Daily Gold Market Report

Gold drifts sideways as investors batten down the hatches

Dalio warns we are at the beginning of a debt crisis and worse times for the economy

(USAGOLD – 6/9/2023) – Gold is drifting sideways in early trading as investors batten down the hatches for what could be a turbulent upcoming week. It is down $1 at $1967.50. Silver is up 9¢ at $24.44. Today’s quiet follows a sharp turn to the upside yesterday after a greater-than-expected jump in unemployment claims. Next week, the Treasury Department will begin replenishing its coffers with a run of auctions on Monday and Tuesday. On Tuesday, the BLS will report on headline inflation for May. On Wednesday, the Fed will wind up its rate meeting with an announcement and press conference.

Ray Dalio, the outspoken founder of Bridgewater Securities, believes that we are in the early stages of a debt crisis and that the worst is yet to come for the economy. “In my opinion,” he told Bloomberg, “we are at the beginning of a very classic late, big cycle debt crisis, when the supply-demand gap, when you are producing too much debt and have a shortage of buyers.… What’s happening now, as we have to sell all this debt, do you have enough buyers? When I look at the supply-demand issue for that debt, there’s a lot of debt, it has to be bought and has to have a high enough interest rate.”

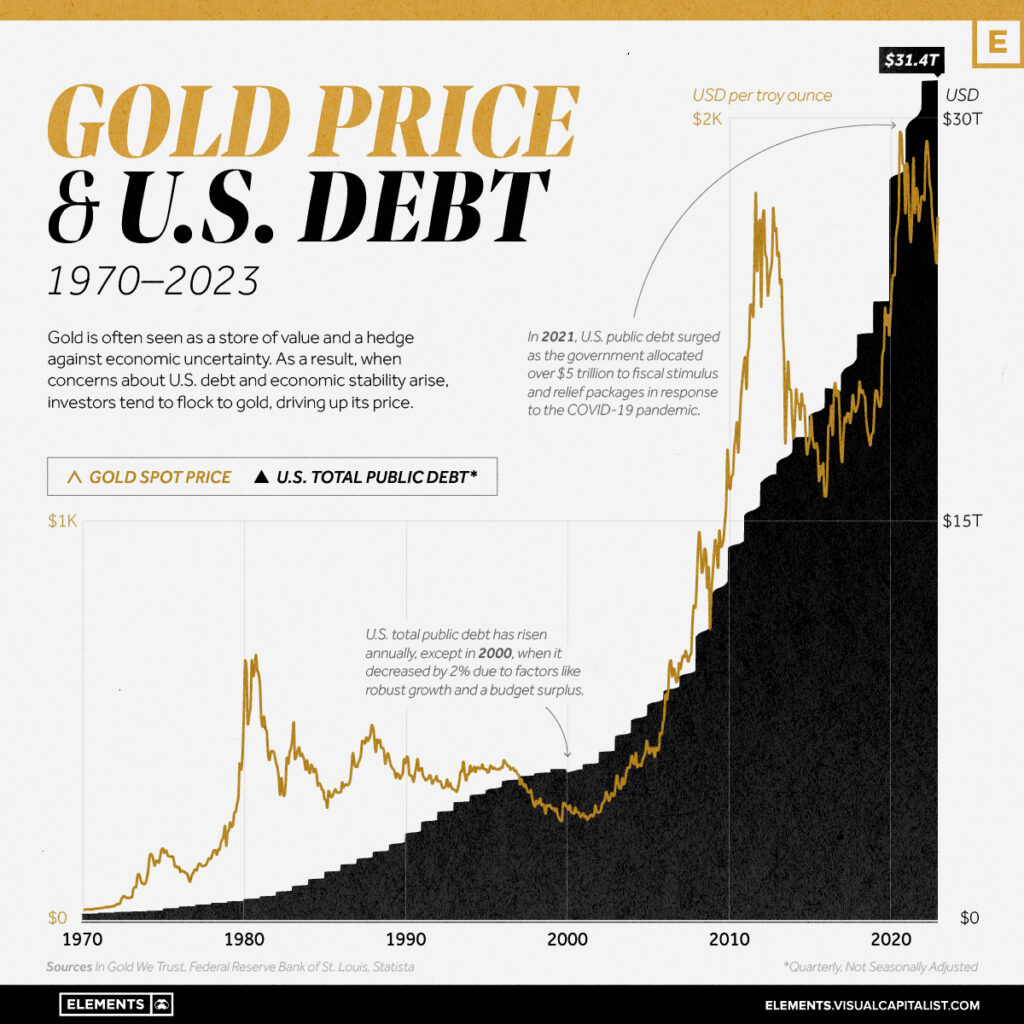

Visualization courtesy of Visual Capitalist com • • • Click to enlarge