USAGOLD

Quality service & portfolio guidance since 1973

USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the gold industry’s oldest and most respected names. The firm’s unblemished, zero-complaints record and solid reviews with the Better Business Bureau testify to the exceptional customer service and professional excellence which sets it apart from the competition.

USAGOLD specializes in gold and silver coins and bullion delivered to our client’s safekeeping. For over 49 years, we have resolutely advocated owning precious metals for asset preservation purposes rather than speculation. Admittedly, this philosophy does not resonate with all prospective gold and silver owners, but if it does with you, we think you will find our firm a kindred spirit.

____________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Everyone thinks the Fed’s rate hike next week will be the final one — except the Fed

MarketWatch/Greg Robb/7-21-2023

USAGOLD note: Several analysts have come forward over the past month to state their belief that inflation is down but not out – in a lull rather than full remission. If that proves to be the case, the Fed could be chasing the inflation rate for many months to come.

The collapse of the risk-free delusion: Implications for the $133 trillion bond market

International Man/Nick Giambruno/July 2023

USAGOLD note: Giambruno warns that “It may be tempting to think the worst is over for bonds – it’s not. As you’ll see, the pain for bondholders is just starting.” The result he says will be a mass movement over time to reliable stores of value.

Short and Sweet

“Bear markets are sneaky beasts. . .”

King World News called the late, great Richard Russell – who regaled us with his wisdom in the Dow Theory Letter for nearly half a century – “the greatest financial writer in history.” We can only guess what Russell would have had to say about the current state of affairs, but the quote above provides a clue. Never predictable in his opinions, he was rock solid on one axiom throughout his career – the necessity and transcendence of gold as a permanent component of the well-balanced investment portfolio. As he said, so often, it helped him sleep at night.

Looking to prevent the beastly bear from sneaking up on your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

‘Something very strange’ explains why a US recession has been delayed

Yahoo!Finance/Matthew Fox/7-20-2023

USAGOLD note: How Wall Street analysts, with an ocean of data sources available to them, missed this important trend is equally strange.

Details in multiple reports are telegraphing inflation will become a big issue in months ahead

Zero-Hedge-Bloomberg/Alyce Anders/7-28-2023

USAGOLD note: The current situation has the feel of the run-up to the inflation surge in 2020. Then purchasing managers were warning of price increases before the general public became aware of the burgeoning problem.

Daily Gold Market Report

Gold off to a slow start to begin the week

Morris finds relevance in central banks buying gold ‘out of choice’ not official dictate

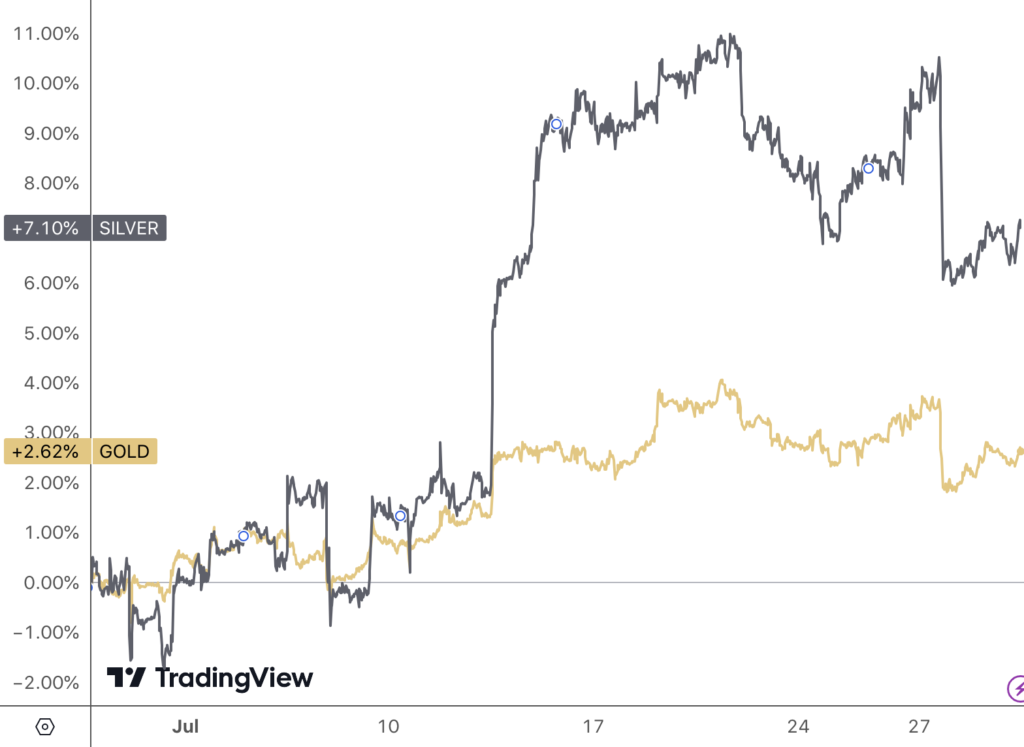

(USAGOLD – 7/31/2023) – Gold is off to a slow start to begin the week in sluggish summertime trading. It is level at $1961.50. Silver is up 5¢ at $24.46. On the month, gold is up 2.6% and silver is up a notable 7.1%. Charlie Morris, the UK-based financial analyst, offers an interesting take on the strong demand for gold among central banks.

“The remarkable thing,” says Charlie Morris in his most recent Atlas Pulse newsletter, “is that the gold standard withered in the 1970s, and other than the recent rumors surrounding a gold-backed BRICS currency, there has been no official need for central banks to own gold. They do so out of choice. It is remarkable how an informal gold standard of sorts is returning despite it being formally vanquished half a century ago. It means that gold is once again relevant despite that not being written down in the statute books.”

Gold and silver price performances

(%, July 2023)

Chart courtesy of TradingView.com • • • Click to enlarge

Deep recession to force full percentage-point fed cut Double Line warns

Bloomberg/Anchalee Worrachate/7-25-2023

USAGOLD note: Sherman thinks that the Fed will be slow to act in the face of a hard recession and then be forced to “unleash the biggest cut since the pandemic struck.” We should add that Doubletree’s Jeff Gundlach consistently has been among the most bearish Wall Street commentators.

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.”

Ernest Hemingway

Notes on the Next War: A Serious Topical Letter

Esquire magazine

September 1935

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

_______________________________________________________________

To end right, start right.

Choose the right portfolio mix with the right firm at the right price.

Choose

USAGOLD

Coins & bullion since 1973

_______________________________________________________________

Gold could hit record high of $2,500, says WisdomTree

“Gold is on track to hit a new record high of $2,225 per ounce by this time next year, according to Nitesh Shah, head of commodities and macroeconomic research at WisdomTree. However, if things go right, the precious metal may shoot even higher to $2,500 per ounce.”

USAGOLD note: Wisdom Tree sees a convergence of influences taking gold to all-time highs.

A $500 billion corporate-debt storm builds over global economy

Bloomberg/Jeremy Hill and Lucca De Paoli/7-18-2023

USAGOLD note: The possibility of a full domino effect cannot be ruled out, in our view, and it could begin anywhere without warning.

Short and Sweet

Worry about the return ‘of’ your money, not just the return ‘on’ it

There is an old saying among veteran investors to worry not just about the return on your money but the return of your money. In the wealth game, emphasize defense when you need to, offense when it makes sense. At all times, remain diversified. And by that, we mean real diversification in the form of physical gold and silver coins and/or bullion outside the current fiat money system – not just an assortment of stocks and bonds denominated in the domestic currency. Keep in mind – if the currency erodes in value, the underlying value of those assets erodes along with it. A proper, genuine diversification addresses that problem now and in the future.

Are you ready to deploy genuine diversification in your portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100• • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

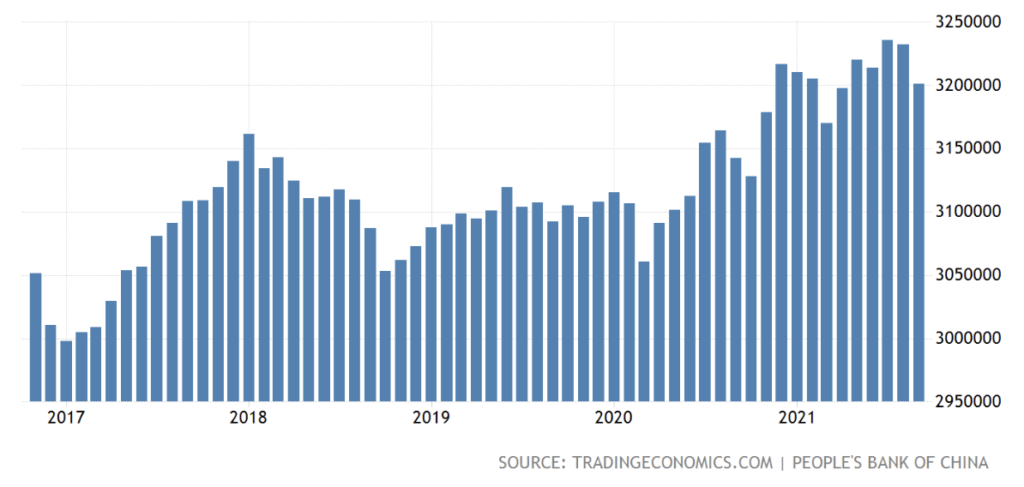

What happened in Beijing? Here’s two theories on why the dollar dropped after Yellen’s visit

MarketWatch/Steve Goldstein/7-19-2023

“Kevin Muir, a former institutional trader that blogs at The Macro Tourist, said China didn’t like what they heard from Yellen so the country decided to send a message. ‘China has $3.2 trillion in FX reserves. Their biggest position will be the U.S. dollar and don’t think they will be shy about using it,’ he says.”

USAGOLD note: A long-held market fear resurfaces – China weaponizing its dollar reserves. It can sell or swap for gold or other currencies. It can continue to refrain from buying U.S. Treasures.

China US dollar reserves

Chart courtesy of Trading Economics

Daily Gold Market Report

Gold takes positive turn as Japan signals reversal of dovish monetary policy

‘The desire for gold is the most universal and deeply rooted commercial instinct of the human race.’

Gerald Loeb, Wall Street trader

(USAGOLD – 7/28/2023) – Gold took a positive turn this morning as Japan signaled it might begin reversing its dovish monetary policy – a move that surprised markets and sent the Japanese yen sharply higher in overseas markets. Gold is up $10 at $1959. Silver is up 19¢ at $29.39. “If inflation has indeed returned to Japan, which we believe it has,” says State Street’s Michael Metcalf, “the BoJ will find itself needing to raise rates just as hopes for interest rate cuts rise elsewhere. This should be a medium-term positive for the JPY [Japanese yen], which remains deeply undervalued.”

We came across this passage from a Dominic Frisby essay earlier this week and thought it worth passing along:

“The experience of beauty, whether derived from nature, art, music or even mathematics, correlates with activity in the emotional brain, the medial orbitofrontal cortex. Beauty has long been associated by philosophers with truth and purity – also qualities commonly associated with gold. Our instinct for gold and the emotions it inspires from beauty to desire are basic. There has not been a culture in history that did not appreciate the value of gold. It is a primal instinct. ‘The desire for gold,’ said Wall Street trader Gerald Loeb, ‘is the most universal and deeply rooted commercial instinct of the human race.’” [Source: MoneyWeek]

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“We sometimes forget that central banking, as we know it today, is, in fact, largely an invention of the past hundred years or so, even though a few central banks can trace their ancestry back to the early nineteenth century or before. It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. By and large, if the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with ‘free banking.’ The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.” – Paul Volcker, (From Deane and Pringle’s The Central Banks, 1995)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

_______________________________________________________________________________________________________________

The Investment of Kings and the King of Investments

The Investment of Kings and the King of Investments

From the small investor just starting out to the high-net-worth individual hedging a multi-million dollar portfolio, we have helped many thousands add precious metals to their holdings in our nearly 50 years in the gold business – safely, economically and with the investor’s goals in mind.

No matter the size of your investment kingdom, we can help!

_______________________________________________________________________________________________________________

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

Reliably serving physical gold and silver investors since 1973

Gold should be dead, but somehow it’s still adding value

MarketWatch/Brett Arends/7-15-2023

USAGOLD note: Arends has never been an ardent supporter of gold, but in this article he reluctantly makes concessions.… To make a long story short, a portfolio that includes a 10% gold diversification over the long run does better than one that doesn’t. How would a 20% diversification look?

Goldman chief economist cuts recession probability to 20%, dismisses yield-curve inversion

MarketWatch/Steve Goldstein/7-18-2023

USAGOLD note: Hatzius, in fact, believes the economy is going to grow “albeit below trend pace.”

Short & Sweet

The true nature of inflation

“The nature of inflation is widely misunderstood and misinterpreted,” writes analyst Dave Kranzler in an Investing.com overview, “‘Inflation’ and ‘currency devaluation’ are tautological—they are two phrases that mean the same thing. … Dollar devaluation has been occurring since the early 1970’s. The value of the dollar relative to gold (real money) has declined 98%. In 1971, $40,000 would buy a 4,000 square foot home in a good suburb. Now it takes $700,000 on average to buy that same home. Price inflation is the evidence of currency devaluation. The CPI is not a real measure of price inflation. The CPI is methodically massaged – starting with the Arthur Burns Federal Reserve (it was his idea) to hide the real degree of currency devaluation from all of the money that has been printed since 1971.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Worried about what currency devaluation is doing to the value of your savings?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973