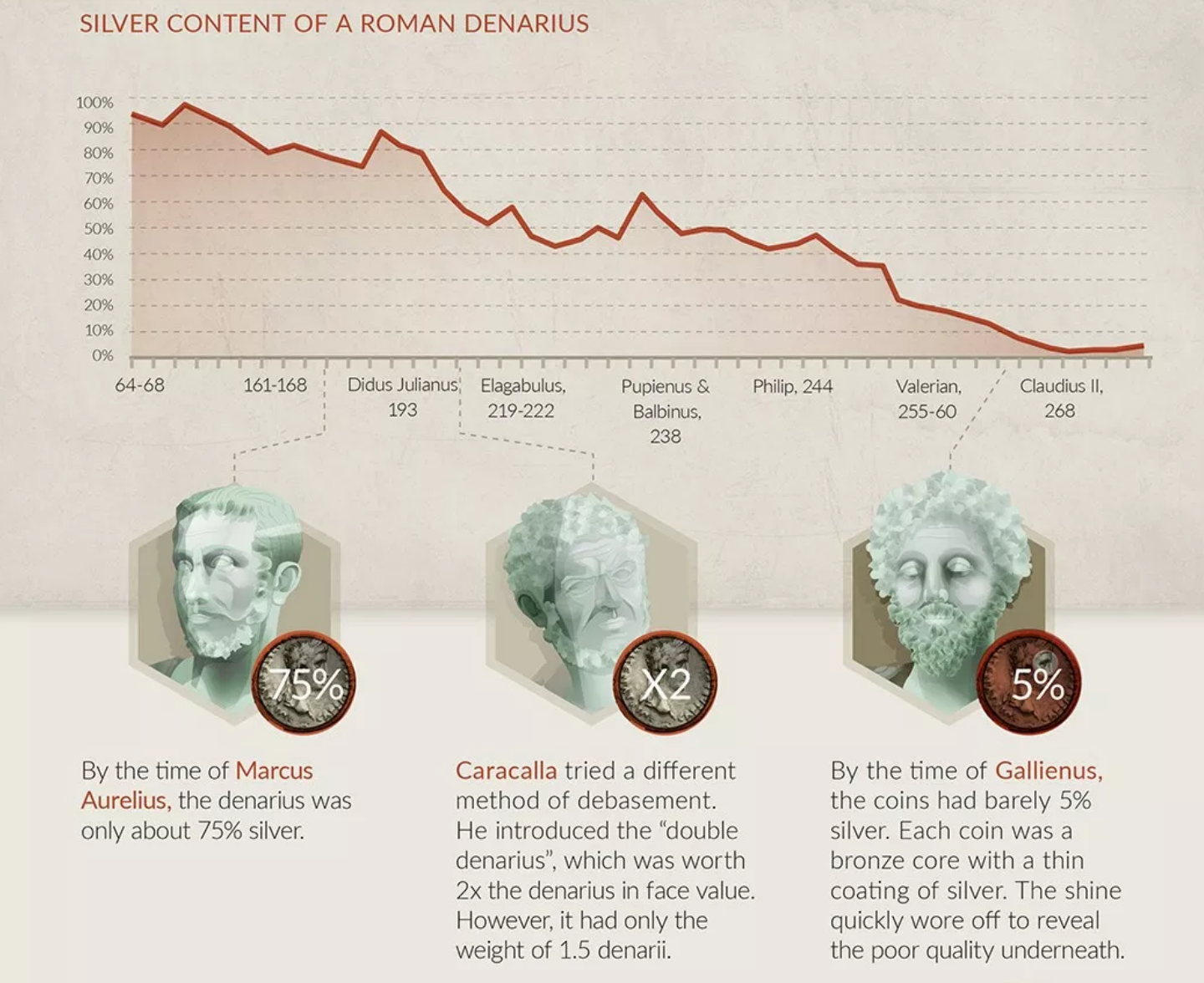

This is where Whyte’s tale takes a turn toward monetary economics and an insightful commentary on Rome’s currency debasement as a symptom of, if not a catalyst for, the empire’s ultimate demise. The inflationary process extended over the reigns of several emperors and went on for more than two centuries (See graphic below). The Roman citizen who had the wisdom to hedge that process ended up preserving and building his or her wealth. Those who did not, at some point along the way, suffered the debilitating effects of the resulting inflation.

Click to enlarge

In Whyte’s telling, Varrus’ grandfather, an advisor to Emperor Diocletian and a member of the ultra-wealthy Seneca banking family through marriage, was among those who chose to accumulate gold coins as a hedge against the on-going debasement of the silver denarius.* When Varrus opens the shipment from his uncle, he finds it to contain a very large hoard of Roman imperial gold coins and a letter describing his grandfather’s rationale for forming the accumulation.

“His heroes,” the uncle writes, “included giants like Cincinnatus and Cato the Elder, both revered for their unswerving loyalty, integrity, and civic duty. More humorously, and with genuine irony, he distrusted banks and bankers – unsurprisingly, perhaps, given that he wed into the wealthiest banking family in Rome… In keeping with that distrust, he was assiduous in hoarding his money, keeping its whereabouts unknown.”

“There are five thousand aureii in the box,” he goes on, “the oldest of them dating from the time of Octavian, Caesar Augustus, and the newest of them, in the fourth level down, minted during the reign of Marcus Aurelius. After that time the value of the aureus declined from year to year as the intrinsic value was degraded by unscrupulous speculators, so your grandfather refused to deal in anything more recent than the mintings of Marcus Aurelius.”

“The bottom layer of coins, though,” he says concluding his description of the chest’s contents, “contains nothing but golden solidi minted during the lifetime of Diocletian. There can be no deception there. The solidus is minted of pure gold, and though few of them were issued, there can be no doubt of there validity in real terms, and my father valued them highly. That layer contains one thousand Diocletian solidi. There is no more valuable coin in existence, and I know of no one other than yourself, among all the people I know, who can claim to have a thousand genuine Diocletian solidi in their possession. Any one of the other coins in the box could fetch ten times their nominal value from a sharp-eyed trader.”

And so it is, according to Whyte’s tale, that great wealth was transferred at the time of Rome’s decline from one generation to the next………

Continued below ……