US banks prepare for losses in rush for commercial property exit

Financial Times/Stephen Gandel, Joshua Chaffin and Eric Platt and Joshua Oliver/6-5-2023

USAGOLD note: Something wicked this way comes…… And the banks see the signs.

Reserve Bank of India ups gold reserve 40% over past five years

EconomicTimes/Gayatri Nayak/6-8-2023

“The Reserve Bank of India’s gold reserves have risen by over 40% since it resumed the purchase of the yellow metal over five years ago. This shows gold has emerged as a strong hedge against inflation and also helped reduce dependence on the dollar to an extent. India’s central bank, unlike others, never sells its gold.”

USAGOLD note: At 795 tonnes, India has the ninth-largest gold reserve in the world. The World Gold Council reports that Indian households may hold as much as 24,000 to 25,000 tonnes of the metal.

India Gold Reserves

Source: TradingEconomics.com

China: A gold bullion investor’s best friend?

Barchart/Levi Donohue/6-2-2023

USAGOLD note: Donohue uncovers a little-known Chinese initiative through its banking system that could bring millions of new investors into the market. We consider China’s latest gold-friendly policy a very important development. “Western bullion investors,” says Donohue, “should brace for a demand shock in the market which will see premiums on gold bullion bars and coins rise and decouple from the paper gold price. China is betting the prospects of its own citizens on gold and as of yet very few people in the west have noticed.”

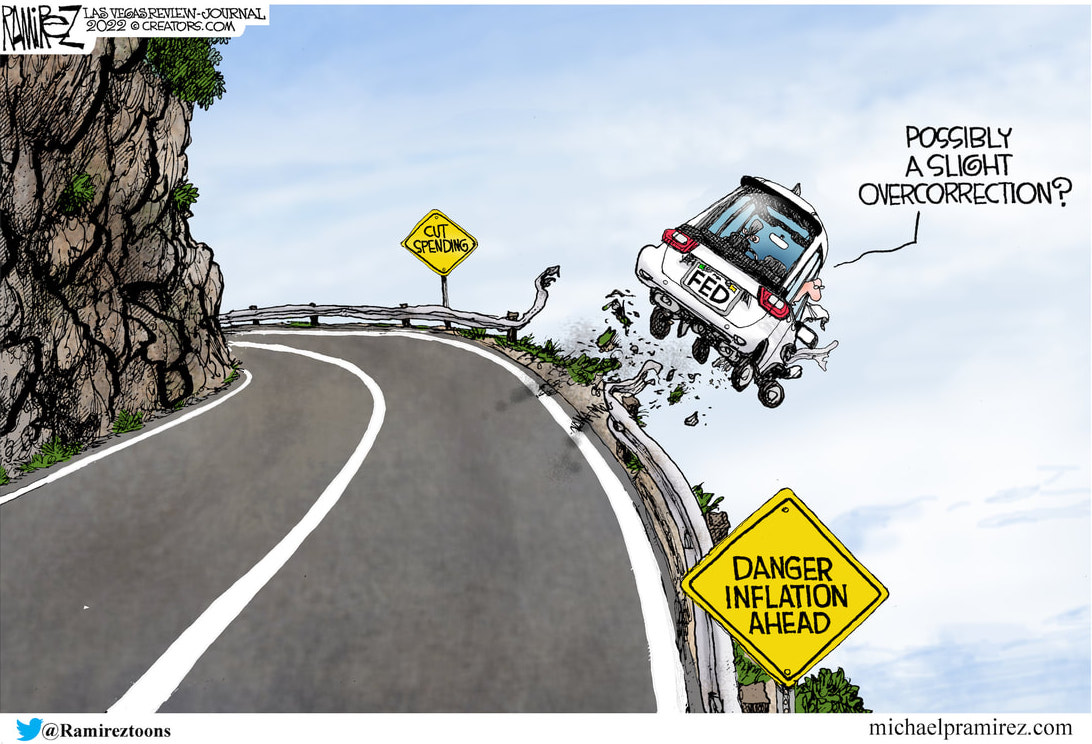

To pause or not to pause? Fed officials divided ahead of critical June meeting

Yahoo!Finance/Jennifer Schonberger/6-8-2023

“Federal Reserve officials are divided on whether to raise interest rates at the central bank’s policy meeting next week.”

USAGOLD note: As we kick off Fed week, three FOMC members favor a hike, two a pause, four could go either way, and two have not commented, according to YahooFinance. The Fed meets for two days starting Tuesday with a rate announcement and press conference scheduled for Wednesday.

Daily Gold Market Report

Gold turns to the downside to start the week

Van Eck says ‘tail risks’ are driving the gold bull market that began in 2015

(USAGOLD – 6/19/2023) – Gold turned to the downside to start the week as markets pondered just what it was the Fed was trying to convey last week. It is down $8 at $1952. Silver is down 25¢ at $24.03. The Wall Street Journal’s Nick Timaraos challenged the Fed’s apparent indecisiveness with a straightforward question asked at the post-meeting press conference: “Chair Powell, what’s the value in pausing and signaling future hikes versus just hiking now?… Why not just rip off the Band-Aid and raise rates today?”

“Gold,” says Van Eck, the New York-based fund manager, “has been in a bull market for over seven years, rising 87% from its secular low in December 2015. However, unlike the steady and predictable bull market of the 2000s, this bull moves up, down and sideways in fits and turns that makes price targeting next to impossible. The main drivers of past gold bull markets are extraordinary tail risks and a falling dollar. We are living in an age of tail risks as the world goes through sickness, war, social disorder and financial stress that most people thought were relegated to the past. The level of tail risks today are at least as significant as past bull markets.”

Gold’s bull market trend since 2015

(After Van Eck’s chart published at the link below)

Chart courtesy of TradingView.com and Van Eck • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“We live in a technological golden age but in a monetary and fiscal dark age. While physicists discover the so-called God particle, governments print and borrow by the trillions. Science and technology may hurtle forward, but money and banking race backward.”

James Grant

Grant’s Interest Rate Observer

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The road to confetti is long and winding

“Does the deployment of helicopter money not entail some meaningful risk of the loss of confidence in a currency that is, after all, undefined, uncollateralized and infinitely replicable at exactly zero cost? Might trust be shattered by the visible act of infusing the government with invisible monetary pixels and by the subsequent exchange of those images for real goods and services? . . . To us, it is the great question. Pondering it, as we say, we are bearish on the money of overextended governments. We are bullish on the alternatives enumerated in the Periodic table. It would be nice to know when the rest of

Dr. MoneyWise says. . . .Some think it takes an advanced degree in economics to understand the merits of a diversification in gold and silver when all it takes is a little common sense. Common sense ownership of physical metal saved the skeptical saver in the time of the French assignat inflation in 1789, the nightmare German inflation in 1923, the global bank collapses in 1932, the American stagflationary breakdown in the 1970s and Venezuela’s inflation in 2019 – even though those episodes span almost 250 years. As old Ben Franklin once said: “A change of fortune hurts a wise Man no more than a change of the Moon.”

_________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Favorite Web Pages

Gold Charts in Various Timelines and Currencies

Euro, Chinese yuan, British pound, Japanese yen, Swiss franc, Indian rupee, Australian dollar, Canadian dollar, U.S. dollar

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

USAGOLD was among the first to offer charts that tracked gold in various currencies and timelines. These live charts have always attracted a steady stream of U.S. and international visitors. As a result, we recently streamlined and upgraded the page to make it more user-friendly and included more currencies in the mix.

We invite your visit and bookmark.

Druckenmiller warns there are ‘more shoes to drop’

Yahoo!Finance-Bloomberg/Will Daniel/6-7-2023

“There’s a lot of stuff under the hood when you go from this kind of environment, the biggest broadest asset bubble ever, and then you jack interest rates up 500 basis points in a year, I think the probability is that Silicon Valley Bank, Bed Bath & Beyond, they’re probably the tip of the iceberg.” – Stanley Druckenmiller, Duquesne Family Office

USAGOLD note: Druckenmiller sees a credit crunch and recession ahead.……

China’s gold binge extends to seventh month as holdings climb

Bloomberg/Sybilla Gross/6-7-2023

“China increased its gold reserves for a seventh straight month, signaling ongoing strong demand for the precious metal from the world’s central banks. China raised its gold holdings by about 16 tons in May, according to data from the People’s Bank of China…”

USAGOLD note: China has led the global central bank gold buying spree. Central bank gold buying was at a record pace in 2023 and it has remained strong in 2023. The chart below is quarterly and does not include China’s most recent purchases which have taken its total holdings to 2092 metric tonnes.

China Gold Reserves

Source: TradingEconomics.com

Wall Street economists are increasingly less worried about a 2023 recession

Yahoo!Finance/Josh Shafer/6-9-2023

USAGOLD note: There are few signs of a recession at this juncture – a hint here or there – but nothing concrete or lasting. Nevertheless, the warnings come almost daily.

Short and Sweet

Blinded by the Money Illusion

“Would I say there will never, ever be another financial crisis? You know probably that would be going too far but I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will be.” – Janet Yellen, Former Federal Reserve chairwoman

With those words, Janet Yellen, now the Secretary of the Treasury and facing an even worse crisis than the one referenced above, put investors around the world on notice, though probably not in the way she intended. In the past, such smug assurances from public officials have been enough to send contrarian villagers heading for the safety of the nearby woods. The informed student of financial history knows that panics, manias, crashes, and collapses are as common to investment markets as hurricanes to Caribbean beaches. To think that suddenly we have banished their recurrence for ‘our lifetimes’ smacks of the kind of misguided hubris that contributed directly to the 2008 meltdown and subsequent untold financial hardship. Just about the time most everyone comes to the conclusion nothing could go wrong, everything goes wrong …… and in a hurry, as we have discovered over the course of the past two years.

Reliably serving physical gold and silver investors since 1973

Forget inflation – deflation is the real danger

MSN-The Telegraph/Ambrose Evans-Pritchard/6-8-20-23

USAGOLD note: China is already showing signs of deflation, says Evans-Pritchard – a deflation it is exporting. He says that the pace is quickening in the United States as the Treasury Department borrows heavily in turn pressuring bank reserves and regional lenders.

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“We’re in very uncharted waters. Nobody has gotten by with the kind of money printing now for a very extended period without some kind of trouble. We’re very near the edge of playing with fire.”

Charlie Munger

Berkshire Hathaway

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gundlach dials up his warning of a US recession

MarketInsider/Zahra Tayeb/6-7-2023

USAGOLD note: Gundlach is not moving off his warning of a severe recession. With new economic vulnerabilities surfacing regularly – anyone one of which could evolve to a full-out crisis in the event of a recession – sage-haven demand for gold is likely to intensify beyond the already high levels.

Treasury’s $1 trillion debt deluge threatens market calm

Bloomberg/Eric Wallerstein/6-7-2023

“Investors are bracing for a flood of more than $1 trillion of Treasury bills in the wake of the debt-ceiling fight, potentially sparking a new bout of volatility in financial markets.”

USAGOLD note: Until we get to the other side of the deep dark wood, we will put emphasis on the coming Treasury bond deluge.

Short and Sweet

Howe says this Fourth Turning will go to 2030

“To be clear, the road ahead for America will be rough,” writes Neil Howe, author of the modern classic, The Fourth Turning (1997), in a recent analysis posted at Hedgeye. “But I take comfort in the idea that history cycles back and that the past offers us a guide to what we can expect in the future. Like Nature’s four seasons, the cycles of history follow a natural rhythm or pattern. Make no mistake. Winter is coming. How mild or harsh it will be is anyone’s guess, but the basic progression is as natural as counting down the days, weeks, and months until Spring.”

For those who, like me, buy into Howe’s notion of a Fourth Turning, the problem is to get to the other side of the woods with our assets reasonably intact. “Currently, this period began in 2008,” he points out, “with the Global Financial Crisis and the deepening of the War on Terror, and will extend to around 2030. If the past is any prelude to what is to come, as we contend, consider the prior Fourth Turning which was kicked off by the stock market crash of 1929 and climaxed with World War II.” Eventually, he says, we will find our way to a first turning – a time of renewal – but we will be sorely tested before we get there. The precious metals have offered solid protection through the first half of the Fourth Turning. Gold is up 145% since the collapse of Lehman Brothers in September 2008 – the event most analysts associate with the start of the crisis. Silver is up 165%. In both instances, the greatest price acceleration occurred in the early years of the crisis.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you looking for a way to get to the other side of the deep, dark wood?

DISCOVER THE USAGOLD DIFFERENCE

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

US Treasury’s $1 trillion borrowing drive set to put banks under strain

Financial Times/Kate Duguid/6-6-2023

USAGOLD note: Erosion in the value of bond portfolios was the key catalyst in the collapse of SVB, First Republic, Signature Bank, and most notably Credit Suisse.