The Fed’s inflation fight faces a new challenge: A dry Panama Canal

Bloomberg/Laura Curtis, Ruth Liao and Michael McDonald/6-2-2023

USAGOLD note: One of those unforeseen circumstances that can wreak havoc with central banks’ monetary policy……The shift to El Nino weather patterns translates to severe drought in Panama – perhaps for months to come.

Rosenberg says the US economy is a ‘dead man walking’

MarketsInsider/Zahra Tayeb/6-2-2023

USAGOLD note: Rosenberg is sticking with the hard landing scenario. He says if the Fed continues to raise rates “they’ll crush the economy.”

Analysis – Dollar bears bide their time as U.S. economic strength persists

Yahoo!Finance-Reuters/Saqib Iqbal Ahmed/6-4-2023

“The dollar is ‘in a very messy transition from bull market to a bear market,’ said Aaron Hurd, senior portfolio manager, currency, at State Street Global Advisors. ‘That transition period is going to be fairly frustrating.'”

USAGOLD note: Hurd expects the dollar to hold up over the short term but decline steadily over the longer run. Gold has done well during extended bear markets for the dollar.

Gold and the US Dollar Index (DXY)

( Dollar index inverted)

Short and Sweet

Economic insecurity is becoming the new hallmark of old age

“In the United States,” writes Katherine S. Newman and Rebecca Hayes Jacobs for The Nation, “economic security in old age was seen, for a long time, as both a social issue and a national obligation. From the birth of Social Security to the end of the 20th century, the common assumption has been that we have a shared responsibility to secure a decent retirement for our citizens. Yet that notion is weakening rapidly. Instead, we have started to hear echoes of the mantra of self-reliance that characterized welfare ‘reform’ in the 1990s: You alone are in charge of your retirement; if you wind up in poverty in your old age, you have only your own inability to plan, save, and invest to blame.”

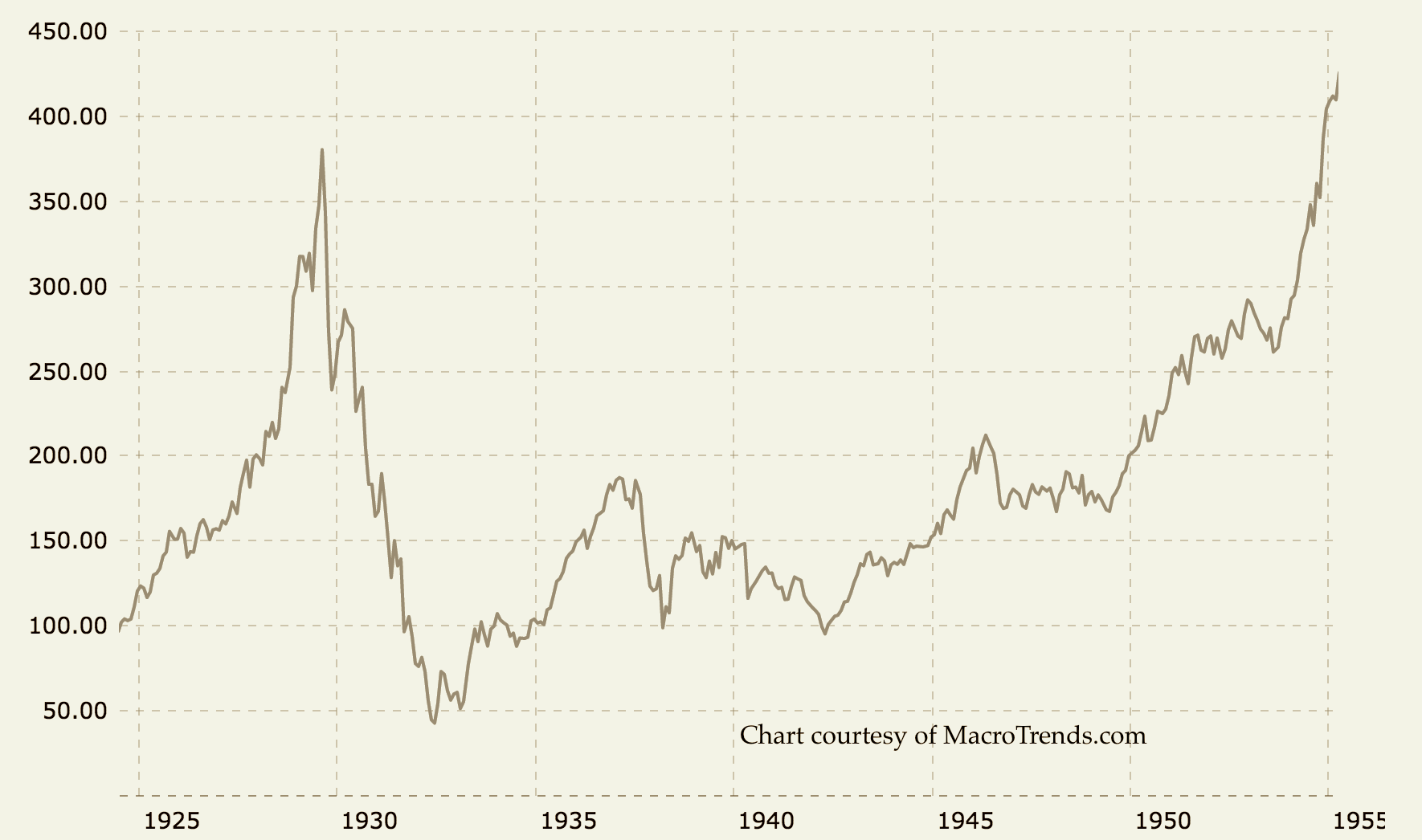

Dow Jones Industrial Average

(1925-1955)

Chart courtesy of MacroTrends.net • • • Click to enlarge

Some compare today’s stock market psychology to the period just before 2008. Others compare it to the 1920s when everything was hunky-dory until suddenly it wasn’t – perhaps a more apt comparison. Too many are “all-in” with respect to stocks in their Individual Retirement Accounts hoping to accumulate as much capital as possible without regard to the potential downside. As the chart above amply illustrates, the stock market did not recover from the losses accumulated between 1929 and 1933 until the mid-1950s, almost 25-years later – a fragment of stock market history lost to time.

Some will rely on the fact that stocks recovered nicely once the Fed launched the 2009 bailout. We should keep in mind though that many prominent Wall Street analysts have warned that the Fed no longer has the firepower it did then. The financial markets and economy are much more vulnerable as a result – all of which brings us back to the notions of self-reliance and taking personal responsibility for our retirement plans. If you find yourself among the group that thinks hedging a stock market downturn to be in your best interest, we can help you effectively structure a gold and silver diversification as part of your retirement plan to hedge that possibility.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Are you ready to hedge a potential Wall Street meltdown in your retirement plan?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Billionaire Perot warns of real recession as loans dry up

Bloomberg/Shelly Hagan and Matthew Miller/5-31-2023

“Ross Perot Jr., whose family is one of the largest independent property developers in the country, warned of a looming real estate recession if banks don’t start lending again.”

USAGOLD note: As noted this morning, despite warnings from the likes of Ross Perot Jr., a number of banks have already declared commercial real estate risky and are trimming their portfolios accordingly.

Daily Gold Market Report

No DGMR Wednesday through Friday. Back Monday. Below is yesterday’s report.

_______________________________________

Gold’s reaction muted on this morning’s drop in headline inflation rate

Hickey says ‘gold does best when stocks are going down’

(USAGOLD – 6/13/2023) – Gold’s reaction to this morning’s drop in the headline inflation rate has been muted thus far. It is up $2 at $1962. Silver is down 2¢ at $24.10. The early reaction to major data releases is not always the real reaction. We should have a clearer indication of where we are headed by the end of today’s trading session. Short-term considerations aside, High Tech Strategist’s Fred Hickey believes that conditions are “perfect” for gold to go to record highs and that it will be propelled by a major correction in the over-valued stock market.

“Historically,” he says, “gold had two big bull markets prior to the current one. The first was in the 1970s. Importantly, gold would go up when the stock market went down. At that time, the price went up 73% in 1973, and another 60% in 1974 during that severe two-year stock bear market. The other big bull market was in the 2000s which was a lost decade for stocks. So again: gold does best when stocks are going down. That’s not the case right now, because the market is being held up by this FOMO move into these very dangerous big cap names, but that will eventually end.” [Source: the market NZZ]

Gold and stocks 1973-1974

Chart courtesy of TradingView.com • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Deflation is a threat posed by a critical breakdown of the financial system. Slow growth and recurrent recessions without systemic financial disturbances, even the big recessions of 1975 and 1982, have not posed such a risk. The real danger comes from encouraging or inadvertently tolerating rising inflation and its close cousin of extreme speculation and risk taking, in effect standing by while bubbles and excesses threaten financial markets. Ironically, the ‘easy money,’ striving for a ‘little inflation’ as a means of forestalling deflation, could, in the end, be what brings it about. That is the basic lesson for monetary policy. It demands emphasis on price stability and prudent oversight of the financial system. Both of those requirements inexorably lead to the responsibilities of a central bank.”

Paul Volcker

Keeping At It: The Quest for Sound Money and Good Government

(2018)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Why America’s economic policy muddle matters

Financial Times/Adam Tooze/6-2-2023

“There is none of [Dutch economist Jan ] Tinbergen’s unified technocratic intelligence here. Nor should one dignify this mess by reference to the wisdom of the 18th-century founders and the principle of the division of powers. The kaleidoscope is driven by the twisted logic of a profoundly divided society and a polarised political class.

USAGOLD note: The invisible hand that played such a large role in building the modern economy is slowly but surely being paralyzed by Washington bureaucrats. Highly recommended reading……

Gold to shine again

Singapore Bullion Market Association/Chen Guangzi/June 2023

USAGOLD note: A practical overview new investors will find informative. Guangzhi is head of research at KGI Securities Singapore. His analysis includes an enlightening table of gold’s performance during recessions.

Signs of de-dollarisation emerging, Wall Street giant JPMorgan says

Yahoo!Finance-Reuters/Marc Jones/6-5-2023

USAGOLD note: These mainstream press articles on de-dollarization inevitably include the caveat that the dollar’s global dominance is not going to happen anytime soon. What they overlook is the damage that can be done on the long road to getting there.

Short and Sweet

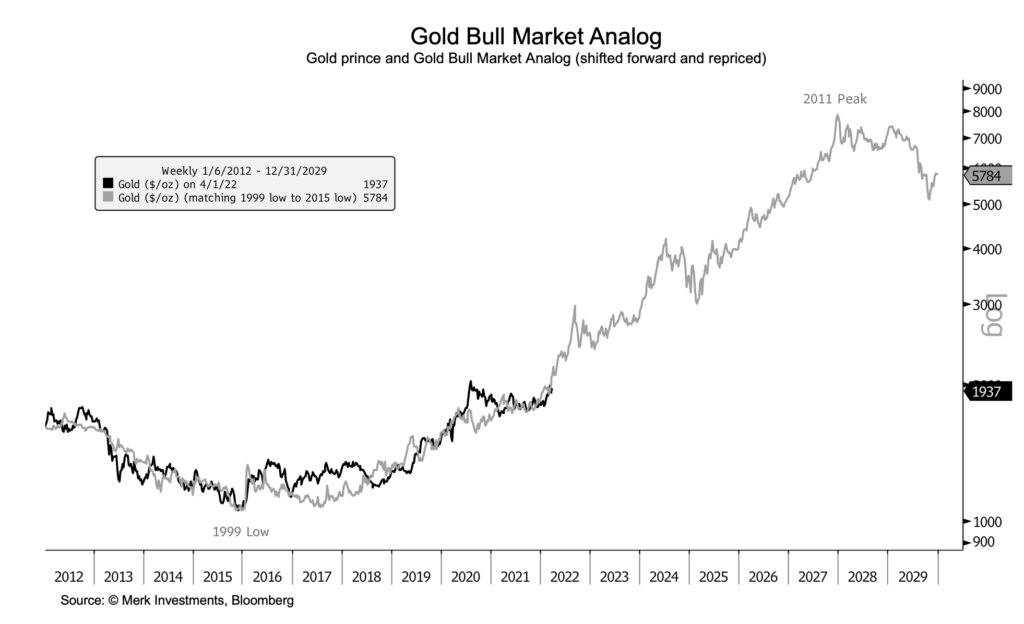

Gold as the ‘generational trade’

Billionaire investor says it will reach $3000 to $5000 as secular bull market resumes

Chart courtesy of Merk Investments • • • Click to enlarge

Wall Street-based billionaire and financier Thomas Kaplan (who once said, “I’m no insect; gold is a great way to make a lot of money.”) is among the group of analysts who believes gold is in the early stages of a new leg in its long-term secular bull market. In 2020, he expanded on the notion in a groundbreaking interview with Stansberry Research’s Daniela Cambone. Though Kaplan made his fortune in the mining business, he is also an Oxford-trained historian (with a Ph.D.) capable of putting gold’s current price trend in the context of a longer-term cycle – one he believes has not yet reached full maturity. (Please see chart above.) His comments, we think you will agree, offer a refreshing perspective at a time when it is sorely needed and when short-termism seems to dominate investor psychology.

“Let’s put it this way,” he says, “gold still remains on Wall Street and in the west probably the most under-owned, least crowded trade in the global financial markets. … The era in which gold was the asset which people loved to hate and hated to love is starting to come to an end. We’re still in the very early innings. It’s still a smart money trade as opposed to a big passive money trade but that’s about to happen.” Merk Investments’ “Gold Bull Market Analog” chart (shown above), which tracks the progress of the current bull market against the one that began in 1999, supports and illustrates Kaplan’s argument. The next leg up, he believes, will be driven by what he calls “bold-faced” names now involved in the gold business. Kaplan mentions Warren Buffett (who at the time of the interview had just purchased stock in mining giant Barrick Gold, Mohamed El Erian, Mark Mobius, Ray Dalio, Paul Tudor Jones, Jeffrey Gundlach, and Kenneth Rogoff. (Long-time readers of this daily newsletter will recognize that list of notables as abbreviated.)

“The difference is this,” he says. “The market is now ready for the next leg of the gold bull market. The first leg was the one that took us up 12 consecutive years in a row regardless of whether there were inflation fears, deflation fears, whether there was a glut of oil or a shortage of oil, political stability or political instability, dollar weakness, dollar strength. It didn’t matter. Every year for 12 years gold went up. The next move is going to be a third wave, a long wave that lasts for a decade or fifteen years, maybe more … I think that you really are looking at a complete paradigm shift that will make gold the generational trade.” From there, Kaplan goes on to say that gold will reach $3000 to $5000 in the years to come.

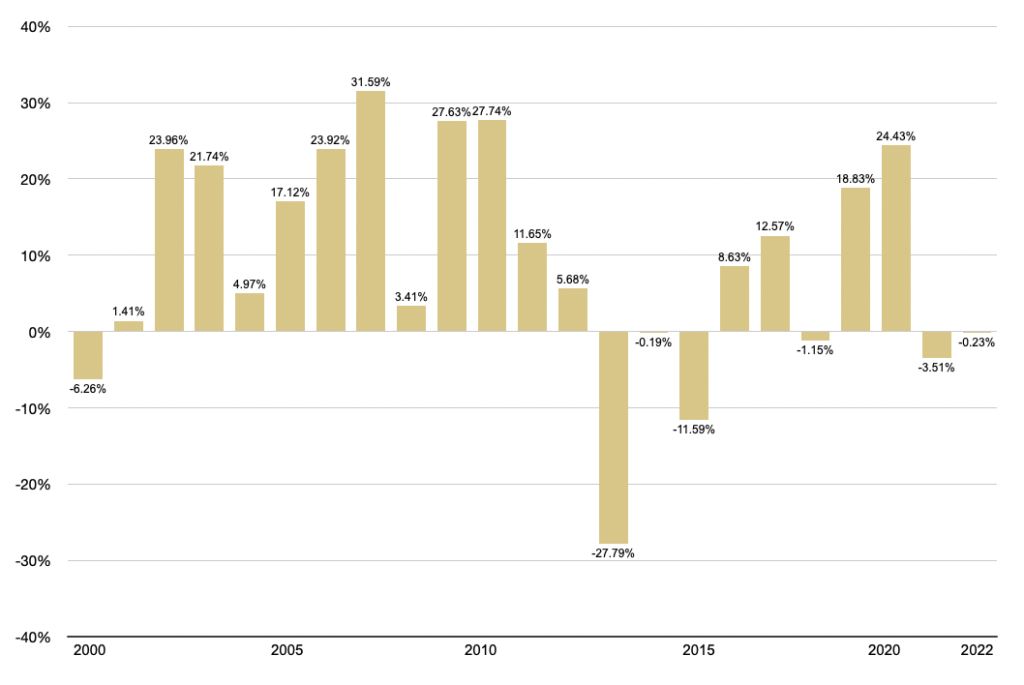

Gold Annual Returns

(Year over year, 2000 to present)

Sources: St. Louis Federal Reserve [FRED], ICE Benchmark Administration

Are you ready to make the ‘generational trade’ part of your holdings?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Short & Sweet

Gold’s secular bull market: 2003-2022

‘Each price correction and consolidation period has been a buying opportunity’

“The last government to doubt gold’s value got burned,” says veteran commodity analyst Andrew Hect in a report posted at Seeking Alpha. “At the turn of this century, the United Kingdom decided to part with one-half of its gold reserves. Ironically, London is the hub of the international gold market, so the UK sent a signal that gold had seen better days. In a series of auctions, the UK sold around 300 metric tons at prices mainly below the $300 per ounce level. Since 2003, gold never traded below $300 per ounce. Since 2010, the price has not ventured below $1,000, and since 2020, the price has remained above $1450 per ounce. … In 1999, gold reached a bottom at $252.50 per ounce. Since then, each price correction and consolidation period has been a buying opportunity in gold. The over two-decade-long bullish trend continues to take gold to higher highs.”

Gold price

(Weekly prices, 2000-2022)

Chart courtesy of TradingView.com

Thinking gold?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Fed chair spoke with UBS CEO amid banking crisis

“Powell’s calendar shows the abruptness with which the banking sector problems — which have since triggered three U.S. bank failures in addition to the UBS-Credit Suisse deal — erupted nearly three months ago.”

USAGOLD note: Investors worry about a black swan event, but what we have had thus far is a cluster of gray swans – abrupt but predictable mini-crises instigated primarily by highly publicized but poorly understood central bank policies. Nevertheless, collectively they have taken their toll and uncovered vulnerabilities that may yet instigate the next black swan. Mark Spitznagel, who with Nicholas Taleb (originator of the term “black swans.”) conducts business as Universa Investments, says that decades of easy money is leading to a “mega-tinderbox time bomb” in the financial system. “He just doesn’t know when the bomb will go off, ” according to a Wall Street Journal article published last weekend.

Daily Gold Market Report

Gold up marginally as we begin what could be a turbulent week for financial markets

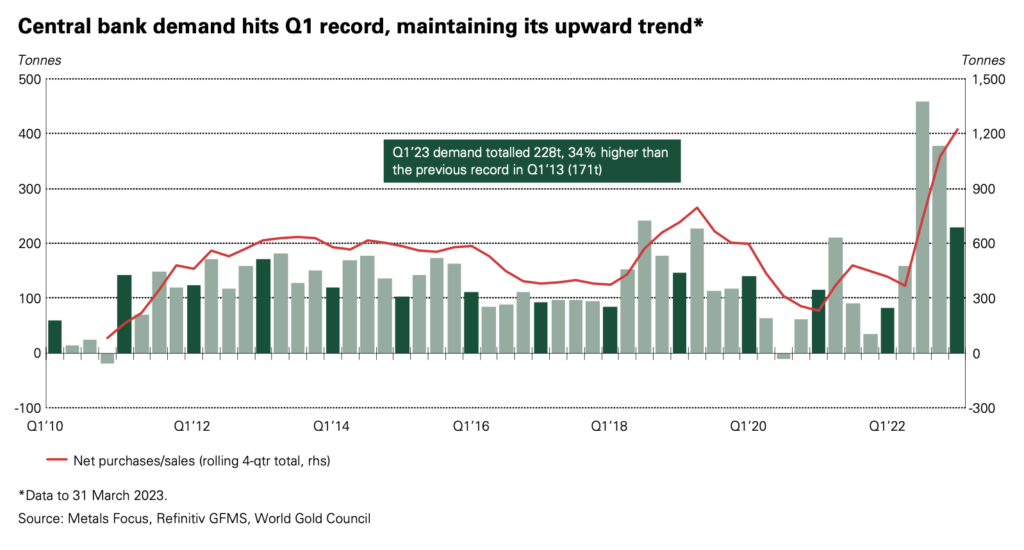

Saxo Bank sees the gold market as ‘resilient,’ maintains bullish outlook

(USAGOLD – 6/12/2023) – Gold is up marginally this morning as we begin what could be a turbulent week for financial markets. It is up $3 at $1966.50. Silver is down 3¢ at $24.34. The Treasury Department will conduct a run of bond auctions to replenish its depleted coffers on Monday and Tuesday. Headline inflation data is due Tuesday, and the Fed will announce its rate decision on Wednesday.

“Gold prices,” says Saxo Bank’s Ole Hansen in a report issued Friday, “continue to be directed by the ebb and flow of US economic data and with that speculation about the short-term direction of US rates.… While not ruling out additional short-term weakness, the market is showing resilience, with silver currently outperforming gold while the miners are still struggling to find a bid amid the current stock market rally.” Overall, the bank maintains a bullish outlook for the metal based on continued dollar weakness, recession risks, strong central bank demand, sticky inflation, and building geopolitical tensions.

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“The current combination of monetary debasement, populism and social unrest is neither a new phenomenon nor a coincidence. The late Roman empire shaved silver coins as it disintegrated; Henry VIII replaced silver coins with copper to pay for wars against France and Scotland; the British empire allowed double-digit inflation to erode bondholders’ wealth following the War of Independence; the Weimar Republic precipitated an inflation spiral. Comparing these examples to QE may sound extreme. Yet the biggest debasement in history may be the one we are experiencing now under the form of a $20tn central bank experiment, which is de facto depreciating money by boosting the price of all assets it can buy.”

Alberto Gallo

Algebris Investments

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Short and Sweet

‘No one questions its value. . .’

Image courtesy of the British Museum Collection/Lydia, croesid, ca 550 BC

Are you ready to add unquestioned value to your investment portfolio?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100• • • [email protected] • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Top ten producers, in metric tonnes

2004 – 2022

Source: U.S. Geological Survey

Ex-Treasury chief Larry Summers says the Fed should consider a big bump in interest rates

MarketsInsider/Zahra Tayeb/6-6-2023

USAGOLD note: Appears Mr. Summers, still echoing Paul Volcker, sees inflation as much more resilient than either the Fed or Wall Street.

Why the Fed is hard to predict

Project Syndicate/Mohamed A. El-Erian/5-30-2023

USAGOLD note: El Erian says that no one knows what is going to happen at it June meeting – not even the Fed itself. It lacks, he says, “a solid strategic foundation.” Our interpretation? It bends with the wind and has become vulnerable to political pressure, it is unpredictable and not the kind of Fed Wall Street is likely to find reassuring.

Short & Sweet

‘Advice doesn’t have to be complicated to be good.’

“The world is complex,” writes analyst Safal Nivetchak. “Consider the various reasons floating around explaining the market’s fall in the last two months – war, inflation, interest rates, FII selling, China, supply chain disruptions, weak GDP, and over valuations. This is not a complete list, but enough to suggest that the world is complex. And so are financial markets. How do you deal with such complexity in your wealth creation journey without losing your sanity? Have an investment process that is elegant in its simplicity.” We found the down-to-earth practicality contained in Nivetchak’s advisory of enormous value, particularly for young investors searching for guidance on the road to building wealth – something appealingly analog in an increasingly complex digital age.

Though he never mentions gold, many successful investors see it as part and parcel of the keep it simple portfolio approach. He offers a memorable quote from Dutch computer science pioneer Edsger Dijkstra: “Simplicity requires hard work to achieve it and education to appreciate it.” Nivetchak ends by quoting Steve Jobs on keeping it simple: “… It’s worth it in the end because once you get there, you can move mountains.” Says Nivetchak, “That’s also true for investing for wealth creation. In practicing simplicity, and staying the course, over time you can also move mountains.”

_________________________________________________________________