Daily Gold Market Report

Gold seesaws quietly in a range ahead of next week’s Fed meeting

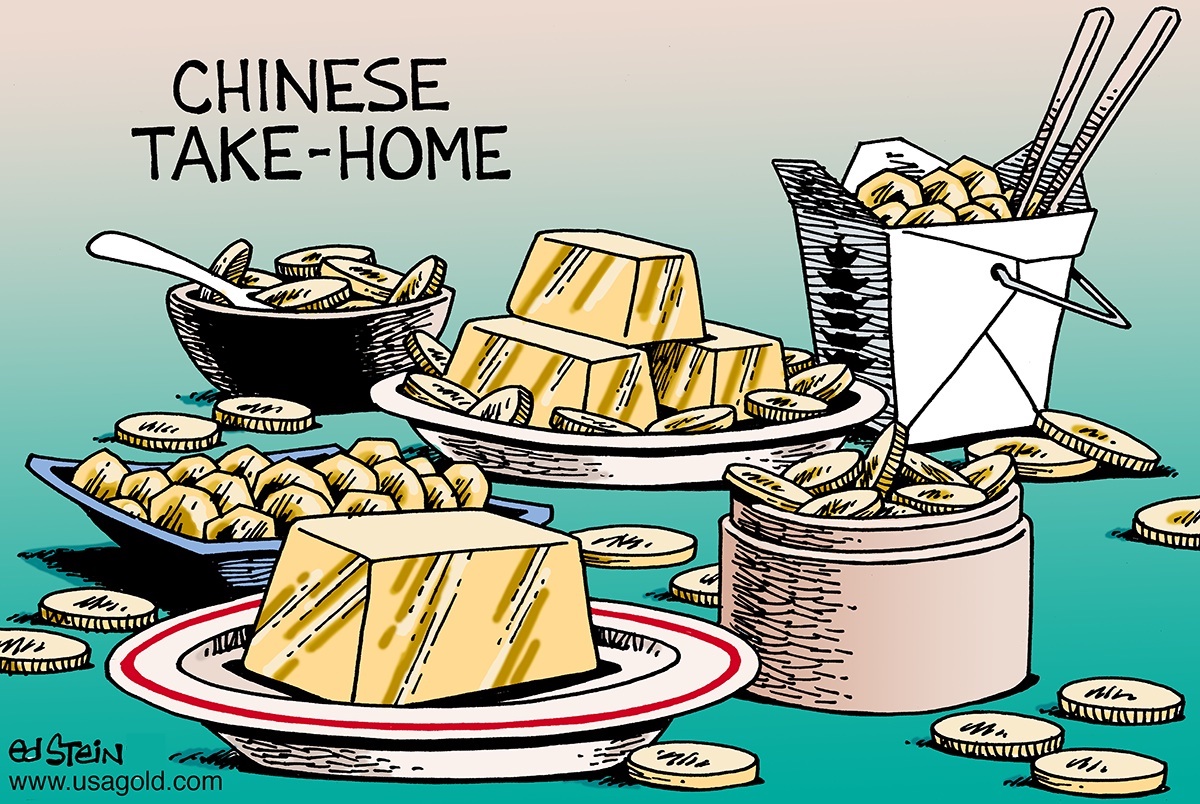

New China initiative could deliver a ‘demand shock’ in physical bullion market

(USAGOLD – 6/7/2023) – Gold continued to seesaw quietly in a range as investors took to the sidelines ahead of next week’s Fed meeting. It is down $3 at $1964. Silver is level at $23.67. In an article posted st BarChart, analyst Levi Donohue says the gold market, courtesy of China’s banking system, is about to experience “a demand shock that is not being factored into current gold futures prices.”

Chines banks will make “it easy for millions of existing renminbi bank account holders to convert these cash savings into a deliverable physical silver or physical gold bullion with a click of the mouse from within their banking applications.” He advises Western precious metals investors to “brace for a demand shock in the market which will see premiums on gold bullion bars and coins rise and decouple from the paper gold price. China is betting the prospects of its own citizens on gold and as of yet very few people in the West have noticed.”