Melt-up vs. Deleveraging

Credit Bubble Bulletin/Doug Noland/5-26-2003

Observations from Credit Bubble Bulletin’s Doug Noland:

Here at home, the banking system remains highly levered and vulnerable. There are scores of big securities portfolios that become immediately problematic in the event of a yield spike. And it wouldn’t take much to restart the deposit exodus from vulnerable institutions. The mortgage marketplace is vulnerable to self-reinforcing deleveraging and interest-rate hedging-related selling. And, generally, leverage permeating the entire system creates vulnerability to a surge in market yields.

The Fed is in a bad place. The resurgent stock market speculative Bubble is a major force for loosening financial conditions and stoking inflationary pressures, while risking a melt-up and crash scenario. But additional Fed tightening measures are problematic for the bond market and banking system.

We’re back to the Fed hikes until something breaks. At this point, financial conditions must tighten significantly to keep inflation from becoming only more deeply ingrained. And especially after this speculative stock market run, tighter conditions pierce Bubbles. For now, such loose conditions set the stage for the nightmare scenario – a surprising jump in inflation, a spike in market yields, and a repricing for tens of Trillions of fixed-income securities. Stocks can relish the fun and games. But look over your shoulder, and you might see inklings of de-risking/deleveraging.”

Daily Gold Market Report

Gold seesaws quietly in a range ahead of next week’s Fed meeting

New China initiative could deliver a ‘demand shock’ in physical bullion market

(USAGOLD – 6/7/2023) – Gold continued to seesaw quietly in a range as investors took to the sidelines ahead of next week’s Fed meeting. It is down $3 at $1964. Silver is level at $23.67. In an article posted st BarChart, analyst Levi Donohue says the gold market, courtesy of China’s banking system, is about to experience “a demand shock that is not being factored into current gold futures prices.”

Chines banks will make “it easy for millions of existing renminbi bank account holders to convert these cash savings into a deliverable physical silver or physical gold bullion with a click of the mouse from within their banking applications.” He advises Western precious metals investors to “brace for a demand shock in the market which will see premiums on gold bullion bars and coins rise and decouple from the paper gold price. China is betting the prospects of its own citizens on gold and as of yet very few people in the West have noticed.”

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Perhaps we slow investors should adopt a mascot. I suggest the sloth. Hanging upside-down, moving at a few metres a minute, is much like trading infrequently: it saves the costs of doing things more quickly. Sloths take almost two months fully to digest each meal — which is handy, given that they eat mildly toxic leaves that would poison them if absorbed too quickly. Investors are reminded, all too often, that the financial world is lush with toxic get-rich quick products. A slower approach to finance makes market movements a great deal more digestible.”

Tim Hartford

Financial Times/The Undercover Economist

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fred Hickey: ‘Long term, conditions are perfect for gold to go to record high’

theMarketNZZ/Interview of Fred Hickey by Christoph Gisiger/5-26-2023

USAGOLD note: Hickey says “gold does best when stocks are going down.” He adds that stocks are being held up by “this FOMO move” in tech stocks but it will eventually end.

Elon Musk warns house prices are set to plunge – and says commercial real estate is in meltdown

MarketsInsider/Zahra Tayeb/5-30-2023

USAGOLD note: There will be repercussions…… in the banking sector and the overall economy. Let’s hope they are not major.

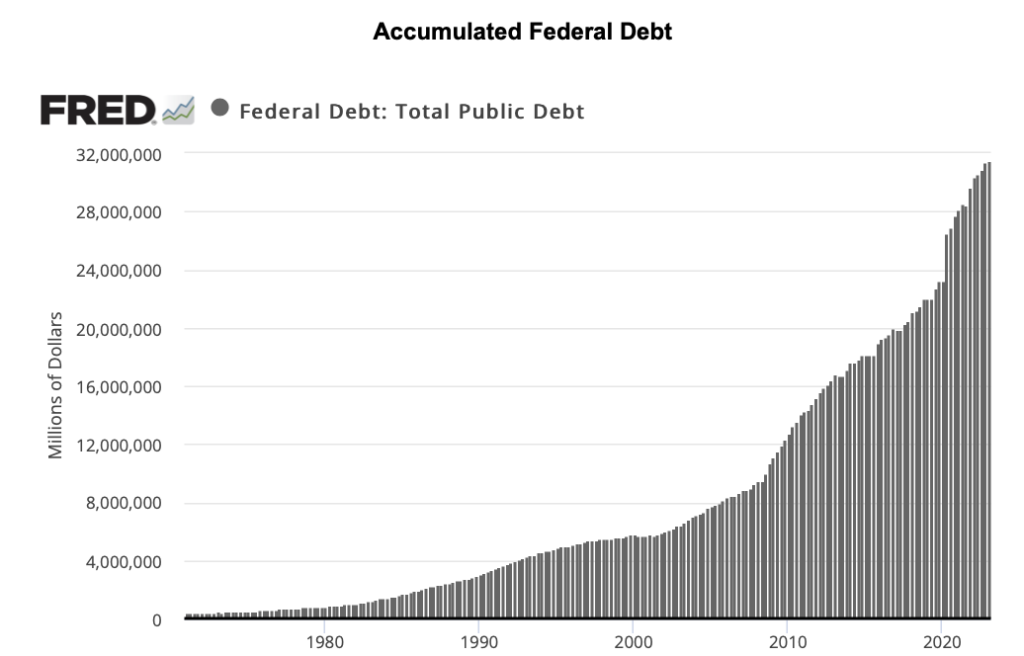

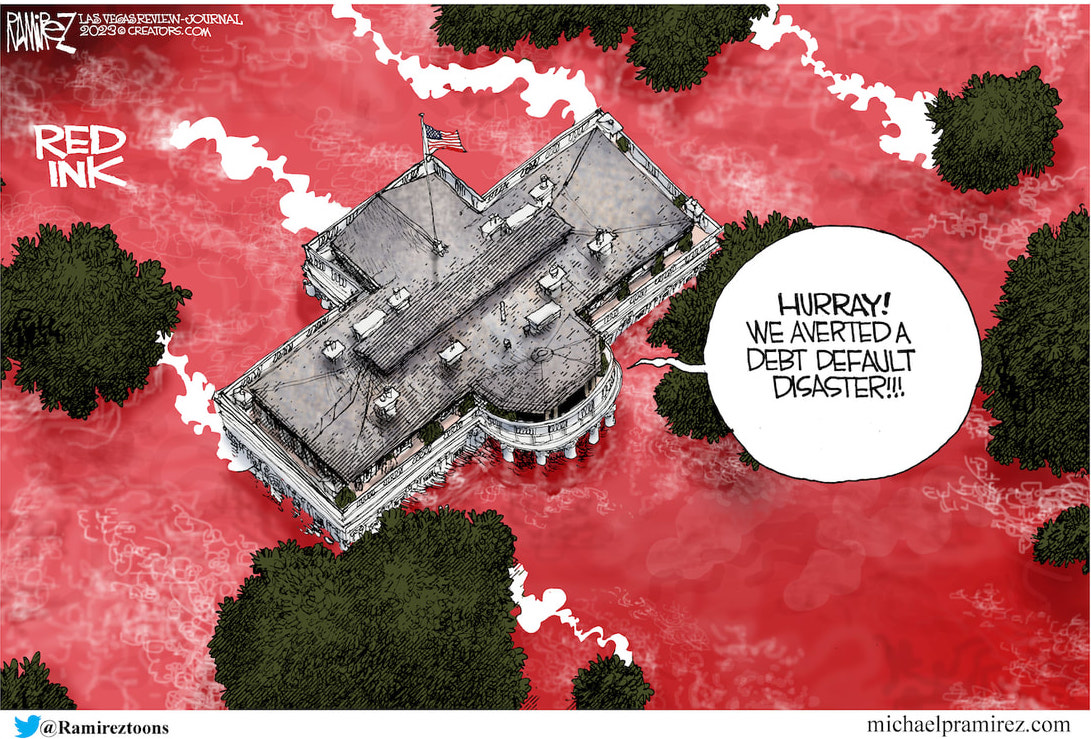

Unruly politicians and unchecked spending risk US debt catastrophe

Financial Times/Michael Strain/5-26-2023

“The nation has arrived at the brink of disaster because of a collision of structural problems in the economy and political system. A deal to increase the debt ceiling and cut certain categories of federal spending would fix the immediate crisis, but would not address these festering problems.”

USAGOLD note: The real debt crisis……The problem of too much debt and its future growth overshadows any debt ceiling arrangement the politicians might stitch together now. Michael Strain is the American Enterprise Institute’s director of economic policy studies.

Sources: St. Louis Federal Reserve [FRED], US Department of the Treasury, Fiscal Service

Short and Sweet

The next great monetary experiment

Daily Reckoning’s Brian Maher warns of the potential consequences of modern monetary theory. “This MMT sounds like a recipe for immense inflation, even hyperinflation,” he says. “You are spending all this money directly into the economy. It will drive consumer prices through the attic roof, you say. This is crackpot. A witch’s sabbath of inflation would surely result. Yes, but here the MMT crowd meets you head on… They agree with you. They agree MMT could cause a general inflation, possibly even a hyperinflation.” [Link to full article]

Modern Monetary Theory (MMT), we would add to Maher’s observation, is neither modern nor a theory. John Law, the Scottish financier, tried a version of it almost exactly 300 years ago (1717-18) in France.* He did so with the blessing of the French monarchy and with a rationale very similar to MMT’s proponents today. MMT entails, simply put, a federal government fiscal policy without spending limits coupled with the power to print whatever money is required to finance any deficits. In the end, Law’s theories (to his surprise if we are to believe the historical account) bankrupted the French people and the government, reduced the economy to ashes, and created such a distaste for paper scrip among the citizenry that it took 80 years for France to reintroduce paper money as a circulating medium.

In The Story of the Greatest Nations (1900), Edward S Ellis and Charles F. Home tell of the public mania that engulfed the French people and led to ultimate financial ruin for thousands:

“The shrewder speculators* became alarmed. They began to sell their shares of stock, and hoard in gold the enormous wealth they had acquired. This resulted in a demand on the government for metal in exchange for its paper, and soon the government had no metal to give. Then the crash came. Those who had the government paper could buy nothing with it. Those who held the Mississippi stock could scarce give it away. It was worthless. The government itself refused to accept its own paper for taxes. A few lucky speculators had made vast fortunes; but thousands of families, especially among the wealthier classes, were ruined.”

That snippet provides a hint as to the steps taken by those who survived Law’s version of modern monetary theory. For those to whom all of this has a distinct ring of familiarity, perhaps a judicious hedge makes some sense. A number of analysts have made the argument that we do not have to wait for the formal launch of modern monetary theory. It is already here.

* Please see this link for a summary of Law’s Mississippi Company land scheme.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Ready to move from education to action?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

The end of King Dollar? The forces at play in de-dollarisation

Yahoo!Finance-Reuters/Naomi Rovnick and Libby George/5-25-2023

USAGOLD note: Though the dollar is likely to remain the currency of choice in international transactions, its status as a reserve holding is in decline. Gold could be among the long-term beneficiaries if the trend continues. In fact, central bank gold demand set a record in 2022 and continues at a record pace in 2023. Reuters says “mushrooming alternatives could create a multipolar world.”

Daily Gold Market Report

Gold marginally higher as investors remain wary of inconclusive outlook

$1.1 trillion+ Treasury debt release muddies financial outlook

(USAGOLD – 6-6-2023) – Gold is marginally higher in early trading as investors remain wary of an inconclusive economic and financial picture. It is up $2.50 at $1966.50. Silver is up 11¢ at $23.71. One of the components of that muddied outlook is the $1 trillion+ tsunami of federal borrowing the Treasury Department is expected to unleash by the end of August. Many Wall Streeters are worried about the threat it imposes on the financial system. “This is a very big liquidity drain,” JP Morgan’s Nikolaos Panigirtzoglou told Bloomberg. “We have rarely seen something like that. It’s only in severe crashes like the Lehman crisis where you see something like that contraction.”

“Since the early 1970s, the logic for gold ownership has been inextricably bound to the cash flow problems of the federal government. As the national debt increased so did the well-documented damage associated with it – to the dollar, to financial markets and to the economy in general. Simultaneously, gold’s role as an inversely correlated portfolio hedge grew over that nearly one-half century as well.” – The National Debt and Gold: Here’s why the two have risen together since the 1970s and why the correlation is likely to continue

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“I’m no insect. Gold is a great way to make a lot of money.”

Thomas Kaplan

Electrum Group

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

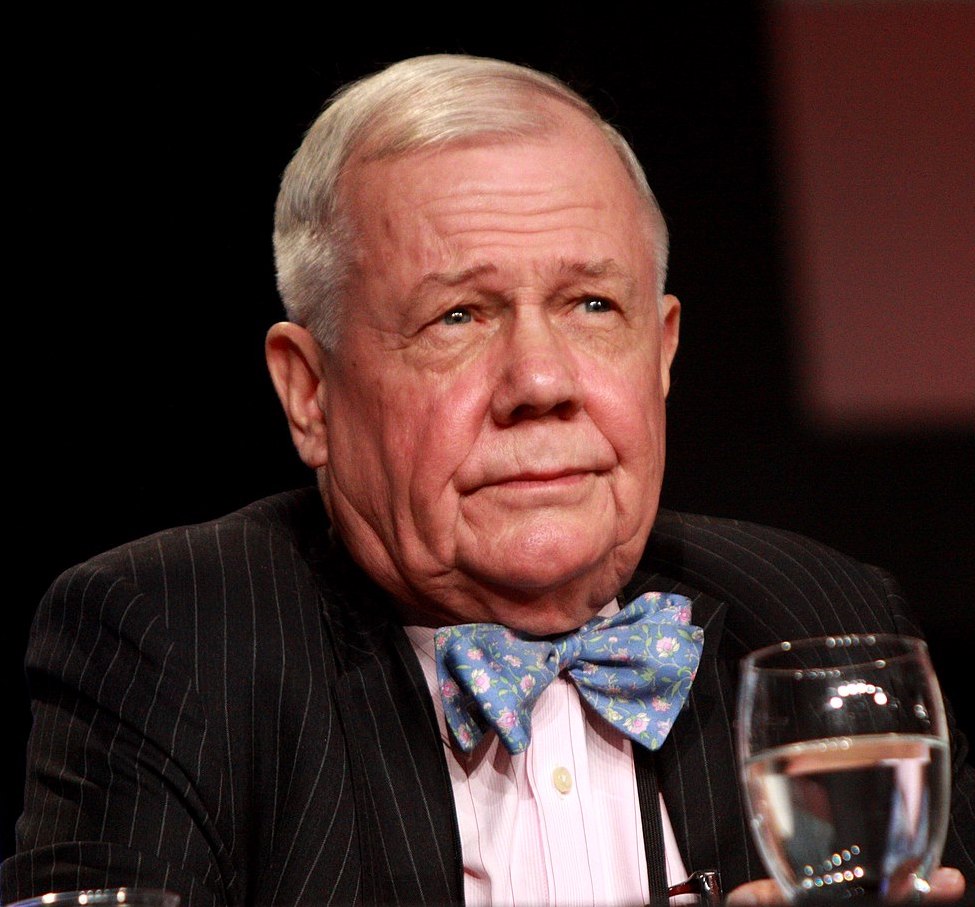

Jim Rogers predicts worst bear market of his life, de-dollarization, and higher interest rates.

MarketsInsider/Theron Mohamed/5-29-2023

USAGOLD note: Rogers says the world has never seen the debt and money printing it has in the last few years. “There will be trouble in all markets,” he adds.

Traders are duped by bear market rally, Morgan Stanley’s Wilson says

Bloomberg/Alexandra Semenova/5-26-2023

USAGOLD note: As Richard Russell (deceased but not forgotten) once put it “bear markets are sneaky beasts and they like to do their damage as secretly and as unobtrusively as possible. I hate to say it but somewhere ahead, the bears going to get it all together and the innocent little stream is going to turn into a waterfall. What can you do about it? Stay out of the market? Protect yourself by remaining in pure wealth, gold.”

The stark ‘de-risking’ choice facing economies

Financial Times/ Mohamed El-Erian/5-26-2023

USAGOLD note: El Erian makes a cutting-edge observation. Economics is no longer alone in determining the structure of national currency reserves. The combined forces of national security, “politics National security, and geopolitics are supplanting economics in shaping national and international interactions. An argument can be made that the level of fragmentation and uncertainty El-Erian elevates gold as the more reliable, long-term option.

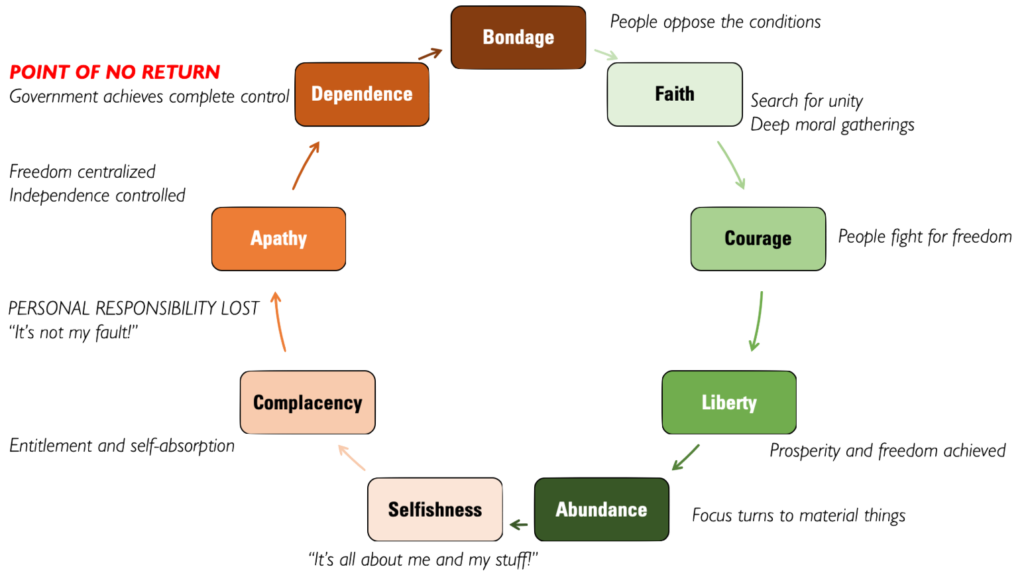

Short & Sweet

Tytler’s Cycle

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship.” – Alexander Fraser Tytler, Scottish historian, (1747-1813)

_______________________________________________________________________

To end right, start right.

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

_______________________________________________________________________

Image attribution: J4lambert, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>,

via Wikimedia Commons

IMF says U.S. should tighten fiscal policy to help cut persistent inflation

Yahoo!Finance-Reuters/David Lawder/5-26-2023

USAGOLD note: Isn’t this the kind of advice IMF usually offers to countries like Argentina and Turkey? Needless to say, even if the politicians agree on a debt ceiling the spending will continue at a high level.

Daily Gold Market Report

Gold starts the week on the downside driven by speculators in the paper markets

WGC: Gold prices have increased by a robust 11% annually over the past 50 years

(USAGOLD – 6/5/2023) – Gold is starting the week on the downside as speculators reacted to the prospect of higher rates, entrenched inflation, and an alarmingly (in certain quarters) strong economy. It is down $6 at $1945. Silver is down 13¢ at $23.55. While the Fed and rates have dominated the paper trade over the past year, concerns about the financial system’s stability have driven record safe-haven demand in the physical market, particularly among central banks and private investors. (See interactive chart below.)

Pointing out that gold prices have increased by a robust 11% annually over the past 50 years, the World Gold Council says, “investors want protection in tough times—and historically, this is when gold shines moving higher when equities and other riskier assets are under pressure. Unusually though, gold can also move higher when these assets are in positive territory. This ability to perform in good times and bad is based on gold’s varied demand and makes it a uniquely efficient asset for an investment portfolio.” [Source: World Gold Council/Reuters]

Chart courtesy of the World Bank

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Ironically, the beggar-thy-neighbor implications of competitive devaluations will almost certainly incite a response from countries who may not originally even have needed to resort to currency debasement in the first place, raising the potential for full blown currency war. How should one position for such an endgame? As is probably evident, any nominal instrument will be devalued in real terms, so the solution is to hold an asset that maintains its real value – an asset that cannot be printed.”

Rick Rieder

BlackRock Funds

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Short & Sweet

Computer software gone mad

Similarly, in early 2017 Financial Times told the story of the textbook, The Making of a Fly: The Genetics of Animal Design. It started out selling for $113 per copy at Amazon – that is until the governing algorithm misfired between two third-party sellers. The price then skyrocketed to $23 million before someone took note and fixed the problem. We forget that computer software, and this applies to Wall Street’s trading apparatus as readily as it does the Amazon pricing platform, is only as reliable and intelligent as the code by which it is instructed to operate. The practical equivalent to Mr. Spock’s solution in the financial realm is to store sufficient capital in the form of gold and silver coins detached from potentially rebellious electronic circuitry.

Worried about the possibility of computer algorithms running amok in financial markets?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • [email protected] • • • ORDER GOLD & SILVER ONLINE 24-7

Reliably serving physical gold and silver investors since 1973

Dr. Moneywise

“In an economy buffeted by the ups and downs of farming and fishing, the people [of India] are used to buying gold after bumper harvests or fishing seasons and selling it after lean ones.” –– Vivek Kaul, Live Mint

Dr. MoneyWise says: “It’s all very simple. Own gold for a rainy day. Use it if and when that day arrives.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Ready to make that rainy-day investment?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Debt ceiling drama will be ‘resolved, but not solved,’ says Jim Grant

USAGOLD note: He goes on to say that these borrowing levels pose a threat to the dollar as global investors worry that the US government could default on future debt payments.