Short and Sweet

For the record……

Gold in the age of inflation

The star investment of the fifty-year era and the most reliable store of value

“Remember what we’re looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.”

Alan Greenspan, November 2014

On Friday, August 13, 1971, then-president Richard Nixon, after a secret meeting at Camp David, devalued the dollar, suspended gold convertibility, and thereby launched the fiat money system and the age of inflation. Shortly thereafter, the president commented, “we are all Keynesians now.” (Please scroll to “The great Keynesian coup of August 1971” for more detail.) It is a notable coincidence – perhaps even fitting – that we would mark the 50th anniversary of the “Nixon shock” on Friday, August 13, 2021. To mark the occasion, we reprint the following from the July 2021 issue of News & Views, our monthly newsletter:

There has been considerable, and some would say tedious, discussion on the subject of inflation over the past several weeks. The Fed wants it. The markets await it. Investors and consumers worry about it. If it does come, the Fed thinks it will be transitory. Others believe it will persist. That said, the current discussion ignores an established historical reality: We already live and have lived with it for a very long time. The Age of Inflation began in August of 1971 when the United States disengaged the dollar from gold and ushered in the fiat money era. Thereafter, the inflationary process has progressively eaten away at our wealth and the purchasing power of our money. Now, some of the best minds in the investment business tell us that it is about to accelerate and that if we ignore it, we do so at our own peril.

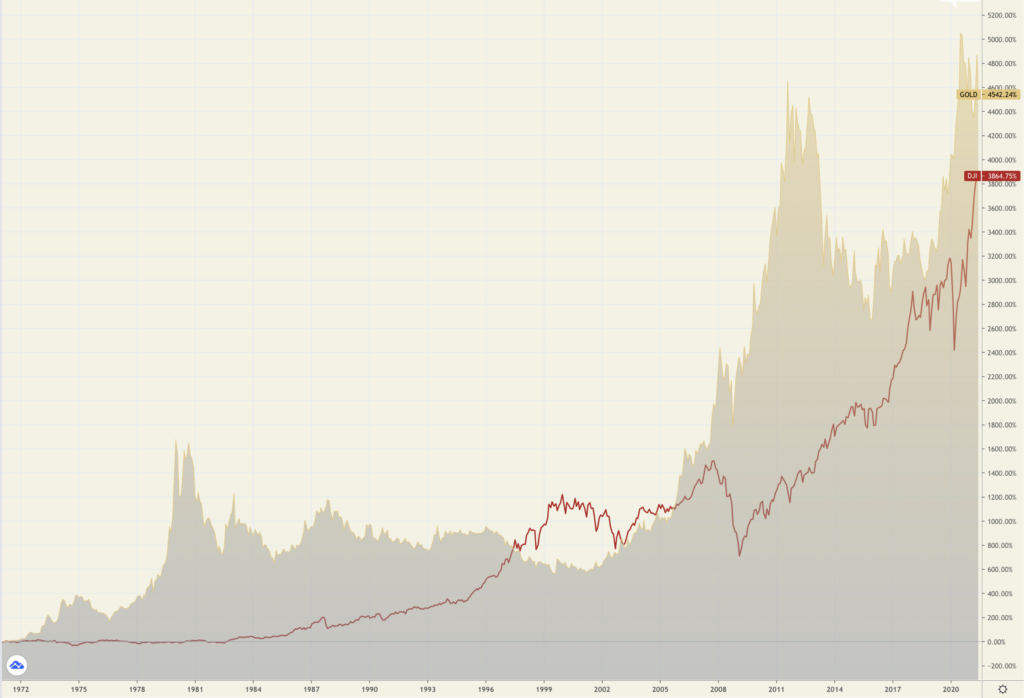

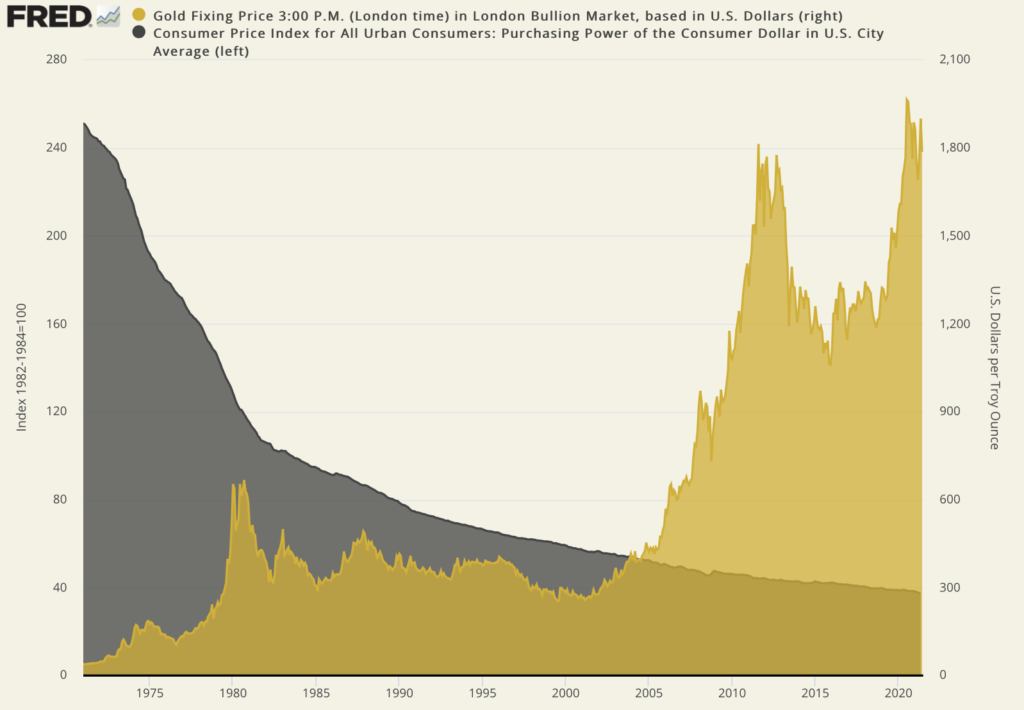

To mark the occasion of the fiat money system’s golden anniversary, we offer two instructive charts. One is something of a myth-buster in that gold has decisively outperformed stocks during the fiat money era. Many will be surprised to learn that gold is up 4,500% since 1971, while stocks have played second fiddle at 3,375%. The other reveals at a glance the pernicious, ongoing debasement of the dollar and gold’s role as a hedge against it. The dollar lost 85% of its purchasing power since 1971, while gold, as just mentioned, gained nearly 4500%. If that does not serve as vindication of gold’s portfolio role in the era of fiat money, I don’t know what will. At the same time, consensus has it that cyclically, stocks are closer to a top than a bottom, and gold is closer to a bottom than a top.

Gold and stocks price performance

Chart courtesy of TradingView.com • • • Click to enlarge

Gold and the purchasing power of the dollar

(1971 to present)

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration • • • Click to enlarge

Looking to get informed and stay informed on the gold market?

TRY A FREE SUBSCRIPTION TO OUR MONTHLY CLIENT LETTER.

No strings attached. Prospective clients welcome!

Short and Sweet

Gold in the Age of Inflation

The star investment of the fifty-two year era and the most reliable store of value

There has been considerable, and some would say tedious, discussion on the subject of inflation over the past several months. The markets await more of it. Investors and consumers worry about more of it. The Fed thinks it is transitory. Others believe it will persist. That said, the current discussion ignores an established historical reality: We already live and have lived with it for a very long time. The Age of Inflation began in August of 1971 when the United States disengaged the dollar from gold and ushered in the fiat money era. Thereafter, the inflationary process has progressively eaten away at our wealth and the purchasing power of our money.

To mark the occasion of the fiat money system’s 52nd anniversary, we offer an instructive chart for those contemplating adding gold to their portfolios. It is a myth-buster showing that gold has decisively outperformed stocks during the fiat money era. Many will be surprised to learn that gold is up almost 4,800% since 1971, while stocks have played second fiddle at 3,633%. At the same time, consensus has it that cyclically, stocks are closer to a top than a bottom, and gold is closer to a bottom than a top.

Gold and stocks price performance

(In percent, 1971-2021)

Chart courtesy of TradingView.com • • • Click to enlarge

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Celebrate the 52nd anniversary of the fiat money system with a gold purchase.

DISCOVER THE USAGOLD DIFFERENCE

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973