Notable Quotable

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“There is nothing we can take for granted in this inflationary crazy economic environment, no rules of thumb that can really guide us. My father was a thrifty man, a truly great man, but also a believer in long-term value and truth. Yes, he loved gold and silver coins too, and very much so. He accumulated them throughout his life. As I look at that today, it is extremely obvious that this was one of his best financial decisions. He was never a day trader or a rah-rah techno champion. He clung to that which he could really trust, really own, really control. That seems like a good way to think even now.” – Jeffrey Tucker, Daily Reckoning

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fitch’s US debt-rating downgrade is bad news for stocks.

MarketsInsider/George Glover/8-2-2023

USAGOLD note: Biden’s track record wasn’t exactly glowing before the Fitch announcement. A good many analysts have warned of late that the government’s fiscal stance – and that includes both the Biden administration and Congress – has become a danger to the economy and financial markets. The yield on the 10-year Treasury jumped from 4.01% to 4.105% after the Fitch announcement.

One hell of a head fake on gold

MishTalk/Mish Shedlock/7-31-2023

USAGOLD note: Mish posts a thumbnail analysis of the current gold market and concludes: “If you have faith in central banks, sell your gold. Otherwise, I suggest hanging onto it.” Worth a visit……

How to choose a gold firm

It may be the most important choice you make as a gold owner

It is surprising how many prospective investors simply dive into gold and silver investing without much in the way of a consumer inquiry. That lack of simple due diligence has ended up costing a good many investors thousands of dollars, and sometimes even hundreds of thousands before the damage is detected.

Here you will find some brief but useful guidelines

to help you choose the right gold and silver company.

To end right, start right.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Monetary vs fiscal dissonance and the return of QE

Zero Hedge/Crescat Capital/7-23-2023

“Following the COVID era, we have entered a period of fiscal dominance among major developed economies. Hence, the escalating debt burden is already near historical levels and compounding at an alarming pace. To sustain the current government spending deluge, we believe it is inevitable that the Fed and other monetary authorities reassume their fundamental role as the primary financiers of government debt.”

USAGOLD note: Crescat predicts “capital will divert away from US Treasuries and flow into gold.”

Chart courtesy of VisualCapitalist.com

The US reserve currency and commodities

Goehring & Rozencwajg/7-24-2023

USAGOLD note: In this in-depth study, Goehring & Rozencwajg say the coming rally and eventual overvaluation in commodities will likely be led by gold.

Short and Sweet

Two legendary central bankers embrace gold

In The End of Alchemy (2017), Mervyn King, the former governor of the Bank of England, writes of central banks’ frustration in dealing with the persistently stagnant global economy. “Central banks,” he says, “have thrown everything at their economies, and yet the results have been disappointing, Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced. . . [W]ithout reform of the financial system, another crisis is certain – sooner rather than later.”

“Our problem,” Alan Greenspan once said, “is not recession which is a short-term economic problem. I think you have a very profound long-term problem of economic growth at the time when the Western world, there is a very large migration from being a worker into being a recipient of social benefits as it is called. And this is legally mandated in all of our countries.” The western world, he concludes, is headed to “a state of disaster.”

It is interesting to note that both Greenspan and King, two of the most respected central bankers in modern times, have embraced gold since leaving their respective posts. The former Fed chairman has consistently suggested that gold is “a good place to put money these days given the policies of governments.”

The former governor of the Bank of England says that he is “very struck by the fact that over many, many years, central banks, governments and individuals have always, despite the protestations of economists, held some gold in their portfolio…[W]hen unexpected things happen, particularly when governments rise and fall, then gold is a means of payment that everyone is always prepared to accept. And I think that’s why even central banks have always had a role in their portfolios for gold.”

_____________________________________________________________________________

Are you ready to embrace gold?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

A long-time market bear who called the 2000 and 2008 crashes warns the S&P 500 could plummet 64%, bursting a historic bubble

MarketsInsider/Zahra Tayeb/7-25-2023

USAGOLD note: Hussman is not impressed by the stock market rally thus far this year. “Yes, this is a bubble in my view,” he says. “Yes, I believe it will end in tears.”

Young, rich Americans don’t trust the stock market, so they’re turning to alternative assets

Yahoo! Finance/Jeannine Mancini/7-31-2023

“Based on a survey conducted by Lansons, it was found that less than 10% of the entire American population has invested in alternative assets. However, among the younger generations, there is a more significant interest in alternative investments, with 30% of Gen Z and 25% of millennials either investing in such assets or possessing knowledge of platforms that facilitate these investments.”

USAGOLD note: One of the alternatives mentioned is gold.

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“The first step in theorizing correctly about money is to understand that the value of money, like that of commodities, is never fixed and unchanging. Chinese philosophers who published the earlier Mohist Canons(468 B.C.~376 B.C.) grasped this crucial point. They recognized that metallic money, such as the ‘knife coins’ then in wide circulation, was valued and exchanged by weight and argued that the real value of money, despite its fixed face value, was not stable but fluctuated inversely with the prices of commodities. When commodity prices were high, money was ‘light’ or its purchasing power low; when prices were low, money was ‘heavy’ or its purchasing power high. Thus, if monetary conditions were such that the nominal prices of commodities were abnormally high, the real prices of commodities were not high but rather money was ‘light’ or depreciated.”

Joseph T. Salerno

The Mises Institute

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Air pockets, free falls, and more cowbells

Hussman Funds/John Hussman/July 2023

USAGOLD note: Hussman tells in detail how the stock market is breaking down and why it should be taken seriously.

Market Overview

Landscape mode is recommended for mobile phone viewing.

Market Data by TradingView

Delayed data except FOREX

It’s all about the lags

LinkedIn/David Rosenberg/7-27-2023

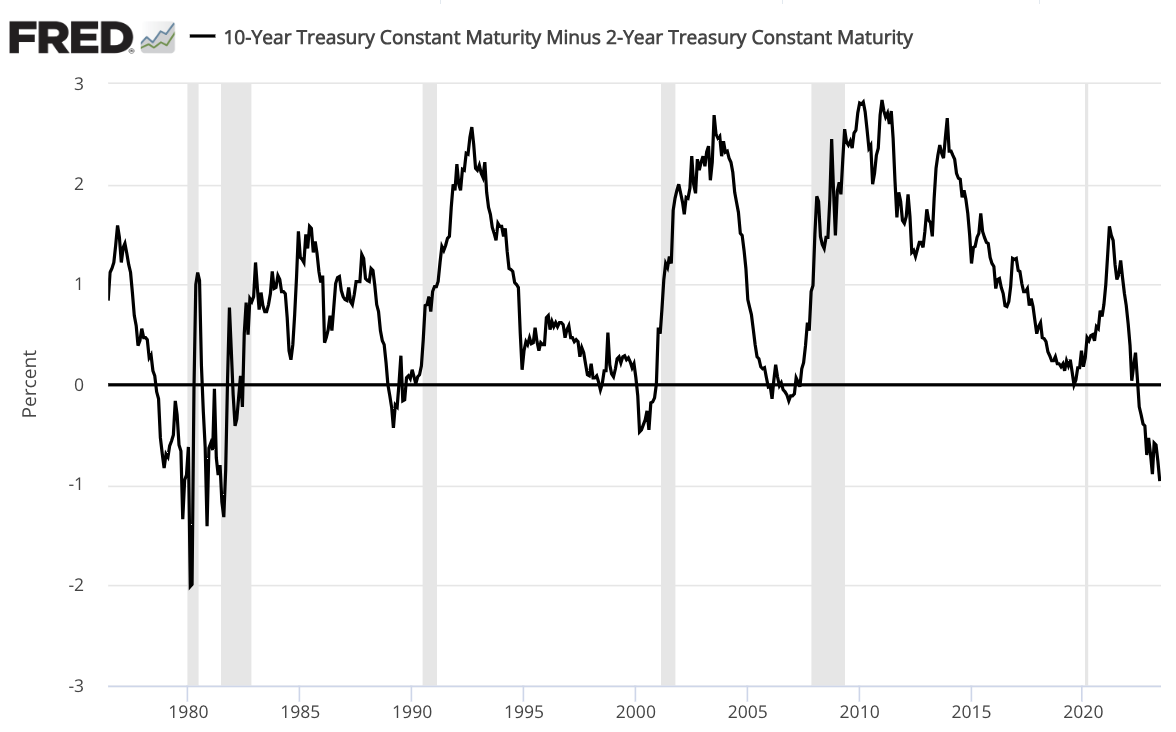

“The fact that Fed-induced curve inversions have presaged recessions 100% of the time in the past is never respected. Always a case of hope triumphing over experience. Thing is — very rarely do recessions occur in the same month as the onset of the inverted yield curve. There are lags, and that typically can be a year or longer. Think back to 2007. But like the story of the boy who cried wolf, the wolf did show up in the end.”

USAGOLD note: A heads up from Rosenberg……

Recessions follow inverted yield curves with a lag

(Grey bars = recessions)

Source. US Federal Reserve [FRED]

|

ORDER DESK Reliably serving physical gold and silver investors since 1973 |

Citi says it’s ‘only a matter of time’ before gold hits a record

Bloomberg/Renjeetha Pakiam/7-20-2023

“The metal is benefiting from loose monetary policy, low real yields, record inflows into exchange-traded funds and increased asset allocation, the bank’s analysts including Aakash Doshi and Ed Morse said in a report. Gold is expected to climb to an all-time high in the next six-to-nine months, and there’s a 30% probability it’ll top $2,000 an ounce in the next three-to-five months.”

USAGOLD note: The report points out that prices for the metal have already posted new highs in every other G-10 and major emerging market currency this year. Silver, it says, will benefit from “demand for a store of wealth.

Our primal instinct for gold

Money Week/Dominic Frisby/7-20-2023

USAGOLD note: Frisby examines mankind’s age-old attachment to gold.

Short and Sweet

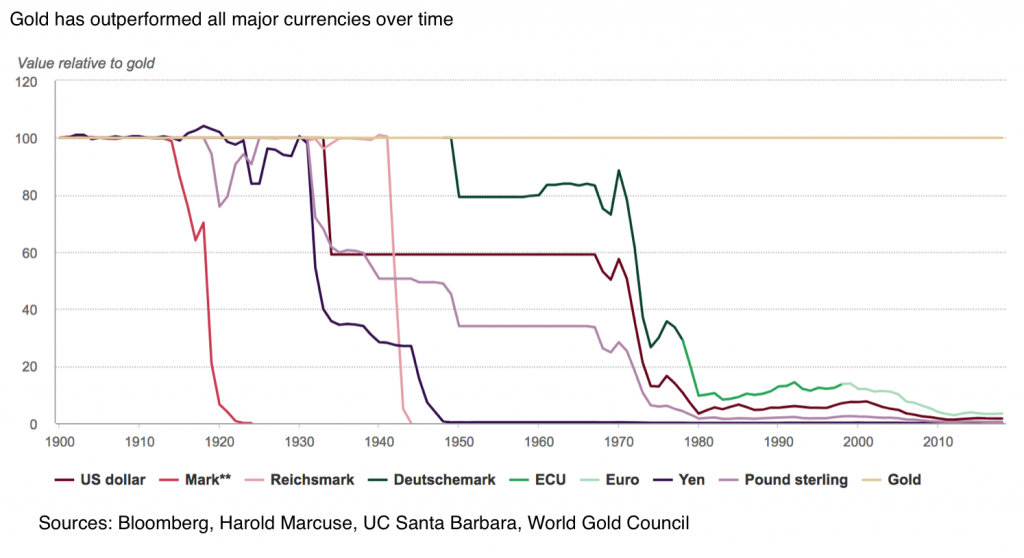

Only real intrinsic money survives the test of time

Here is a timeless observation from the now-deceased Richard Russell (Dow Theory Letter):

“Paper money is now being created wholesale throughout the world. Stated simply, all paper currency is now valued against each other. But more important, ultimately ALL paper is ultimately valued against the only true, intrinsic money – gold. In world history, no irredeemable paper currency has ever survived. Since all the world’s currency is now irredeemable (in gold), this means that in the end, the only form of money that will survive is real intrinsic money – gold. It’s not a question of whether gold will survive, it’s a question of when the world’s current paper money will deteriorate and finally die. I can tell you that irredeemable paper will not survive – but obviously I can’t tell you when it will die. The timing is the only uncertainty.”

The chart below from the World Gold Council speaks to Russell’s point. It shows the performance of various currencies – past and present – against gold over the long term. When the end comes, as the chart illustrates, it can come abruptly and without warning. For those who stick to the proposition that gold is not really an inflation hedge, or that it is not really a safe-haven against currency debasement, the chart offers instruction. For those who already own gold as a safe-haven, it provides justification. For those who do not own gold, it serves as an incentive. As the old saying goes: All is well until it isn’t.

Chart courtesy of the World Gold Council

________________________________________________________________________

Ready to begin or add to your precious metals holdings?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Oil markets will face ‘serious problems’ as demand from China and India ramps up, IEF secretary general says

CNBC/Charmaine Jacob/7-22-2023

USAGOLD note: Rising oil prices could have a profound effect on the inflation rate as it settles in, assuming McMonigle is right.

Most of what we’ve heard about the yuan dethroning the dollar is from the West. Here’s what China’s actually said about it.

MarketsInsider/Huileng Tan/7-31-2023

USAGOLD note: Important insights at the link……