Why the Fed is hard to predict

Project Syndicate/Mohamed A. El-Erian/5-30-2023

USAGOLD note: El Erian says that no one knows what is going to happen at it June meeting – not even the Fed itself. It lacks, he says, “a solid strategic foundation.” Our interpretation? It bends with the wind and has become vulnerable to political pressure, it is unpredictable and not the kind of Fed Wall Street is likely to find reassuring.

Short & Sweet

‘Advice doesn’t have to be complicated to be good.’

“The world is complex,” writes analyst Safal Nivetchak. “Consider the various reasons floating around explaining the market’s fall in the last two months – war, inflation, interest rates, FII selling, China, supply chain disruptions, weak GDP, and over valuations. This is not a complete list, but enough to suggest that the world is complex. And so are financial markets. How do you deal with such complexity in your wealth creation journey without losing your sanity? Have an investment process that is elegant in its simplicity.” We found the down-to-earth practicality contained in Nivetchak’s advisory of enormous value, particularly for young investors searching for guidance on the road to building wealth – something appealingly analog in an increasingly complex digital age.

Though he never mentions gold, many successful investors see it as part and parcel of the keep it simple portfolio approach. He offers a memorable quote from Dutch computer science pioneer Edsger Dijkstra: “Simplicity requires hard work to achieve it and education to appreciate it.” Nivetchak ends by quoting Steve Jobs on keeping it simple: “… It’s worth it in the end because once you get there, you can move mountains.” Says Nivetchak, “That’s also true for investing for wealth creation. In practicing simplicity, and staying the course, over time you can also move mountains.”

_________________________________________________________________

Fed poised for another big policy mistake?

Credit Bubble Bulletin/Doug Noland/6-2-2023

Selected quotes from Friday’s report:

“It’s not a close call. If the Fed “Skips” policy tightening at the June 14th FOMC meeting, it will be yet another big policy mistake. The long string of errors has greatly damaged the Federal Reserve’s inflation-fighting credibility. It has also promoted dangerously dysfunctional market structure. At this point, the Fed should err on the side of demonstrating resolve in reining in inflationary excesses.”

. . . . . . . . . . . . . .

“Financial markets are also poised to sustain inflationary pressures. Resurgent Bubble Dynamics have fueled a major loosening of financial conditions. Surveys and anecdotes point to a degree of bank lending tightening. But this has been more than offset by risk embracement, leveraged speculation, and liquidity excess throughout the financial markets.”

. . . . . . . . . . . . . .

“Basically, the Fed/GSE liquidity backstop was integral to the pricing and liquidity dynamics that made derivatives so appealing for both hedging and speculating. And the bigger this complex became – and the more critical to the markets and economy – the more the Fed was compelled to quickly intervene to stabilize markets. Last year’s heightened concerns that the unfolding tightening cycle created ambiguity with respect to the Fed’s liquidity backstop were allayed by the Bank of England’s September and the Federal Reserve’s March interventions.”

Daily Gold Market Report

Gold drifts sideways as investors batten down the hatches

Dalio warns we are at the beginning of a debt crisis and worse times for the economy

(USAGOLD – 6/9/2023) – Gold is drifting sideways in early trading as investors batten down the hatches for what could be a turbulent upcoming week. It is down $1 at $1967.50. Silver is up 9¢ at $24.44. Today’s quiet follows a sharp turn to the upside yesterday after a greater-than-expected jump in unemployment claims. Next week, the Treasury Department will begin replenishing its coffers with a run of auctions on Monday and Tuesday. On Tuesday, the BLS will report on headline inflation for May. On Wednesday, the Fed will wind up its rate meeting with an announcement and press conference.

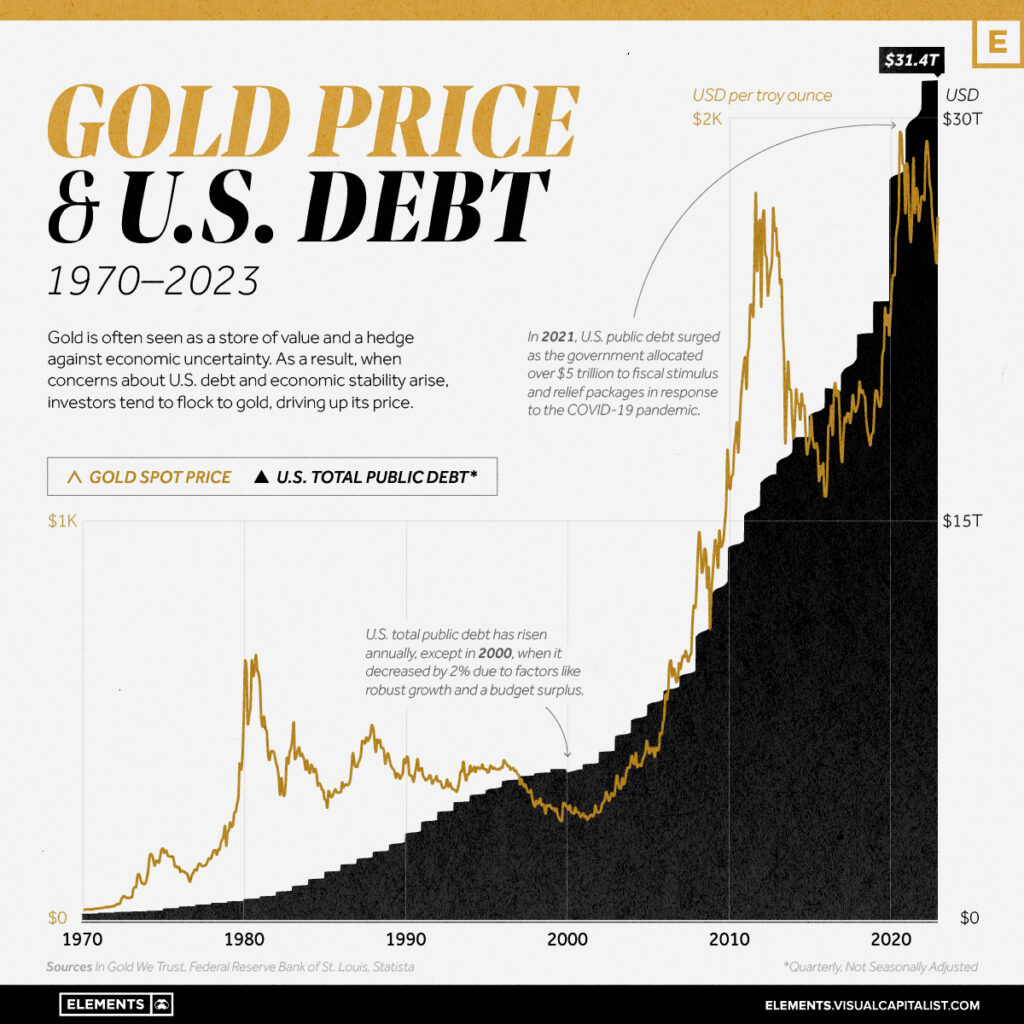

Ray Dalio, the outspoken founder of Bridgewater Securities, believes that we are in the early stages of a debt crisis and that the worst is yet to come for the economy. “In my opinion,” he told Bloomberg, “we are at the beginning of a very classic late, big cycle debt crisis, when the supply-demand gap, when you are producing too much debt and have a shortage of buyers.… What’s happening now, as we have to sell all this debt, do you have enough buyers? When I look at the supply-demand issue for that debt, there’s a lot of debt, it has to be bought and has to have a high enough interest rate.”

Visualization courtesy of Visual Capitalist com • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“. . .[I]f you go down the line of currencies around the world, you don’t find many attractive opportunities. And that’s why I say if the world were to give up on dollars and give up on euros, they’d probably go back to the old standby, which is gold. And I don’t mean by gold, government run gold standard, like we had in the late 19th century. That’s politically impossible. Governments will never be willing to subordinate their policies to the constraints of a hard commodity ever again… So how could gold make a revival as a sort of international money? Well, we don’t actually need a government run gold standard anymore…since people have always had confidence in gold as a long-term store of value, there’s no reason why it couldn’t play that role.”

Benn Steil

Director of International Economics

Council on Foreign Relations

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

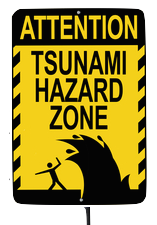

Trillion-dollar vacuum is coming for Wall Street rally

Yahoo!Finance-Bloomberg/Denitsa Tsekova and Ksenia Galoucho/6-3-2023

USAGOLD note: “As the tsunami approaches,” says Britain’s National Oceanography Centre, “water is drawn back from the beach to effectively help feed the wave.… A tsunami is short enough to have a rapid effect, in minutes, but long enough to carry enormous energy.”

Backlash against weaponized dollar is growing across the world

Bloomberg/Michelle Jamrisko and Ruth Carson/6-2-2023

USAGOLD note: We note with interest how quickly de-dollarization went from minor to major issue…… The rapid embrace of alternatives suggests a long-suppressed concern about the role the dollar plays in a nation-state’s economic independence.

Short & Sweet

When paper money dies, precious metals prevail.

The lessons learned from the nightmare German hyperinflation of 1923

“They’ll print money until they run out of trees.”

Jim Rogers, investor and financial commentator

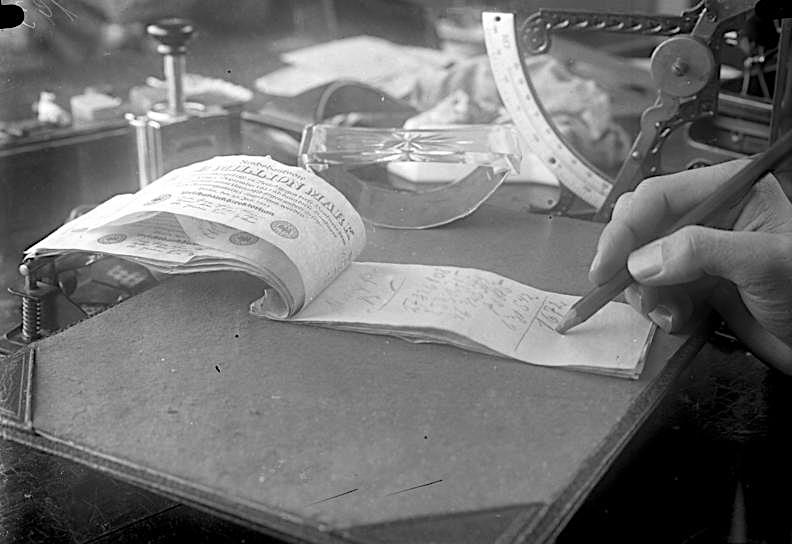

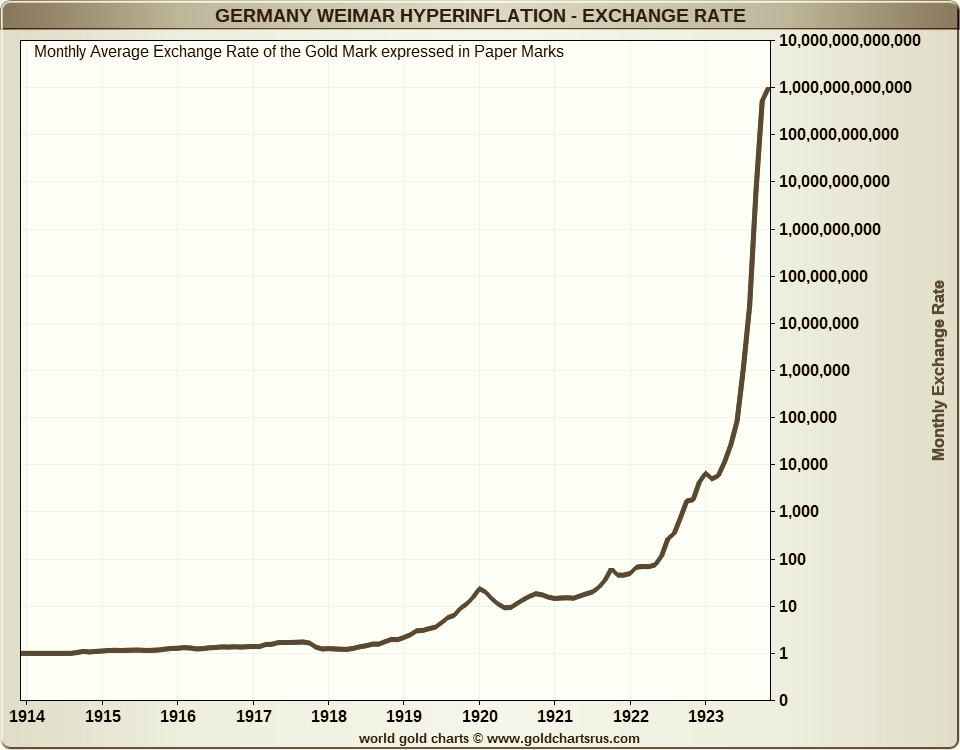

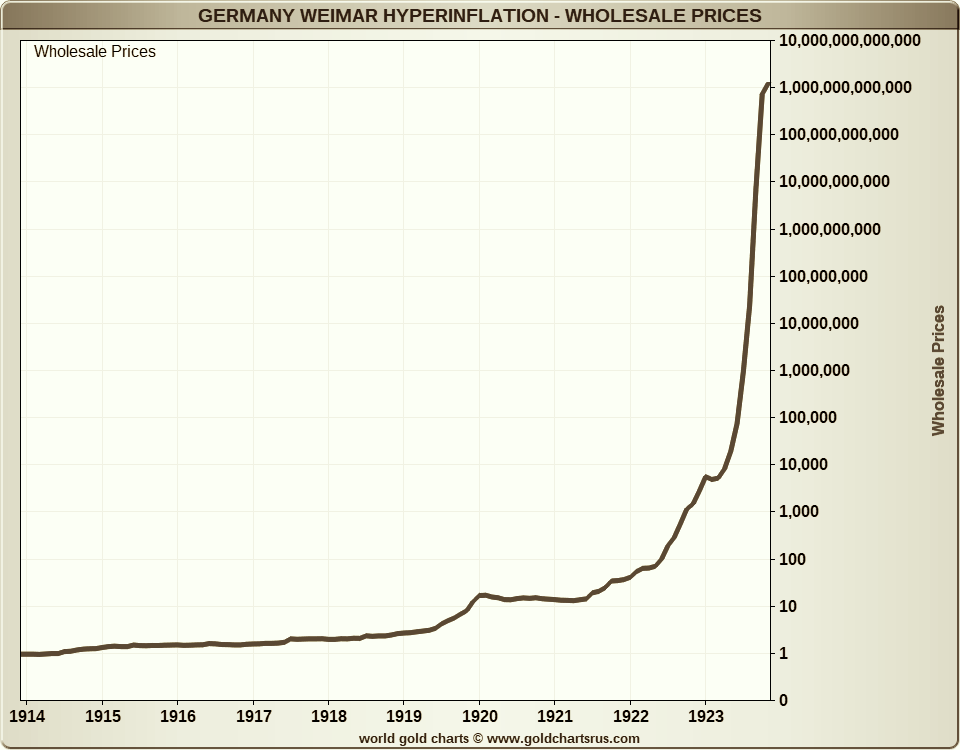

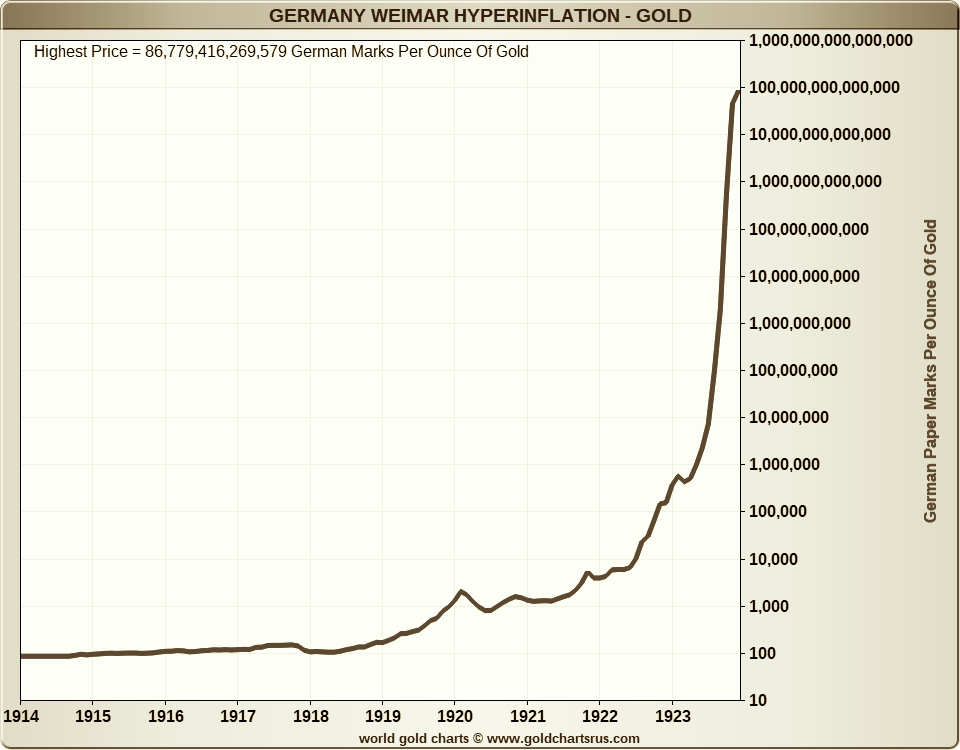

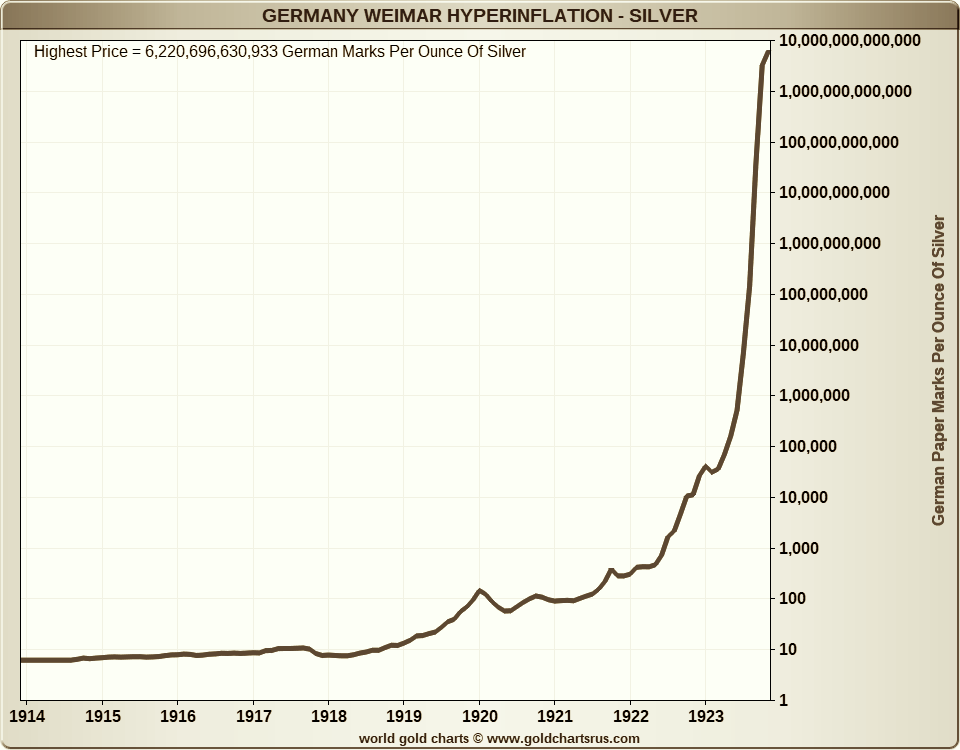

Not many investors are seriously concerned about hyperinflation in the United States at this juncture. At USAGOLD, we, too, see it as an outlier – something that could happen but not a probability. But that’s the thing about hyperinflations. Rarely does the handwriting appear unmistakably on the wall. Not many were worried about hyperinflation in Germany in 1923 when it struck out of the clear blue. When disaster did strike, however, it came with a vengeance. Prices shot up in 1921. Then just as quickly – within the space of a year – they ran out of control. By 1923, an individual’s life savings could not purchase a cup of coffee. We ran into the following charts researching another matter at the GoldChartsRUs website. The one unsettling aspect they all have in common is their verticality – an indication of how quickly and conclusively the inflationary catastrophe swept through the German economy.

The first and second charts reflect the severe debasement of the German mark at the time. The third and fourth show how gold and silver performed as a hedge. In effect, what could have been purchased with an ounce of gold or silver before the debacle, could have been purchased at any time as it worsened and finally when it ended a few years later. Few, as stated above, predict an inflationary disaster on the level of the Weimar Republic. Still, it is good to know that by preparing for the lesser version of inflation, one prepares for the nastier versions as well.

Charts courtesy of GoldChartsRUs • • • Click to enlarge

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Interested in preserving your purchasing power in even the worst-case scenario?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Image (top): Paper German marks converted to notepad, 1920s Weimar Republic. Attribution/ Bundesarchiv, Bild 102-00193 / CC-BY-SA 3.0, CC BY-SA 3.0 DE <https://creativecommons.org/licenses/by-sa/3.0/de/deed.en>, via Wikimedia Commons

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

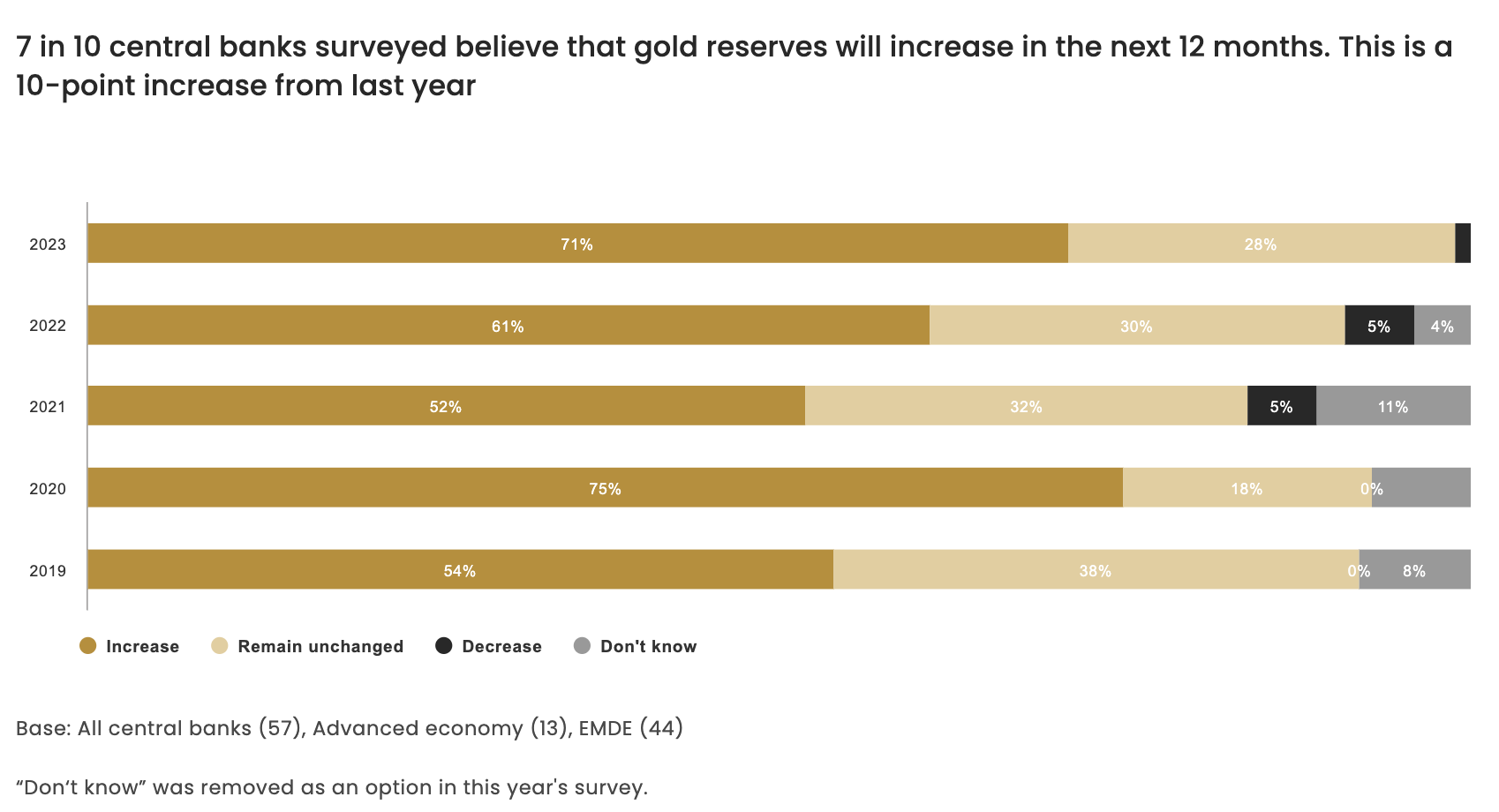

2023 central bank gold reserves survey

World Gold Council/Gold Hub/5-30-2023

“Following a historical high level of central bank gold buying, gold continues to be viewed favourably by central banks. Our 2023 survey revealed that 24% of central banks intend to increase their holding reserves in the next 12 months. Furthermore, central banks’ views towards the future role of the US dollar were more pessimistic than in previous surveys. By contrast, their views towards gold’s future role grew more optimistic, with 62% saying that gold will have a greater share of total reserves compared to 46% last year.”

USAGOLD note: Many believe that central bank purchases are the chief reason for gold’s rise over the past year to central banks purchases. That being the case, World Gold Council’s finding in the survey bode well for the future.

Daily Gold Market Report

UPDATE – Goid’s sharp turn to the upside has to do with the surge in unemployment claims. It leaves room for the Fed to pause rates at next week’s FOMC meeting. It is up $28 at $1970. Silver is up 86¢ at $24.37.

__________________________________

Gold up marginally as choppy price performance continues

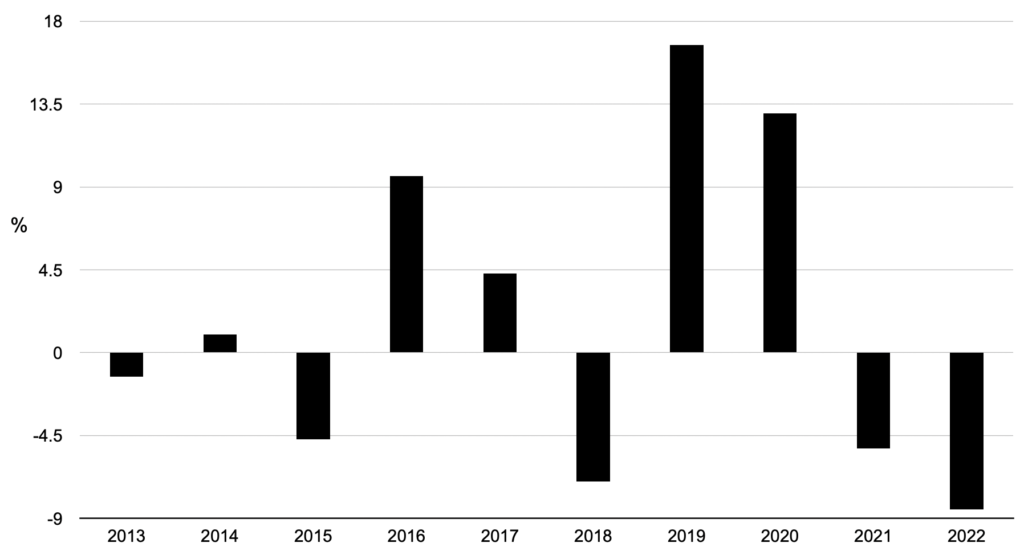

Five up years, five down years during the summer months since 2013

(USAGOLD –6-8-2023) – Gold is up marginally this morning in the follow-up to yesterday’s sell-off. It is up $7 at $1949.50. Silver is up 28¢ at $23.79.In a recent client briefing, Gold Newsletter’s Brien Lundin offers a couple of explanations for gold’s choppy price behavior over the past month.

“For gold,” he says, “it seems that algos are simply keying off the rising yields part of the equation and ignoring the cheapening currency implications.… Again, not much to report on, and certainly nothing different from what I’ve been saying over the past few weeks. The Fed is likely to pause at next week’s meeting, but I believe that gold and bonds are already looking ahead at the possibility of a pivot — actual rate cuts — by the fall. That would mean something more than a recession has popped up and, needless to say, this would be extremely bullish for metals and miners. In the meantime, we’re smack dab in the summer doldrums already.”

Editor’s note: Though trading and volumes in the gold market do tend to fade during the summer months, it has been a mixed bag over the past ten years in terms of price performance. We have had five down years and five up years, June through August, since 2013. Perhaps the old dictum to “sell in May and go away” is changing in this era of the portable office and instantaneous news availability.

Gold price performance

(%, June through August 2013-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: TradingView.com

Notable Quotable

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“The question is whether there’s enough gold to back the currency reserves. The answer is for the price of gold to go higher, perhaps much higher.… Just wait until they’re forced to loosen into an inflationary spike to support the Treasury. At that point, it’s best to have some gold. That’s what grandpa Ben taught me.” – David Einhorn, Greenlight Capital (US News report)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

How chasing the sugar rush of monetary infusions gave us high inflation

South China Morning Post/Richard Harris/6-1-2023

USAGOLD note: Some solid background on how we got where we are now from an expert on Asian markets who formerly held senior positions at JP Morgan, Citi and BNY Mellon. He ends with an interesting comment: “Across London, the fact that the Bank of England, well endowed with economics PhDs, still has ‘very big lessons to learn’ about inflation indicates that the future of economic mismanagement is secure.”

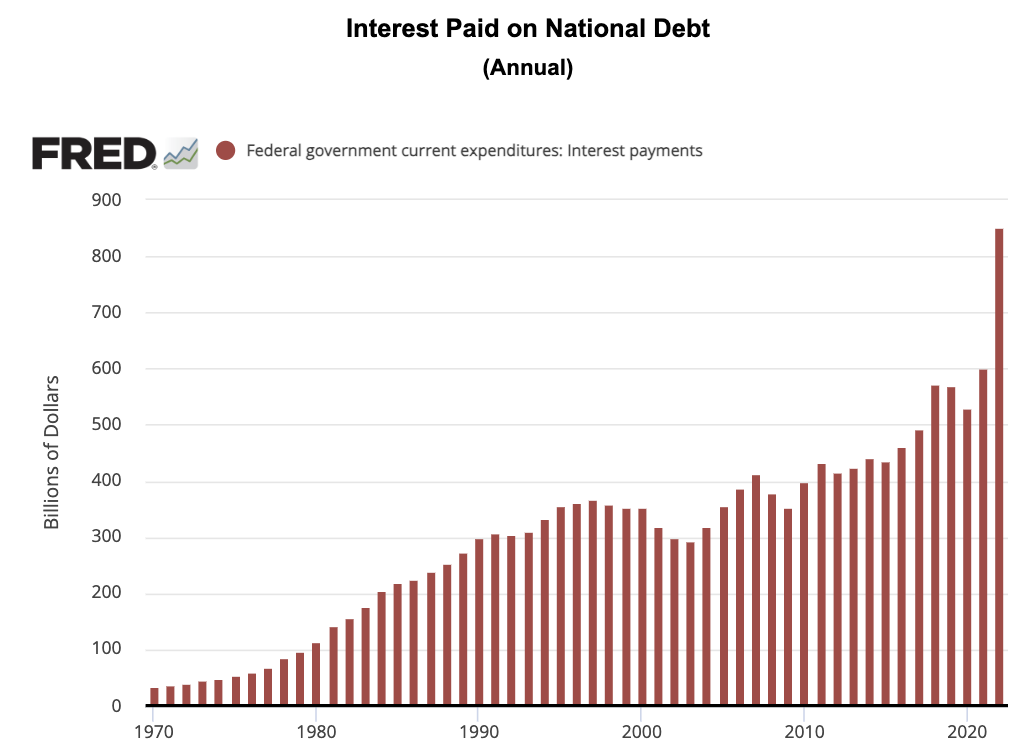

Why Yellen doesn’t lose sleep over US borrowing

Yahoo!Finance-Bloomberg/Christopher Condon/5-31-2023

“One reason she’s sanguine is that Yellen is among a number of prominent economists to embrace an alternative method for measuring the sustainability of the nation’s debt. Instead of looking at the pile of outstanding bonds as a share of the economy’s output, she prefers the ratio of interest payments — crucially, after adjustment for inflation — to GDP.”

USAGOLD note: It is beyond our understanding how a Treasury Secretary could look at the level of the federal government’s interest payments without being alarmed. It’s because insiders like Yellen do not lose sleep over the national debt, that so many others do.

Sources: St. Louis Federal Reserve [FRED], Office of Management and Budget

The ‘impenetrable armor of the dollar’ is at risk, says BlackRock’s Rieder

Semafopr/Liz Hoffman/5-23-2023

USAGOLD note: In times like these, the dollar would be dominant in the flight to quality, says Rieder, “but after sanctions and the dynamic around deglobalization [post-pandemic], international investors are inclined to diversify.” We would add fears of US government default to that list even if things change for the better. Gold has been one of the key beneficiaries of the diversification Rieder mentions.

Short & Sweet

Ubiquity, complexity, and sandpiles

Contemplating the impact of that last grain of sand

For a long while, John Mauldin (Mauldin Economics) has been one of the more thoughtful big picture analysts – someone whose work we read regularly. In a recent reflection posted at the GoldSeek website, he begins with a section on a Brookhaven National Laboratories study of sandpiles. Researchers attempted to ascertain at which point, and to what degree, the last grain of sand falling on the pile causes disequilibrium and the collapse of the pile. It found that the impact of the last grain of sand varied. It “might trigger only a few tumblings or it might instead set off a cataclysmic chain reaction involving millions.”

“We cannot accurately predict when the avalanche will happen,” Mauldin concludes. “You can miss out on all sorts of opportunities because you see lots of fingers of instability and ignore the base of stability. And then you can lose it all at once because you ignored the fingers of instability. You need your portfolios to both participate and protect. Don’t blindly buy index funds and assume they will recover as they did in the past. This next avalanche is going to change the nature of recoveries as other market forces and new technologies change what makes an investment succeed. I cannot stress that enough. Don’t get caught in a buy-and-hold, traditional 60/40 portfolio. Don’t walk away from it. Run away.”

So why would the story of the last grain of sand hitting the pile before it begins to dissemble be important? “The peculiar and exceptionally unstable organization of the critical state,” says Mark Buchanan, who wrote a book on catastrophes of all kinds (and referenced by Mauldin), “does indeed seem to be ubiquitous in our world. Researchers in the past few years have found its mathematical fingerprints in the workings of all the upheavals I’ve mentioned so far [earthquakes, eco-disasters, market crashes], as well as in the spreading of epidemics, the flaring of traffic jams, the patterns by which instructions trickle down from managers to workers in the office, and in many other things.” There comes a breaking point a which time the result is uncontrollable.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Worried about the sandpiles building in various markets?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Melt-up vs. Deleveraging

Credit Bubble Bulletin/Doug Noland/5-26-2003

Observations from Credit Bubble Bulletin’s Doug Noland:

Here at home, the banking system remains highly levered and vulnerable. There are scores of big securities portfolios that become immediately problematic in the event of a yield spike. And it wouldn’t take much to restart the deposit exodus from vulnerable institutions. The mortgage marketplace is vulnerable to self-reinforcing deleveraging and interest-rate hedging-related selling. And, generally, leverage permeating the entire system creates vulnerability to a surge in market yields.

The Fed is in a bad place. The resurgent stock market speculative Bubble is a major force for loosening financial conditions and stoking inflationary pressures, while risking a melt-up and crash scenario. But additional Fed tightening measures are problematic for the bond market and banking system.

We’re back to the Fed hikes until something breaks. At this point, financial conditions must tighten significantly to keep inflation from becoming only more deeply ingrained. And especially after this speculative stock market run, tighter conditions pierce Bubbles. For now, such loose conditions set the stage for the nightmare scenario – a surprising jump in inflation, a spike in market yields, and a repricing for tens of Trillions of fixed-income securities. Stocks can relish the fun and games. But look over your shoulder, and you might see inklings of de-risking/deleveraging.”

Daily Gold Market Report

Gold seesaws quietly in a range ahead of next week’s Fed meeting

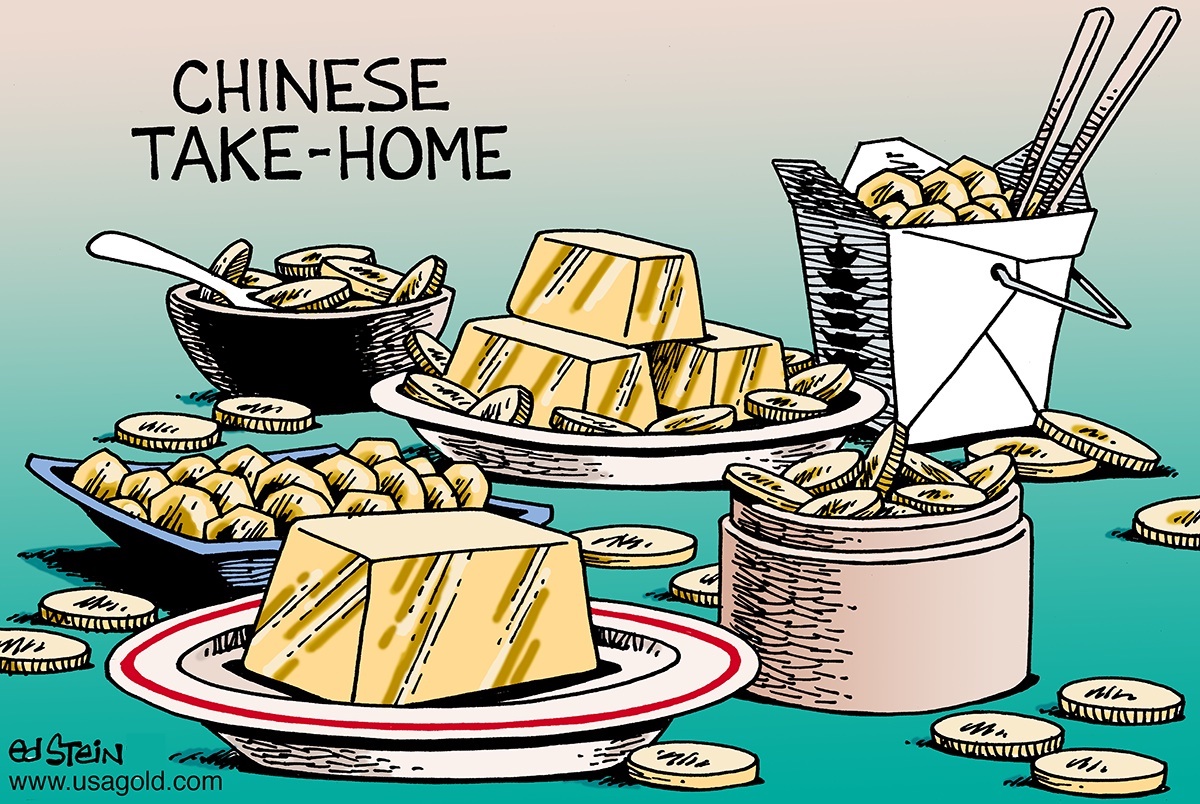

New China initiative could deliver a ‘demand shock’ in physical bullion market

(USAGOLD – 6/7/2023) – Gold continued to seesaw quietly in a range as investors took to the sidelines ahead of next week’s Fed meeting. It is down $3 at $1964. Silver is level at $23.67. In an article posted st BarChart, analyst Levi Donohue says the gold market, courtesy of China’s banking system, is about to experience “a demand shock that is not being factored into current gold futures prices.”

Chines banks will make “it easy for millions of existing renminbi bank account holders to convert these cash savings into a deliverable physical silver or physical gold bullion with a click of the mouse from within their banking applications.” He advises Western precious metals investors to “brace for a demand shock in the market which will see premiums on gold bullion bars and coins rise and decouple from the paper gold price. China is betting the prospects of its own citizens on gold and as of yet very few people in the West have noticed.”

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Perhaps we slow investors should adopt a mascot. I suggest the sloth. Hanging upside-down, moving at a few metres a minute, is much like trading infrequently: it saves the costs of doing things more quickly. Sloths take almost two months fully to digest each meal — which is handy, given that they eat mildly toxic leaves that would poison them if absorbed too quickly. Investors are reminded, all too often, that the financial world is lush with toxic get-rich quick products. A slower approach to finance makes market movements a great deal more digestible.”

Tim Hartford

Financial Times/The Undercover Economist

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fred Hickey: ‘Long term, conditions are perfect for gold to go to record high’

theMarketNZZ/Interview of Fred Hickey by Christoph Gisiger/5-26-2023

USAGOLD note: Hickey says “gold does best when stocks are going down.” He adds that stocks are being held up by “this FOMO move” in tech stocks but it will eventually end.

Elon Musk warns house prices are set to plunge – and says commercial real estate is in meltdown

MarketsInsider/Zahra Tayeb/5-30-2023

USAGOLD note: There will be repercussions…… in the banking sector and the overall economy. Let’s hope they are not major.