Our primal instinct for gold

Money Week/Dominic Frisby/7-20-2023

USAGOLD note: Frisby examines mankind’s age-old attachment to gold.

Short and Sweet

Only real intrinsic money survives the test of time

Here is a timeless observation from the now-deceased Richard Russell (Dow Theory Letter):

“Paper money is now being created wholesale throughout the world. Stated simply, all paper currency is now valued against each other. But more important, ultimately ALL paper is ultimately valued against the only true, intrinsic money – gold. In world history, no irredeemable paper currency has ever survived. Since all the world’s currency is now irredeemable (in gold), this means that in the end, the only form of money that will survive is real intrinsic money – gold. It’s not a question of whether gold will survive, it’s a question of when the world’s current paper money will deteriorate and finally die. I can tell you that irredeemable paper will not survive – but obviously I can’t tell you when it will die. The timing is the only uncertainty.”

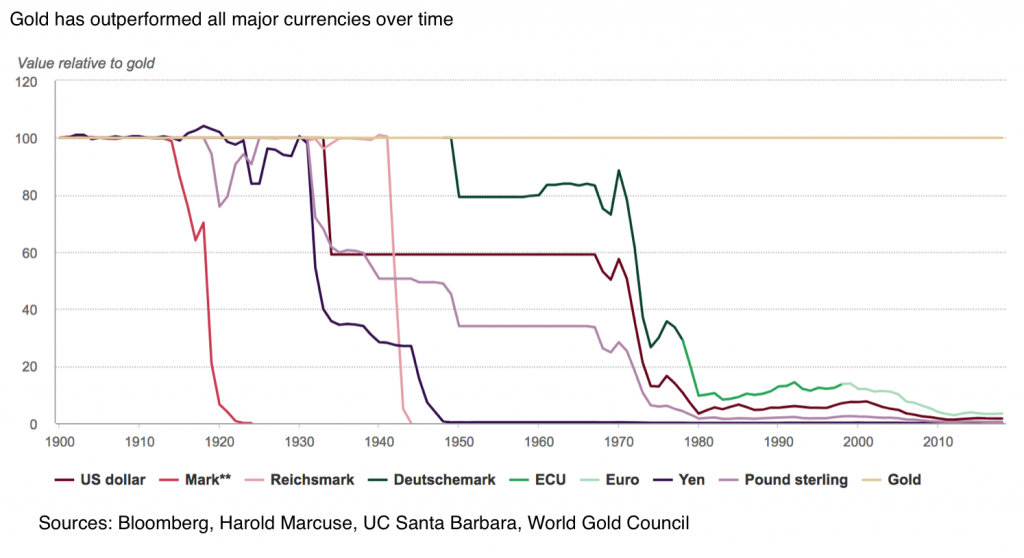

The chart below from the World Gold Council speaks to Russell’s point. It shows the performance of various currencies – past and present – against gold over the long term. When the end comes, as the chart illustrates, it can come abruptly and without warning. For those who stick to the proposition that gold is not really an inflation hedge, or that it is not really a safe-haven against currency debasement, the chart offers instruction. For those who already own gold as a safe-haven, it provides justification. For those who do not own gold, it serves as an incentive. As the old saying goes: All is well until it isn’t.

Chart courtesy of the World Gold Council

________________________________________________________________________

Ready to begin or add to your precious metals holdings?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Oil markets will face ‘serious problems’ as demand from China and India ramps up, IEF secretary general says

CNBC/Charmaine Jacob/7-22-2023

USAGOLD note: Rising oil prices could have a profound effect on the inflation rate as it settles in, assuming McMonigle is right.

Most of what we’ve heard about the yuan dethroning the dollar is from the West. Here’s what China’s actually said about it.

MarketsInsider/Huileng Tan/7-31-2023

USAGOLD note: Important insights at the link……

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“‘Experience keeps a dear school,’ said Ben Franklin, ‘but fools will learn in no other.’ The wise man remembers. The fool forgets. The wise man listens. The fool talks. He ignores both the living and the dead… the immemorial dead, whose whispers carry the distilled wisdom of history. No – this time is different, comes the fool’s eternal cry. The past is of no use to me.”

Brian Maher

Daily Reckoning

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Traders brace for $102 billion wave of Treasury bond sales

Bloomberg/Liz Capo McCormick/7-31-2023

USAGOLD note: The new bond sales come at a time when the Fed, Japan, and China are no longer buyers. What happens if support doesn’t materialize?

China’s gold consumption reaches 555 tons, rising 16.4% in the first half of 2023

USAGOLD note: China’s appetite for gold grows as its middle classes gain wealth……Note the strong gain in bullion bar demand, a sign that Chinese investors are buying gold as a safe haven.

Thinking about buying gold and silver?

Gold in six easy lessons

1. Don’t buy it because you need to make money; buy it to protect the money you already have.

2. Don’t look at price as a barrier; look at it as an incentive.

3. Don’t buy the paper pretenders; buy the real thing in the form of coins and bullion.

4. Don’t fall prey to glitzy TV ads; do your due diligence instead.

5. Don’t allow naysayers to divert your interest; allow yourself the right to protect your interests as you see fit.

6. Don’t forget the golden rule: Those who own the gold make the rules!

Ready to become a member of the ruling class?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

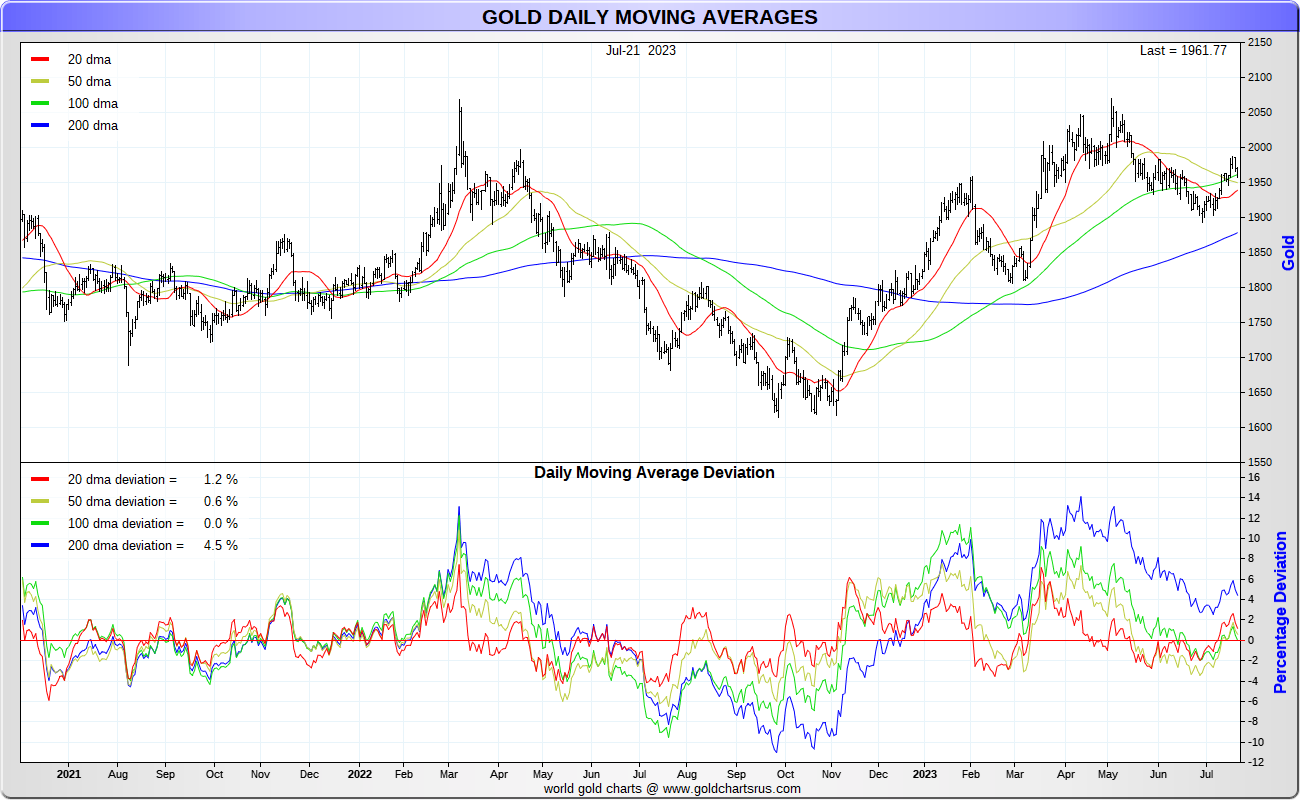

Buy gold and sell U.S. dollars, this strategist says. Here’s why.

MarketWatch/Frances Yue/7-21-2023

“When a global slowdown has been lacking, the dollar has declined at a per annum rate of -1% whereas gold has gained 10% per annum…” – Tim Hayes, Ned Davis Research, chief global investment strategist

USAGOLD note: Ned Davis Research recently downgraded the U.S. dollar from neutral to bearish and upgraded gold from neutral to bullish. It points to an important technical indicator as further evidence of the changing dollar-gold scenario. In January, gold achieved “a golden cross, when its 50-day moving average rose above the index’s 200-day moving average, while the U.S. dollar saw a death cross.” Since the January crossover, gold is up 7.75%, and the US dollar index is down 2.2%.

Who wants to keep hiking rates on the FOMC and who doesn’t?

Bloomberg/Steve Matthews, Kyungjin Yoo and Dave Merrill/7-25-2023

“After more than a year of solid agreement that higher interest rates were needed, differences among policymakers have started to deepen as they weigh when to stop hiking and how long to keep rates elevated.”

USAGOLD note: The politics of economics at the Fed broken down. A good lead in to today’s rate decision and press conference……

Short and Sweet

Inflation is a process not an event

But history, as we are learning now, shows runaway inflation can come suddenly and without warning

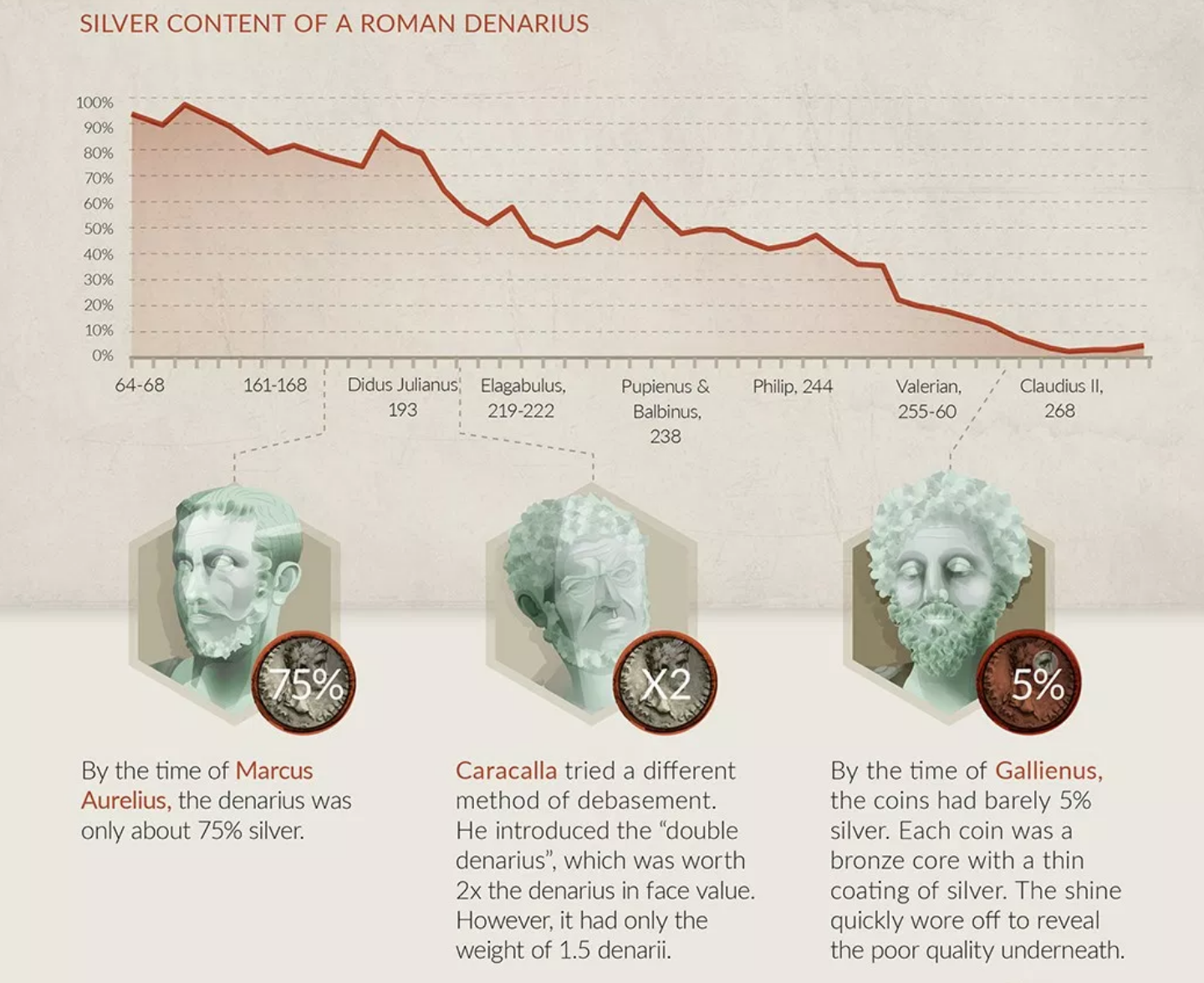

Image courtesy of Visual Capitalist • • • Click to enlarge

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius. The Roman citizen who had the wisdom to hedge that process by going to gold at nearly any point along the way ended up preserving some portion, if not all, of his or her wealth. Those who did not suffered its debilitating effects. In the inflationary process, the line between cause and effect is not always a straight one, and its timing difficult to discern. History teaches us, though, that when runaway inflation does arrive, it comes suddenly, without notice, and with a vengeance. That is why it pays to view gold as a permanent and constantly maintained aspect of the investment portfolio. “A change of fortune,” Ben Franklin tells us, “hurts a wise Man no more than a change of the Moon.”

_________________________________________________________________

(Related please see: News & Views Special Report / March 2020 / Hedging the decline and fall of a currency – The baseline case for gold hasn’t changed much in 1700 years)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to prepare your portfolio for whatever uncertainty lies ahead

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

The inflation giant has awakened. Why price growth will persist.

Barron’s/Brian Swint/7-23-2023

“To the contrary, inflation is likely to be a more persistent threat than it has been in decades, owing to the long list of powerful forces that have driven prices higher, and the limits of central-bank efforts to control it.”

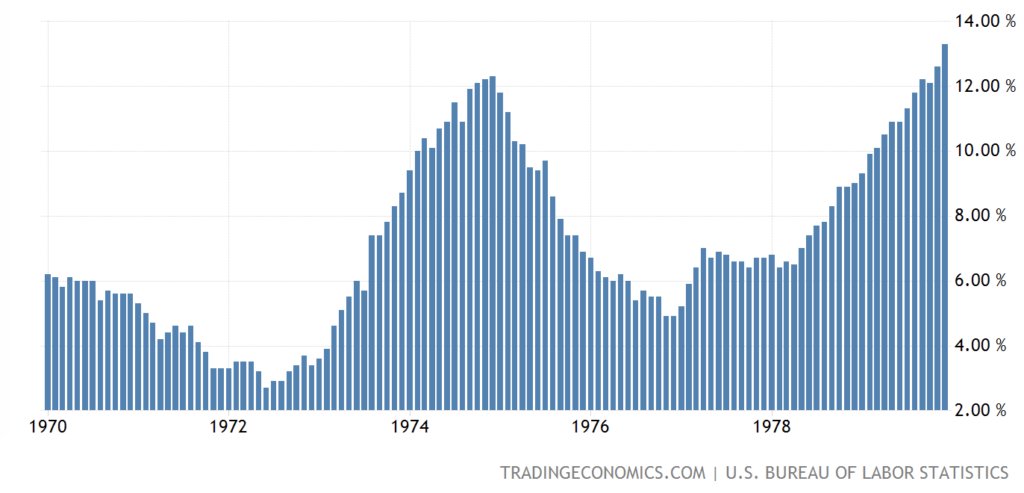

USAGOLD note: Anyone who lived through the decade of the 1970s can tell you that claims that inflation had been tamed were often wildly overblown.

Inflation rate 1970s

Chart courtesy of TradingEconomics.com

Daily Gold Market Report

Gold down in lackluster trading pushed by stronger dollar

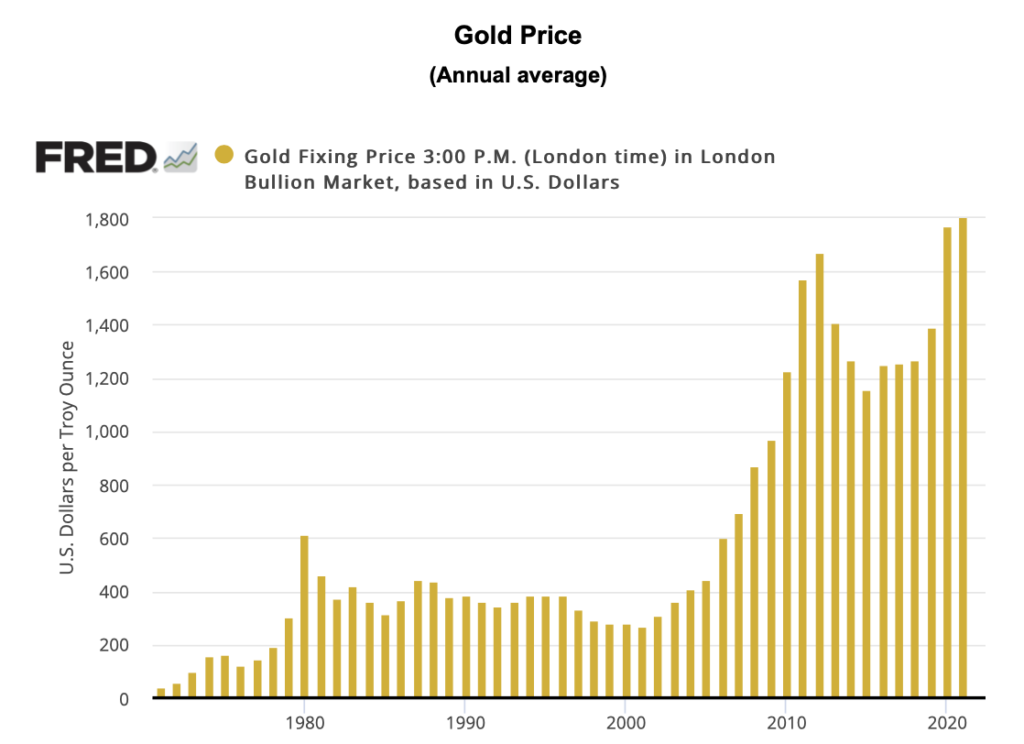

Credit Suisse sees new record high for later in year, then $2355

(USAGOLD – 8/1/2023) – Gold is down this morning in lackluster trading pushed for the most part by a stronger dollar. It is down $10 at $1957. Silver is down 29¢ at $24.54. Credit Swiss is not allowing the summer drag alter its bullish stance on the yellow metal.

“We maintain our long-held view,” it says in an advisory released yesterday, “for a major floor to be found the key rising 200-DMA of $1,883 and for an eventual retest of major resistance at the $2,063/2,075 record highs to be seen. We still stay biased to an eventual break to new record highs later in the year, which would then be seen to open the door to a move to $2,150 next, then $2,355/65.”

Chart by USAGOLD • • • Data source: Macrotrends. net

The role of gold in central bank reserves

USAGOLD note: Steele provides historical background on gold’s role as a central bank reserve asset and offers seven monetary functions that encourage it. All seven have to do with gold’s status as the ultimate store of value and final means of payment.

The Fed’s newfound focus on data is bad news for the sliding dollar

MarketsInsider/George Glover/7-29-2023

USAGOLD note: The most important data, as pointed out in this article, provide reasons for lowering rates which would continue to fuel the dollar’s slide against other currencies.

Defective Fed policy ensures inflation’s revival

ZeroHedge-Bloomberg/Simon White/7-28-2023

USAGOLD note: Yet another under-the-radar analysis predicting more inflation down the road – second coming……

USAGOLD

Quality service & portfolio guidance since 1973

USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the gold industry’s oldest and most respected names. The firm’s unblemished, zero-complaints record and solid reviews with the Better Business Bureau testify to the exceptional customer service and professional excellence which sets it apart from the competition.

USAGOLD specializes in gold and silver coins and bullion delivered to our client’s safekeeping. For over 49 years, we have resolutely advocated owning precious metals for asset preservation purposes rather than speculation. Admittedly, this philosophy does not resonate with all prospective gold and silver owners, but if it does with you, we think you will find our firm a kindred spirit.

____________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Everyone thinks the Fed’s rate hike next week will be the final one — except the Fed

MarketWatch/Greg Robb/7-21-2023

USAGOLD note: Several analysts have come forward over the past month to state their belief that inflation is down but not out – in a lull rather than full remission. If that proves to be the case, the Fed could be chasing the inflation rate for many months to come.

The collapse of the risk-free delusion: Implications for the $133 trillion bond market

International Man/Nick Giambruno/July 2023

USAGOLD note: Giambruno warns that “It may be tempting to think the worst is over for bonds – it’s not. As you’ll see, the pain for bondholders is just starting.” The result he says will be a mass movement over time to reliable stores of value.

Short and Sweet

“Bear markets are sneaky beasts. . .”

King World News called the late, great Richard Russell – who regaled us with his wisdom in the Dow Theory Letter for nearly half a century – “the greatest financial writer in history.” We can only guess what Russell would have had to say about the current state of affairs, but the quote above provides a clue. Never predictable in his opinions, he was rock solid on one axiom throughout his career – the necessity and transcendence of gold as a permanent component of the well-balanced investment portfolio. As he said, so often, it helped him sleep at night.

Looking to prevent the beastly bear from sneaking up on your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973