Buy gold and sell U.S. dollars, this strategist says. Here’s why.

MarketWatch/Frances Yue/7-21-2023

“When a global slowdown has been lacking, the dollar has declined at a per annum rate of -1% whereas gold has gained 10% per annum…” – Tim Hayes, Ned Davis Research, chief global investment strategist

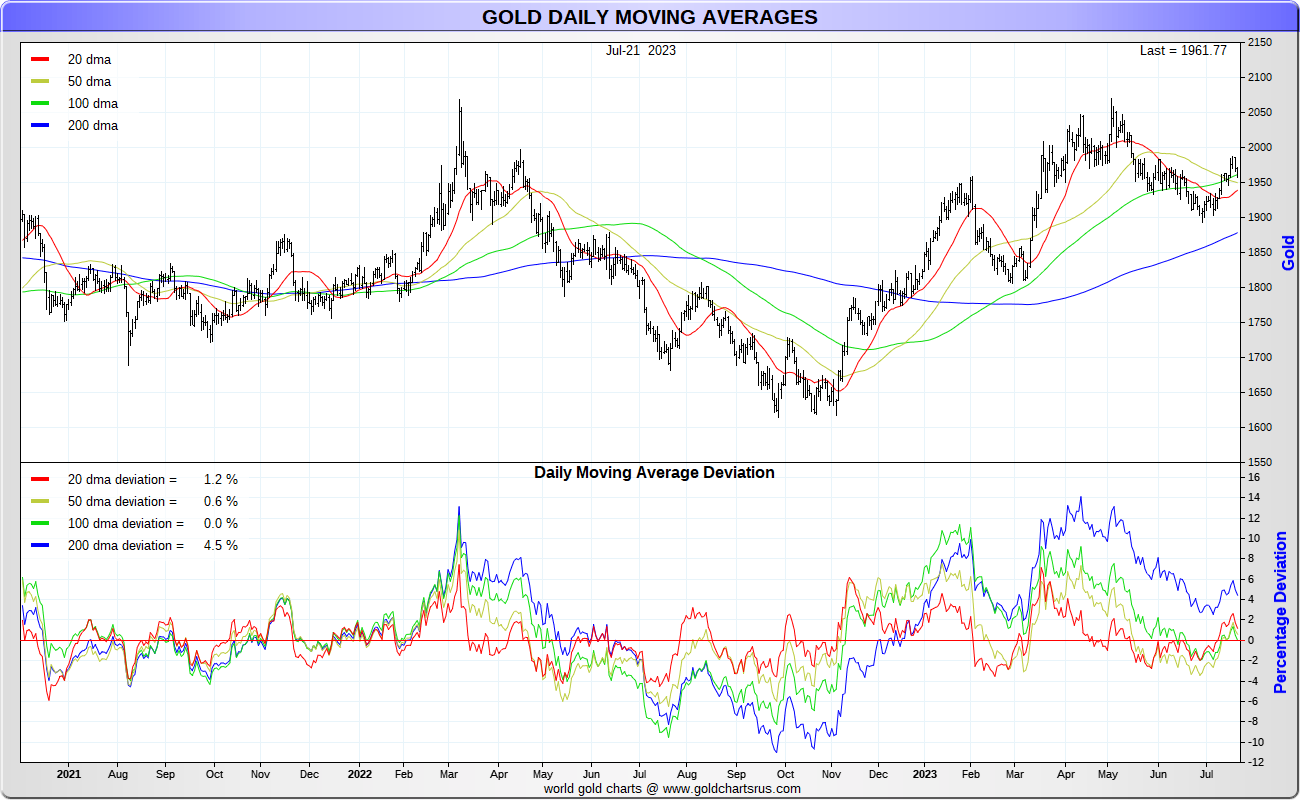

USAGOLD note: Ned Davis Research recently downgraded the U.S. dollar from neutral to bearish and upgraded gold from neutral to bullish. It points to an important technical indicator as further evidence of the changing dollar-gold scenario. In January, gold achieved “a golden cross, when its 50-day moving average rose above the index’s 200-day moving average, while the U.S. dollar saw a death cross.” Since the January crossover, gold is up 7.75%, and the US dollar index is down 2.2%.